eclipse_images/E+ via Getty Images

Introduction

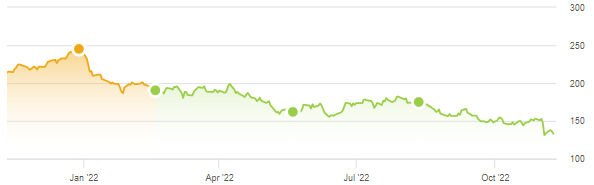

Zoetis Inc. (NYSE:ZTS) released their Q3 2022 results last Thursday (November 3). Shares fell 11% on the day of the results and, while they have recovered about half of that loss since, remain 39% down year-to-date. Compared to when we upgraded our rating to Buy in February, ZTS stock has lost 26% after dividends:

|

Librarian Capital’s Zoetis Rating History vs. Share Price (Last 1 Year)  Source: Seeking Alpha (09-Nov-22). |

Q3 results were worse than our investment case, but mostly due to temporary macro factors. EPS fell 3.7% year-on-year, but largely due to currency and a higher tax rate. Revenue grew 5% operationally, below our investment case, attributed to supply chain disruptions and labor shortages at U.S. veterinary clinics. There were positive developments on the Simparica Trio blockbuster and the new Librela and Solensia products. Supply chain issues are expected to be mostly resolved by year-end, and Net Income is still guided to grow 9-11% operationally this year. Zoetis shares are at a reasonable 30x P/E and 2.5% Free Cash Flow Yield. Our forecasts indicate a total return of 62% (16.8% annualized)by2025 year-end. Buy.

Zoetis Buy Case Recap

Zoetis is the global leader in animal health, with a high-quality business that we believe to be capable of growing EPS at a 10%+ CAGR sustainably:

- The global animal health market is growing structurally, historically at 5-6% per year. Petcare is the main driver, benefiting from growing pet numbers and new products serving previously unmet needs

- Zoetis can grow its revenues faster than the market, at a high-single-digit revenue CAGR, thanks to its leading portfolio, brands, product innovations, scale, sales and marketing infrastructure

- Zoetis’ margin will continue to expand, from a combination of mix shift, pricing power, manufacturing efficiencies and natural operational leverage

COVID-19 was a net positive for Zoetis, boosting the number of pets and their demand for medical products, though this was partly offset by a reduction in protein demand and lower livestock prices.

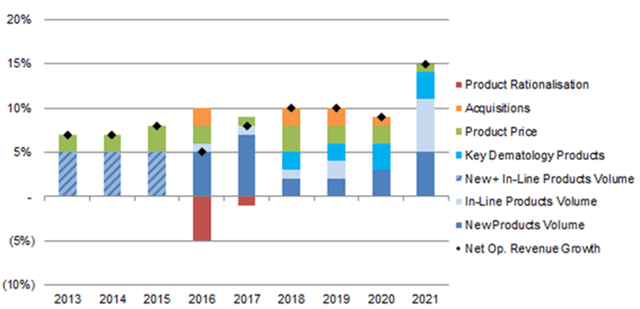

Zoetis’ operational revenue growth (excluding acquisitions) was 15% in 2021, and averaged 8% in the years before:

|

Zoetis Components of Op. Revenue Growth (2013-21)  Source: Zoetis company filings. |

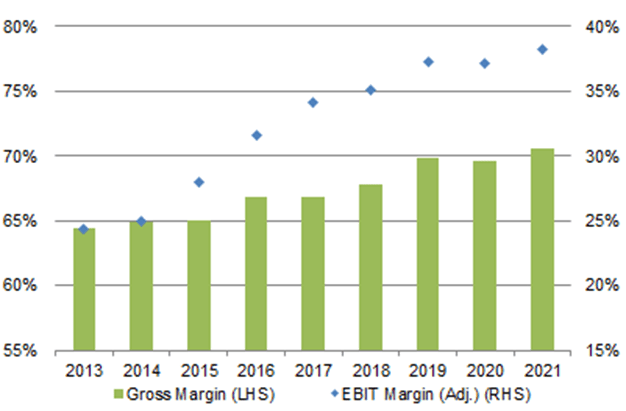

Zoetis’ Gross Margin and EBIT Margin have both been rising over time, including by another 1 ppt each in 2021:

|

ZTS Gross Margin & EBIT Margin (2013-21)  Source: Zoetis company filings. |

Q3 results were worse than our investment case, but mostly due to temporary macro factors.

