This article was highlighted for PRO subscribers, Seeking Alpha’s service for professional investors. Find out how you can get the best content on Seeking Alpha here.

(We previously wrote about Zoetis as “Blue Sky Capital“)

Introduction

Since we initiated our coverage on Zoetis (ZTS) with a Buy rating in June 2019 (“Zoetis: High-Quality Compounder Growing 10% Per Year“), shares have returned 21.7% as of March 7 (including $0.52 in dividends), massively outperforming the S&P 500. Zoetis shares have also been relatively resilient during the market correction since mid-February, validating our view that it is a defensive stock that deserves its premium valuation:

|

Zoetis Share Price vs. S&P 500 (Since 26-Jun) NB. Zoetis performance based on 26-Jun closing price of $113.05. Source: Yahoo Finance (07-Mar-20). |

In this article, we review Zoetis’ 19Q4 results (released on February 13) and current valuation, and explain why we believe the stock continues to be a Buy.

Buy Case Recap

Our Buy case was centred around Zoetis being a high-quality business that is capable of growing its EPS at a CAGR of 10% sustainably over time, through a combination of high-single-digit revenue growth and steady margin expansion:

- The animal health industry is growing by 5-6% annually on average, driven by secular trends including the growing popularity of companion animals, their increasing medical needs as owners demand higher standards, and the growth in livestock due to increasing global protein consumption (driven by rising affluence in emerging markets). Revenue growth is also helped by the highly consolidated nature of the market.

- Zoetis has an explicit goal of growing faster than the industry and a track record of achieving this, given its broad set of competitive advantages including scale, a superior salesforce, innovative R&D and a comprehensive product portfolio.

- Zoetis’ revenues are highly resilient due to animal health products being mission-critical, medical needs being recurring and Zoetis’ geographic, species and product diversification.

- Zoetis has continued to expand its operating margin, from a combination of improving mix, pricing power, natural operational leverage and efficiencies, with management targeting a 100 bps improvement in the gross margin between 2018 and 2020

When our Buy case was published in June 2019, ZTS was trading on a 36.1x P/E and a 2.6% free cash yield (relative to 2018 financials), which we believed to be justified by its strong growth and defensive characteristics.

We believed ZTS could deliver an annualised return of more than 10% over time, from the combination of its (then) 0.6% dividend yield and its share price appreciating by 10% a year on average, thanks to EPS growing at a CAGR of 10% (including 1% from buybacks) and stable valuation multiples.

Nearly all of the elements of our investment case remain in place, as we will explain below. One change is that Zoetis has achieved its gross margin expansion target early and indeed exceeded it. While share price is now more than 21% higher, EPS used in our valuation has also grown 16%, so the expansion in its P/E is a relatively limited 2.3x (to 37.4x).

19Q4 Results Headlines

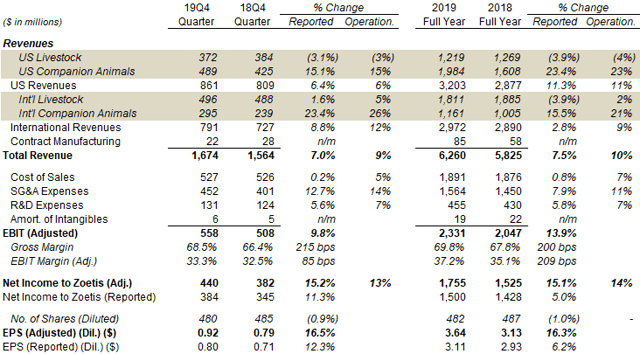

Zoetis delivered a strong set of Q4 results, with revenue growing 7.0% year on year (9% operationally), EBIT growing 9.8%, net income growing 15.2% (13% operationally), and EPS growing 16.5%:

|

ZTS 19Q4 Results Highlights (Non-GAAP) NB. All figures are non-GAAP except otherwise stated. Source: ZTS results press release (19Q4). |

For full year 2019, revenue grew 7.5% (10% operationally), EBIT grew 13.9%, net income grew 15.1% (14% operationally), and EPS grew 16.2%.

Currency was a headwind to revenues, due to the weakening of the euro, the Brazilian real and the Argentinian peso against the U.S. dollar.

2019 results included the benefit of the $2.0bn Abaxis acquisition in 2018 (which added approx. 2% to revenue growth), but Q4 was the first quarter to have lapped this, meaning nearly all of the revenue growth there was organic.

2019 Results in Detail

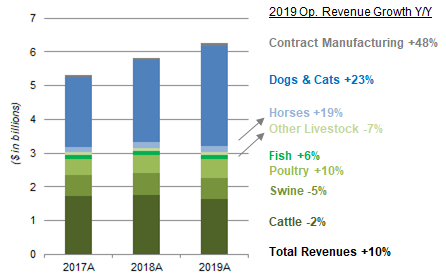

In 2019, the global animal health market grew 3-4%, below the 5.6% in 2018 due to a weak U.S. cattle market and African swine fever in China. Zoetis’ operational revenue growth of 10% was once again above market.

