Justin Sullivan

Thesis

I have previously been bearish on Tesla, Inc. (NASDAQ:TSLA) due to valuation concerns, but I am gradually changing my mind towards a more bullish consideration. Although I still believe that Tesla is valued at a very proud market cap, which dwarfs the valuation of multinational competitors such as Volkswagen (OTCPK:VWAGY) and Toyota (TM), I have to admit that Elon Musk’s revolutionary brand continues to deliver.

First, I note that Tesla is ramping up deliveries at an incredible pace, breaking record after record. Second, despite the risk-off sentiment, Tesla stock is outperforming both growth stocks and legacy carmakers YTD. Third, people continue to love the Tesla brand, with all its flaws. This will allow the company to push into new verticals and claim additional market opportunities. Finally, Tesla’s culture of entrepreneurship and innovation provides a strong foundation for revolutionary new ideas — such as the humanoid robot presented on Friday 30 September.

I upgrade TSLA shares from ‘Hold’ to “Buy.” I calculate a fair implied target price of $366.80/share.

4 Reasons Why I Changed My Mind

A True Growth Stock

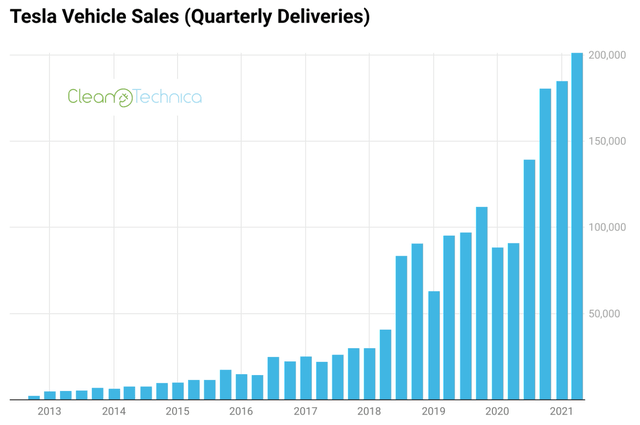

Tesla’s growth has been truly impressive in the past – constantly beating analyst consensus estimates and the claims of famous short sellers such as Jim Chanos and David Einhorn. The reason is simple, but very important: Tesla’s growth is not constrained by consumer demand, but by supply constraints. Accordingly, Tesla’s future growth trajectory also will depend on neutralizing supply constraint and ramping up production in the giga-factories in Berlin and Austin.

As Musk highlighted:

Our constraints are much more in raw materials and being able to scale up production.

For 2022, Tesla is poised to easily surpass the 1 million deliveries milestone and could aim for 2 million in 2023, according to Bloomberg Intelligence. Elon Musk is said to target a 50% year-over-year sales growth through 2023.

Obviously, the first sequential decrease in deliveries in Q2 2022 was due to Covid-19 caused factory shutdowns in Shanghai. Since then, conditions appear to have improved significantly. In August 2022 alone, the company delivered 76,965 China-Made Cars (data from China’s Passenger Car Association). This implies a greater than 170% month-over-month growth.

Apple-Like Brand Image

Tesla’s past growth performance and future potential is closely related to the company’s strong brand image, which in the consumer sector is arguably only matched by Apple. And Seeking Alpha readers are surely well aware how fundamentally important Apple’s brand image was/is for shareholder value creation.

With a strong brand, consumers accept smaller “production flaws,” quietly pay up for price increases, and support a company’s expansion into new markets and business opportunities. The latter, in my opinion, will play a pivotal role in helping Tesla claim new opportunities in the race for building a robotaxi fleet and marketing humanoid robots. In the opinion of many investors, these new businesses will eventually render Tesla bigger than a car company – which consequently justifies a different mindset towards valuation.

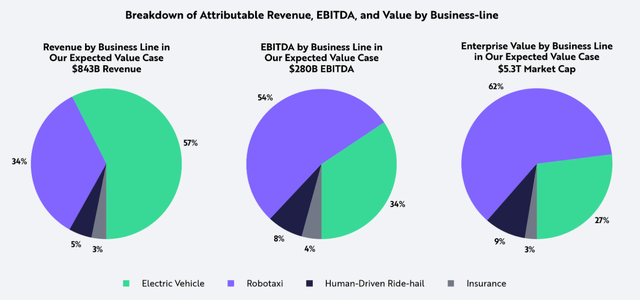

According to ARK Investment, although this should be taken with a grain of salt, Tesla’s 2025 EBITDA from robotaxis could account between 34% to 62% of the carmaker’s total EBITDA.

Moreover, an aspirational brand also makes a company less exposed to economic cycles (reference next argument). And supports a strong business performance even in recessionary environments, as Ferrari and Apple have empirically proven.

A History of Superior Stock Performance

In 2020/2021 Tesla stock has been considered as one of the most obvious bubble stocks, surging more than 1200% from lows in March 2020 to highs in October 2021. Many investors, me included, believed that the stock will revert to the mean sharply once the excess optimism fades. But as most growth stocks have lost somewhere between 50% to 90% of equity value (ARK Innovation (ARKK), for instance, is down more than 70% from its all-time high (ATH)), Tesla has lost only about 30%. Notably, tesla even outperformed some of the legacy “value” carmakers such as Volkswagen. VWAGY stock has lost some 40% from its ATH!

