Michael Vi

Preamble

I have previously written an overview of Zscaler, Inc. (NASDAQ:ZS) in August (3 Stocks For Income And Growth Investors) so do refer to that for some of the reasons for investing in ZS. In this article, I will be reviewing the thesis more in light of the most recent Q1 2023 conference call.

Thesis

This article discusses the following:

A) Is the company still posting strong revenue growth, and is it expecting that growth for the rest of FY 2023?

B) Is the company still on a clear path to profitability?

C) What messages is the management conveying to the stakeholders?

D) Possible Catalysts To Consider

E) Re-Valuation based on the most recent data points: What is ZS worth?

For a busy investor like you, I will summarize my position simply by saying “Buy the dip if you trust the management to grow the business to reach profitability in a few years“. However, I urge you to read on to consider the reasons for doing so as you do your own due diligence. Like a friend of mine said recently, “Do not borrow someone else’s conviction“. And I look forward to engaging with you in the comments section.

Revenue Growth

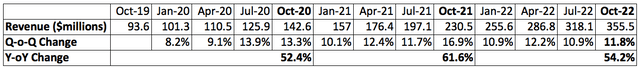

Revenue has been growing nicely. Year-on-year growth slowed slightly to 54.2% compared to the 2020-2021 growth rate of 61.6% but still impressive. Looking at revenue growth on a quarter-on-quarter basis, the company has been growing steadily in the low to mid-teens since July 2020.

Author’s table. Data from Fast Graphs Financials and ZS 10-Q

I also love the fact that this growth is largely organic. Over the 3 years, Zscaler only made three strategic acquisitions to augment its technologies; Edgewise Networks in 2020, Smokescreen Technologies in 2021, and ShiftRight in 2022. These are not companies with large revenues so acquiring these small companies (Edgewise Networks had revenue of $7.4 million while ShiftRight’s revenue was reportedly just $3.8 million) is definitely not for their customer base.

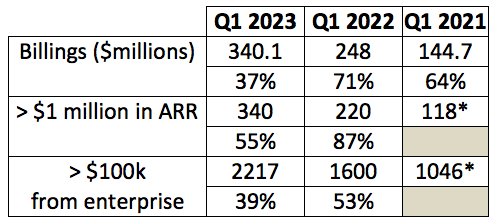

The growth in billings, which is contracted business that has yet to turn to revenue, and growth in the larger enterprise customers that generate more than $100 thousand and more than $1 million annually in ARR are all coming along nicely.

Data from Q1 2020-2023 10-Qs and transcripts, * represents calculated figure from given % in 10-Qs and transcripts

These growth figures tell me three things. One, customers recognize the value proposition of Zscaler’s products and services and are willing to pay for them. Two, with more enterprise customers signing up, the recurring revenue stream will be less lumpy as the larger customers are less likely to reduce or cut their subscriptions in tough times like the smaller customers might need in order to preserve capital. Three, Zscaler is taking market share, and if Zscaler’s claims that this is a $70 billion industry is anywhere close, then it is only getting started.

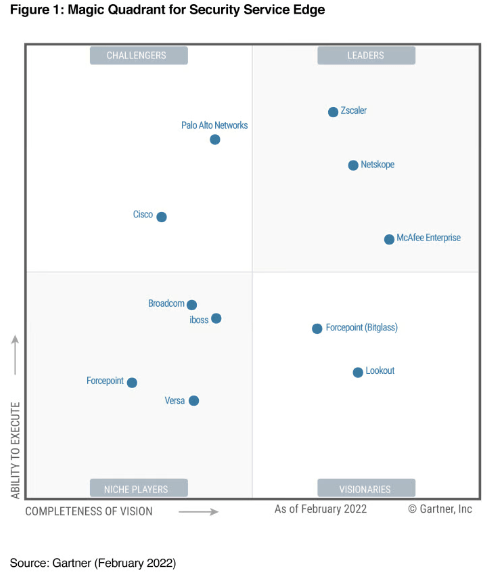

And it is not difficult to see why customers would sign up with ZS and stay on with them (net retention rate exceeded 125% again). You most likely know that Zscaler sets the standard for the new Security Service Edge (SSE) category, being positioned as a Leader and highest in Ability to Execute in the 2022 Gartner Magic Quadrant for SSE. And that is 11 years consecutively as a Leader in Gartner’s Magic Quadrant for Secure Web Gateways.