By species, Zoetis’ revenue growth was led by a strong 23% growth in revenues from Dogs & Cats. In Livestock, Swine revenues were down 5%, and Cattle revenues were down 2%, with both reflecting weak markets for reasons stated above, but Poultry revenues were up 10% and Fish revenues were up 6% (helped by a new product for salmon, albeit from a low base):

|

ZTS Revenues & Operational Revenue Growth by Species (2017-19)

NB. Includes the benefit of acquisitions; organic operational revenue growth was 8%. Source: ZTS results press release (19Q4). |

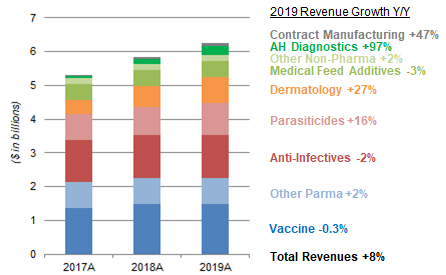

By product category, revenue growth was led by Parasiticides (up 16%) (including its Simpirica blockbuster) and Dermatology (up 27%) (including Apoquel and Cytopoint). Diagnostics revenues increased by 97%, largely in Point of Care, helped by the Abaxis acquisition completed in 18Q3; the diagnostics market also grew 10% year on year:

|

ZTS Revenues & Operational Revenue Growth by Category (2017-19)

NB. Includes the benefit of acquisitions; organic operational revenue growth was 8%. Source: ZTS results press release (19Q4). |

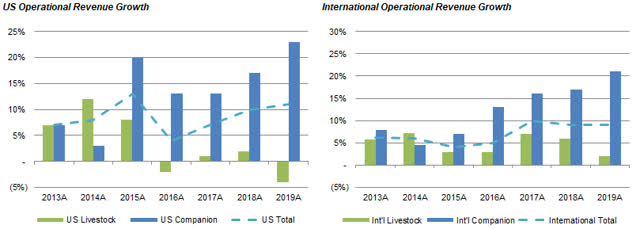

By region, Zoetis continued to grow faster in the U.S. than outside the U.S., with both regions driven by the growth in Companion Animal revenues:

|

ZTS Op. Revenue Growth – U.S. & International (2013-2019A) Source: ZTS company filings. |

The U.S. generated 57.4% of segmental EBIT in 2019, and has a higher margin (62.6% vs. 50.0%) than the non-U.S. segment.

U.S. Livestock revenues have been weak since 2016, from poor beef and dairy cattle markets as well as the effects of the Veterinary Feed Directive in 2017.

China generated $200m of revenues in 2019 (3.2% of group revenues), flat year on year despite the impact from African swine fever, which reportedly reduced herd sizes in China by more than 50%. Companion Animals are now more than 50% of revenues in China, and “growing rapidly.”

We regard the weak cattle market in the U.S. as a cyclical phenomenon, and the African swine fever outbreak as a one-off event. So we believe long-term growth in the animal health market and in Zoetis revenues will remain strong.

Overall, consistent with its track record in recent years, ZTS has again delivered another year of high-single-digit organic revenue growth (and, including acquisitions, 10% operational revenue growth). The 8% organic revenue growth in 2019 consisted of 2% from new products, 4% from existing products and 2% from pricing, a healthy balance similar to previous years:

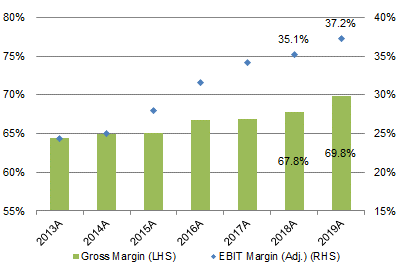

Zoetis’ 2019 EBIT margin was 209 bps higher year on year, largely driven by gross margin having risen 200 bps, which was partly helped by currency:

|

ZTS Gross Margin & EBIT Margin (2013-19A)

Source: ZTS company filings. |

The 200 bps expansion in gross margin is more than the 100 bps targeted by management originally between 2018 and 2020; and the currency effect will reverse in 2020. However, Zoetis’ margins will continue to be helped by mix, with the higher-margin Companion Animal products growing faster, slightly offset by fast-growing Diagnostics products being lower-margin, as well as natural economies of scale and operational leverage.