Zoetis Q3 Results Headlines

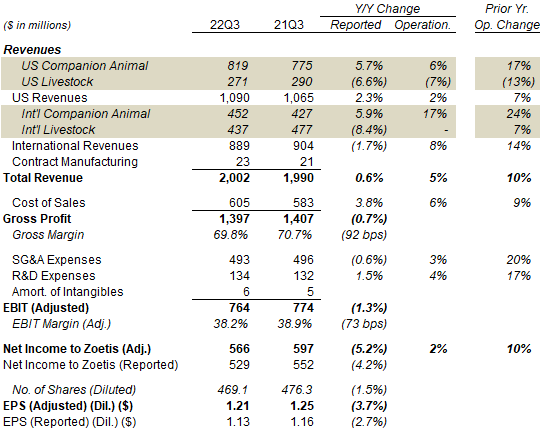

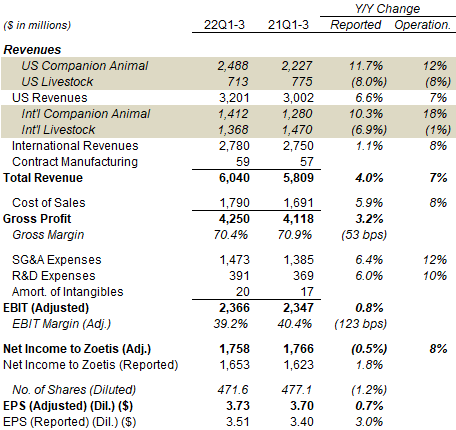

Zoetis’ Q3 2022 results were disappointing, with Adjusted EPS falling 3.7% year-on-year:

|

Zoetis P&L (Non-GAAP) (Q3 2022 vs. Prior Year)  Source: Zoetis results release (Q3 2022). |

However, much of the EPS decline was due to currency and a higher tax rate. Adjusted Net Income fell 5.2% (or $31m) in U.S. dollars but rose 2% operationally. Of the $31m decline, $29m was due to a higher tax expense, the result of a 4 ppt increase in the effective tax rate (in turn the result of a negative geographic mix shift). Adjusted EBIT fell just 1.3% in U.S. dollars, and likely rose by a low-single-digit operationally.

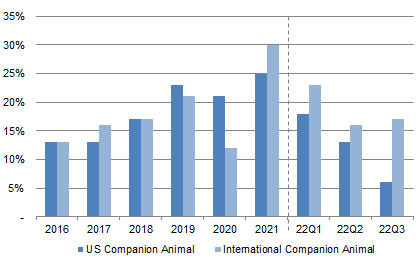

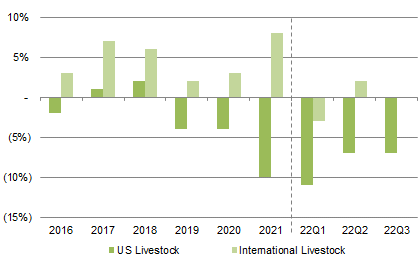

Total revenue grew 0.6% in U.S. dollars and 5% operationally, below our investment case. Revenue still grew by 17% operationally in International Companion Animal, but by only 6% in U.S. Companion Animal (compared to 15% in H1 and 25% in 2021). Revenue declined by 7% operationally in U.S. Livestock and was flat in International Livestock. Management attributed much of the weakness to macro or one-off factors (discussed in more detail in the next section).

Gross Margin fell by approximately 90 bps year-on-year in Q3, primarily (about 70 bps) due to currency. Management has increased prices by about 5% year-to-date on companion animal products, but this was offset by the impact on generic competition on livestock products, giving a price benefit of about 2% overall.

EBIT margin fell by approximately 70 bps year-on-year in Q3, less than Gross Margin, with reductions in discretionary spending having helped reduce SG&A Expenses growth to 3% operationally, 2 ppt less than revenues.

Year-to-date, Zoetis’ Adjusted Net Income has grown 8% operationally but fell 0.5% in U.S. dollars:

|

Zoetis P&L (Non-GAAP) (Q3 YTD 2022 vs. Prior Year)  Source: Zoetis results release (Q3 2022). |

Year-to-date Adjusted EPS is up 0.7% from last year, helped by share buybacks.

Macro & One-Off Headwinds in Q3

Zoetis’ relatively weak operational revenue growth in Q3 can be attributed to macro and one-off factors.

