martin-dm

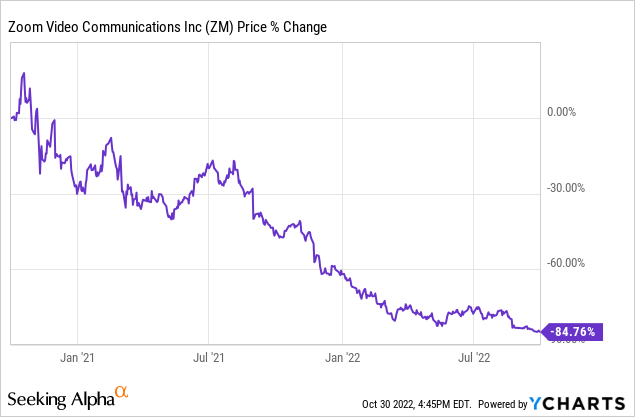

Shares in Zoom (NASDAQ:ZM) have fallen more than 80% in the last 2 years. There were several reasons for this drop that I would like to present to you in this article. Zoom has a strong balance sheet and good management. But the company has a few problems to keep in mind. If the company continues to grow at a reasonable pace, the shares may bring interesting returns to long-term investors. But it doesn’t look like it yet, according to current estimates. But that may change.

Why Is The Stock Down Over 80%, In The Last 2 Years?

Why have ZM shares fallen so much in the last 2 years? The reasons that caused this big drop are several. The first is the valuation at which ZM traded at the time. Zoom was really overvalued at the time. ZM was at its all-time high, having traded for a Price/Sales of 69x two years ago. Yes, you’re hearing correctly. Even if it was PE, it would be extremely high, but the fact that ZM was trading for a Price/Sales of 69x at the time was really too high. Price/Book of the company was 87x at the time. The valuation at which ZM traded at its peak was just too high, and eventually that bubble burst. The other reason that caused this slump is the end of the pandemic. Zoom was a company that really benefited a lot from the pandemic, and the fact that the pandemic ended wasn’t good for ZM. People could spend quite a bit less time at home and therefore use Zoom quite a bit less than during a pandemic. This, of course, caused a much slower growth in the company’s sales and profits than previously expected and caused an even bigger decline in the company’s shares. The third reason is that there’s more and more competition. That’s a really big deal for Zoom. Zoom competes with the likes of Apple (AAPL), Microsoft (MSFT), Google (GOOG) (GOOGL), and many others. Although I personally think Zoom has the best product on the market, competition is just really a lot and of course, that’s not good for Zoom. These are the 3 main reasons why I think the company’s stock has fallen so much in the last year.

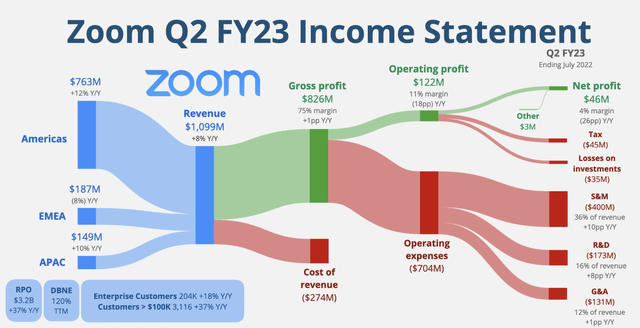

Financials Of Zoom

Now I would like to take a look at the company’s financials. ZM had sales of $1.099 billion in Q2 FY 2023. That’s an increase of 7.6% YoY. Certainly, much slower growth than Zoom has been used to in the last two years. The gross margins of the company remain high as they were 75.1%. The net income of the company was in this quarter only $45.75 million. That’s more than 85% less than a year ago. That’s very bad indeed. This decline in net income was mainly due to the rather larger cost of R&D and S&M thanks to the competition already mentioned. By the way, R&D and S&M costs have been rising every quarter for the last two years, which is definitely not good to see. The company’s balance sheet, though, remains strong. The company has $5.520 billion in cash and $8.047 billion in total assets. ZM has no long-term debt and has only $2.057 in total liabilities. That means if the management wanted to, tomorrow it could repay all of the company’s liabilities, and ZM would still have $3.463 billion in cash. The problem that ZM currently has is the company’s profit, which has only been decreasing in the last few quarters. That’s something investors need to keep in mind. The balance sheet of Zoom is still strong, though, which is very good.

The Growth Strategies Of Zoom

Zoom mainly due to the pandemic in the last couple of years has grown sales by hundreds of percent. But that quickly changed and it is now estimated that Zoom sales will grow by only 7.1% this year. And over the next few years, it is estimated that the company’s revenues will not grow even in double digits. But there are a few strategies that management plans to use for further growth. I want to introduce you to the main ones now. The first is a drive new customer acquisition. Zoom wants to achieve this primarily through marketing and its basic plan, which is free of charge. The other is to expand within existing customers. Simply attract existing customers to better and therefore more expensive plans. Then there is an innovation of their platform continuously. This is very important so that it does not happen that even more customers start using the products of the competition. At the same time, if ZM still has a good product, it will attract more customers. And as a final strategy, there is accelerated international expansion. The company’s management simply wants to expand to even more countries. These are the main strategies Zoom will use for further growth.

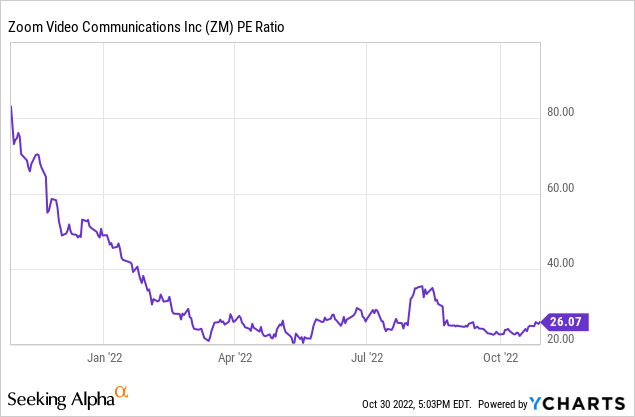

The Valuation Is Cheap

ZM’s current valuation is really cheap compared to what ZM has traded for the last 2 years. The company is now trading at Price/Sales of 5.84x. A year ago, the company traded for Price/Sales of 22x. In one year, a lot can change in the market. The current PE of Zoom is 26x. NTM PE of the company is 24x. ZM currently trades at the lowest valuation it has ever traded at. Despite the big growth in the pandemic, ZM shares have risen only currently by 35% since April 2019, when the company went public. That’s really low considering the rapid growth. The current Price/Book of ZM is only 4.19x. Overall, the valuation of ZM is currently really cheap compared to the past.

The Biggest Risk Zoom Has

The biggest risk Zoom has is the competition already mentioned. That’s a really big deal for ZM. It also shows how much the company has started spending on S&Ms and R&D over the last few quarters. And in my opinion, this is not likely to slow down in the next few quarters. Zoom simply needs to invest more and more money to have the product customers want to buy instead of the competition, which is mostly free. Competition, in my opinion, is the biggest risk Zoom has. It is also estimated that ZM will grow rather slowly, which is also not good at all.

Conclusion

The current valuation of the company is really cheap compared to the past. Zoom has great leadership and the balance sheet is still strong. More and more competition is not at all good for Zoom. And the biggest problem is that the competition doesn’t have a much worse product than Zoom and mainly offers its products mostly for free. If despite the competition, management is able to outperform estimates about the growth in sales and profits that ZM currently has, Zoom can deliver very interesting returns to long-term investors. But personally, I’m not betting on it.

Be the first to comment