krblokhin

Earnings of Zions Bancorporation, National Association (NASDAQ:ZION) will receive support from moderate loan growth through the end of 2023. Further, the top line will benefit from the rising rate environment as a majority of the loan portfolio comprises variable-rate loans. On the other hand, higher provision expenses will drag earnings. Overall, I’m expecting Zions Bancorporation to report earnings of $5.89 per share for 2022, down 13% year-over-year. Compared to my last report on the company, I have slightly reduced my earnings estimate as I’ve increased the provision expense estimate for this year. For 2023, I’m expecting earnings to grow by 17% to $6.88 per share. The year-end target price suggests a small upside from the current market price. Based on the total expected return, I’m maintaining a buy rating on Zions Bancorporation.

Loan Growth to Likely Remain Close to the Historical Trend

The loan portfolio grew by a remarkable 2.2% rate in the second quarter of 2022 (8.7% annualized), which surpassed my expectation. Going forward, the growth rate will likely decelerate from the second quarter’s level due to high interest rates that will curtail credit appetite.

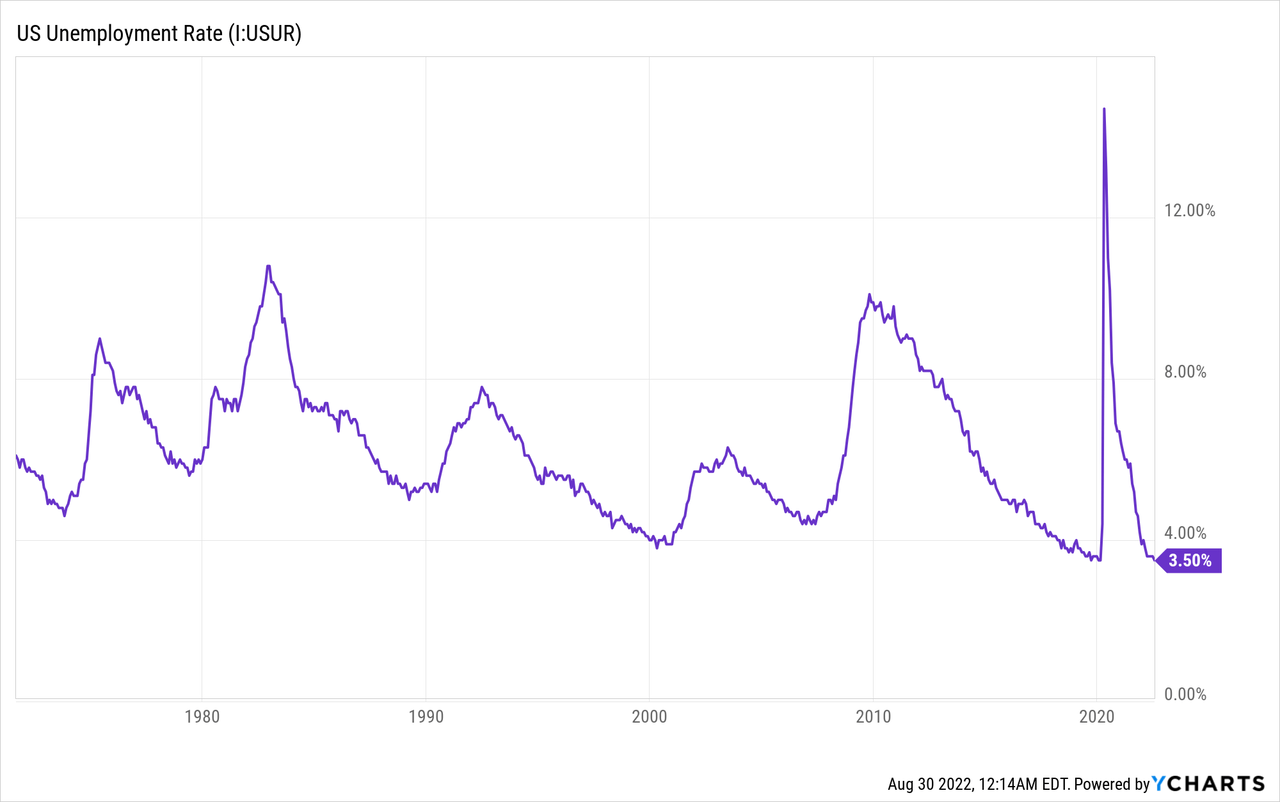

On the other hand, strong job markets will likely sustain loan growth. Zions Bancorporation operates in eleven western states namely Arizona, California, Colorado, Idaho, Nevada, New Mexico, Oregon, Texas, Utah, Washington, and Wyoming. As the economies of these states are varied, the national average is appropriate for Zions Bancorporation.

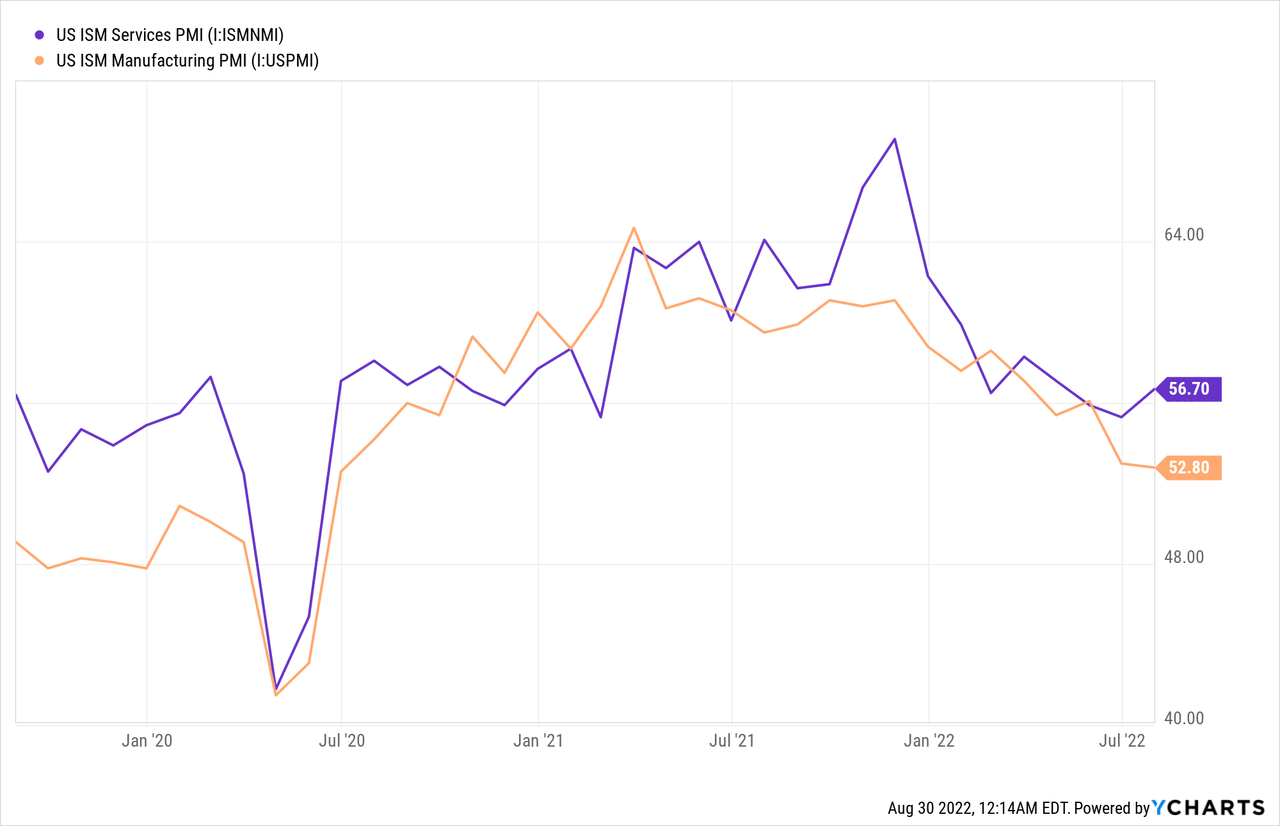

As a large part of the loan book comprises commercial loans, the purchasing managers’ index is also a good gauge of credit demand. As shown below, the index is still in the expansionary territory (above 50) which bodes well for commercial loan growth.

