BD Images

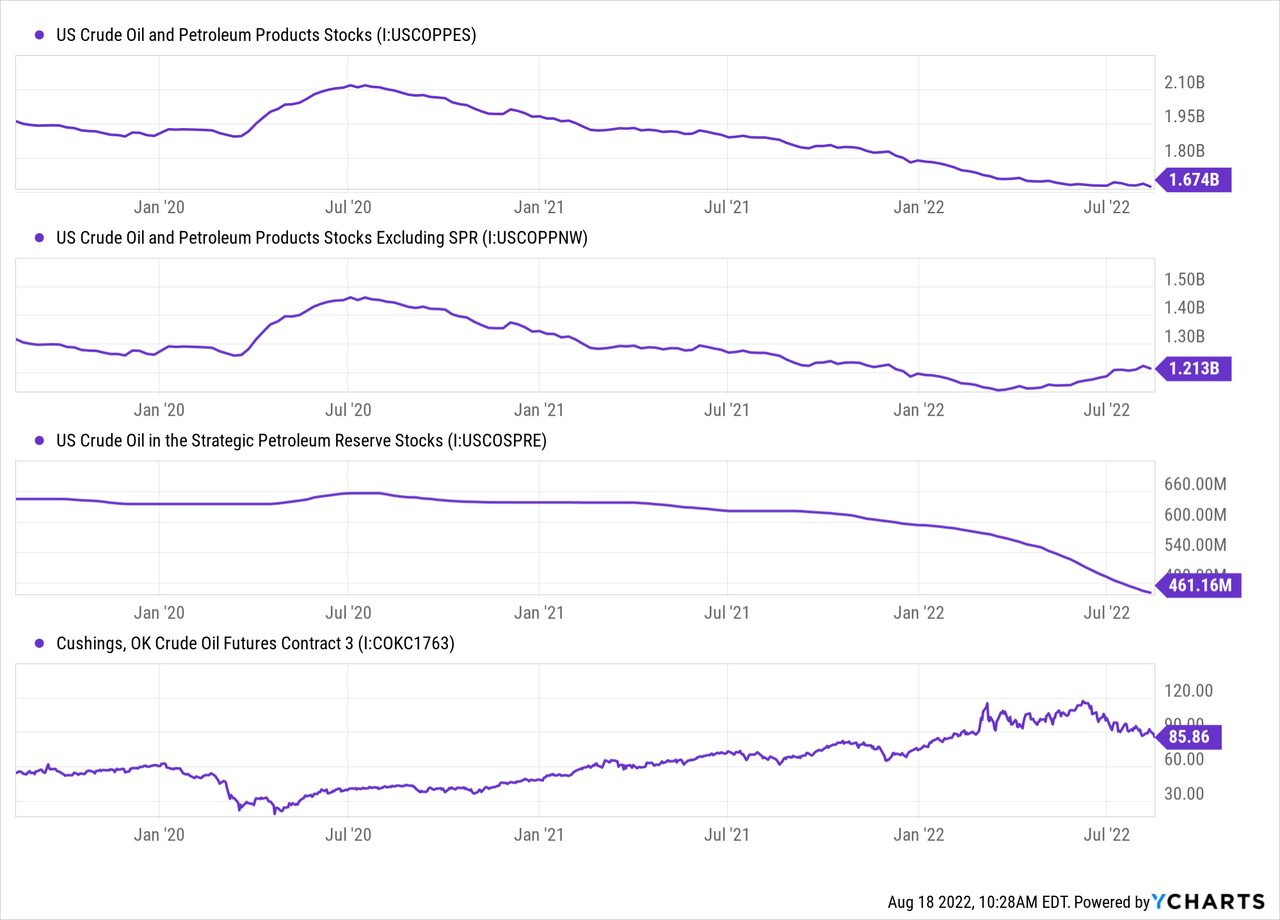

After over a year of solid gains, energy stocks have seen lackluster performance over the past two months. Crude oil and gasoline have drifted lower as the surge in Strategic Petroleum Reserve withdrawals have shored up supply. Accordingly, liquid products, such as crude oil and gasoline, have declined while natural gas (and NGLs) have risen since they do not benefit from the SPR release. Crude oil is currently at ~$90 per barrel, down around 27% from its $122 June high, but maybe forming a support level at current prices. Notably, oil’s recent decline began when commercial oil and gas inventories began to rise in May; however, total oil and gas inventories (which include SPR reserves) have declined slightly since. See below:

The oil market is still in shortage. Energy prices respond to commercial inventories far more than total storage. The commercial oil market is in a surplus driven not by increased production but by immense SPR withdrawals. Technically, these withdrawals can continue until mid-2023 but are expected to end in late October. After that, given minimal signs of increased production growth and record oil exports, it seems very likely the commercial oil market will return to a significant net shortage.

As detailed in numerous recent articles, I believe the energy dip is a buying opportunity for crude oil producers. While exploration and production oil stocks remain volatile, I expect them to benefit from higher oil prices once SPR withdrawals slow. Of course, not all energy companies may benefit as some segments may see costs grow at the same pace as earnings. Oil refiners such as Valero (VLO) and Phillips 66 (NYSE:PSX) may not benefit directly from higher oil prices and may even see some strain on profits. In early June, I signaled potential risk regarding Valero and crack spread (refinery margin) expectations in “Valero Is Overvalued As Crack Spreads Are Unlikely To Sustain Extreme Highs.” Both VLO and PSX declined subsequently with crack spreads.

Today, both are slightly cheaper than they were months ago, and the market is no longer expecting record crack spreads to remain. PSX is fascinating as the company recently decided to buy out DCP Midstream (DCP) for a ~5% premium. Phillips made this deal nearly a year after acquiring Phillips 66 Partners, showing the company is trying to integrate vertically. PSX is trading at a forward “P/E” of 5.7X, which makes it a discount opportunity for many investors; however, its EPS will likely decline with lower crack spreads. With this in mind, I believe it is an opportune time to take a closer look at the company and its macroeconomic environment.

Crack Spread Outlook

The most critical factor facing Philips 66 today is the crack spread. Crack spreads are the difference in per-barrel prices of crude oil and crude oil products such as gasoline and diesel. They are a live gauge of refinery profit margins since refiners purchase and sell crude products. Crack spreads rise when refinery output is below the demand for gasoline or diesel and vice versa.

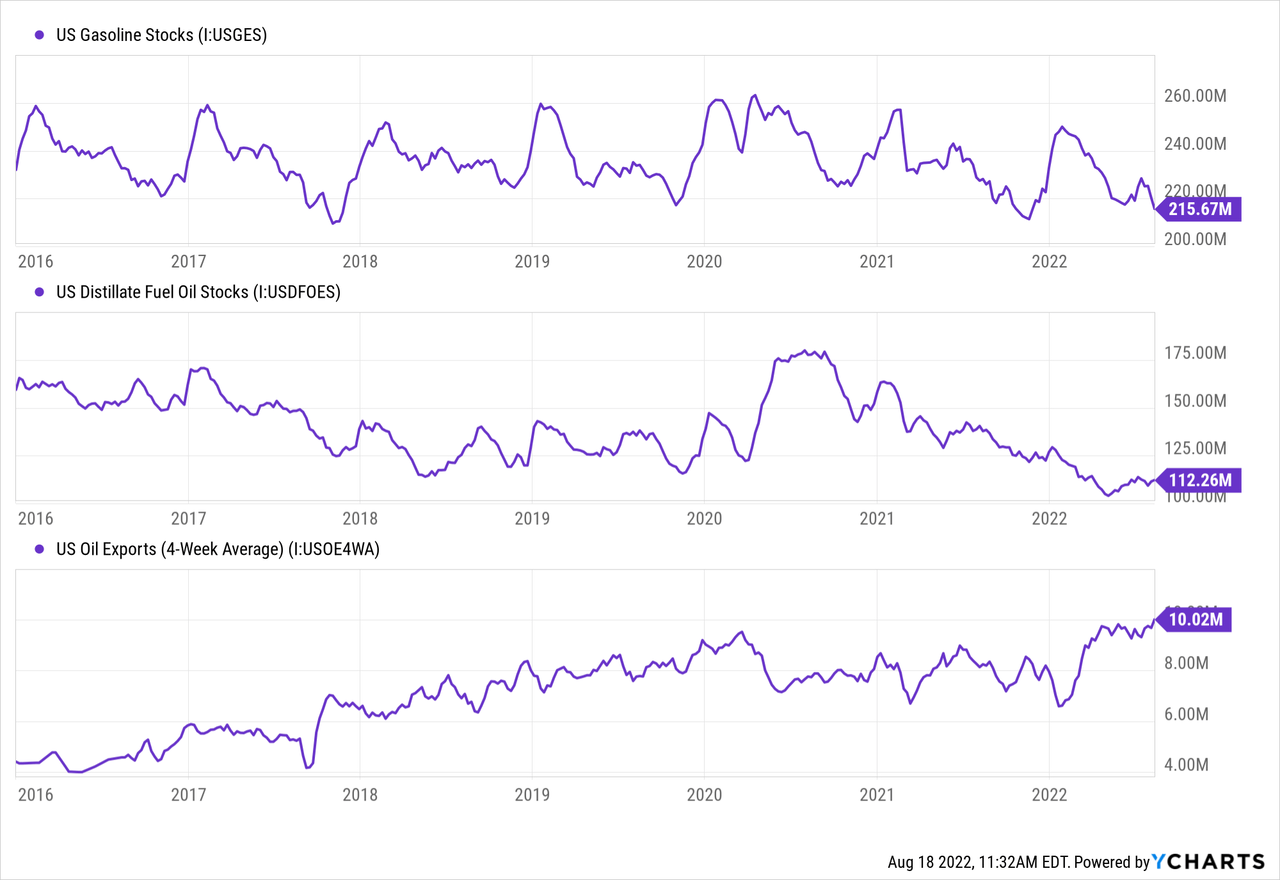

During the first half of 2022, crack spreads were extremely high due to a confluence of factors, including increased demand for US crude oil exports and weak US refinery capacity (both post-COVID lockdowns and a long-term decline in refinery investment), and high domestic demand for gasoline. This situation created a relatively significant shortage of distillate fuel, as seen in inventory levels. See below:

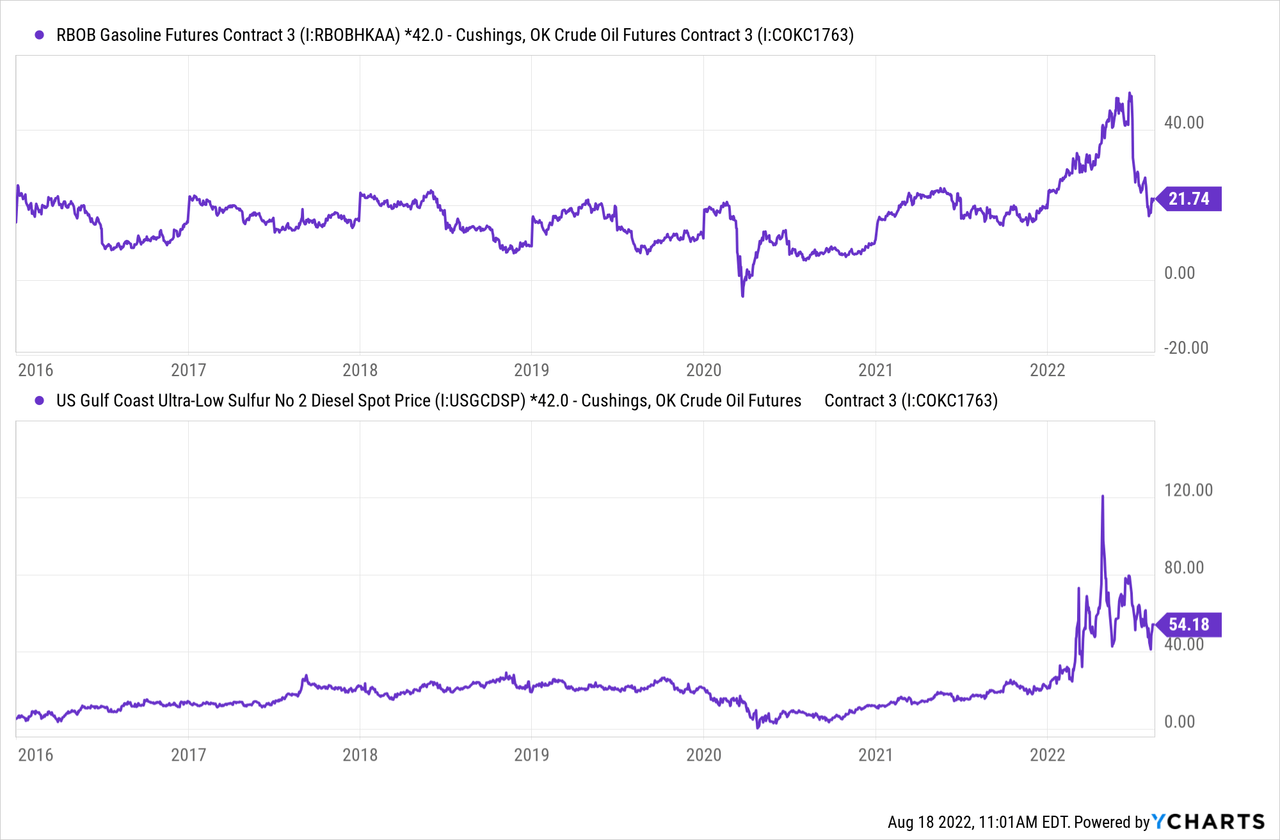

Both gasoline and diesel inventories remain near long-term lows. The more critical diesel shortage has recovered somewhat despite the continued sharp rise in US oil exports, likely due to increased crude supplies from the SPR release. The gasoline crack spread also rose dramatically but has rapidly returned toward long-term averages. See below:

Note that prices are multiplied by 42X to reflect gallon-to-barrel conversion. Additionally, the diesel crack spread uses spot price as futures are unavailable.