Not every 1000% rally is a bubble. As I have highlighted the similarity between Apple and Tesla with regards to “brand love,” one could argue that Tesla stock resembles the performance of Apple. Notably, AAPL stock surged by more than 1,000% between 2004 and 2007 and has appreciated by another 2,700% since. Accordingly, the argument that Tesla might continue to outperform – despite the rich valuation – is not necessarily farfetched.

Tesla’s Innovation and Entrepreneurship Culture

On Friday 30 September, Tesla revealed a very basic prototype of the company’s humanoid robot, which was teased about a year ago. Musk claims that the robot — which is called Optimus and is estimated to cost below $20,000 — will one day support millions of people in their daily work routines.

Musk has multiple times highlighted a shrinking global population as the most pressing threat to humanity. And accordingly, Tesla’s Optimus robot should be position as a labor-saving technology to address a new market opportunity that could perhaps even dwarf climate change investments.

Twitter

Although the Optimus robot is still in a very early development phase, lacking most of the human basic skillset including a brain, the prototype shown highlighted Tesla’s commitment for innovation and risk-taking to materialize new market opportunities. And this commitment has served Musk’s supporter and TSLA shareholders very well in the past. Beware betting against entrepreneurship and innovation.

Valuation

Now the most important question: what would be a reasonable valuation anchor for Tesla? Without a doubt, different analysts will value Tesla differently, and price target will vary significantly. But here is how I would approach the task.

First, I want to acknowledge that Tesla is a high-growth company. And accordingly, I want to base my analysis not on current numbers, but on what I believe could be achieved in 2030.

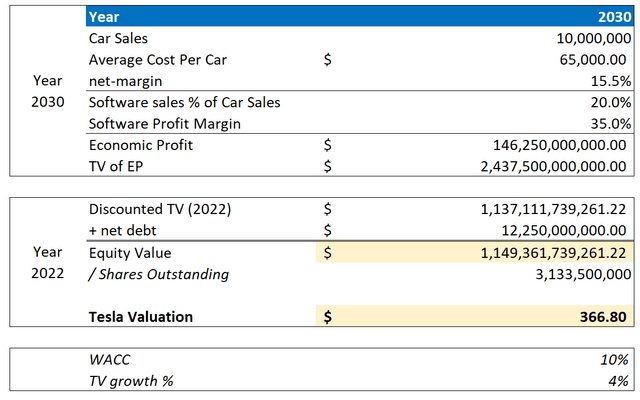

That said, for the base-case I anchor my valuation on an estimated 10 million car sales in 2030, and an average sales price per car of $65.000. Furthermore I assume a net-profit margin of 15.5%, which is only slightly above Tesla’s 2022 net profit margin and in my opinion a very reasonable assumption if one consider increased economies of scale. (Note that I expect sales volume to almost 10x.)

In addition, I assume that for every dollar that Tesla generates selling cars, the company will be able to sell 20 cents of software solutions and insurance (for reference, Apple generates about 30 cents worth of services for every dollar of hardware sales). For Tesla’s software business, I argue 35% net-profit margin is reasonable — in line with margins of leading tech/internet companies.

Based on this, I calculate a $146.25 billion annuity, with a present value equal to $2.438 billion. This number discounted back to 2022, assuming a 10% rate and adding a $12.25 billion of net-cash, gives an equity value of $1.149 billion, or $366.8/share.

Author’s Assumptions; Author’s Calculations

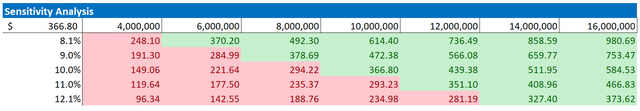

What if we vary the discount rate and number of car sales? I have enclosed a sensitivity table that shows the result of different combinations. For reference, red cells imply overvaluation as compared to current share-price, green cells

- Upside case $980/share +325% gain

- Downside case $96/share -70% loss

Author’s Assumptions; Author’s Calculations

Risks

Although Tesla has proven to be more resilient than what investors thought, both in relation to a challenging macro-economy and fading risk-sentiment, I believe the major risk for Tesla stock remains that a worsening macroeconomic backdrop will pressure investors risk-sentiment to such a degree that Tesla stock’s growth multiples compress. Or in other words, investors should acknowledge that much of Tesla’s share price performance remains driven by general sentiment towards stocks (Tesla’s beta vs the S&P 500 (SPX) is about 1.7). Accordingly, investors should be prepared to stomach volatility, even though Tesla’s fundamental outlook remains unchanged.

Personally, I do not believe that increasing competition in the race for electrification will influence the demand for Tesla — like “other” smart phone makers do not influence the demand for iPhones. The increased competition could, however, exacerbate Tesla’s supply challenges, as more competition chases for a limited supply of raw materials and key manufacturing components.

Conclusion

I am late to the party. And, arguably, some readers might consider my article as a contra indicator – arguing when bears turn bullish, it is time to sell. But I think it is important to be able to change one’s mind as an investor — if the information set implies that this is the correct choice. Without a doubt, Tesla has proven to deserve this “win.” Personally, I value Tesla shares at a base-case target price of $366.8/share (approximately 40% upside).

Be the first to comment