jean-francois/iStock Editorial via Getty Images

Investment thesis: It is becoming increasingly clear that the world is entering a period of prolonged scarcity issues, especially when it comes to commodities, energy, food, and other vital products that are necessary to our general well-being. Companies that can help to address this problem should be given particular attention by investors because they are likely to see a significant increase in business activities, with revenues and profits likely to be positively affected. Greenbrier Companies (NYSE:GBX) is one such company. It is likely to see increased demand for its rail equipment products, given that rail transport is more fuel-efficient than road freight operations. Passenger rail travel is likely to see an increase as well, given the growing drive to eliminate short-distance air travel, as well as reduce personal passenger vehicle travel in Europe. The recent market selloff provides an opportunity to buy Greenbrier stock at a lower price, even though its business profile does not make it particularly vulnerable to possible stagflationary trends. In fact, it will feature as one of the companies helping to remedy stagflation, thus it may become one of the few manufacturing companies that are set to benefit from an otherwise bleak global economic outlook going forward.

Greenbrier’s latest financial results are encouraging.

For the second quarter of its fiscal year ending in February, Greenbrier recorded net earnings of $11.2 million, on revenues of $683 million. It makes for a somewhat thin profit margin of just about 1.6%, which is less than ideal within the context of producer prices continuing to rise both in the US and in the EU, where Greenbrier has most of its facilities and conducts its activities. Revenues more than doubled compared with the same period from last year, while last year’s losses of just under $14 million for the same quarter of last year, were almost matched in magnitude by the net earnings of the latest quarter. It is therefore a significant improvement. The increase in revenues compared with the first quarter of this fiscal year was 19%.

Other highlights of note include an increase in railcar orders, with $930 million worth of new orders added for the quarter, which can arguably be seen as a future prognosis of revenues going forward. Inventories have grown by about $200 million over the past year, suggesting that profit margins may improve in the longer term since costs were incurred, but revenues were not collected for all produced merchandise. Interest and foreign exchange costs came in at just under $12 million, which is less than 2% of revenues. This is a measure I tend to look at often when assessing the overall financial health of a company. I tend to start worrying when interest costs rise above 5%. Greenbrier is clearly not in the danger zone in this regard. It is an issue that I think will become more prominent for investors as interest rates tend to rise after decades of declining rates.

A note on the rising tide of global scarcity as it relates to Greenbrier’s business model.

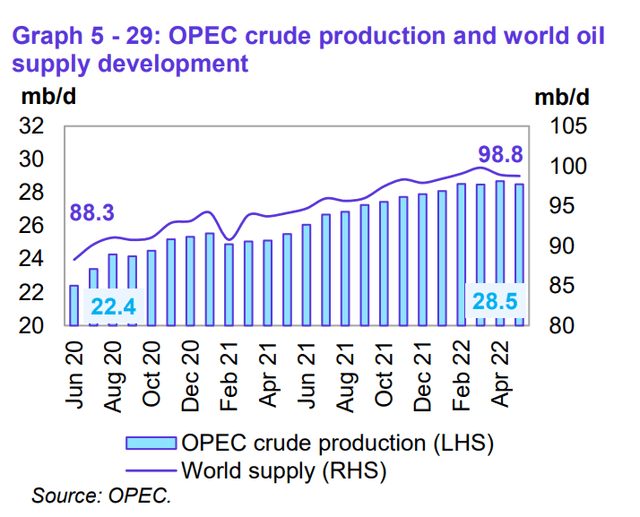

OPEC’s latest monthly oil market report suggests that by the last quarter of this year, we will see total global liquids demand rising to 102.8 mb/d on average. As of May of this year, global liquids output was 98.8 mb/d.

Global monthly oil production (OPEC)

In other words, the world has to find an extra 4 mb/d in supplies within the next four months, even as we are trying to reduce Russia’s export volumes, if we are to reconcile the global supply/demand balance. The world seems to be entering a prolonged period of liquid fuel scarcity as soon as this fall. The implications for Greenbrier are that rail transport is set to gain a long-term advantage as road freight transport is becoming more expensive.

The food scarcity issue, relating to logistical problems we are facing in regard to Ukrainian supplies, is apparently stimulating efforts to increase rail freight capacity from Ukraine to some of the EU’s ports, in order to circumvent the continued blockage of Ukraine’s grain exports in the Black Sea. It seems that expectations are now that Ukraine will be blocked from using its ports for the foreseeable future, which necessitates the building out of new rail infrastructure within the EU in order to get Ukrainian grains and other exports moving. It is yet another effort to re-adapt to geological, economic, and geopolitical trends taking place currently, and it illustrates how Greenbrier can see increased demand for its products as a consequence.

It should be noted that the current energy crisis issues, which in my view are set to persist for the long term are not all good news for Greenbrier. Expensive energy means slower economic growth, which in turn reduces demand for all transportation. While this may be true, the very high price of fuel should lead to rail transport gaining enough ground versus alternatives such as road and air transport, that it may see a significant increase in demand, even as demand for transport services overall may decline or stagnate going forward.

Investment implications:

Within the context of scarce resources, efficiency tends to win over convenience. Road transport has the advantage of the flexibility and most often the added advantage of speed over rail transport, even though it is more costly and less fuel-efficient. Air transport is even faster and in many ways enjoys more flexibility over both rail transport and road transport options, but it is the least fuel-efficient option and it is the most expensive option by far. In the age of cheap energy, cheap money, and declining labor costs, as we outsourced much work to the developing world, production costs and fuel efficiency in transport were not as much of an issue, thus it made the just-in-time supply chain economy possible.

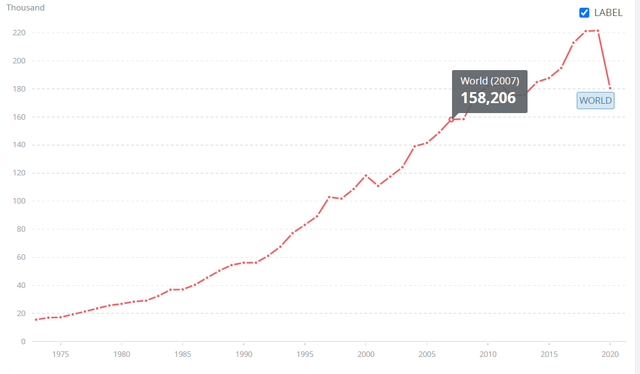

Air cargo transport (World Bank)

As we can see, global air cargo transport quadrupled from 1990 to 2019, despite the high costs involved. Our economic model developed increasingly with a premium placed on speed of delivery, as well as the flexibility of volumes delivered on short notice.

With energy prices headed up, which is pushing up the price of borrowing, as well as other related costs, there is likely to be a shift back for companies to start prizing lower logistical costs, over flexibility and speed of delivery. For instance, Walmart (WMT), which was already operating under the pressure of thin profit margins, just recently saw its profits slashed by about a quarter compared with the same period last year. Needless to say that it will be looking to improve operating costs wherever possible, even if it will be at the expense of planning further ahead in terms of receiving inventory, by having its inventory travel a longer distance on rail on average in some instances than it is currently the case.

Greenbrier is well-positioned to take advantage of such fundamental changes in North America, as well as in Europe and elsewhere. More rail transport means more rail cars will be needed. Aside from such longer-term transformational trends, there is the example of the Ukraine transport issue, where it seems that we are now set to see a dramatic increase in EU rail transport capacity towards and away from the Ukraine border. Alternative solutions are sought to Ukraine’s dependence on maritime transport in the Black sea. I just read recently on the Romanian site Adevarul that a previously abandoned rail link between Ukraine and the port city of Galati is being urgently refurbished and set to re-enter service after being abandoned for more than 30 years. Many more such projects are likely to be announced in response to the emerging challenge of keeping Ukraine connected to the global supply chain. Greenbrier has the perfect opportunity to participate in the expansion of rail transport between Ukraine and the EU in the coming months and years, since it has facilities in Romania as well as Poland.

I had a modest Greenbrier stock position in the recent past, which I sold not long before the overall stock market started to slide. I figured that there was a good chance of seeing an opportunity for a more favorable entry point on this investment opportunity. I took up a small position in this stock again this week. If there will be further declines in its stock price in the next few weeks or months I will consider adding to it. The recent decline in the stock price has very little to do with the outlook for this company. The broader economic and geopolitical trends are working in its favor. The very pressures that are driving the overall stock markets lower, namely a stagflationary environment, in part driven by resource scarcity issues, are actually a reason to expect more market interest in Greenbrier’s rail products. A fundamental economic shift that seems to be taking place this decade, which is likely to favor more fuel-efficient transport options will benefit this company, making it potentially one of the few manufacturers to have the potential to be winners this decade.

Be the first to comment