TU IS/iStock via Getty Images

Investment Thesis

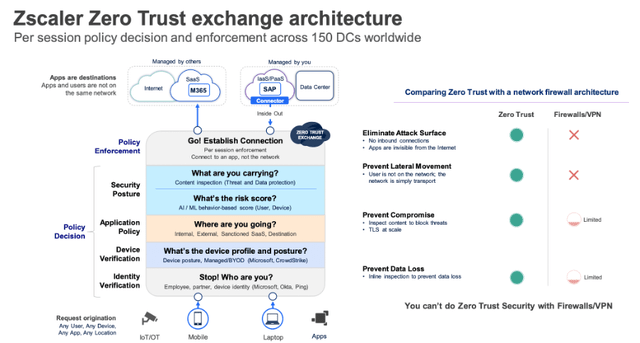

Zscaler (NASDAQ:ZS) is a leading cloud-native cybersecurity provider, with its core product being the Zscaler Zero Trust Exchange platform. The Zero Trust exchange is used to ensure that the right users within an organisation are able to access the right applications (e.g. external SaaS applications) at the right time. This Zero Trust exchange is especially critical for businesses who are moving their IT infrastructure to the cloud.

Zscaler Q4’22 Investor Presentation

I detailed my analysis of Zscaler in a previous article, and found that the company has many things I look for in my investments: being leader in an important emerging industry, having a founder-CEO with plenty of skin-in-the-game, operating with an attractive business model and margin profile, and having powerful economic moats such as a network effect and switching costs. Combine this with the fairly recession-resilient industry of cybersecurity, and I found Zscaler to be an irresistible investment.

There is no denying, however, that the stock has appeared expensive ever since it came public. The company recently hit $1 billion in annual revenue, but it has a current market capitalisation in excess of $22 billion – so valuation will always be seen as a negative.

When a company has this kind of lofty valuation, it has to deliver very strong results 4 times a year. So, has Zscaler achieved this in its Q4’22 results? Let’s take a look.

Earnings Overview

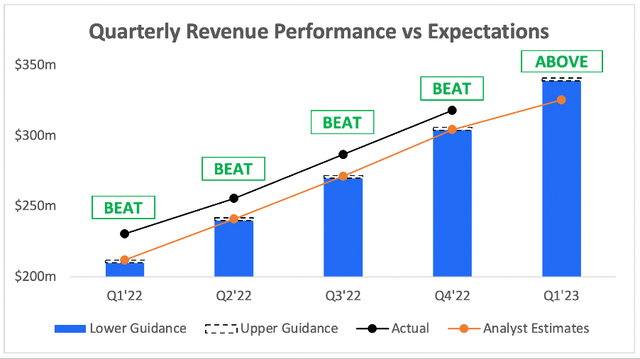

Starting on the top line, and once again Zscaler comfortably exceeded both management’s guidance and Wall Street’s expectations on revenue. The company delivered 61% YoY revenue growth in Q4’22, bringing in $318.1m, which was ahead of management’s guidance of $304-$306m and also beat analysts’ estimates of $304m.

Investing.com / Zscaler / Excel

The company also guided for Q1’23 revenue of $339-$341m, once again coming in ahead of analysts’ estimates of $326m. Just taking one look at that chart above tells you everything you need to know about Zscaler; this company beats guidance for fun, and I’m sure it will continue this trend into FY23.

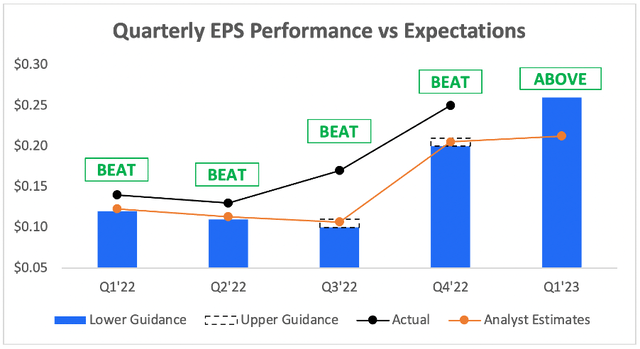

Moving onto the bottom line, and it’s more of the same story. Adjusted EPS of $0.25 in Q4 came in ahead of management’s $0.20-$0.21 guidance whilst also beating analysts’ estimates of $0.21. Once again, guidance for Q1’23 came in ahead of expectations too, with management guiding for EPS of $0.26 vs analysts’ expectations of $0.21.

