VioletaStoimenova/E+ via Getty Images

Who is 1Life?

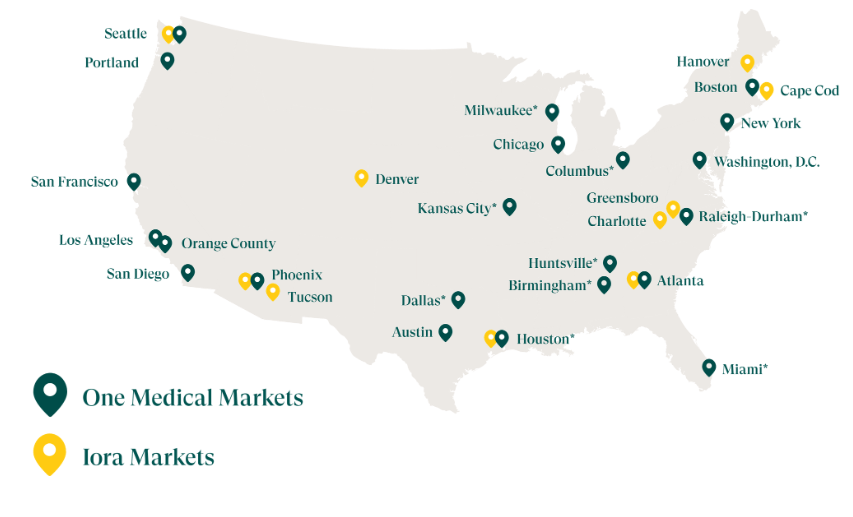

1Life Healthcare, Inc. (NASDAQ:ONEM), most commonly known as One Medical, is a primary care provider that has a network of over 100 physical offices across the U.S. and also provides 27/7 virtual care. While expanding geographies rapidly, the current memberships are only offered in select metro areas such as LA, Seattle, Boston, Austin, and Atlanta, although the recent acquisition of Iora did help diversify the platform. A membership starts at $199 per year and is covered by a range of insurance policies issued by Aetna (NYSE:CVS), Blue Cross Blue Shield affiliates, UnitedHealth (UNH), Anthem (ELV), Cigna (CI), Centene (CNC), and more (incl. Medicare with 65+ plans). However, as is typical, the membership does not cover all costs, and the need to perform procedures is a way to drive revenues.

One Medical Website

The company is attempting to use novel services and capabilities as a way to differentiate the platform from peers. Much of this has to do with the technology platform (cloud services, telehealth, efficient appointment booking, etc.) that allows for members to have a significant amount of freedom. However, the platform is lacking in terms of home healthcare services and this could be one reason for the acquisition: home healthcare providers looking to grow their membership and technology base. As I discussed in an article on Signify Health and Brookdale Senior Living, home health services are a growing area of the market, and most providers are moving to provide these services. I believe 1Life, and members, would welcome an acquisition with open arms as the economy of scale improves member care capabilities.