Overall, I’m expecting loan growth to return to the historical range of mid-single digits. I’m expecting the portfolio to grow by 1% in every quarter (4% annualized) till the end of 2023.

Rate-Sensitive Loan Book to Enable Margin Expansion

The loan book is quite sensitive to interest rate changes as it is heavy on variable-rate loans. Around 40% of the loan book will reprice within three months of a rate hike and another 10% will reprice in between 4 to 12 months (considering hedging), as mentioned in the earnings presentation.

Unfortunately, the deposit book is also quite rate-sensitive. Around 51% of the deposit book is made up of non-interest-bearing deposits, which will make the average deposit cost upwards sticky in a rising rate environment. Further, securities made up a hefty 32% of total earning assets at the end of June 2022. This portfolio had a duration of 4.4 years; therefore, only a small part of the portfolio can be expected to mature and re-price this year. As a result, the securities portfolio will hold back the average earning-assets yield as rates rise.

The results of the management’s interest-rate sensitivity analysis given in the presentation show that a 200-basis points hike in interest rates could boost the net interest income by 11% over twelve months. Considering these factors, I’m expecting the margin to increase by 30 basis points in the second half of 2022 before stabilizing in 2023.

Above-Average Provisioning Likely for the Second Half

Zions Bancorporation reported a high net provision expense of $41 million in the second quarter of 2022, which negatively surprised me. Nonperforming assets and accruing loans 90 days past due made up 0.40% of total loans at the end of June 2022. In comparison, allowances for loan losses made up 1.05% of total loans. The allowance coverage was satisfactory at the end of June; however, it will feel a bit tight in the coming quarters. This is because of a high inflation environment and threats of a recession that will increase credit risk. As a result, I believe Zions Bancorporation will have to make further sizable contributions to provisions for expected loan losses.

Overall, I’m expecting provisioning to be above normal for the second half of 2022 before declining to almost a normal level in 2023. I’m expecting the provision expense to make up 0.16% of total loans (annualized) in the second half of 2022. For 2023, I’m expecting the net provision expense to make up 0.07% of total loans. In comparison, the net provision expense averaged 0.06% of total loans in the last five years.

In my last report on Zions Bancorporation, I estimated a net provision reversal of $3 million for 2022. I’ve increased my provision expense estimate because the second quarter’s performance negatively surprised me. Further, I have a worse credit outlook than before.

Expecting Earnings to Dip in 2022 Before Growing by 17% in 2023

Moderate loan growth and margin expansion will likely drive earnings through the end of 2023. Moreover, as mentioned in the conference call, the management is close to completing a technology project that will replace the existing loan and deposit systems. Not only will the project-related expenses taper off once the project is completed, but core operating expenses should also decline as a result of a more streamlined system.

On the other hand, a higher provision expense will likely drag the bottom line. Overall, I’m expecting Zions Bancorporation to report earnings of $5.89 per share for 2022, down 13% year-over-year. For 2023, I’m expecting earnings to grow by 17% to $6.88 per share. The following table shows my income statement estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |||||