In U.S. Companion Animal, operational revenue growth decelerated to just 6% in Q3, which management attributed to supply chain shortages, impacting Simparica Trio in particular, as well as labor shortages at U.S. veterinary clinics. The reorganization of the U.S. salesforce to create a dedicated Diagnostics field force has again contributed to a decline in Diagnostics revenues, though Diagnostics is only a modest part of Zoetis (with just 4% of group revenues in Q3).

|

Zoetis Companion Animal Op. Revenue Growth (Since 2016)  Source: Zoetis results releases. |

Zoetis attributed it supply chain issues to a variety of factors, including COVID-19, capacity constraints, delays at a third-party capacity project, and component parts shortages.

Supply chain issues have been affecting the whole animal health sector through 2022. For example, Elanco (ELAN) also suffered supply chain disruptions in H1, though these have improved by Q3. However, things appear to have got worse for Zoetis in Q3, after some competitors have gained shelf space at Zoetis’ expense, and with higher demand during the parasite season exacerbating the effects of its shortages. As CFO Wetteny Joseph explained on the call:

“We had outages throughout the peak of parasiticide season for Simparica Trio to Q2 and Q3. Though we recovered late in Q3, the impact was such that we allowed competitors to be more aggressive about placing products on shelves, which we saw that impact as we exited Q3 … Supply issues are not unique to us, given the wide variety of products and species. It’s relatively commonplace in this industry … we saw more of an impact here in Q3 given the timing of our recovery on some of these”.

In International Companion Animal, operational revenue growth was 17%, demonstrating the segment’s ability to grow where supply is not an issue. There was double-digit growth in both Brazil, despite economic headwinds there, and in China, despite the disruption in that market from COVID-19 lockdowns.

In U.S. Livestock, revenues declined 7% operationally, continuing the weakness since 2021. Supply chain disruptions were an issue here (affecting vaccines especially), but generics competition and increased competition in vaccines were also mentioned as factors.

|

Zoetis Livestock Op. Revenue Growth (Since 2016)  Source: Zoetis results releases. |

The impact from generics in Q3 was likely exceptional. Management highlighted two products, DRAXXIN in Cattle and Zoamix in Poultry, as the most affected. Most of the impact was likely due to DRAXXIN, previously Zoetis’ biggest Livestock product with approximately $350m in revenues (equivalent to 12% of 2020 Livestock revenues). (The entire Poultry portfolio was 16% of Zoetis’ global revenues). DRAXXIN’s patent expired in 2021 and management anticipated revenue declines of 20% annually – 2021 was “a bit better” than this while 2022 was worse. Zoetis has only one other product of similar size that will be at risk from generics, APOQUEL (worth approximately 10% of revenues), and new entrants have been repeatedly delayed and now not expected until H2 2023.

In International Livestock, revenues were flat operationally, with growth in Fish and Sheep offset by declines in Swine and in Brazil. The decline in Swine was due to “lower sales across Europe”, with lockdowns in China reducing export demand and inflation pushing up input costs, while the decline in Brazil was due to supply challenges and lower Cattle demand, the latter caused by consumers trading down from beef to cheaper proteins.

Positive News on Key Products

There were positive developments on Zoetis’ key products in Q3:

- Simparica Trio (parasiticide for dogs) sales grew 43% operationally to $172m (including $157m in the U.S.)

- Key Dermatology products (APOQUEL and Cytopoint) sales grew 11% operationally to $343m

- Librela (monoclonal antibodies for osteopathic pain in dogs) sales grew to $31m (from $26m in Q2) and is on track to exceed $100m in 2022. It is the #1 product in its category in Europe; U.S. FDA approval is now expected in H1 2023 (compared to 2022 previously), with a market launch there planned in late 2023

- Solensia (monoclonal antibodies for osteoarthritic pain in cats) sales grew to $6m (from $5m in Q2), and the product has been launched in the U.S. at the end of Q3

These figures represented a strong performance, especially considering supply chain issues in Q3, which affected Simparica Trio especially and also forced trade-offs between other products like Cytopoint and Librela.

Supply Chain Issues Expected to Improve

Zoetis believes its supply chain issues have either been resolved already or will be by year-end. As CEO Kristin Peck explained on the Q3 earnings call:

“We had mAbs (monoclonal antibodies) issues; we worked through that. We’re now in full supply on our mAbs in all the markets that we’ve launched in … We did had paras (parasiticides) challenges in Q2. Q3, honestly our supply came in too late in Q3 … But again, I think the paras problem will work itself out as you look into Q4 …

Some of those (supply chain issues) will continue into next year. But we’re really confident that the biggest challenges we were anticipating this year around mAbs have been addressed. As you look at paras, both Simparica Trio, Rev (Revolution), we’ll work through that by the end of this year.”

Peck also mentioned that, on the aforementioned delayed third-party capacity project, she is monitoring the weekly output of Simparica Trio and Revolution personally and consequently have “strong confidence” on their resolution.

Zoetis 2022 Outlook

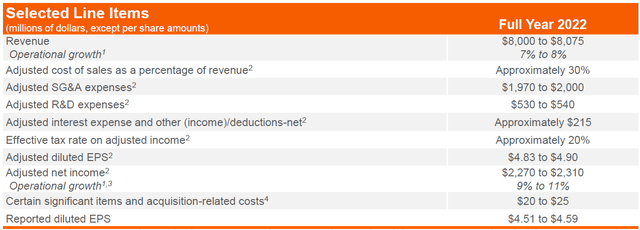

Zoetis has reduced its full-year outlook, but Net Income is still expected to grow 9-11% operationally in 2022.

Expected 2022 operational revenue growth has been cut to 7-8% (was 9.5-10.5%), and Costs of Sales Margin is raised slightly to 30% (was 29.0-29.5%), offset by slightly lower SG&A and R&D expenses. Adjusted EPS is now expected to be $4.83-4.90 (was $4.97-5.05), from operational Net Income growth of 9-11% (was 11-13%):

|

Zoetis 2022 Earnings Guidance  Source: Zoetis results presentation (Q3 2022). |

The outlook implies that Net Income growth will recover in Q4. We believe this is achievable.

Valuation: Is Zoetis Stock Overvalued?

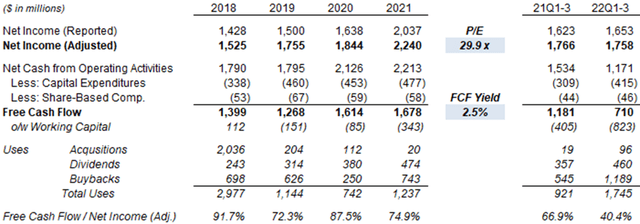

At $142.61, relative to 2021 financials, Zoetis shares are at a 29.9x P/E and a 2.5% Free Cash Flow Yield:

|

Zoetis Earnings, Cashflows & Valuation (Since 2018)  Source: Zoetis company filings. NB. 2018 figures not pro forma Abaxis acquisition (completed Jul-18). |

Relative to the mid-point of the new 2022 EPS guidance, Zoetis shares are at a P/E of 29.3x.

Year-to-date, CapEx has been 34% higher year-on-year as Zoetis continues to expand its capacity, and working capital cash outflows have been $418m worse (including $139m more in inventories), likely to be at least partly related to stockpiling as a remedy to supply chain disruptions.

Zoetis pays a dividend of $1.30 ($0.325 per quarter), representing a Dividend Yield of 0.9%. The dividend was raised by 30% in December 2021, and another hike is likely to be announced next month.

Zoetis has repurchased $545m of its stock in Q1-3, equivalent to 0.8% of its current market capitalization. Out of a $3.5bn share repurchase program authorized in December 2021, $3.0bn remained at the end of Q3.

Zoetis Stock Forecast

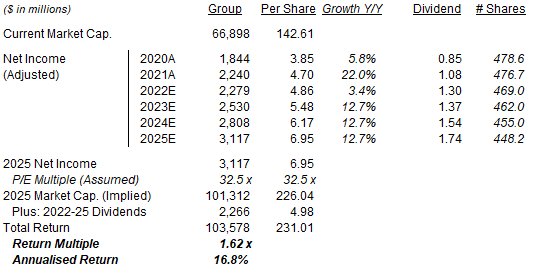

We have made small changes in our forecast assumptions and reduced our exit multiple.

Our key assumptions now include:

- 2022 EPS of $4.86 (was $5.00)

- From 2023, Net Income growth of 11% a year (unchanged)

- 2022 share count of 469.0m (was 471.9m)

- From 2022, share count reduction of 1.5% a year (was 1.0%)

- 2022 dividend of $1.30 (unchanged)

- From 2023, dividend to grow on a Payout Ratio of 25.0% (unchanged)

- P/E of 32.5x at 2025 year-end (was 37.0x)

Our new 2025 EPS forecast of $6.95 is 1.4% lower than before ($7.05):

|

Illustrative Zoetis Return Forecasts  Source: Librarian Capital estimates. |

With shares at $142.61, we expect a total return of 62% (16.8% annualized) by 2025 year-end.

Is Zoetis Stock A Buy? Conclusion

We reiterate our Buy rating on Zoetis Inc. stock.

Be the first to comment