CloudVisual/iStock via Getty Images

Last week, I used the pronounced market weakness to enter a trading position in leading dry bulk shipper Golden Ocean Group (NASDAQ:GOGL) or “Golden Ocean”.

Introducing Golden Ocean

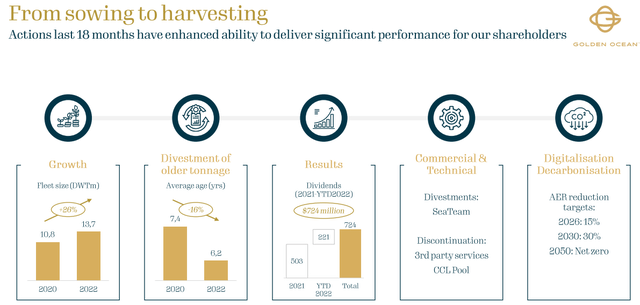

The company commands a modern fleet of 94 dry bulk carriers with an average age of six years and clear focus on the larger vessel classes (Capesize and Panamax).

Golden Ocean is controlled by Norwegian-born shipping magnate John Fredriksen who beneficially owns almost 40% of outstanding common shares.

The company is dual-listed in Oslo and New York and, with a market capitalization of $1.75 billion, among the most valuable dry bulk shipping companies in the world.

Low Break-Even Levels

With industry-low break-even rates of $13,000 for Capesizes and $9,350 for the Panamax fleet, Golden Ocean is well-positioned for a potential industry recovery next year after an ugly combination of much weaker-than-expected Chinese iron ore demand and rapidly easing port congestion has put some pressure on charter rates as of late.

Dividend Focus

Besides keeping a relatively young fleet profile, management’s ongoing focus has been on returning capital to shareholders, with an aggregate $3.60 in cash dividends per common share paid since the beginning of 2021.

Company Presentation

Strong Financial Results

Six weeks ago, Golden Ocean reported strong first-half results, with Adjusted EBITDA of $341 million and $279 million in cash flow from operations both up significantly on a year-over-year basis.

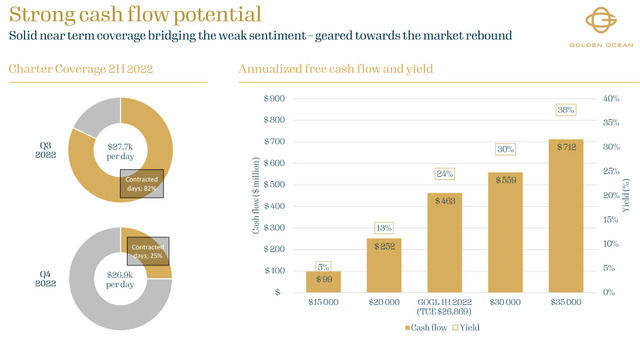

Moreover, the company managed to contract the vast majority of available days for the third quarter ahead of the recent drop in charter rates, which should result in another strong quarterly report next month. Shareholders are likely to receive a dividend of at least $0.50 per common share.

Company Presentation

Q4 And Particularly Q1 Likely To Be Weaker

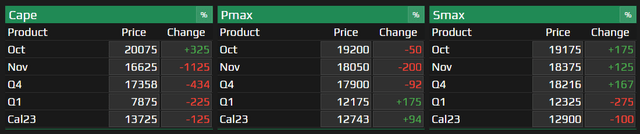

That said, based on current Forward Freight Agreement (“FFA”) rates, Q4 and particularly Q1 are likely to be weaker even with the majority of the fleet currently enjoying healthy scrubber premiums.

Braemar Atlantic Securities

Should Capesize FFAs for Q1 remain in the current range, the company’s larger vessels are unlikely to generate meaningful profits even when accounting for material Newcastlemax and scrubber premiums. The Panamax fleet would do somewhat better, but rates remain a far cry of what investors have gotten used to over the past two years.

But even when assuming no improvements in charter rates, Golden Ocean is still likely to pay a dividend for both Q4 and Q1 albeit at reduced levels.

Potential Market Recovery Next Year

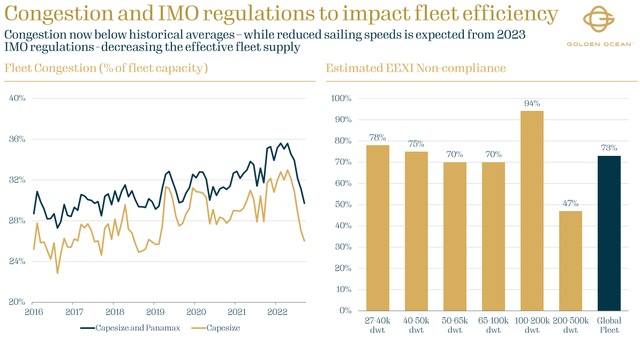

While inflation and related recession fears are currently impacting demand, with congestion now below historical averages, an order book at record lows and new environmental regulations likely to result in materially reduced sailing speeds next year, the industry outlook isn’t all that bad.

Company Presentation

Should China’s government finally pull through with a large-scale stimulus, iron ore demand is likely to recover materially, which in turn would benefit Capesize charter rates.

Valuation And Leverage

In a recent note, Fearnley Securities assessed the company’s net asset value (“NAV”) at $11. While a number of smaller and lower-quality peers are trading at even more depressed valuations, the recent sell-off provides investors the rare opportunity to buy into a market leader at a sizeable discount to NAV.

At a loan-to-value (“LTV”) ratio of 37%, leverage shouldn’t be an issue for the time being.

$100 Million Share Buyback Program

Following the recent 50%+ pullback from multi-year highs marked in Q2, I wasn’t exactly surprised by Tuesday’s $100 million share buyback announcement:

The Board of Directors of Golden Ocean Group Limited (…) has on October 4, 2022, authorized a share buy-back program of maximum USD 100 million to purchase up to an aggregate of 10,000,000 of the Company’s common shares for a period up to 12 months, commencing October 4, 2022. The maximum amount to be paid per share is USD 10.0, or equivalent in NOK for shares acquired at Oslo Stock Exchange.

(…)

Ulrik Uhrenfeldt Andersen, Chief Executive Officer, comments:

«The uncertainty in the global economy has impacted capital markets and near-term dry bulk freight sentiment. Following the recent share price development, we find it in our shareholders’ interest that the Company has the authorization to repurchase our common stock as part of its capital allocation strategy. Given the strength of our balance sheet and our constructive long-term market outlook, the Board has decided to add the opportunity to allocate part of our financial resources to pursue such share buyback. This plan reflects our confidence in the market and our strategy to invest for long-term shareholder return».

Bottom Line

Despite the recent market weakness, Golden Ocean is likely to deliver another set of strong quarterly results next month and keep its dividend at healthy levels.

That said, based on current FFAs, investors need to prepare for reduced payouts in Q4 and particularly Q1, but new environmental regulations and a record low order book should provide some support to charter rates next year even in case of ongoing, muted Chinese commodity demand.

In addition, the company’s new share buyback program is likely to put a short-term floor under Golden Ocean’s share price.

Lastly, in contrast to many of its smaller industry peers, Golden Ocean doesn’t have any meaningful corporate governance issues.

Speculative investors looking for exposure to the larger dry bulk market segments should consider scaling into the shares on weakness.

Be the first to comment