| Income Statement | ||||||||||

| Net interest income | 2,230 | 2,272 | 2,216 | 2,208 | 2,433 | 2,670 | ||||

| Provision for loan losses | (39) | 39 | 414 | (276) | 48 | 40 | ||||

| Non-interest income | 552 | 562 | 574 | 703 | 661 | 704 | ||||

| Non-interest expense | 1,678 | 1,742 | 1,704 | 1,741 | 1,870 | 1,941 | ||||

| Net income – Common Sh. | 850 | 782 | 501 | 1,088 | 888 | 1,038 | ||||

| EPS – Diluted ($) | 4.08 | 4.16 | 3.02 | 6.79 | 5.89 | 6.88 | ||||

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

||||||||||

In my last report on Zions Bancorporation, I estimated earnings of $5.92 per share for 2022. I’ve decreased my earnings estimate as I’ve increased my provision expense estimate following the second quarter’s performance.

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, a stronger or longer-than-anticipated recession can increase the provisioning for expected loan losses beyond my estimates.

Higher Interest Rates Lead to Equity Erosion

Zions Bancorporation’s tangible equity book value has dipped from $40.54 per share at the end of June 2021 to $27.76 per share at the end of June 2022, as mentioned in the 10-Q Filing. This drop was mainly attributable to unrealized losses on the available-for-sale securities portfolio. As interest rates increased, the market value of the securities dropped. These losses bypassed the income statement and directly reduced the equity book value.

I’m expecting further pressure on equity book value as I’m expecting a 75 basis points hike in interest rates in the remainder of this year. I’m expecting rates to be stable in the first half before trending downwards in the second half of next year.

On the other hand, retained earnings will likely lift the equity book value. The following table shows my balance sheet estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |||||

| Financial Position | ||||||||||

| Net Loans | 46,219 | 48,214 | 52,699 | 50,338 | 52,904 | 55,053 | ||||

| Growth of Net Loans | 4.4% | 4.3% | 9.3% | (4.5)% | 5.1% | 4.1% | ||||

| Other Earning Assets | 18,836 | 16,753 | 23,553 | 37,360 | 30,378 | 31,611 | ||||

| Deposits | 54,101 | 57,085 | 69,653 | 82,789 | 80,650 | 83,925 | ||||

| Borrowings and Sub-Debt | 6,377 | 3,835 | 2,908 | 1,915 | 1,723 | 1,793 | ||||

| Common equity | 7,012 | 6,787 | 7,320 | 7,023 | 5,569 | 6,354 | ||||

| Book Value Per Share ($) | 34.0 | 36.1 | 44.7 | 45.7 | 36.9 | 42.1 | ||||

| Tangible BVPS ($) | 29.0 | 30.7 | 38.5 | 39.1 | 30.2 | 35.4 | ||||

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

||||||||||

Adopting a Buy Rating Due to a Moderate Total Expected Return

Given the earnings outlook, I’m expecting Zions Bancorporation to increase its dividend by $0.02 per share in the third quarter of 2023. My dividend and earnings estimates for 2023 suggest a payout ratio of 24%, which is close to the five-year average of 28%. My dividend estimate suggests a decent forward dividend yield of 3.0%.

Zions Bancorporation’s capital ratios are currently a bit low due to the recent equity book value erosion. The total risk-based capital ratio stood at 12.3% at the end of June 2022, as opposed to the minimum regulatory requirement of 10.5%. Nevertheless, in my opinion, capital adequacy requirements will not affect the dividend trend next year.

