krblokhin/iStock Editorial via Getty Images

The topline of Zions Bancorporation, National Association (NASDAQ: NASDAQ:ZION) is highly sensitive to interest rate changes. Therefore, the recent sharp increase in the Federal Funds rate will boost earnings in the year ahead. Further, the top line will benefit from mid-single-digit loan growth. On the other hand, provision reversals will likely taper off this year after remaining unsustainably elevated last year. Overall, I’m expecting Zions Bancorporation to report earnings of $5.92 per share in 2022, down 13% year-over-year. Compared to my last report on Zions Bancorporation, I have significantly increased my earnings estimate due to the greater-than-expected monetary tightening. The year-end target price suggests a high upside from the current market price. Therefore, I’m upgrading Zions Bancorporation to a buy rating.

Loan Growth to Return to a Normal Level for 2022

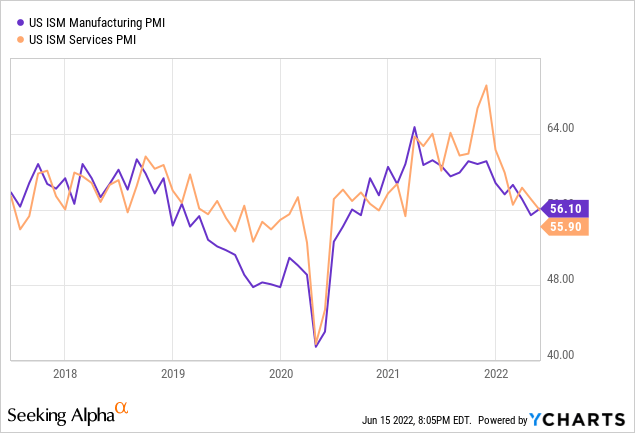

After subdued loan growth in the last two quarters, I’m expecting loan growth to improve in the remainder of the year, thereby getting closer to the historical norm. My optimism is partly attributable to economic factors. Around two-thirds of Zions Bancorporation’s revenues come from commercial customers, as mentioned in the second quarter’s investor update presentation. Therefore, the purchasing managers’ index (“PMI”) is a good indicator of credit demand for the year ahead. In my opinion, the PMI is a better gauge than GDP growth in Zion’s case because GDP is more broad-based and includes the public sector. As shown below, the PMI has remained in the expansionary territory in the last year and a half.

Moreover, the management mentioned in the first quarter’s conference call that it expects line utilization to continue to strengthen as businesses will work to rebuild their inventories.

Further, the bulk of the pressure from Paycheck Protection Program (“PPP”) forgiveness is now over. However, Zions Bancorporation’s PPP portfolio still makes up a sizable part of the company’s total loan book, unlike most other banks. According to details given in the investor update presentation, PPP loans outstanding totaled $1.5 billion at the end of March 2022, representing 2.8% of total loans. As a result of the PPP portfolio’s large size, the remaining forgiveness will have a material impact on the total loan portfolio size.

Considering these factors, I’m expecting the loan portfolio to increase by 4.7% in 2022, which is close to the historical average. Meanwhile, I’m expecting deposit growth to trail loan growth by a small margin. The following table shows my balance sheet estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | ||||

| Financial Position | |||||||||

| Net Loans | 44,262 | 46,219 | 48,214 | 52,699 | 50,338 | 52,692 | |||

| Growth of Net Loans | 5.2% | 4.4% | 4.3% | 9.3% | (4.5)% | 4.7% | |||

| Other Earning Assets | 18,448 | 18,836 | 16,753 | 23,553 | 37,360 | 35,491 | |||

| Deposits | 52,621 | 54,101 | 57,085 | 69,653 | 82,789 | 84,846 | |||

| Borrowings and Sub-Debt | 5,359 | 6,377 | 3,835 | 2,908 | 1,915 | 1,367 | |||

| Common equity | 7,113 | 7,012 | 6,787 | 7,320 | 7,023 | 6,387 | |||

| Book Value Per Share ($) | 33.9 | 34.0 | 36.1 | 44.7 | 45.7 | 42.1 | |||

| Tangible BVPS ($) | 29.1 | 29.0 | 30.7 | 38.5 | 39.1 | 35.4 | |||

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

|||||||||

High Rate-Sensitivity to Bear Fruit this Year

Thanks to the commercial loans-heavy loan portfolio, the interest income is quite sensitive to rate changes. Commercial loans generally have shorter durations than other loan types, especially residential mortgages. Therefore, a large part of the loan portfolio will re-price in the year ahead. At the same time, the presence of non-interest-bearing deposits will further benefit the margin. Around 50.9% of the total deposit portfolio comprised of non-interest-bearing deposits at the end of March 2022. These deposits will make the average deposit cost upwards sticky in a rising interest-rate environment.

On the other hand, the large securities portfolio will limit the margin expansion. As mentioned in the presentation, the securities portfolio carried a duration of 4.3 years, which is quite long. This means that we can reasonably expect yields on a majority of the portfolio to remain locked this year even as interest rates rise.

The management’s interest-rate sensitivity analysis given in the presentation shows that a 200-basis points increase in interest rates can boost the net interest income by a hefty 16% over twelve months. Considering the factors mentioned above and the management’s sensitivity analysis, I’m expecting the margin to improve by 50 basis points in the last nine months of 2022 from 2.60% in the first quarter of the year.

In my last report on Zions Bancorporation which was published back in December 2021, I estimated the margin to increase by only six basis points. Since the issuance of that report, the economic outlook has changed drastically. At the time of writing that report, the Federal Reserve projected the Federal Funds rate to be around 0.9% (median) for 2022. Following the June 2022 meeting, the Federal Reserve is now projecting federal funds rate of 3.4% (median) for this year. As a result, my updated margin estimate is far higher than the estimate I gave in my last report on the company.

Provision Normalization to Hurt Earnings

Zions Bancorporation posted a large net provision reversal of $33 million for the first quarter of 2022, which exceeded my expectations. I’m not expecting any big provision reversals in the year ahead because the allowance level has now declined to a level quite close to non-performing loans. Allowances made up 1.02% of total loans at the end of March 2022, as mentioned in the presentation. In comparison, non-performing assets and accruing loans that were more than 90 days past due made up 0.50% of total loans at the end of March 2022. Moreover, the sharp monetary tightening increases the chances of a recession. Banks are unlikely to release reserves when such threats are present.

Meanwhile, the provisioning for expected loan losses from the loan additions will likely remain at a normal level in the year ahead. Overall, I’m expecting the provision expense, net of reversals, to make up 0.08% of total loans (annualized) in the last nine months of 2022. In comparison, the net provision expense averaged 0.06% of total loans in the last five years. For the full year, I’m expecting a net provision reversal of $3 million, representing a negative 0.01% of total loans. Compared to my last report on Zions Bancorporation, I have not changed my provision estimate for the last nine months. However, because of the first quarter’s heightened reversals, my full-year provision estimate is below the estimate I gave in my last report.

Expecting Earnings to Dip by 13%

The lower provision reversal will likely be the chief driver of an earnings decline this year relative to last year. Further, the non-interest income will likely decline as last year’s heightened securities gains are unlikely to be repeated. Moreover, the fee income will likely be lower this year as Zions Bancorporation intends to reduce its overdraft and non-sufficient-funds fees. As mentioned in the conference call, the management expects these fee measures to reduce fee income by around $5 million per quarter starting in the third quarter of 2022.