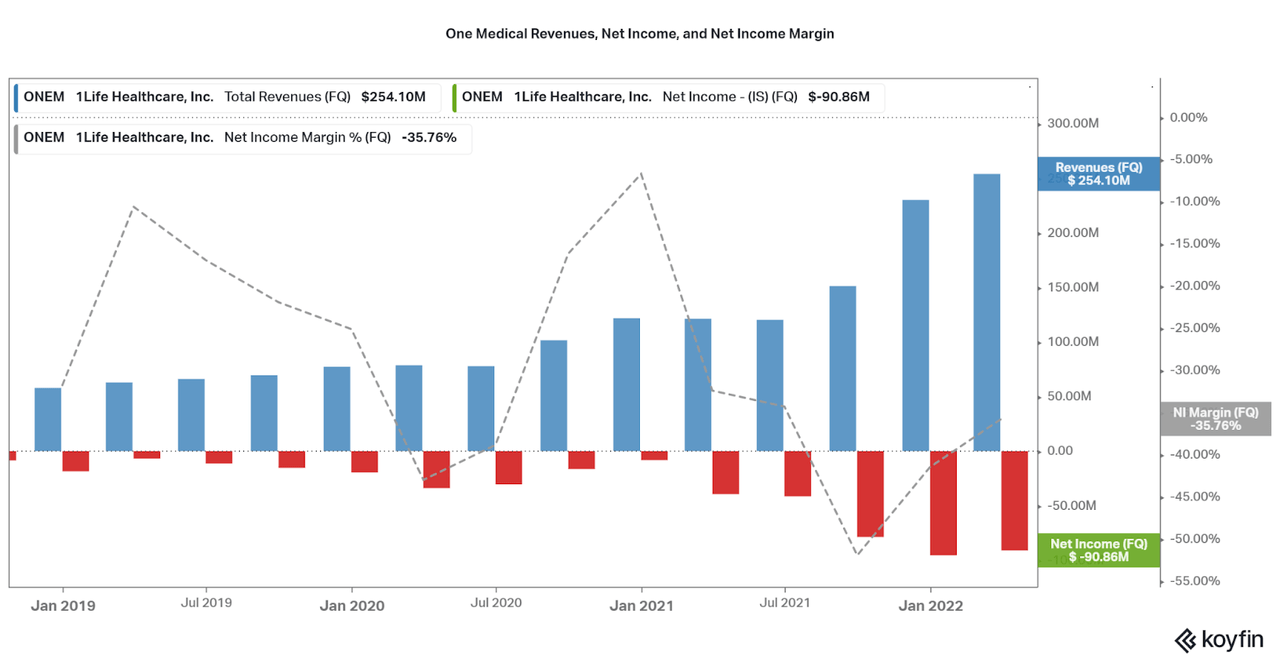

As of the quarter ended March 2022, One Medical has 767,000 memberships, up 28% YoY. This led to earning $254 million in revenues for the quarter, a new high up 109% YoY (thanks to an acquisition going through last fall). While growth is present, net income continues to be negative, and increasing YoY. Unfortunately for those looking to acquire the company, much of these expenditures have been supported by debt, and One Medical is currently holding $200 million more in debt than cash. In contrast, purchasers have the benefit of a 70% decline in share price over the past year, so 1Life is certainly beginning to look appetizing. More on the purchase cost later.

Koyfin

Is CVS financially sound enough to purchase 1Life Healthcare?

The short answer is, yes, merely due to the potential size of the acquisition. However, the real answer is more nuanced. While the company owns a duopoly over retail pharmacies along with Walgreens (WBA) and offers an extremely stable financial profile in any economy, current headwinds include significant amounts of debt, lagging organic growth, and declining margins.

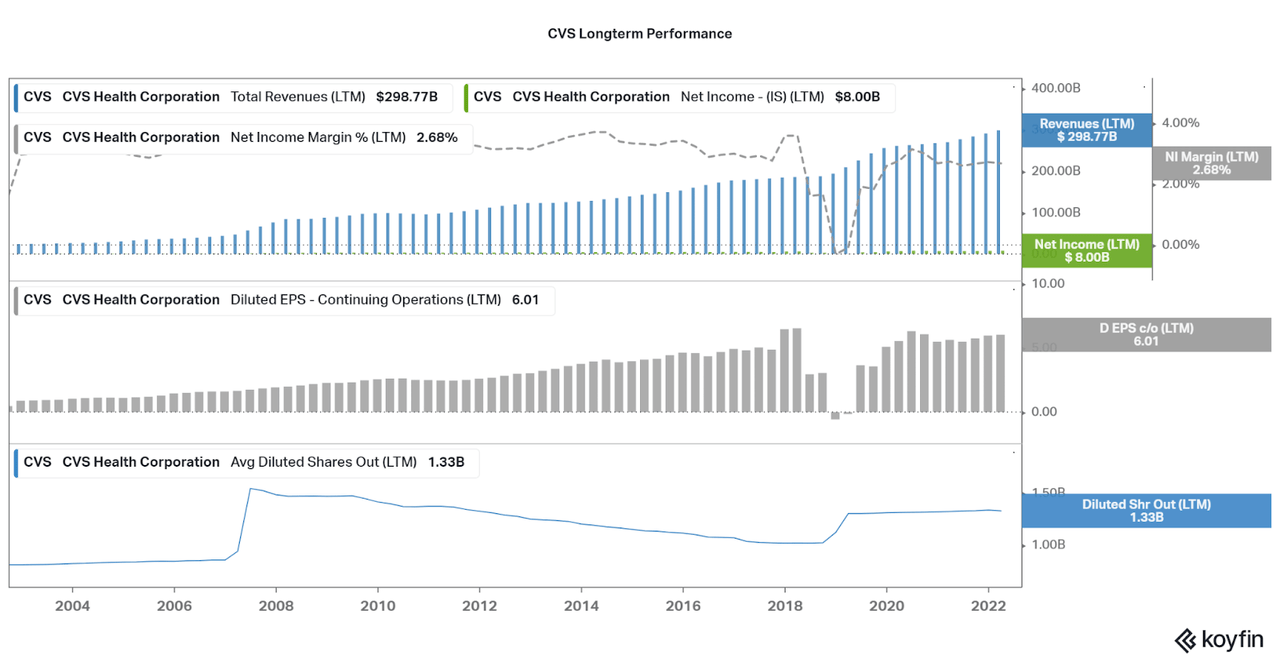

I believe the performance chart below offers two tales. First, a highlight of the extremely stable and moat-like business, especially through periods such as the financial crisis and pandemic. However, a closer inspection shows that net income is slowly falling to precipitous levels. Margins are already slim for consumer-facing businesses, and it does not help that revenues are becoming more volatile. As I will discuss next, one recent event is certainly part of the make-or-break scenario for CVS.

Koyfin

To combat the risks of increasing competition from alternate retailers and retail healthcare providers, CVS decided to acquire Aetna in 2018 (quite noticeable on the chart above). While revenues certainly took off after the acquisition of this healthcare provider, margins have failed to improve in a similar manner. While rebounding after the initial acquisition period, the downward trend seen prior to the acquisition is still visible. As one may assume, this could be due to innovation investments for CVS’s telehealth and home health services and will improve in time. Then, one can also assume purchasing 1Life at current record low valuations is a cheap way to expand the platform in one fell swoop.