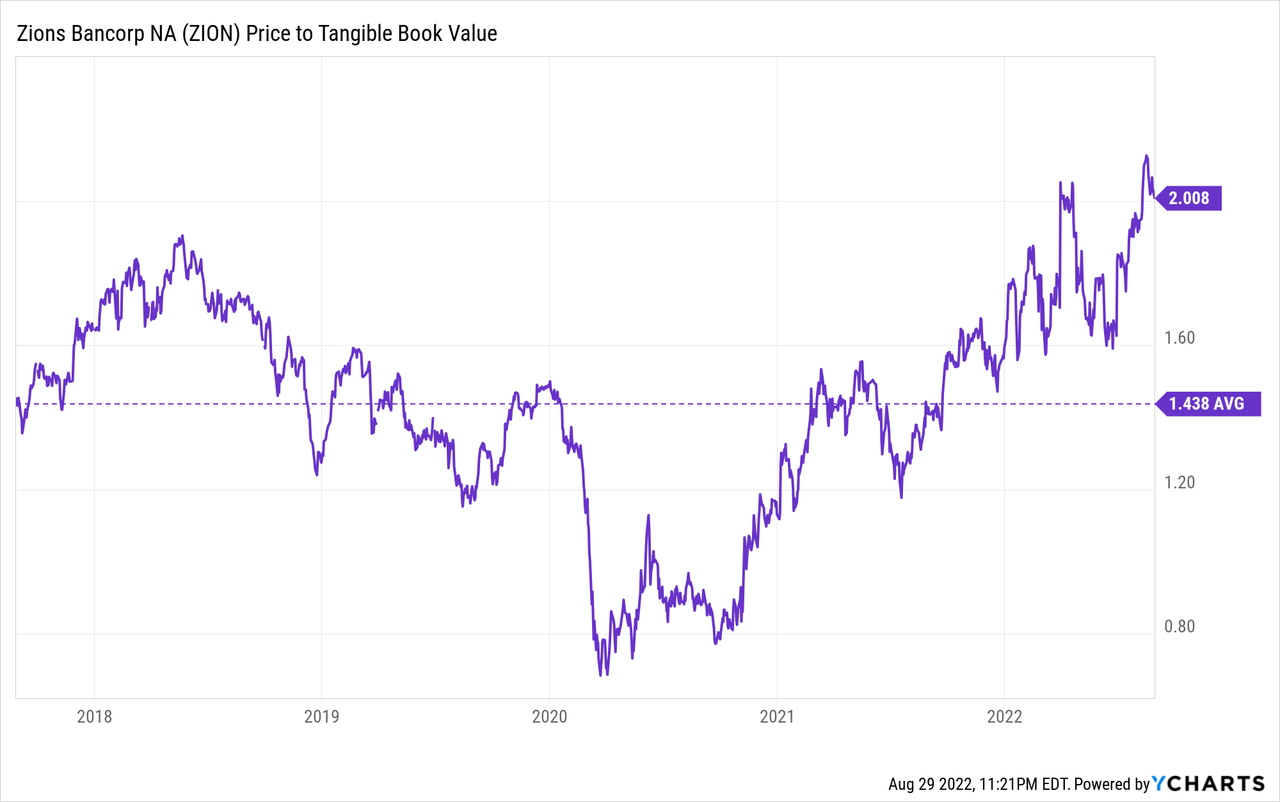

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Zions Bancorporation. The stock has traded at an average P/TB ratio of 1.44 in the past, as shown below.

Multiplying the average P/TB multiple with the forecast tangible book value per share of $30.2 gives a target price of $43.4 for the end of 2022. This price target implies a 22.1% downside from the August 29 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.24x | 1.34x | 1.44x | 1.54x | 1.64x |