On the other hand, mid-single-digit loan growth and significant margin expansion will likely support the bottom line. Overall, I’m expecting Zions Bancorporation to report earnings of $5.92 per share in 2022, down 13% year-over-year. The following table shows my income statement estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | ||||

| Income Statement | |||||||||

| Net interest income | 2,065 | 2,230 | 2,272 | 2,216 | 2,208 | 2,419 | |||

| Provision for loan losses | 24 | (39) | 39 | 414 | (276) | (3) | |||

| Non-interest income | 544 | 552 | 562 | 574 | 703 | 656 | |||

| Non-interest expense | 1,649 | 1,678 | 1,742 | 1,704 | 1,741 | 1,884 | |||

| Net income – Common Sh. | 550 | 850 | 782 | 501 | 1,088 | 898 | |||

| EPS – Diluted ($) | 2.60 | 4.08 | 4.16 | 3.02 | 6.79 | 5.92 | |||

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

|||||||||

I have significantly increased the earnings estimate from the estimate given in my last report on Zions Bancorporation. This estimate revision is mostly attributable to the increase in the net interest margin estimate.

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, the threat of a recession can increase the provisioning for expected loan losses.

Upgrading to a Buy Rating

Zions Bancorporation is offering a dividend yield of 2.9% at the current quarterly dividend rate of $0.38 per share. The earnings and dividend estimates suggest a payout ratio of 25.7% for 2022, which is in line with the five-year average of 24.5%. Therefore, the earnings outlook presents no threats to the dividend level.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Zions Bancorporation. The stock has traded at an average P/TB ratio of 1.44 in the past, as shown below.

| FY17 | FY18 | FY19 | FY20 | FY21 | Average | |

| T. Book Value per Share ($) | 29.1 | 29.0 | 30.7 | 38.5 | 39.1 | |

| Average Market Price ($) | 44.3 | 52.1 | 46.4 | 35.5 | 56.6 | |

| Historical P/TB | 1.52x | 1.80x | 1.51x | 0.92x | 1.45x | 1.44x |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $35.4 gives a target price of $51.0 for the end of 2022. This price target implies a 4.0% downside from the June 15 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.24x | 1.34x | 1.44x | 1.54x | 1.64x |

| TBVPS – Dec 2022 ($) | 35.4 | 35.4 | 35.4 | 35.4 | 35.4 |

| Target Price ($) | 43.9 | 47.4 | 51.0 | 54.5 | 58.1 |

| Market Price ($) | 53.1 | 53.1 | 53.1 | 53.1 | 53.1 |

| Upside/(Downside) | (17.4)% | (10.7)% | (4.0)% | 2.6% | 9.3% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 12.2x in the past, as shown below.

| FY17 | FY18 | FY19 | FY20 | FY21 | Average | |

| Earnings per Share ($) | 2.60 | 4.08 | 4.16 | 3.02 | 6.79 | |

| Average Market Price ($) | 44.3 | 52.1 | 46.4 | 35.5 | 56.6 | |

| Historical P/E | 17.0x | 12.8x | 11.2x | 11.7x | 8.3x | 12.2x |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $5.92 gives a target price of $72.3 for the end of 2022. This price target implies a 36.1% upside from the June 15 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 10.2x | 11.2x | 12.2x | 13.2x | 14.2x |

| EPS 2022 ($) | 5.92 | 5.92 | 5.92 | 5.92 | 5.92 |

| Target Price ($) | 60.5 | 66.4 | 72.3 | 78.2 | 84.1 |

| Market Price ($) | 53.1 | 53.1 | 53.1 | 53.1 | 53.1 |

| Upside/(Downside) | 13.8% | 25.0% | 36.1% | 47.3% | 58.4% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $61.6, which implies a 16.0% upside from the current market price. Adding the forward dividend yield gives a total expected return of 18.9%.

I adopted a neutral rating in my last report on Zions Bancorporation because the stock price at that time was quite close to my target price. Due to the increase in the earnings estimate, I have now slightly increased my target price, which has increased the upside. Moreover, the recent market rout has also increased the implied price upside. Based on the total expected return, I’m now upgrading Zions Bancorporation to a buy rating.

Be the first to comment