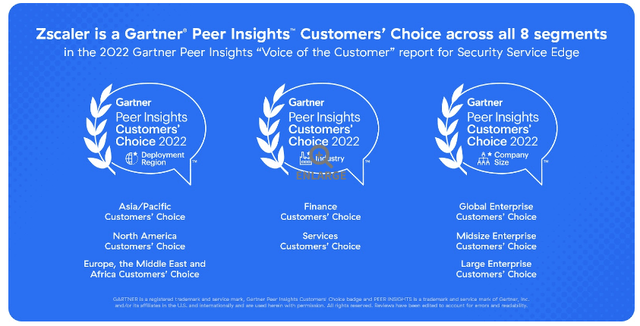

Gartner 2022

Zscaler has also been recognized as a Customers’ Choice vendor for 2022 in the Security Service Edge (SSE) category on Gartner® Peer Insights™. Zscaler was named as a leader in all eight segments in the accompanying “Voice of the Customer” Report for SSE, the only vendor to get this recognition.

Path To Profitability

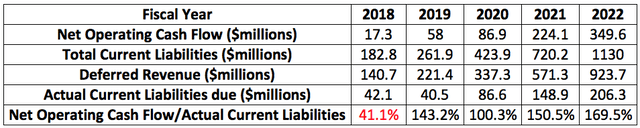

To understand if the business model of a young company is working, I see if its net operating cash flow exceeds the current liabilities because if it does not the company has to finance the shortfall either by borrowing or diluting shareholders – which neither is good for the shareholders. ZS’s net operating cash flow has been increasing every year but so have the total current liabilities. In fact, the latter far exceeds the former. However, if we look at ZS’s current liabilities more closely, we will see that a majority of those fall under “deferred revenue”, which is the unearned portion of billed fees for ZS’s subscriptions, and these will be recognized as revenue within the next 12 months. Stripping these out leaves the actual current liabilities that are due for payment within each fiscal year.

Data from Seeking Alpha ZS Balance Sheet

2018 was the only year when the net operating cash flow fell short of the actual current liabilities due in that fiscal year but from 2019 onwards, ZS’s net operating cash flow, which represents the company’s ability to generate sufficient positive cash flow to maintain and grow its operations, has been more than able to pay off the actual current liabilities, and that has been increasing from 100.3% in 2020 to 169.5% in 2022.

ZS’s path to profitability is clear.

Read Between The Lines

This is a tough year to operate in. Everyone agrees with this, be it the CEO or CFO of CrowdStrike (CRWD) or the CEO or CFO of ZS.

Yet, the message between the lines is clear when CEO Jay Chaudhry said:

… a Global 1000 financial services company in Asia after deploying ZIA for 110,000 users last year, upgraded to Zscaler for users, our entire user protection platform for all 130,000 employees. As a growing company, they are using Zscaler to quickly and cost effectively open new branch offices with secure Internet connectivity, reducing the branch opening costs by 50% compared to legacy firewall-based architecture.

… In today’s environment, ROI and cost optimization are becoming bigger priorities as business leaders are being asked to do more with less.

… Customers are engaging with us to embrace zero trust architecture, consolidate point products, simplify IT and standardize on the Zscaler platform, all of which delivers better security and lower cost.

Message 1 to Potential Customers: One of Zscaler’s value propositions is it saves organizations money for their cybersecurity needs. Join us!

CEO Jay also mentioned a fair bit about their customers. Here is a list:

- 8 of the top 10 global banks.

- 7 of the top 10 insurance companies outside China.

- ZS is the only cloud security service to have two products at the highest level of FedRAMP certification, which resulted in it landing 12 of the 15 cabinet-level agencies, of which four deals in this Fed vertical were each over $1 million, and the remaining eight represent opportunities for future upselling. Also, not forgetting that in Q4 2021, ZS reported over 100 government agencies, and federal integrators as customers.

- When asked about competition, the CEO had this to say:

I’ll tell you on the higher end of the large enterprise segment, we haven’t really seen much competitive changes at all… They look for the right architecture. They take this thing very seriously. And almost all these large deals, when firewall companies have tried to come in and compete, they’re often excluded.

