Michael Vi

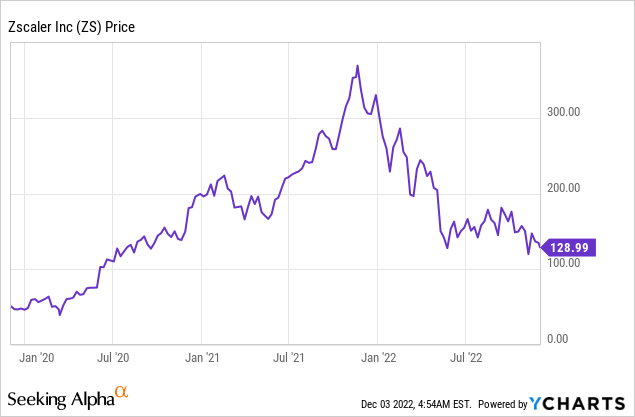

Zscaler (NASDAQ:ZS) is a leading cybersecurity and networking company that helps thousands of companies give secure IT application access to employees. Many large organizations are “digitally transforming” to the cloud and now require a new network architecture. In addition, the rise of remote working has expanded the “attack surface” and made it harder for security teams to track employee security. Zscaler solves all these problems and I will explain how in the business model section. The company has continued to produce strong financial results in the first quarter of the fiscal year 2023 as it beat both revenue and earnings growth estimates. Management did forecast “longer sales cycles” moving forward given macroeconomic uncertainty. However, I believe this is completely justified. The stock plummeted by 10% on the tepid outlook and thus in this post I’m going to break down the business model, financials, and valuation, let’s dive in.

Business Model Recap

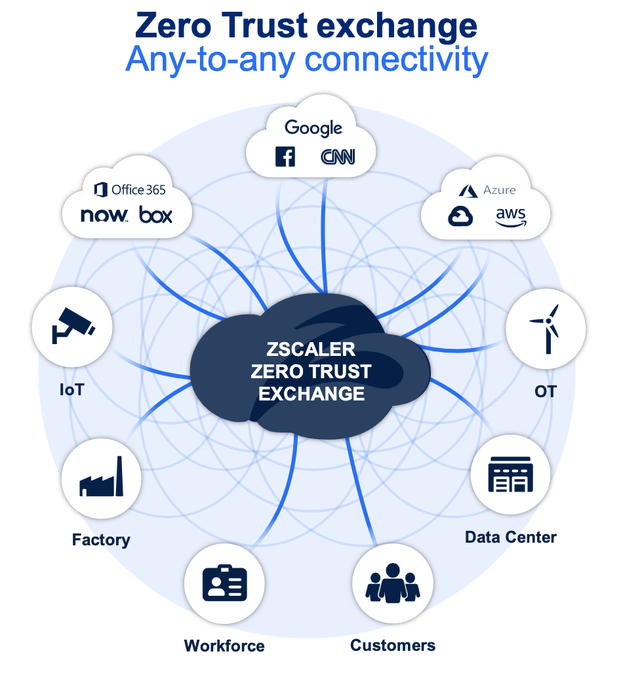

In my previous post on Zscaler, I discussed its business model in detail, here is a quick recap. Zscaler is a pioneer in the “Zero Trust” network architecture and is ranked a Gartner leader for the Security edge. “Zero trust” basically means by default those who access a corporate IT network are “not trusted” and only given access to the applications they need. This may seem like common sense but in a traditional corporate network once an employee or hacker logs in they can access pretty much everything. This means a hacker can exploit a harmless application but then “move laterally” to extract sensitive financial or customer data. Zscaler solves this problem with its “intelligence switchboard” which routes each employee to only the application they need and thus enabling “least privileged access”.

Zero Trust Zscaler Switchboard (Zscaler)

The company’s “Zero Trust Exchange” is basically a private cloud platform that enables the security and connection of multiple devices and locations. From corporate network PCs to remote working smartphones. The platform acts as an alternative to the VPN or Virtual Private Network which can be slow and doesn’t stop the “lateral movement” of hackers.

The Zero Trust Exchange processes over 279 billion “transactions” and prevents 7 billion security or policy violations each day.

Its four main products include:

The products are often sold in “bundles” which offer customers complete user protection. Management estimates the business has a “6X” upsell opportunity with its existing customers alone. The platform is also immensely popular with financial service companies as its “proxy architecture” enables TLS traffic, which is encrypted to be inspected, which is a game-changer. Thus it is no surprise the company serves 8 of the top 10 global banks and the top 10 largest insurance companies outside of China.

Zscaler has recently acquired ShiftRight a workflow automation tool that is expected to bolster Zscaler’s solution to offer quicker incident response time through automated accountability.