FY20 Outlook

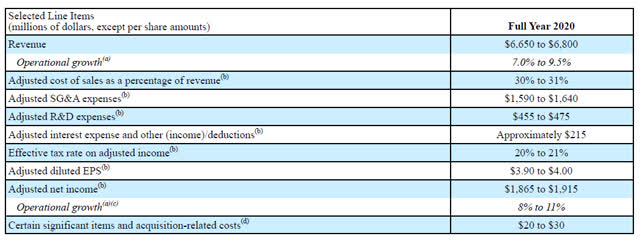

At 19Q4 results management also provided guidance for FY20, which includes operational growth of 7.0-9.5% in revenues and 8-11% in net income:

|

ZTS 2020 Guidance Source: ZTS results press release (19Q4). |

The guidance is based on the global animal market growing at 4-5% in 2020, with the Swine market in China being “neutral to slightly positive” and the Cattle market “returning to growth.” Zoetis is expected to grow faster than market in Companion Animals and in Poultry, in-line or faster than market in Swine, and in line with market in Cattle.

The launch of Simpirica Trio (an all-in-one parasiticide for dogs) is expected to add $150m in incremental revenues, or 2.4% of 2019 group revenues. This has already been launched in several European markets in February, received U.S. FDA approval in late February and will be launched in the U.S. shortly thereafter. However, currency will represent a 100 bps headwind to revenues.

Net income growth will be slower in 2020 than prior years due to a number of factors, with a one-off increase in tax rate being a key one. Management is expecting a higher effective tax rate, both from the new GILTI (Global Intangible Low Tax Income) tax and one-off beneficial items in 2019 – these are expected to reduce net income growth by 300 bps. Other factors include COGS margin being “neutral to slightly worse” year on year (30-31% vs. 2019’s 30.2%) due to currency and acquisitions, and “strategic investments.”

Including buybacks reducing the share count by approx. 1%, we expect EPS to grow operationally by 9-12% in 2020. (And EPS growth will likely be the lowest in Q1, due to the timing of the Simpirica Trio launch and investments.) As the increase in tax rate is a one-off, we expect annual EPS growth to reaccelerate to at least 10% after 2020.

Valuation

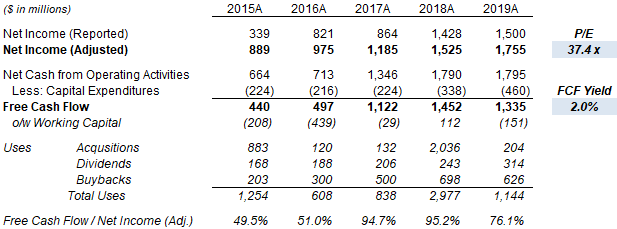

At $137.05, on 2019 financials, Zoetis shares are on a 37.4x P/E and a 2.0% free cash flow (“FCF”) Yield; the dividend yield is 0.6% ($0.80 per share):

|

ZTS Earnings, Cashflows & Valuation (2015-19A)

NB. 2018 figures not pro forma Abaxis acquisition (completed Jul-18). Source: ZTS company filings. |

Zoetis has continued to return about 70% of its free cash flow in dividends and buybacks, with the latter reducing the share count by 1% in 2019.

While Zoetis’ multiples represent a premium valuation, we continue to believe this is deserved given Zoetis’ strong, long-term growth potential and defensive characteristics.

With stable valuation multiples, we expect the share price to grow in line with EPS, i.e. at 9-12% in 2020 and at least 10% annually thereafter. Investor’s average annual return is likely to be more than 10% over the medium term, consisting of 0.6% in dividends and at least 10% in average annual share price growth.

Conclusion

Zoetis shares have returned 21.7% since our initial Buy rating in June 2019, demonstrating resilience during the market correction in the last few weeks.

19Q4 results show that its structural growth drivers remain intact, with strong performances in Dogs & Cats, Parasiticides and Dermatology. Newer areas like Diagnostics and Fish are progressing well, though not yet material contributors due to their small starting sizes.

Including buybacks, we expect EPS growth to continue to be at least 10% over the medium term, slightly lower in 2020 (9-12%) due to some one-offs.

Zoetis is at a premium valuation that is well-deserved, given its strong, long-term growth potential and defensive characteristics.

With stable valuation multiples, we expect the share price to grow in line with EPS, i.e. at 9-12% in 2020 and averaging at least 10% annually thereafter.

At $137.05, investors’ average annual return is likely to be more than 10% over the medium term, consisting of 0.6% in dividends and at least 10% in average annual share price growth.

We believe Zoetis shares offer a good balance of quality and growth for conservative, long-term investors, and reiterate our Buy rating.

However, more adventurous investors open to higher risks are likely to find other candidates with larger upside, given sharp falls in share prices across the market in recent weeks.

Note: A track record of my past recommendations can be found here.

Disclosure: I am/we are long ZTS. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment