Phillip Faraone/Getty Images Entertainment

A Quick Take On F45 Training Holdings

F45 Training Holdings Inc. (NYSE:FXLV) went public in July 2021, raising approximately $325 million in gross proceeds from an IPO that priced at $16.00 per share.

The firm provides fitness workout programs, content and equipment to fitness studios worldwide.

FXLV has numerous challenges ahead of it while it seeks to rationalize its cost structure, increase capital access in a higher cost of capital market while a global slowdown appears to be gaining steam in some respects.

I’m on Hold for FXLV in the near term.

F45 Training Overview

Austin, Texas-based F45 was founded in 2013 in Sydney, Australia to integrate technology-driven workouts via a growing franchise network.

Management is headed by interim CEO Ben Coates who replaced founder, president, Chairman and CEO Adam Gilchrist, who stepped down recently due to poor financial results and a slashed forward outlook.

The company’s primary offerings include:

-

Fitness programming algorithm

-

Content database of training movements

-

Content delivery platform

The firm pursues a 100% franchise business and revenue model, seeking to offer compelling economics to its franchisees, where locations can be as small as 1,600 square feet in size.

F45 Training’s Market & Competition

According to a 2021 market research report by Mordor Intelligence, the global health and fitness club market was an estimated $81 billion in 2020 and is forecast to grow at a CAGR (Compound Annual Growth Rate) of 7.21% from 2021 to 2026.

The main drivers for this expected growth are a continued rise in the benefit of health awareness and increasing incidence of obesity leading medical caregivers and governments to encourage exercise as a regular feature of individual habits.

Also, the North American region will continue to dominate the health and fitness center market in the coming years.

Major competitive or other industry participants include:

-

Full service health clubs

-

Other studio concepts

-

Other sports clubs and activities

-

At-home and digital fitness offerings

F45 Training’s Recent Financial Performance

-

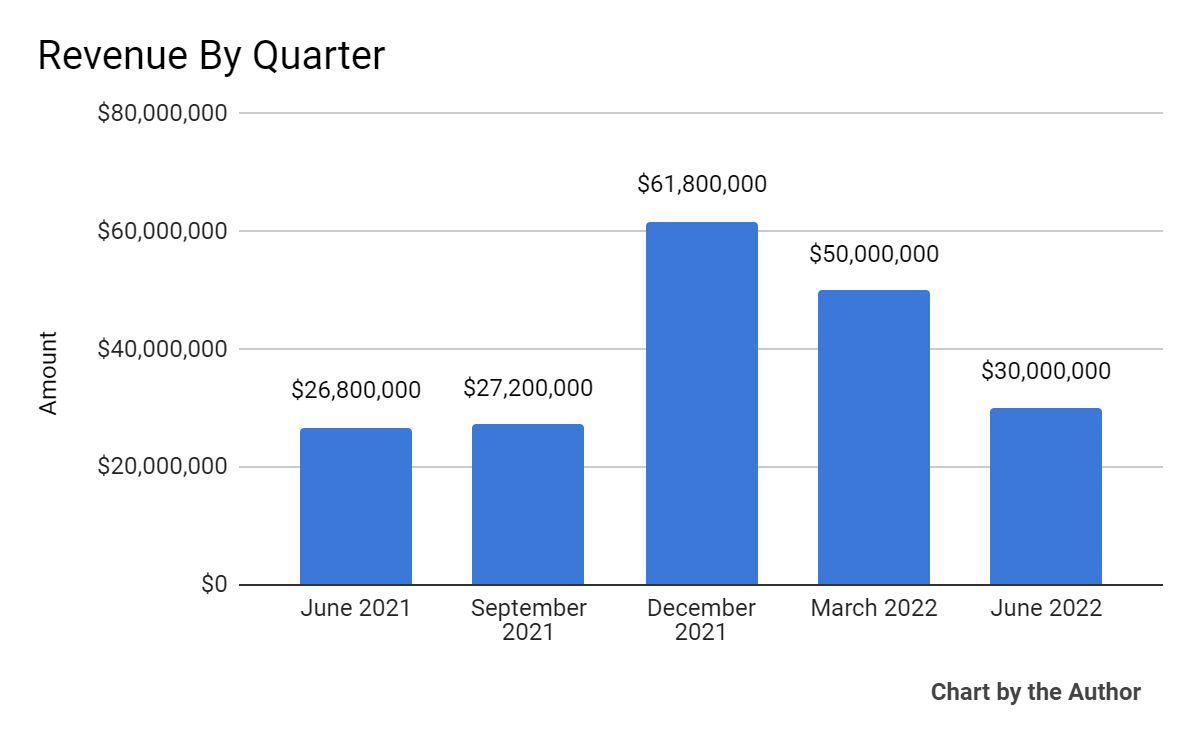

Total revenue by quarter has been highly variable over the past 5 quarters:

5 Quarter Total Revenue (Seeking Alpha)

-

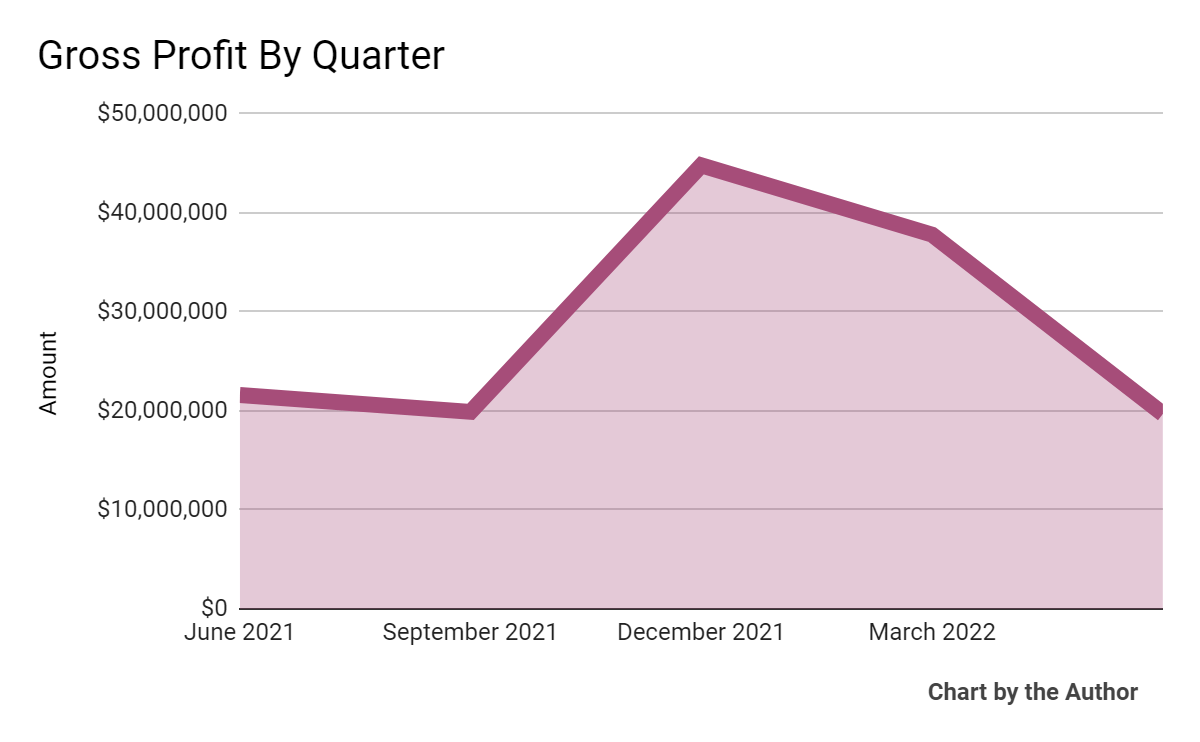

Gross profit by quarter has followed a similar trajectory to that of total revenue:

5 Quarter Gross Profit (Seeking Alpha)

-

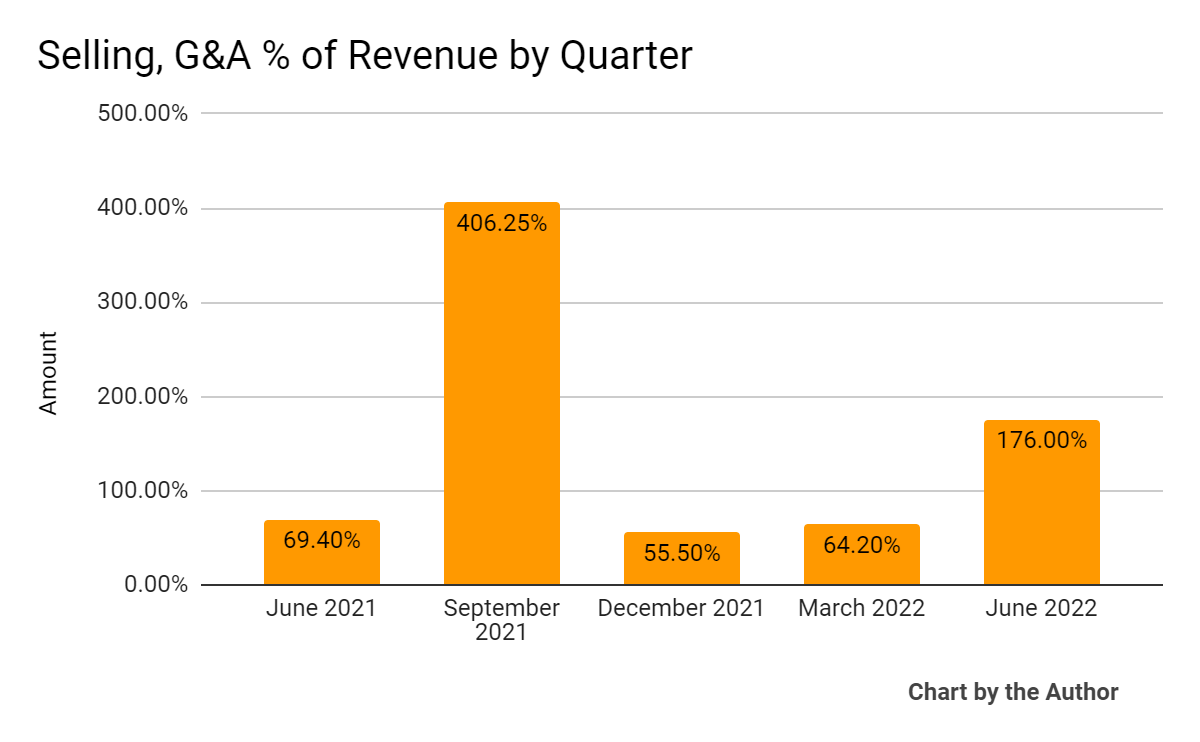

Selling, G&A expenses as a percentage of total revenue by quarter have fluctuated materially, as the chart shows below:

5 Quarter SG&A % Of Revenue (Seeking Alpha)

-

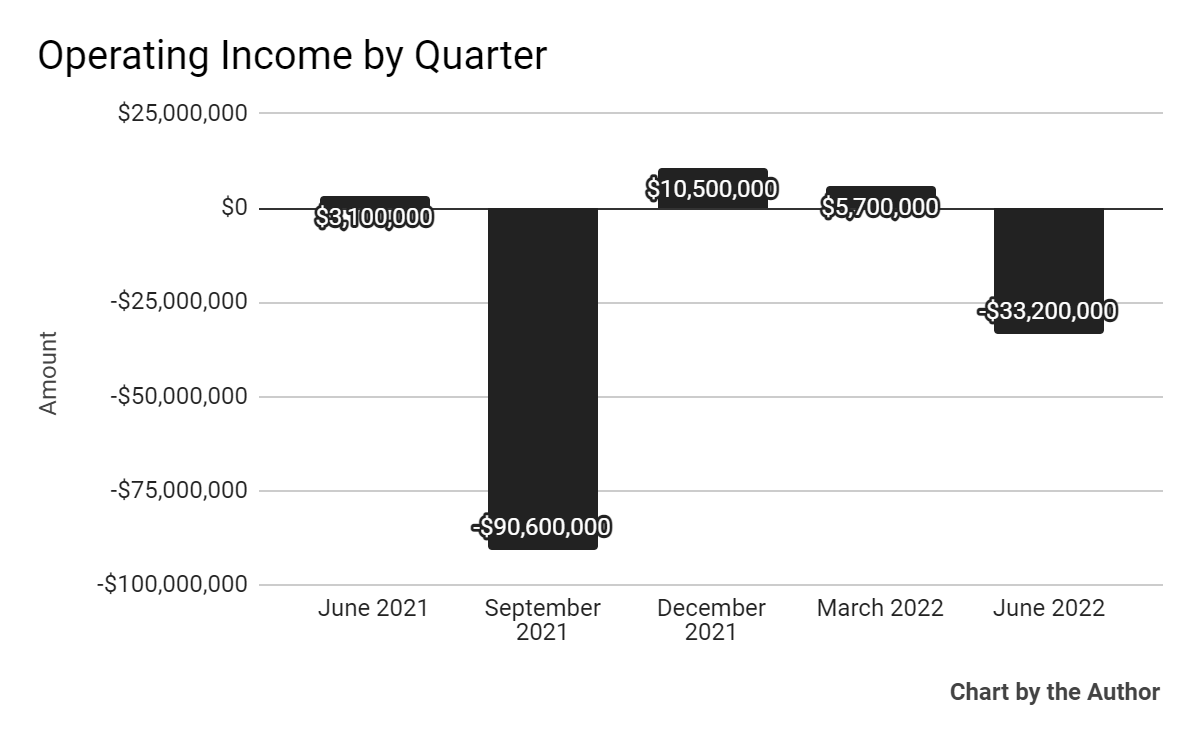

Operating income by quarter has also varied greatly in recent reporting periods:

5 Quarter Operating Income (Seeking Alpha)

-

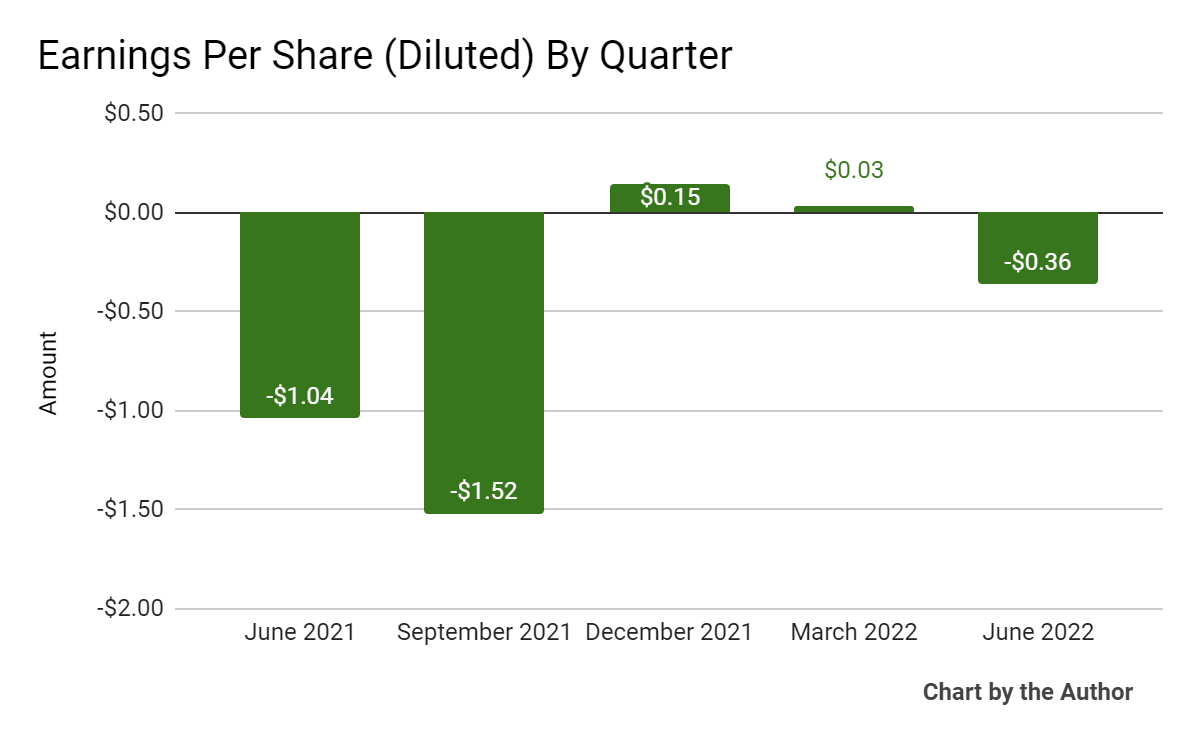

Earnings per share (Diluted) have produced highly variable results:

5 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

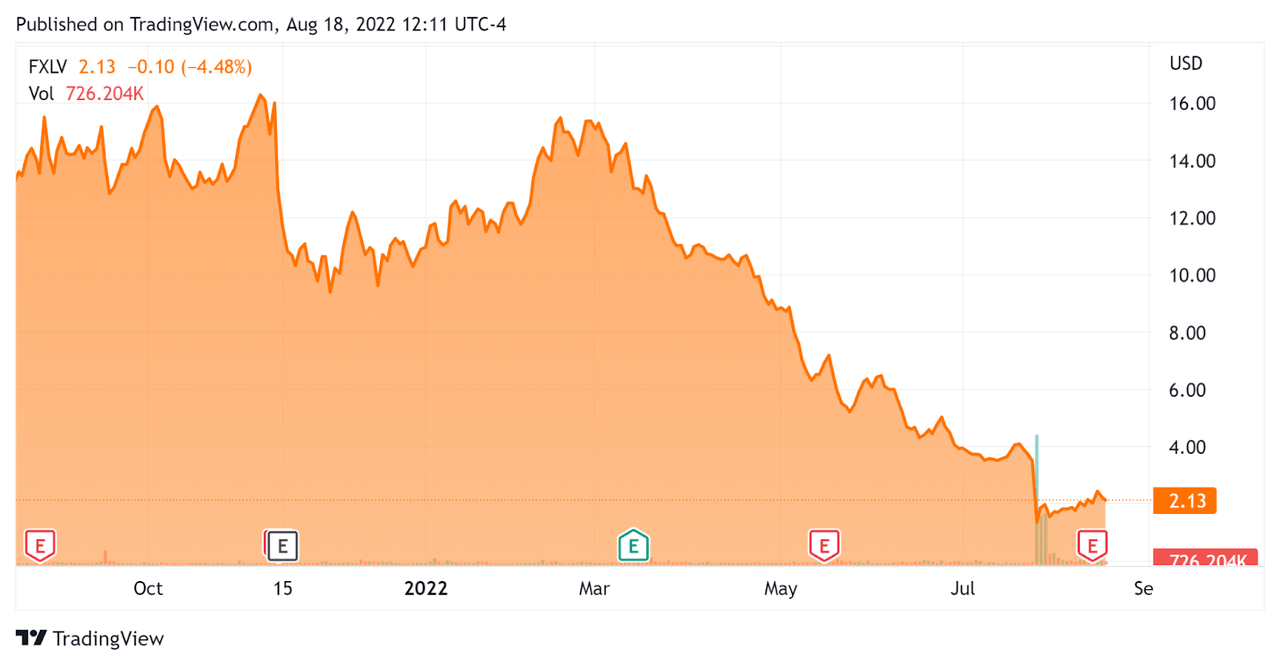

In the past 12 months, FXLV’s stock price has dropped 83.7% vs. the U.S. S&P 500 index’ fall of around 2.6%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For F45 Training

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value |

$268,300,000 |

|

Market Capitalization |

$215,180,000 |

|

Enterprise Value / Sales |

1.59 |

|

Revenue Growth Rate |

98.8% |

|

Operating Cash Flow |

-$104,370,000 |

|

Earnings Per Share (Fully Diluted) |

-$1.70 |

|

Net Income Margin |

-87.4% |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be Planet Fitness (PLNT); shown below is a comparison of their primary valuation metrics:

|

Metric |

Planet Fitness |

F45 Training |

Variance |

|

Enterprise Value / Sales |

12.31 |

1.59 |

-87.1% |

|

Operating Cash Flow |

$225,290,000 |

-$104,370,000 |

-146.3% |

|

Revenue Growth Rate |

59.5% |

98.8% |

66.0% |

|

Net Income Margin |

9.0% |

-87.4% |

-1076.6% |

(Source – Seeking Alpha)

A full comparison of the two companies’ performance metrics may be viewed here.

Commentary On F45 Training

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted the corporate reorganization efforts by board member and interim CEO Ben Coates while the firm searches for a permanent CEO to replace founder Gilchrist.

The company recently sharply reduced its forward growth guidance and studio expansion plans and has reduced financial ability to assist franchise owners due to the retraction of a $250 million growth capital facility as a result of the company’s share price drop.

FXLV recently announced a global workforce reduction of around 110 employees, with a target reduction of SG&A expenses by 45% versus Q1 2022.

As to its financial results, total revenue contracted sharply from the previous quarter, but rose year-over-year by 11.9%, mostly due to increased equipment revenue.

However, equipment gross margin dropped due to increasing costs while SG&A expenses rose dramatically due to a variety of reasons.

For the balance sheet, the firm finished the quarter with $8.5 million in cash and equivalents, $150.2 million in total liabilities of which long-term debt was $61.6 million.

Looking ahead, the firm slashed its forward guidance for new franchises sold, from 1,500 to around 400 at the midpoint of the estimate.

Full year 2022 revenue guidance was cut from $265 million at the midpoint to $125 million.

Regarding valuation, the market is valuing FXLV at an EV/Revenue multiple of around 1.6x, having beaten down the stock in sequential price drops on disappointment performance amid a rising cost of capital environment.

The primary risk to the company’s outlook is the restrictions on growth as franchisees have difficulty accessing capital to open studios.

Another risk would be a resurgence of the COVID-19 virus variants in some of its operating regions during the coming winter period.

A potential upside catalyst to the stock could include a new financing facility that would improve capital access to franchisees.

FXLV has numerous challenges ahead of it while it seeks to rationalize its cost structure, increase capital access in a higher cost of capital market while a global slowdown appears to be gaining steam in some respects.

I’m on Hold for FXLV in the near term.

Be the first to comment