xavierarnau/E+ via Getty Images

Author’s note: This article was released to CEF/ETF Income Laboratory members as part of the CEF Weekly Roundup on October 4, 2022, with certain numbers updated. Please check latest data before investing.

RIV rights offering

The rights offering for RiverNorth Opportunities Fund, Inc. (RIV) is here! This appears to be an annual tradition now for RIV, and we discussed the 2020 (public link) and 2021 (public link) rights offerings in previous CEF Weekly Roundups.

From the press release:

WEST PALM BEACH, Fla.–(BUSINESS WIRE)–RiverNorth Opportunities Fund, Inc. (NYSE: RIV) (the “Fund”) announces that its Board of Directors (the “Board”) has authorized and set the terms of an offering to the Fund’s stockholders of rights to purchase additional shares of common stock of the Fund. In this offering, the Fund will issue transferable subscription rights (“Rights”) to its stockholders of record as of October 14, 2022 (the “Record Date” and such stockholders, “Record Date Stockholders”) allowing the holder to subscribe for new shares of common stock of the Fund (the “Primary Subscription”). Record Date Stockholders will receive one Right for each share of common stock held on the Record Date. For every three Rights held, a holder of Rights may buy one new share of common stock of the Fund. Record Date The Rights are expected to be listed and tradable on the New York Stock Exchange (“NYSE”) under the ticker: RIV.RT. Record Date Stockholders who fully exercise all Rights initially issued to them in the Primary Subscription will be entitled to buy those shares of common stock that are not purchased by other Record Date Stockholders. The subscription price per share of common stock will be determined based upon a formula equal to 95% of the reported net asset value or 95% of the market price per share of common stock, whichever is higher on the Expiration Date (as defined below). Market price per share of common stock will be determined based on the average of the last reported sales price of a share of common stock on the NYSE for the five trading days preceding (and not including) the Expiration Date. The subscription period will expire on November 8, 2022, unless extended by the Board (the “Expiration Date”).

This is a transferable 1-for-3 offering, with a subscription formula of the higher of 95% of NAV or 95% of the average market price in the five days preceding (but not including) the expiry date. This makes this year’s offering formula the same as 2020’s, but different to the 2021 offering where 97.5% of NAV was used. The difference in the subscription formula is likely due to the different premium/discount valuation of the fund. In 2021, RIV traded at a higher premium so the floor was also higher. The ex-rights date is October 13, 2022 while the expiry date is November 8, 2022.

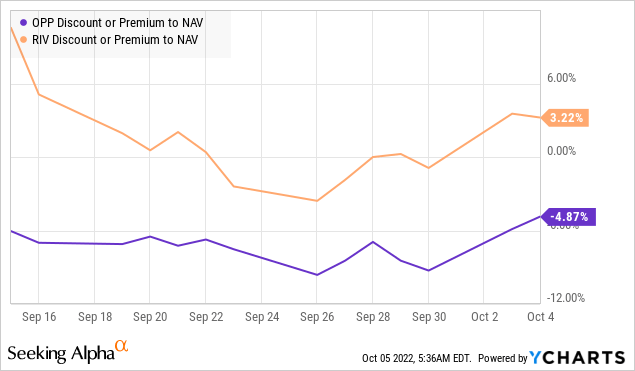

The fund managers are probably kicking themselves that they didn’t conduct the offering back in September when the premium was much higher at over +10%. However, the reason that they probably didn’t pull the trigger then is because the rights offering for RiverNorth/DoubleLine Strategic Opportunity Fund (OPP) (which was also undersubscribed, as we discussed in last week’s Roundup) (public link) was still ongoing, and RiverNorth does not have both of their CEFs undergoing rights offerings at once.

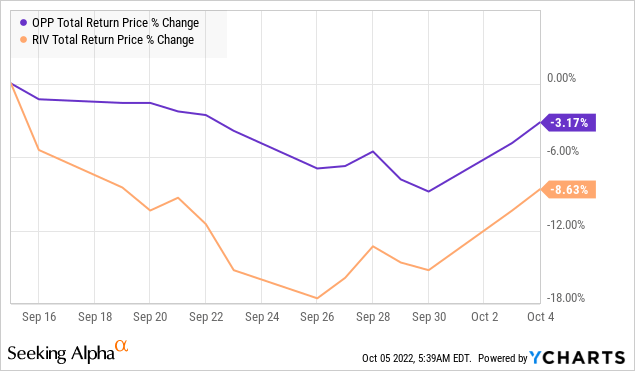

On the topic of timing, our own Nick made a great call to our members to swap from RIV to OPP in mid-September, based on the fact that RIV’s premium remained elevated compared to OPP, which was undergoing its own rights offering at the time, despite the fact that RIV’s own rights offering was likely coming soon as well (see OPP And RIV: Time For A Swap (public link)). This prediction came true last week when RIV announced its own rights offering.

YCharts YCharts

Subscription strategy

RIV dropped upon the announcement of the rights offering down to +1.42% premium but has since rebounded to a +4.50% premium (as of October 7, 2022). If history is anything to go by, then the play here would be to sell RIV now and rebuy later once the rights offering is over. This is because the benefit from rebuying at a lower price using the “sell and rebuy” strategy has nearly always been greater than holding through the offering and subscription for new shares at a slight discount.

For those investors who don’t wish to execute the “sell and rebuy” strategy (for tax or other reasons), they will be assigned transferable RIV rights under the ticker RIV.RT. For those who do not wish to subscribe for new shares in the offering, I would recommend selling those rights as soon as possible because, in our experience, the price of the rights declines over the offering period.

For those who do wish to subscribe for new shares, remember to inform your broker before the deadline as the default action is to not subscribe. However, should RIV trade below a -5% discount towards expiry, one should not subscribe as it would be cheaper to buy the fund on the open market.

Be the first to comment