Nastassia Samal/iStock via Getty Images

Investors often have to get more creative as investing strategies mature. Investing during normal times doesn’t require much additional thinking. However, when markets are at or near record highs in unique times, investors often have to find new strategies to continue to receive the same income and total returns.

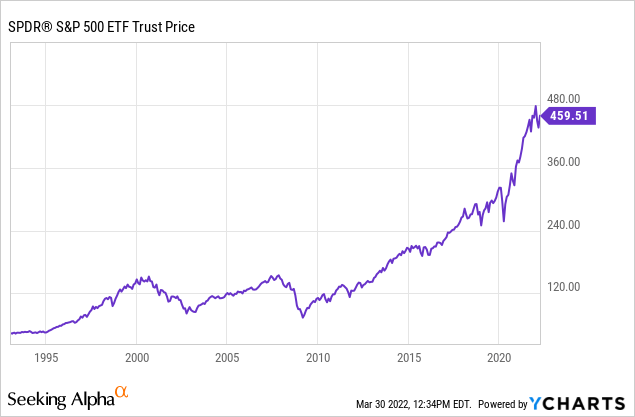

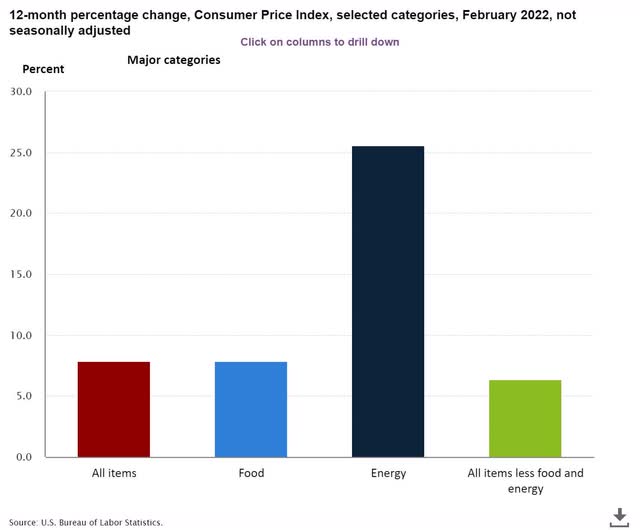

Today, the S&P 500 (SPY) and most major indexes are at record highs. Most stock and index funds are also yielding less than the current rate of inflation, and inflation rates continue to consistently run at over 6% according to the Consumer Price Index (CPI).

The S&P 500 and most other major indexes have been at or near records highs for some time, and the CPI is showing a rate of inflation above five percent.

Since inflation is running over five percent a year and most leading dividend and income funds are yielding less than 3%, most dividend and income investors who want to continue to continue to get inflation-adjusted income and total returns will have to become more creative with their investing strategies.

One strategy that is used by some funds effectively to generate additional income is a covered call strategy. The Global X Russell 2000 Covered Call ETF (BATS:RYLD) is a well-built and effective managed fund that is a good investment right now for investors in general. It has effectively used options to generate significantly above-average income and total returns.

The covered call strategy is a very simple way of using options that are difficult to consistently execute successfully. An option contract is the right to buy or sell 100 shares. A put option is the right to sell 100 shares, and a call option is the right to buy 100 shares. An income-based covered call strategy is when you own the underlying equity you are selling out of the money calls against.

A simple example would be a stock that trades at $50 dollars a share. If you own 100 shares of this stock, you could sell someone the right to buy your shares at a price above $50 a share for a price, by selling them a call option, or the right to call in and buy your shares. Options have expiration dates, and on the expiration date, the options expire worthless because the stock is priced below the call option price at the date of expiration, or the option is exercised since the stock price is above the price the call option was sold at on the date of expiration.

Selling covered calls is a bad strategy when you own a volatile stock or fund, because selling the call caps your upside while the investor still has unlimited downside. Selling covered calls can be effective when done properly with low volatility investments where the option in the stock has some heightened volatility because of underlying market conditions. We currently see such conditions in much of the market with the Russian invasion of Ukraine.

The Global X Russell 2000 Fund is a good example of how selling covered calls can work to maximize income and total returns for investors. The holdings of this fund are 21.1% health, 13.5% financial services, 3.7% basic materials, 11% consumer cyclical, 8% real estate, 3.6% consumer defensives, 2.2% utilities, 4% energy, 4% communication services, 14% industrials, and 14% technology.

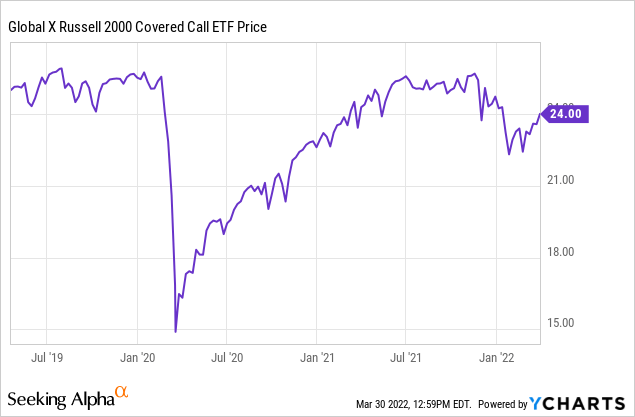

The fund has a good mix of defensive and cyclical stocks, and even though this fund is not heavily overweight in defensive sectors, the fund has delivered steady income and total returns without excessive volatility outside of the brief pandemic sell-off. The fund has, of course, recovered from that sell-off along with the overall market.

In order for a covered call strategy to be effective over the long term, you must have enough volatility to make the options you are selling have value. However, the investor also doesn’t want too much volatility when the downside risks are significant.

RYLD is a very well-run fund that has done an excellent job of executing a simple strategy that is difficult to use successfully. This fund currently yields 12.46%, and the dividend growth rate has been 17.56%. The Russel fund hasn’t been around long enough to show long-term facts about the income distribution, but an investor can’t assess a fund like this just by looking at the income growth. You need to look at average payouts, because the options that are sold against the underlying equity the fund owns will obviously vary based on volatility levels and other factors.

This fund should outperform and offer the best income and total returns during periods of elevated volatility in the market, just as we are seeing right now. In addition to the geopolitical situation, inflation levels are high, and there have been recent signs of an economic slowdown in consumer and industrial data. Elevated levels of volatility should exist in the market for some time.

This fund has $1.23 billion dollars in total assets under management, pays monthly distributions, and sells call options against the underlying equities the fund owns through the Vanguard Russell 2000 ETF (VTWO). The expense ratio of .6% is very low as well, since this is obviously an actively managed fund, and the fund has been run well.

The Russel fund offers monthly distributions, and the monthly distributions obviously vary based on what the funds receive for the options that were sold. However, the distributions over the last year and a half have been impressive, ranging from $.22 to $.24 so far this year, and from $.22 a share to $.30 a share in 2021. The average monthly distribution last year was nearly $.25 a share. The data from 2019 and 2020 is skewed because of the pandemic, and there is only data for seven months in 2019.

Investing strategies should evolve as markets change, and many investors have successful strategies that work in different market conditions. Not every investing strategy is suitable for all market conditions. With markets at record highs, inflation running high, and volatility levels elevated, the covered call strategy that the Global X Russell 2000 Covered Call ETF uses is a good strategy that offers investors additional income and total returns in difficult market conditions. This fund should continue to both outperform the major indexes and offer solid inflation-adjusted returns.

Be the first to comment