Kena Betancur/Getty Images News

Investment Thesis

Zoom Video Communications, Inc. (NASDAQ:ZM) has seen its stock surge to unsustainable heights during the pandemic. However, those heady days are well over as Zoom’s revenue growth crashed back to earth. Furthermore, late investors to the game have also seen their holdings in ZM stock plummet, it has fallen more than 80% from its 2020 highs.

Therefore, it is somewhat of a pandemic reset, as Zoom stock last traded at levels last seen in August 2019 and February 2020. Despite that, the company’s financials have improved tremendously since then. Therefore, Zoom is a much stronger company financially that no longer needs to spend massive amounts on brand marketing. Consequently, the company has refocused its expenditures on product development and global expansion.

Nonetheless, we don’t expect ZM stock to have significant near-term catalysts. Moreover, it’s also not significantly undervalued. Getting hammered has brought it back down to earth. But that doesn’t mean it’s undervalued tremendously. Yet, we think the current entry point has skewed the risk/reward profile of investing in ZM more positively than we expected.

Therefore, we rate ZM stock a Buy.

Zoom Video’s Q4 Earnings Indicate 2022 Is A Transition Year

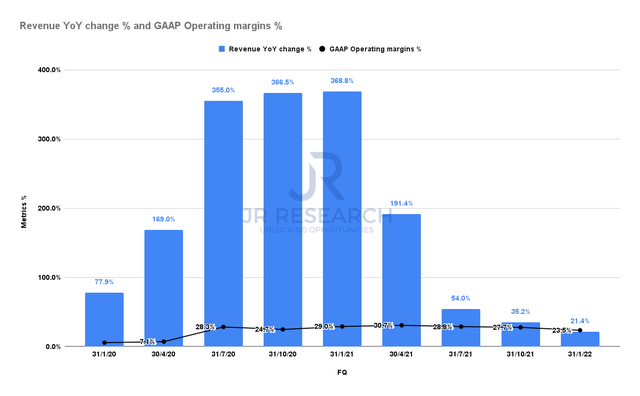

Zoom revenue change % and GAAP EBIT margins % (S&P Capital IQ)

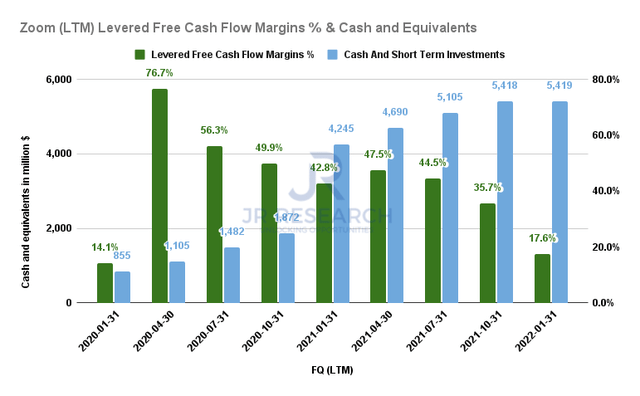

Zoom LTM FCF margins & Cash (S&P Capital IQ)

Readers can easily glean the phenomenal yet unsustainable revenue growth rates over the past two years. Those high triple-digit growth rates in 2020 are now a thing of the past. But, it is unreasonable for investors to assume Zoom can maintain these unsustainable growth rates. The bubble has to burst somehow, and it has already been burst.

If we refer to its FQ4 earnings card, Zoom posted revenue growth of just 21.4%. However, it’s still a respectable metric, given the headwinds from the reopening. Furthermore, Zoom’s GAAP operating margins have remained stable. Notably, Zoom posted an operating margin of 23.5%, down from 29% in the previous year.

Furthermore, its FCF margins have remained robust at 17.6% in FQ4. In addition, it has also helped Zoom acquire a massive cash hoard of more than $5.4B at the end of FY22. So, it has leveraged the pandemic tailwinds astutely and positioned its business tremendously well exiting the pandemic.

Nevertheless, Zoom’s FY23 guidance disappointed the market. Management guided revenue of $1.07B (low-end) for FQ1’23, up 11.9% YoY. It also guided full-year FY23 revenue of $4.54B (mid-point), up 10.7% YoY. Therefore, there’s no doubt that Zoom can no longer be considered a high-growth SaaS stock. Investors should expect FY23 (CY2022) as a year of transition to its next growth phase.

But, Zoom’s Enterprise Pivot Should Be Significant Moving Forward

Therefore, it’s imperative for investors to understand where Zoom will be pivoting to drive growth moving forward.