Investing.com / Zscaler / Excel

All in all, another extremely impressive quarter from Zscaler – yet another cybersecurity leader that doesn’t seem to miss, even in a difficult environment. As CEO and Founder Jay Chaudhry said on the earnings call:

My conversations with hundreds of IT executives confirm that cybersecurity remains the number one IT priority and a top Board level issue. Independent CIO surveys confirm Zero Trust security and SASE will continue to be a top priority. Zscaler’s proxy-based cloud platform is the best solution for tackling sophisticated cybersecurity challenges. In addition, the rise of hybrid work and the need for secure digital transformation are driving the demand for Zscaler. We believe periods of macro uncertainty can accelerate adoption of disruptive technologies like ours, which offer better security and user experience while substantially reducing cost and IT complexity. As the pioneer and recognized leader in Security Service Edge, we are well positioned to capture this ongoing market shift towards Zero Trust.

If these results aren’t enough evidence that this company is highly recession-resistant, then the above snippet should put investors’ minds at ease. The company is still managing to execute brilliantly in a tough environment, and it gives me a lot of faith in Zscaler for the future.

Full Year Overview

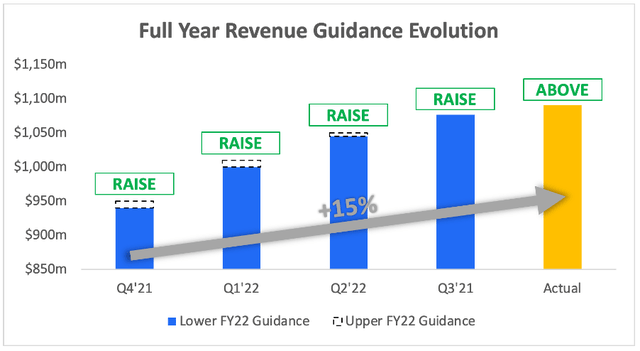

Zscaler operates an unusual financial year, which ends in July, meaning that the company just wrapped up its FY22 results. The company achieved revenues of $1,091m in FY22, coming in ahead of its most recent full year revenue guidance of $1,077m. As you can see from the chart below, Zscaler’s full year revenue came in a whole 15% higher than the company’s first guidance offered in Q4’21.

Consensus Gurus / Zscaler / Excel

This is a good sign, because the only place Zscaler fell short vs expectations was on full year guidance for FY23. Management said to expect $1,490-$1,500m, representing YoY growth of ~37% YoY at the midpoint, which came in below analysts’ estimates of $1,505m.

Yet here’s a fun fact; if Zscaler’s final FY23 revenue comes in 15% higher than this first guidance (which happened in FY22), then it will actually see revenue of ~$1,725m and YoY growth of ~58%. I’m not saying this will happen, but I do think that shares of Zscaler are up >10% following these results, despite this guidance miss, because the market knows that FY23 revenue figures will probably be much higher when September 2023 comes around.

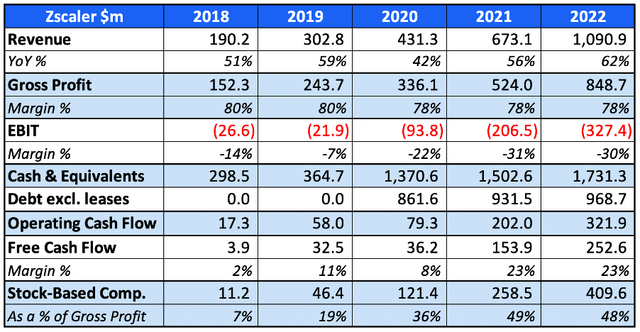

The end of a year is also a good time to properly look at the financial position of a company, and how it has evolved in the past 12 months. As we can see below, revenue growth of 62% in 2022 actually accelerated once again – it’s the first time Zscaler has exceeded 60% annual growth over the past five years, which is scarily impressive.