Diesel crack spreads remain well-above normal levels while reformulated gasoline’s spread has roughly normalized. These data represent “1:1” crack spreads – the current “3:2:1” composite spread is approximately $29 per barrel. Phillip’s last earnings call stated that the “3:2:1” spread averaged $21.9 in Q1 and $46.7 in Q2. During Q2, the company realized a margin of $28.3 per barrel, meaning its refinery cost per barrel was ~$18.4 ($46.7 minus $28.3). During Q1, the company realized a $10.5 margin per barrel, giving it an estimated cost-per-barrel of $11.4 in Q1. If we assume production costs are around that $11-$18 per barrel range, then Phillip’s Q3 profit margin per barrel will likely be around $14 per barrel – well below Q2’s level but above the usual $5-$10 range.

All else being equal, Phillip’s profits are likely slipping back toward inflation-adjusted normal levels. PSX’s EPS over the next year will probably be around $9-$12 based on crack spreads, giving it a forward “P/E” of around 7.3X to 9.8X. Previous estimates of $15.6 2022 EPS were made before the recent decline in crack spreads. PSX may adjust lower if its Q3 and Q4 EPS outlooks are revised lower.

Of course, it is possible for crack spreads to return to spring levels under a few circumstances. Gasoline and distillate product supplied data have not declined despite the rise in prices, signaling limited demand destruction at current gas prices. Gasoline and distillate inventories are still low, while crude oil exports continue to rise. However, refinery capacity utilization has improved, and I believe the end of SPR withdrawals, combined with European gas-to-oil switching, will likely benefit oil prices far more than gasoline. As such, upcoming catalysts may be a net negative for refiner crack spreads.

A Look at the Phillips 66 – DCP Midstream Deal

On Wednesday, Phillips 66 made a non-binding offer to acquire all publicly held common units of DCP Midstream for $34.57 per unit. Many investors believe the cost will rise as DCP’s stock shot up to $38 per unit on Thursday. Phillips 66 already owns a significant stake in DCP but will pay a substantial sum if the deal goes through. Phillips 66’s business model will also change if the deal goes through as DCP’s ~$830M annual income would increase PSX’s by roughly 15%.

On the positive side, DCP’s income is likely less volatile than Phillip’s due to relatively flat trends in midstream oil supply and demand. As detailed regarding the ETF (AMLP), I believe midstream oil is a solid investment today due to growing stability and maturation in the midstream market after years of volatility. DCP also has a very similar forward “P/E” to PSX, so the deal should not dilute PSX’s EPS but may improve its dividend capacity.

On the negative side, it appears many investors expect a higher premium for DCP. The midstream company also has $5.1B in total financial debt compared to Phillips 66 at ~$13B, so the deal will likely substantially increase Phillip’s debt leverage. In my view, overall, this deal appears to be a net neutral for Phillip’s 66 as it will likely improve Phillip’s 66 cash-flow stability but increase its long-term solvency risks. The chief risk in a combined company would be a decline in gasoline demand since it would negatively impact both crack spreads and midstream fees.

The Bottom Line

In the immediate view, I believe PSX is fairly valued today and is trading at a reasonable forward “P/E” given the expected volatility in crack spread profit margins. The stock has a moderate risk of negative earnings revision given a decline in crack spreads. The next three months will be crucial for the firm as we’ll likely see how energy markets react to a reduction in crude oil supply from the SPR. By year-end, we will also see if oil prices rebound and US exports continue to rise as Europe switches natural gas for crude oil.

In my view, these factors do not bode well for Phillips 66 as higher crude prices will lower profit margins – mainly if gasoline demand destruction arises. Though the DCP deal is interesting, I do not believe it will improve Phillip’s 66 in the short run. That said, PSX is a potential long-term value opportunity today as it may benefit significantly from vertical integration. Even more, given that no refineries have been built in decades or likely will ever be built, crack spreads may rise over coming years unless a widespread electric car transition occurs. At PSX’s current valuation, it may be a decent long-term investment, but I do not believe the stock is undervalued in the short run.

Be the first to comment