Management reiterated its emphasis on its enterprise business. Its Enterprise growth has been strong but still accounted for 50% of its revenue. Investors should recall that enterprise has always been Zoom’s primary focus. However, the start of the pandemic had driven many smaller businesses/users to use Zoom. While these users have contributed to Zoom’s profitability, the growth cadence is not expected to be maintained. Therefore, Zoom has continued to experience notable digestion in growth/churn from these users.

In addition, management also emphasized that its enterprise revenue is still expected to reach 20% YoY in FY23, partially offset by its non-enterprise flattish YoY cadence. Hence, management will continue to build on its unified communications (UC) platform strategy beyond just video conferencing.

We believe the enterprise strategy is critical to Zoom’s sustainability moving forward. Despite the reopening cadence moving in full force, workers still prefer hybrid working. For example, Bloomberg reported recently that “the average New York City office worker intends to reduce time in the office by 49%.” So, employees continue to prefer hybrid work as essential rather than a total return to the office.

Furthermore, employers have also continued to make adjustments for a hybrid working environment. For instance, Apple’s (AAPL) back-to-office transition expects employees to return to the office three days a week. Even Microsoft (MSFT) has redesigned its office furniture to facilitate hybrid meetings and discussions. Therefore, we don’t think going back to the office 100% of the time will ever return. Instead, hybrid work will likely be the default setting moving forward. Employers and employees are still trying to balance the benefits of in-person collaboration and the productivity gains of remote working. But, going back to the office full time? We don’t think it is ever likely.

Is ZM Stock A Buy, Sell, Or Hold?

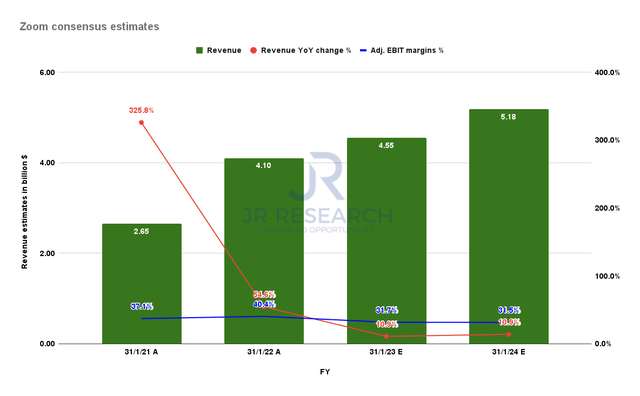

Zoom consensus estimates (S&P Capital IQ)

Consensus estimates suggest that Zoom’s FY24 (CY2023) could be the inflection point in its revenue growth deceleration as it expands its enterprise base. Zoom CFO Kelly Steckelberg was also confident in the company’s execution as she articulated (edited):

We absolutely expect there to be an inflection point and for revenue to start to reaccelerate in the back half of FY23. We are not prepared to give multiyear guidance at this point. But what you should expect is we’re modeling for the exit growth rate to be higher than the full-year growth rate for FY23. (Zoom’s FQ4’22 earnings call)

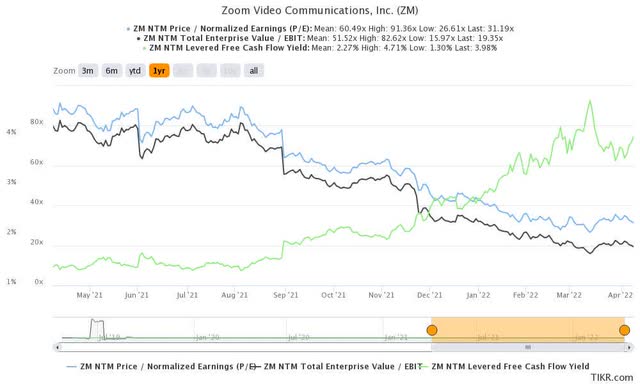

Zoom valuation metrics (TIKR)

However, we mentioned earlier that Zoom is not significantly undervalued given its growth rates. Zoom last traded at an NTM normalized P/E of 31.2x. The median P/E for the software industry is 35.5x, with median NTM earnings growth of 20.3% based on S&P Cap IQ data.

However, consensus estimates suggest that Zoom’s adjusted EPS would fall by 29.9% in FY23 before reversing in FY24. Therefore, we don’t think ZM stock looks significantly undervalued despite the compression.

Hence, investors need to be patient and have a firm conviction in management’s ability to execute well on its enterprise expansion.

Nonetheless, we believe that its current valuation looks attractive. However, we don’t expect significant near-term catalysts, and investors must be willing to hold for at least five years.

As such, we rate ZM stock a Buy.

Be the first to comment