What will be plain scary to some investors is the level of operating losses and the fact that, in 2022, almost half of Zscaler’s gross profit was paid out as stock-based compensation. I am usually quite lenient with companies when it comes to spending in order to capture a big opportunity (as Zscaler is), but seeing ~50% of gross profit being paid out as SBC two years in a row is a bit unsettling. I still don’t mind it for now, but it will undoubtedly put some investors off.

A benefit of this, however, is that Zscaler has been able to rake in free cash flow, and it maintained an impressive 23% free cash flow margin in 2022. As the company continues to scale, I can see it becoming a cash flow machine in the future. It also has a stellar balance sheet, with $1.7 billion in cash and just under $1 billion of debt in the form of convertible senior notes.

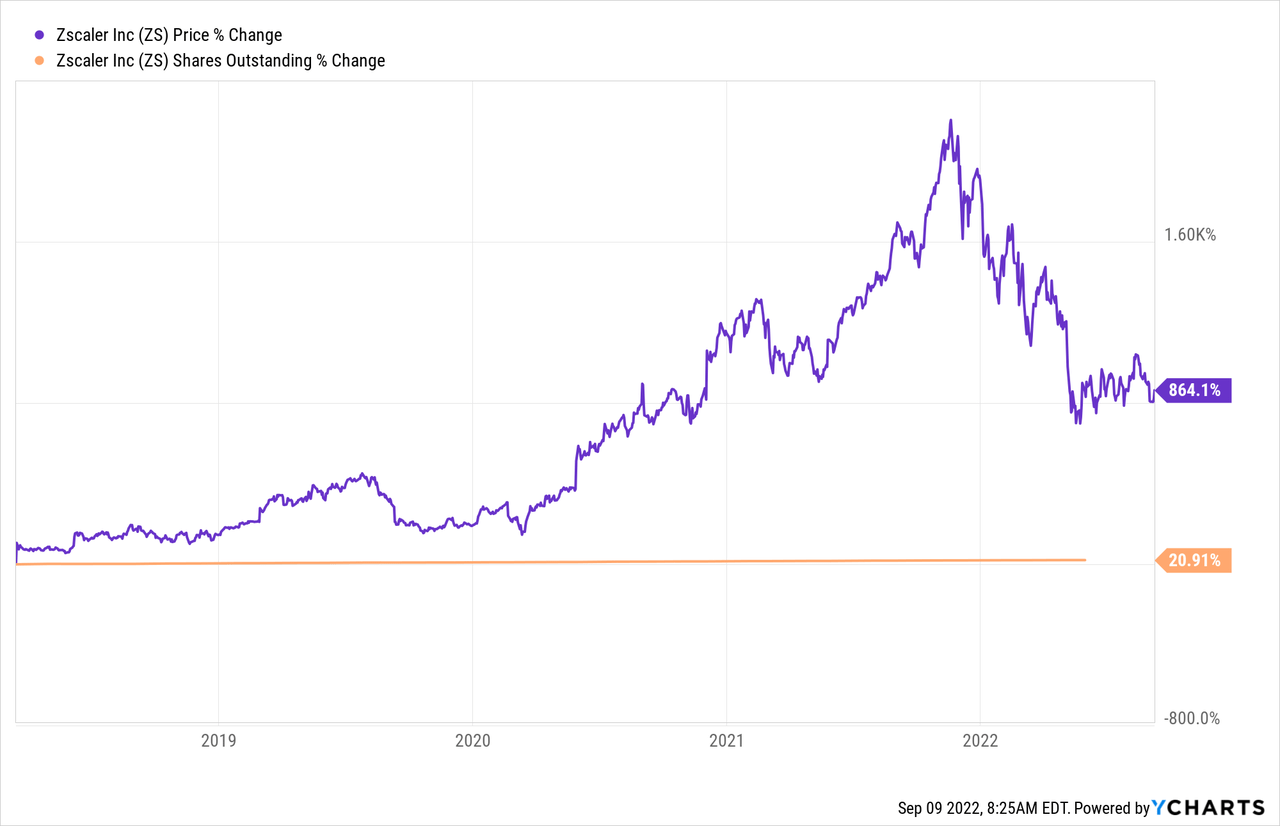

If I touch back on the stock-based compensation – some investors will be concerned that this is leading to dilution and is a bad thing for shareholders. This would be true, if the company fails to continue to perform; however, since Zscaler’s 2019 IPO, shares outstanding have increased by 21% whilst the share price has increased by a whopping 864%!

