mirsad sarajlic/iStock via Getty Images

One relatively small but diverse company that I took it interest in earlier this year is Griffon Corporation (NYSE:GFF). The company currently operates in multiple industries, including the home and building products space through the sale of garage doors, rolling steel doors, and other related products. It also is involved in the consumer and professional products categories with the production of tools and other products for home storage and organization, landscaping, and more. Previously, it was also involved in the defense electronics space.

Buying into a company as diverse as this can be rather dangerous because it’s possible for management to lose sight of where the greatest value comes from. There’s also the risk of investing too much money into assets that frankly will never create the kind of value that said investments necessitate. However, in some cases, such as with this particular firm, it becomes clear that significant value can be created once management realizes that things are not going quite as well as they might otherwise go. And when that does come to pass, the upside for shareholders can be rather material. Such has been the case in the past couple of months with Griffon. And when factoring in increased guidance from the company, it becomes highly probable that further upside is just around the corner.

So many changes in such a short time

On May 9th of this year, I wrote an article that looked upon Griffon in a favorable light. I called the enterprise a small niche holding company that seemed to offer attractive upside for investors. This was based on recent performance that had been rather solid and had a lot to do with how cheap shares were at that time. As a result of my findings, I ultimately rated the business a ‘buy’, indicating that I felt as though it would generate returns that would outpace the broader market for the foreseeable future. So far, the company has performed better than I would have anticipated. While the S&P 500 is up by just 0.8%, shares of Griffon have generated a return for investors of 18.3%.

Such a short time has passed since the publication of the aforementioned article that the company has not even had the opportunity to release financial results for another quarter. But even so, a lot has changed since then. For starters, on May 16th, the management team at the business announced that they were beginning a review of strategic alternatives regarding the enterprise. They believed that there was unlocked potential within the business and investors would be best served by trying to extract that value. They were rather noncommittal in terms of the specific outcome they were aiming for, but they did say that they were exploring all options, including a potential sale of the business, a merger, divestitures, and even potentially a recapitalization. Almost any time that a company announces something like this, it can prove a strong catalyst for upside, but basing an investment decision on this kind of development alone is speculative and risky.

Then, on June 27th of this year, the company announced another interesting development. This was the completion of its sale of Telephonics to TTM Technologies. At the time of my prior article, the company said that it expected to bring in net proceeds from the deal of at least $250 million. Ultimately, it ended up bringing in $330 million in cash from the transaction. The company also ended up announcing, on June 27th, that it was paying out a $2 per share special dividend to its investors. This is on top of the $0.09 per share in regular quarterly dividends that the business has been paying out. This special dividend translates to a one-time payout of 7.2% compared to the company’s current share price as of this writing. The overall cost to investors, based on my calculations, is $114.1 million.

In addition to paying out this distribution, the company also said that it was allocating $300 million to the paydown of some of the $800 million term loan that the enterprise currently has on its books. This move alone addresses one of my concerns from my prior article on the company that leverage was awfully high. In addition to reducing risk for investors, it should also help to reduce annual interest expense, based on the term loan’s recent 3.4% annualized interest rate, in the amount of $10.2 million. and on top of all of this, the company also recently, in light of improved market conditions, increased its guidance for EBITDA this year by $120 million, taking it from $355 million to $475 million.

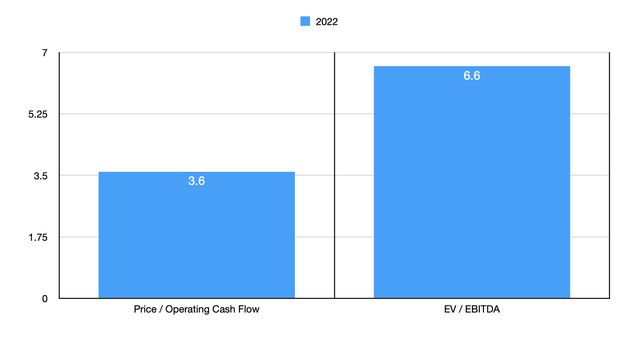

Factoring in all of these changes, I decided to re-price the company. We already have management guidance for EBITDA for the current fiscal year. But we don’t have an estimate when it comes to operating cash flow. So what I did was strip out projected interest expense for the entirety of the year from EBITDA ticket us something that should more or less be similar to operating cash flow. And based on my estimates, that number should come out to roughly $408.7 million. On a forward basis, this implies a price to operating cash flow multiple of 3.6, while the EV to EBITDA multiple of the company should be 6.6. To put the pricing of the company into perspective, I also compared it to the same five companies that I compared it to in my last article. On a price to operating cash flow basis, these companies ranged from a low of 8.7 to a high of 79.4. And using the EV to EBITDA approach, the range was from 7.4 to 15.9. In both cases, Griffon was the cheapest of the group.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Griffon | 3.6 | 6.6 |

| Gibraltar Industries (ROCK) | 79.4 | 10.6 |

| Janus International Group (JBI) | 17.5 | 15.9 |

| PGT Innovations (PGTI) | 15.1 | 12.2 |

| Tecnoglass (TGLS) | 8.7 | 7.4 |

| Apogee Enterprises (APOG) | 15.6 | 13.9 |

Takeaway

These are, truly, exciting times for investors in Griffon. At present, the company is doing exceptionally well for itself and it seems to be fighting hard to create value for its investors. I am very happy with the company’s decision to pay down debt, especially given the current environment of rising interest rates. But given how cheap shares are, I wish the firm would have bought back stock instead of paying out the special dividend. All other things considered though, the picture looks positive and, despite the stock rising nicely in such a short timeframe, I have no hard time believing that further upside is highly probable. And because of this, I’ve decided to retain my ‘buy’ rating on the business.

Be the first to comment