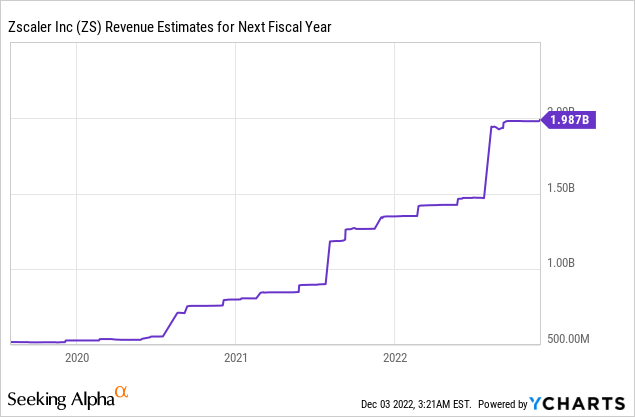

Growing Financials

Zscaler reported strong financial results for the first quarter of the fiscal year 2023. Revenue was $355.5 million, which beat analyst estimates by $14.76 million and increased by a rapid 54% year over year. This was driven by strong growth in the Secure Private Access [ZPA] product, which grew revenue by a blistering 78% year over year and now makes up 19% of the total.

By breaking down revenue by region, the company is well diversified with the Americas making up 52% of total revenue. This is followed by the EMEA region at 33% and APJ at 15%. Given the Americas still make up the bulk of revenue with the U.S in general this is positive for the strong dollar as foreign exchange rates are acting as significant headwinds for companies with large international revenue.

The true “top line” for SaaS companies and similar is Billings which is the amount invoiced to customers. In this case Billings increased by 37% to $340 million. The growth rate is slower than revenue but it is also against a difficult comparison. Zscaler faced a headwind as “billings duration” increased above the midpoint of the company’s “normal” 10 to 14 months. This increase in billings duration is estimated to have impacted revenue by ~5%.

Remaining performance obligations [RPO] is also an interesting metric to analyze and you can think of this as contracted revenue. Technically it is the sum of Deferred revenue (payment from the customer who is still waiting for the service to be provided) and backlog. In this case RPO increased by a rapid 57% year over year to $2.68 billion.

Zscaler has continued to execute its upsell strategy and existing customers are finding the product extremely sticky with a dollar-based net retention rate of greater than 125% as in prior years. As of the end of Q1, FY23, the company reported 348 “millionaire customers” who pay more than $1 million annually which has increased by a rapid 55% year over year. Zscaler has a large base of enterprise customers which means they have a large runway to grow the account value with these customers via cross-sells. The company also added 128 customers who pay more than $100,000 annually which now brings the total to 2,217 customers.

Notable customers include 8 of the top 10 global banks which made a four-year $10 million annual commitment to adopt Zscaler to secure thousands of branch offices and hundreds of thousands of employees internationally.

In the recent quarter, Zscaler upsold a Global 1000 financial services company in Asia which is using the ZIA platform to secure its 110,000 employees and has now upgraded to secure all 130,000 employees. The business is also using Zscaler to rapidly open branch offices as the business expands, at a 50% lower cost than a legacy firewall-focused architecture.

Another notable win was a new enterprise customer in the technology sector which purchased the entire “bundle” of Zscaler’s products (ZIA, ZPA and ZDX) for its 4,000 employees to control workload security. This enables the customer to continue its remote working strategy which has allowed them to close 12 offices at significant costs.

Zscaler is also popular with governments from around the world and is the only cloud security service to have two products with the top-rated FedRAMP certification. In the recent quarter, Zscaler scored four deals over million with the Federal government. The beautiful thing about working directly with the government is they have large budgets and are immensely consistent when it comes to payments.

The company has also doubled its Average Contract Value [ACVV] with a Fortune 500 aerospace customer as they purchased workload protection to add on to the ZIA transformation bundle for 115,000 employees purchased in 2020.

Profitability and Expenses

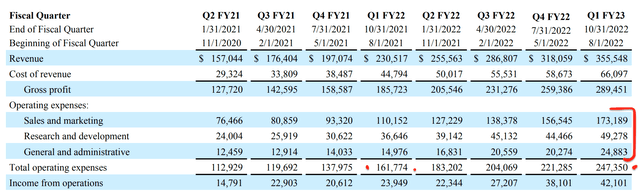

Zscaler reported earnings per share of $0.29 on a Non-GAAP basis, which beat analyst estimates by $0.03. The company reported a 52% increase in its operating expenses, which rose from $161.8 million in Q1FY22 to $247.4 million by Q1FY23. The majority of these expenses ($173 million) goes on Sales and Marketing as the company aggressively expands. This makes sense as the high customer retention and digital transformation of enterprises mean it is a generational “land grab” opportunity. However, overtime I would like to see improving efficiencies in marketing spend and G&A expenses driving down as the business scales. Total expenses made up around 70% of revenue last year and 69% this year. G&A expenses made up ~7% of revenue in Q1FY22, which is actually slightly more than the 6.5% reported in the prior year.

Cash flow from operations was $128.5 million in Q1FY23 which was greater than the $93.3 million reported in the prior year, albeit at a smaller percentage of revenue 36% vs 40%. Free Cash Flow showed a similar pattern with $95.6 million (27% of revenue) in Q1FY23, up from the $83.4 million (36% of revenue) reported in the prior year.

The company has a robust balance sheet with Cash, cash equivalents and short-term investments of $1.8 billion, which increased by $93.5 million from the prior quarter. In terms of debt, the company has $1.1 billion in convertible senior note debt, which is long-term debt and thus manageable.

Advanced Valuation

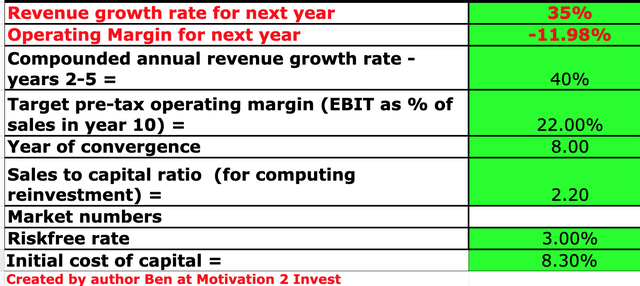

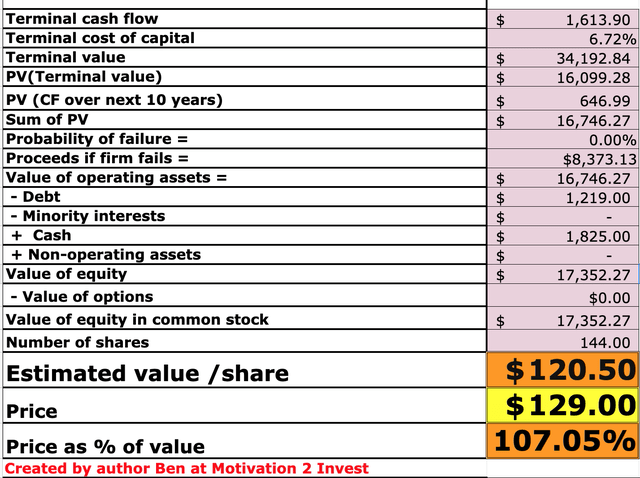

In order to value Zscaler I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation. I have forecasted a conservative 35% revenue growth for next year which is less than the 54% revenue growth reported less quarter. This is also slightly less than management’s full fiscal year 2023 revenue guidance of 40%. I expect this slower growth to be driven by long sales cycles and larger buying committees which management has alluded to. In years 2 to 5, I have forecasted revenue growth to accelerate to 40% per year, as economic conditions are likely to improve.

Zscaler stock valuation 1 (created by author Ben at Motivation 2 Invest)

To increase the valuation accuracy I have capitalized R&D expenses, which will increase the operating margin to 22%, which is aligned with management’s “long-term” target. I have assumed “long term” to be 8 years.

Zscaler stock valuation 2 (created by author with Matterport Model)

Given these factors I get a fair value of $120 per share, the stock is trading at $129 per share at the time of writing and is thus 7% overvalued.

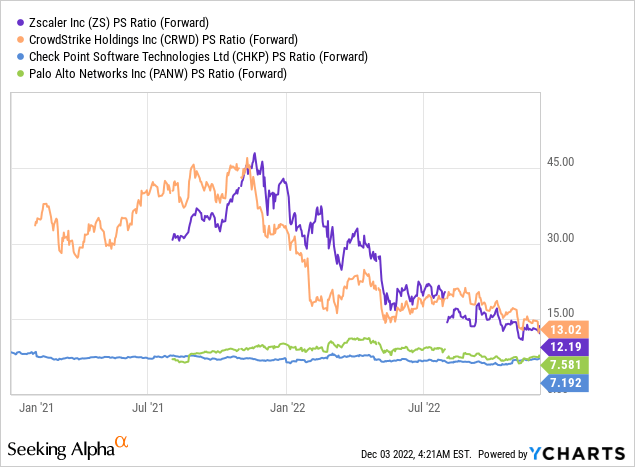

As an extra datapoint, Zscaler trades at a Price to Sales ratio = 12 which is 52% cheaper than its 5-year average. Relative to other cybersecurity companies Zscaler trades midrange, as you can see on the chart below.

Risks

Longer Sales Cycles/Recession

The high inflation and rising interest rate environment has caused many analysts to forecast a recession that will “ravage” the S&P 500 in 2023. Whether these forecasts occur or not, it will still impact the psychology of decision-makers and thus result in longer sales cycles for companies.

Final Thoughts

Zscaler is a tremendous company that has continued to produce strong financial results. Management has started to see some signs of longer sales cycles, but the long-term story remains intact. As I have used conservative estimates and the company is such high quality with high retention, I deem this stock to be “fairly valued” at the time of writing.

Be the first to comment