This is why I have no issue with the dilution right now; Zscaler is delivering far more value for shareholders than it is taking away in the form of dilution.

Valuation

As with all high growth, disruptive companies, valuation is tough. I believe that my approach will give me an idea about whether Zscaler is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

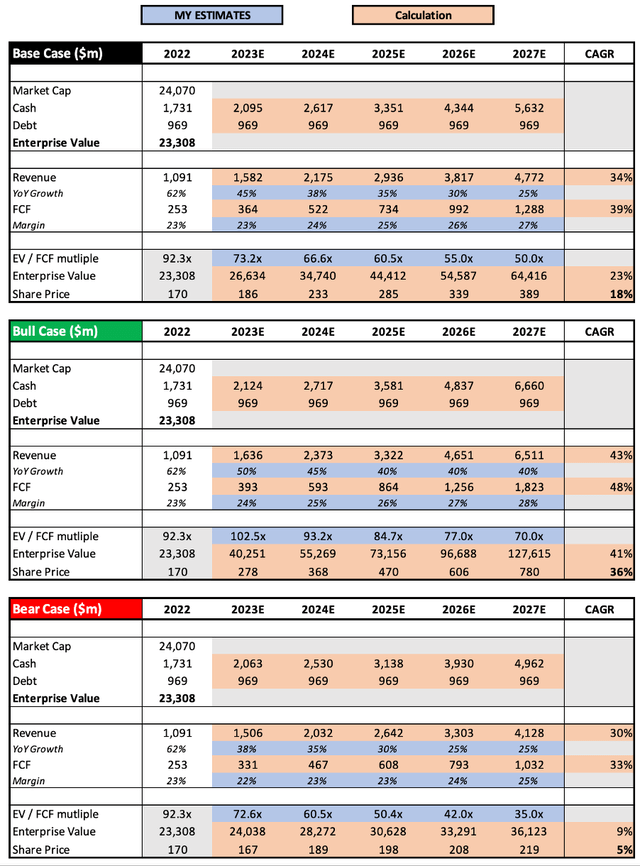

I have slightly changed the valuation approach from my previous article, in order to better demonstrate the risk and opportunity within the bear and bull case scenarios.

My base scenario is similar to my previous model, with updated figures for 2023 based on management’s latest guidance. Whilst they have guided to 37% YoY revenue growth, I expect Zscaler to comfortably exceed this and achieve at least 45% growth. I have assumed gradual expansion of free cash flow margins as the company continues to scale up, and I have also accounted for substantial shareholder dilution in each scenario. I have also used an EV / FCF multiple in 2027 in each scenario which I feel best reflects the future potential of Zscaler from 2027 onwards.

My bull case scenario assumes that Zscaler achieves 50% revenue growth in 2023, which I think is very doable, and revenue grows at a 43% CAGR through to 2027. My bear case scenario assumes one of the worst case scenarios, where Zscaler sees growth falter substantially and only achieves a 30% CAGR through to 2027.

Put all this together, and I can see Zscaler shares achieving a CAGR through to 2027 of 5%, 18%, and 36% in my respective bear, base, and bull case scenarios.

I know many investors out there would call Zscaler expensive, but it all depends on how you judge an ‘expensive’ stock. Does it have a high price-to-sales ratio? Yes, but that takes a very short-term view and ignores the business itself.

Zscaler has a substantial runway for growth that is partially priced in, and despite shares maybe looking expensive to some investors, I feel that they are very reasonably priced given the quality and potential of this business.

Investment Thesis: On Track

This is another easy quarter for me as a Zscaler investor. The company continues to grow rapidly, continues to roll out new products, continues to win new contracts, and continues to seize the large opportunity in front of it. Unsurprisingly, I will be reiterating my ‘Buy’ rating on Zscaler.

Be the first to comment