| TBVPS – Dec 2022 ($) | 30.2 | 30.2 | 30.2 | 30.2 | 30.2 |

| Target Price ($) | 37.4 | 40.4 | 43.4 | 46.4 | 49.5 |

| Market Price ($) | 55.8 | 55.8 | 55.8 | 55.8 | 55.8 |

| Upside/(Downside) | (32.9)% | (27.5)% | (22.1)% | (16.7)% | (11.3)% |

| Source: Author’s Estimates |

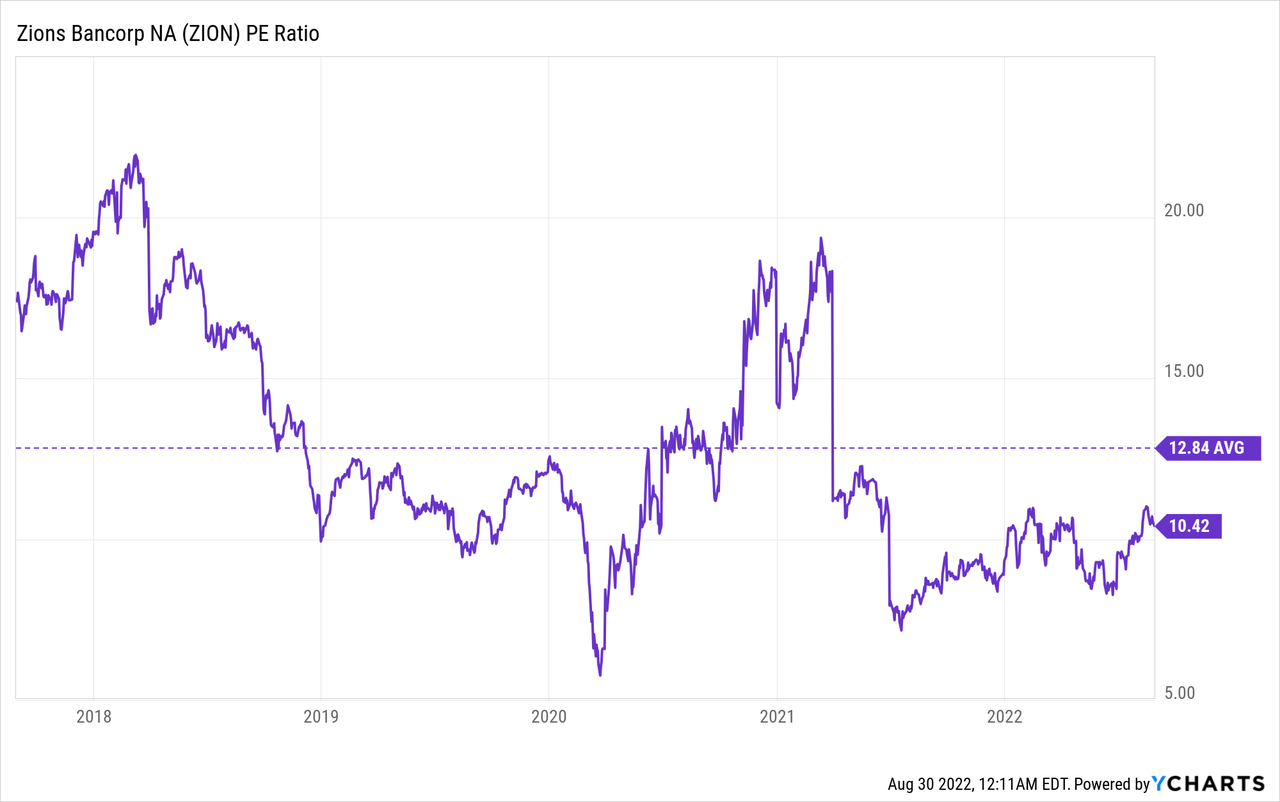

The stock has traded at an average P/E ratio of around 12.8x in the past, as shown below.

Multiplying the average P/E multiple with the forecast earnings per share of $5.89 gives a target price of $75.6 for the end of 2022. This price target implies a 35.6% upside from the August 29 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 10.8x | 11.8x | 12.8x | 13.8x | 14.8x |

| EPS 2022 ($) | 5.89 | 5.89 | 5.89 | 5.89 | 5.89 |

| Target Price ($) | 63.8 | 69.7 | 75.6 | 81.5 | 87.4 |

| Market Price ($) | 55.8 | 55.8 | 55.8 | 55.8 | 55.8 |

| Upside/(Downside) | 14.5% | 25.1% | 35.6% | 46.2% | 56.7% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $59.5, which implies a 6.7% upside from the current market price. Adding the forward dividend yield gives a total expected return of 9.8%. Hence, I’m adopting a buy rating on Zions Bancorporation.

Be the first to comment