Message 2 to Shareholders: Zscaler has a strong moat and is positioned to take market share. Stay with us!

Potential Catalysts

The new products (Zscaler Digital Experience or ZDX, and Zscaler Deception) in addition to the main offerings ZPA and ZIA are showing lots of promise.

CEO Jay said:

Beyond our core products, we are excited about the rapid adoption of our two emerging product pillars; ZDX to manage digital user experience and Zscaler for workloads to secure servers and workloads. New ACV from our workload communication product is growing nearly 100% year-over-year. And our newest deception and C-Net [ph] offerings are seeing strong customer interest.

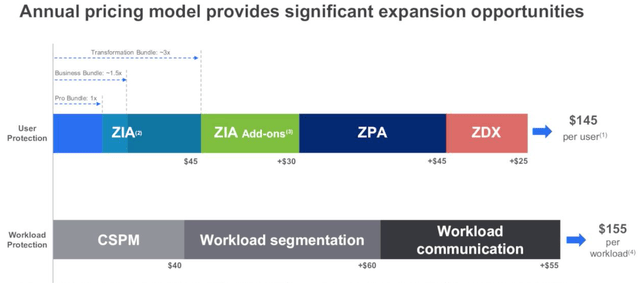

The company does not provide a breakdown of the revenue contributed by each product but the June 2022 investor presentation slides (see below) showed the opportunity to bundle ZDX with the core products.

ZS Investor Presentation Slide

Likewise, as Zscaler Deception seemed well received, I look forward to seeing the finalized pricing of that product rolled out in their pipeline. This will be another product that can cross-sell and upsell, and make the whole experience with ZS more sticky.

The other catalyst comes from the U.S. federal government which is making a big push toward zero trust. In January 2022, the Office of Management and Budget released a memorandum that mandates a federal zero trust architecture (ZTA) strategy, requiring agencies to meet specific cyber security standards and objectives by the end of the fiscal year 2024, two years from now. Zscaler has a first-mover advantage in this space, with over 100 government agencies, and federal integrators as customers. It landed 12 of the 15 cabinet-level agencies, out of which four deals in this Fed vertical were each valued over $1 million.

Re-Valuation

One of my favorite authors on Seeking Alpha loves to say, “Valuation matters and it matters a lot” and I totally agree with him. If you know who he is, leave a comment below. This is what we will attempt in this segment.

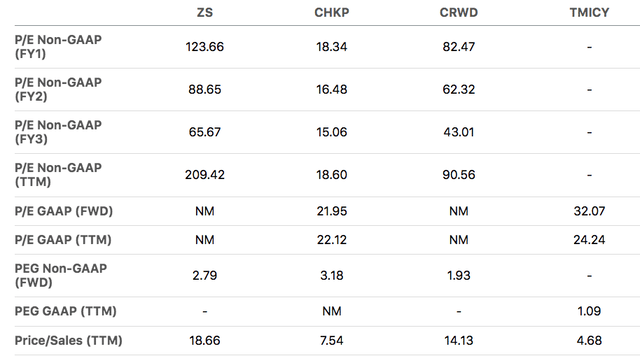

Comparative Valuation: Using Price-sales is more appropriate than Price-to-earnings to value a fast-growing company like Zscaler. At a P/S of 18.66, Zscaler is definitely the most expensive company when compared to these peers, even against CrowdStrike which I recently wrote an article about.

Seeking Alpha ZS Valuation Comparison Page

Morningstar analyst Malik Ahmed Khan posted the following note on 2 December 2022,

We are lowering our fair value estimate for narrow-moat Zscaler to $170 from $211 primarily because of a reduction in our top-line growth estimates as macroeconomic headwinds bear down on the firm. While last quarter remained strong despite the macro tightness, this quarter painted a different picture for Zscaler as the firm noted macroeconomic pressures affecting its billings as customers scrutinized their spend on technology. While we continue to view Zscaler’s zero-trust security offerings as industry-leading, we expect elevated macroeconomic uncertainty to weigh down on the firm’s financials over the coming quarters. Zscaler’s shares fell 10% after hours. As a result, despite our fair value estimate revision, we think that the firm’s shares are trading at an attractive price for long-term investors willing to stomach the near-term volatility.