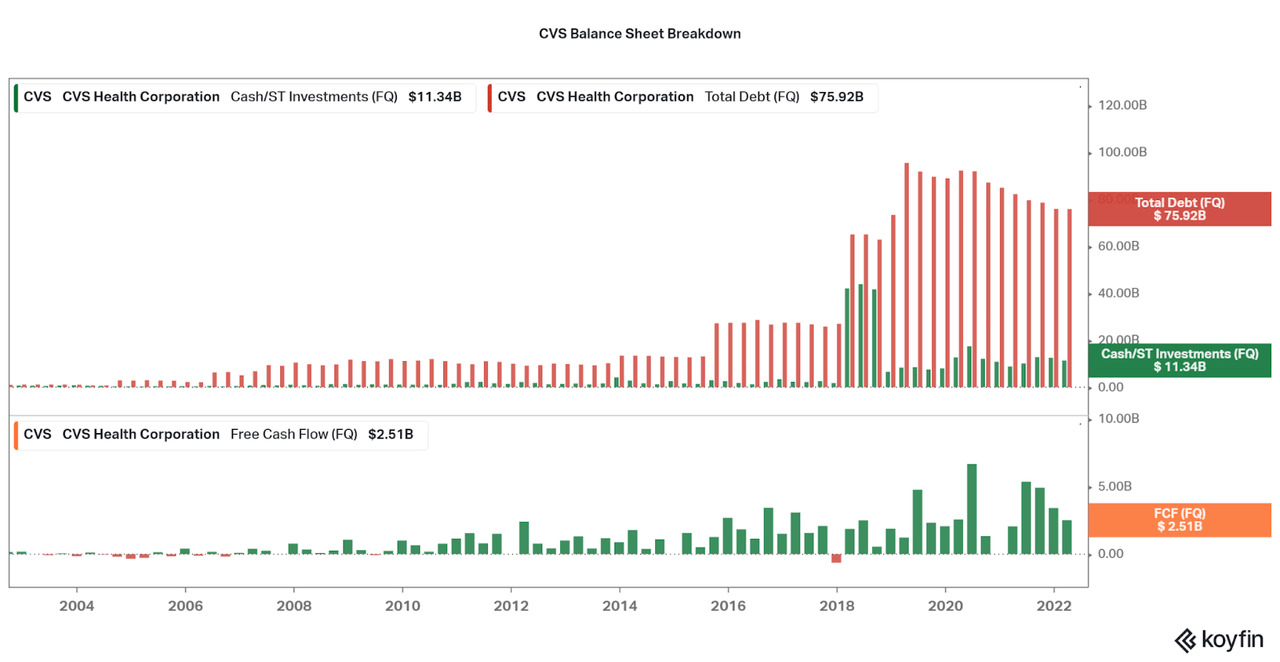

However, there is no data indicating that CVS is the potential suitor at the moment. While the name is the go-to at the moment, excess leverage is the one risk that exists and may prevent the acquisition from going through. Currently, CVS has $75 billion in debt and only $11 billion in cash, while 1Life is trading at a $1.8 billion enterprise value. This chump change does not damage the company further, but CVS is treading water as it is. Therefore, 1Life investors are betting on whether CVS is willing to use over 50% of their average yearly FCF to invest in their health care platform. That begs the question: how significant are the health care service segments?

Koyfin

Acquisition remains uncertain

While most of us are familiar with CVS’s retail locations that sell both over-the-counter and prescription medicines, and possibly MinuteClinics at these physical sites, some may not know that CVS also offers health insurance plans. As a side note, MinuteClinics now offer e-visits and/or 24/7 video visits (in partnership with Teladoc (TDOC)) and these services are also mostly covered by Aetna. This scale already in place dwarfs One Medical.

With the most recent earnings, Health Care Benefits accounted for over 30% of the $76 billion total quarterly revenues. Further, this segment is growing the fastest (compared to retail and pharmacy sales), with full year revenue growth expected to reach 9-11% YoY, compared to 5-6% for the company as a whole. As you can see, another issue to consider is whether 1Life is worth CVS’s time. Other metrics to consider are as follows:

-

1,100 MinuteClinic locations vs 125+ Physical Locations for One Medical.

-

39 million approximate Aetna insurance members and millions of retail MinuteClinic users vs. ~750,000 One Medical members.

-

CVS already has a partnership with Teladoc to provide telehealth services, along with other in-place infrastructure.

As a result, one has to wonder whether CVS will go through with the acquisition. There are certainly other healthcare providers who may look to gain an increased benefit from the relatively cheap acquisition of 1Life. Interestingly, ONEM has led their business as if they plan on moving forward alone, especially after the debt-heavy acquisition of Iora last year. I am sure growth investors certainly favor a decade of growth over a one-time payment. Maybe not, and I will certainly be waiting for more news to come out.

Thanks for reading.

Be the first to comment