jiefeng jiang

Thesis

We highlighted in our early July article on Marvell Technology, Inc. (NASDAQ:MRVL), urging investors to bide their time and not rush in. Interestingly, MRVL formed a robust bottoming process in July before rallying through the summer.

Despite the recent pullback from its August highs, our assessment suggests that MRVL has likely bottomed in July. Therefore, the pullback offers investors another opportunity to add exposure after MRVL fell more than 20% from its August highs.

Investors should expect Marvell to report slower growth moving ahead as it laps highly challenging comps. However, its cloud and data center-focused segment opportunity should help mitigate the downside volatility from the broad semi downturn. Despite that, we need to caution that MRVL’s valuation is more attractive but not undervalued.

Notwithstanding, we are confident that its growing EV opportunity within its automotive segment should help boost its margins profile moving forward. Moreover, its growing data center business should continue to help lift its operating leverage. Therefore, we believe MRVL’s long-term growth opportunity within the semi space remains robust, thus deserving its growth premium.

As such, we revise our rating on MRVL from Hold to Buy.

Marvell Is Not Immune To A Broad Semi Downturn

MRVL had lost more than 50% of its value from its December highs when it was overvalued by a mile. Therefore, the value compression over the past year is justified, as the market anticipated that even its enterprise/data center/hyperscaler-focused business is unlikely to sustain its growth cadence.

The company also experienced weakness in certain legacy products, as CEO Matt Murphy accentuated:

I think the overall trends in data center are very, very strong, I’m saying in aggregate. I think underneath the hood, depending on the type of components you supply, [and] your end customer orientation, you’re definitely going to see churn, right? I mean, we called it out in ours that we have a legacy portfolio of products that we sell, we said that’s down, right? I think there’s some inventory burn going on there and some adjustments. (Citi 2022 Global Technology Conference)

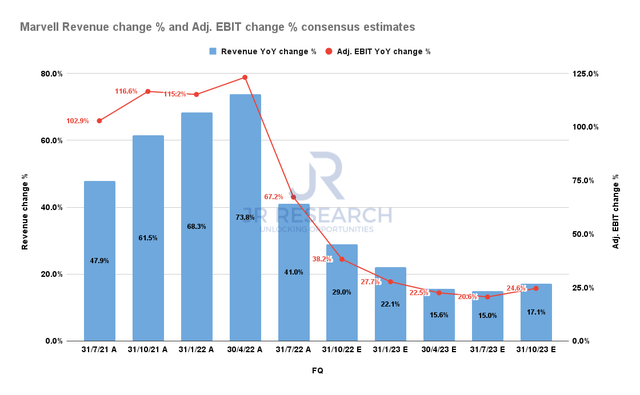

Marvell Revenue change % and Adjusted EBIT change % consensus estimates (S&P Cap IQ)

As seen above, Marvell’s revenue growth is expected to moderate further through 2023. Its Q3 guidance, which came in below the previous consensus estimates, corroborated our last article that investors need to anticipate a moderation in its growth cadence. As a result, its adjusted EBIT growth is projected to be impacted, but it is still demonstrating operating leverage.

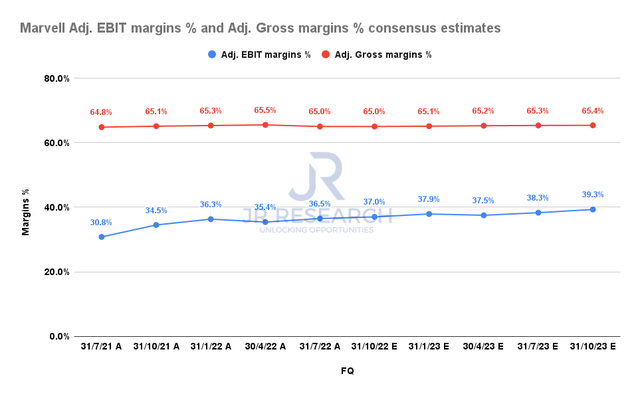

Marvell Adjusted EBIT margins % and Adjusted Gross margins % consensus estimates (S&P Cap IQ)

Consequently, Marvell is still expected to post stronger operating margins, lifted by its accretive data center and automotive segment. Hence, we believe its robust profitability profile should continue to support its premium valuation.

The company also expects its supply chain dynamics to be more constructive in FY23, given the weakness in the consumer side of things. Marvell remains capacity constrained, despite its robust growth. However, the company highlighted that the capacity benefits should accrue progressively, as it takes time for the capacity to be available.

Is MRVL A Buy, Sell, Or Hold?

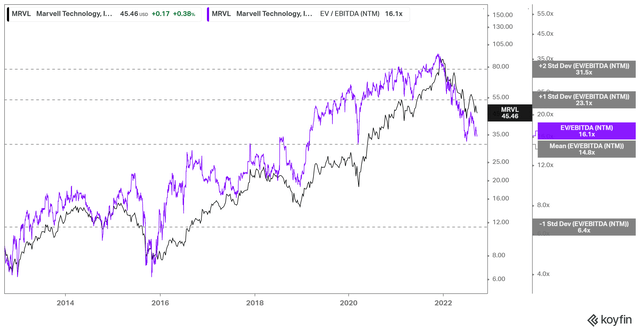

MRVL NTM EBITDA multiples valuation trend (koyfin)

MRVL was clearly overvalued in late 2021 as its valuations surged above the two standard deviation zone above its 10Y mean. Therefore, we welcome the massive digestion in its growth premium, as MRVL has fallen close to its 10Y mean.

We gleaned that the current zone has supported its valuation in the March 2020 COVID bottom. Furthermore, Marvell has transformed its business significantly, gaining exposure and market share across the enterprise/data center/hyperscaler/automotive space, as demonstrated in its revenue growth. Therefore, we believe the growth premium is justified.

As such, the pullback to its 10Y mean represents an attractive opportunity for investors to add exposure, given its long-term secular growth drivers and robust inherent operating leverage.

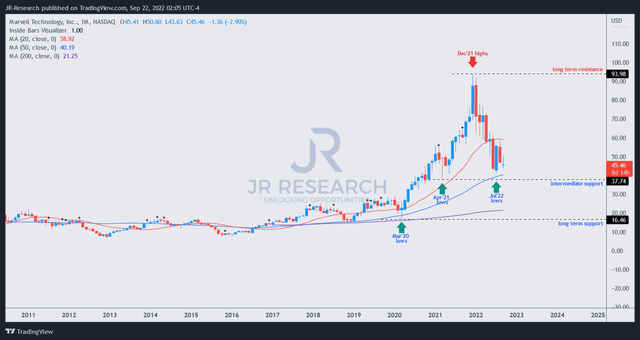

MRVL price chart (monthly) (TradingView)

MRVL has retraced more than 50% from its December all-time highs. Notably, it found support close to its intermediate support in July 2022, which also supported its upward momentum in April 2021.

Therefore, we believe that MRVL could continue to find resilience along that support zone, helping to stifle further downside volatility. Also, the 50-week moving average (blue line) seems to support its current bottoming process, suggesting that its long-term bullish bias remains robust.

Coupled with an attractive valuation, considering its secular growth drivers and constructive price action, we revise our rating on MRVL from Hold to Buy.

Be the first to comment