Wedbush analyst Dan Ives lowered ZS’s price target to $180 from $200 but maintained an outperform rating on it, noting that the results were “solid” and the company is showing momentum into the next fiscal year, despite worries about the global economy.

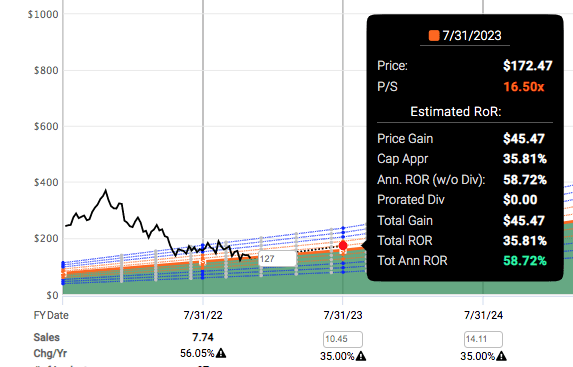

I believe the analysts’ estimates are quite plausible. Based on the most recent guidance of 40% sales growth, I build in some margin of error by assuming lower revenue growth of 35% and assuming the price-to-sales multiple contracts from 18.6 to 16.5 in an environment that continues to see derisking, and ZS could be worth $172.47 in a year.

Fast Graphs

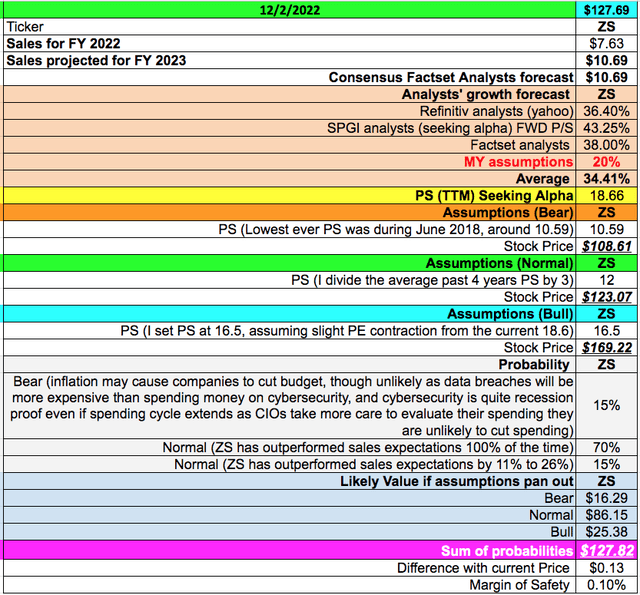

Using DCF: In August 2022, I valued ZS between $187.31 and $220.46. Using the latest guidance and data points from different rating agencies, I recalculated the possible fair value of ZS, considering bear, normal, and bull scenarios, and deliberately building in additional margins of safety by (1) giving my own growth estimate of 20% which is half of management’s projection, and (2) assuming lower P/S multiples than the current multiple in all three scenarios to factor in a sustained bearish environment, I reached a fair value price of $127.82.

Averaging these figures ($127.82 + $180 + $170)/ 3 gives me a fair value of $159.27 which represents a 19% margin of safety.

Final Thoughts

Long-term ZS investors should not be invested in the company simply because of a good story (founder-led, excellent Glassdoor score of 96% for CEO Jay Chaudhry, fast-growing company, industry leader, etc.) but as co-business owners, so ZS investors should stay invested because the company has executed well on the fundamentals.

Zscaler is a company that continues to take market share and is growing revenue and generating increasing operating cash flow. It presents itself as an effective and cost-saving alternative for enterprise customers seeking solutions for their cybersecurity needs – and it is working; more and larger customers are flocking to ZS, and they are staying on.

And ZS’s management has to continue to execute well. The positive reasons for staying invested must be sustained despite the negative aspects (high stock-based compensation, increasingly negative net income, etc.). Those aspects, which are absolutely valid, are important for ZS investors to keep an eye on too because the company has to turn profitable someday, as measured in GAAP terms.

ZS investors can be patient and accumulate shares when they are unfairly punished. At the same time, shareholders should keep a close watch to hold management accountable to continue to increase revenue, increase operating income, take market share, reduce expenditure on sales and marketing, and perhaps most importantly, show improving net income that trends in the right direction.

Be the first to comment