shaunl/E+ via Getty Images

Instead of an investment thesis

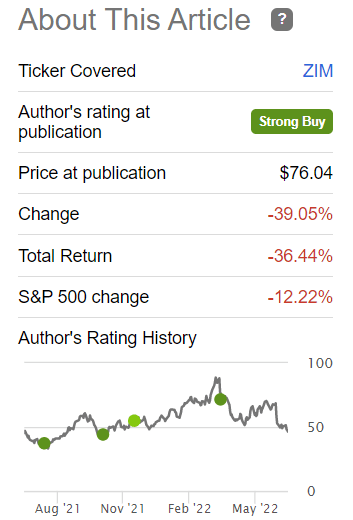

The article you are reading is the 5th in my series of articles on ZIM Integrated Shipping (NYSE:ZIM). When I first paid attention to this company in July 2021, the stock was worth just over $36. Since then, my rating has not changed – I have always written that ZIM’s potential for value investors is enormous and not fully reflected in the price.

Unfortunately, my last call aged extremely badly – even with the dividend yield, the potential buyer would have lost more than 36% with that purchase.

Seeking Alpha, My last bullish call on ZIM

Nevertheless, I remain optimistic and will try to free up some space in my investment portfolio for the next averaging down of my long position in ZIM shares that I still hold.

My reasoning

First off, we need to find out why the stock is falling. In my opinion, a combination of factors played a role here, which together caused quotations to plunge by >48% from their peak in March.

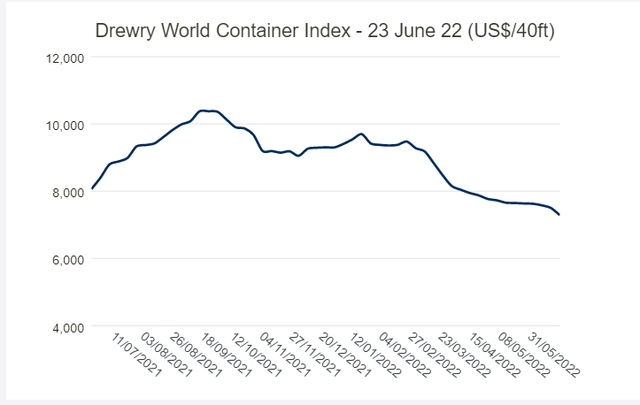

It was not until mid-March that Drewry’s composite world container index, which until then had been relatively stable in the $9000-$9500 range, began to fall sharply – at the time of writing the index stands at $7,285.89 per 40-foot container (-3% compared to last week).

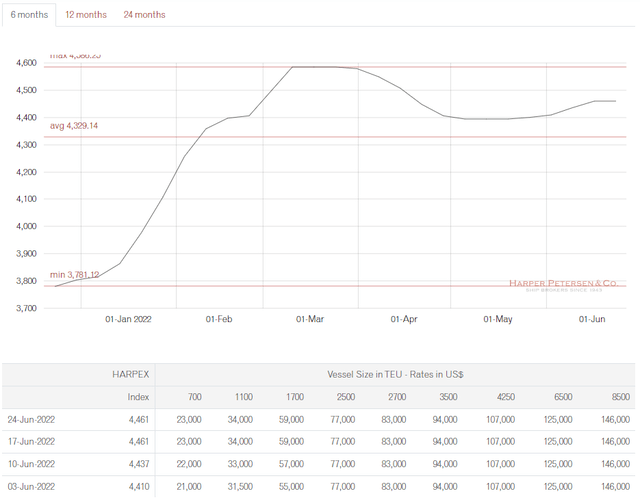

At the same time, the HARPEX index, which tracks pricing in the charter market for containerships, also fell slightly from its March levels, but still looked much stronger than Drewry – this discrepancy was probably the main motive for the sell-off in ZIM shares, as the narrowing of the spread should theoretically bring less profit for ZIM going forward.

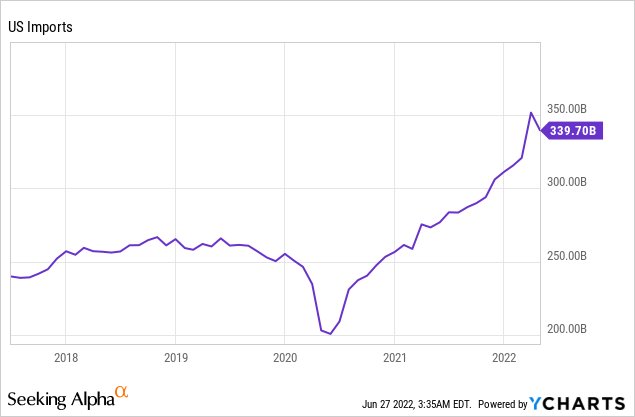

Moreover, various media write tirelessly about deglobalization processes and the slowdown of U.S. imports.

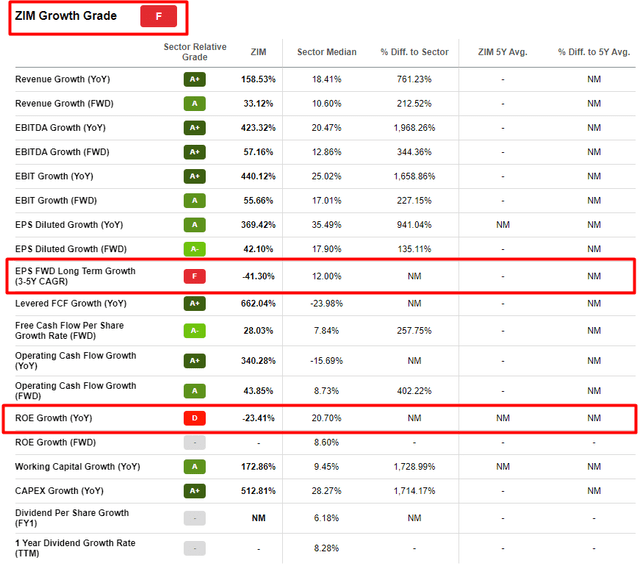

The combination of the above expectations is severely affecting ZIM’s EPS figures – literally due to two metrics, Seeking Alpha’s Growth Factor Grade for ZIM has changed from “A” to “F” in a very short time:

Seeking Alpha, ZIM, author’s notes

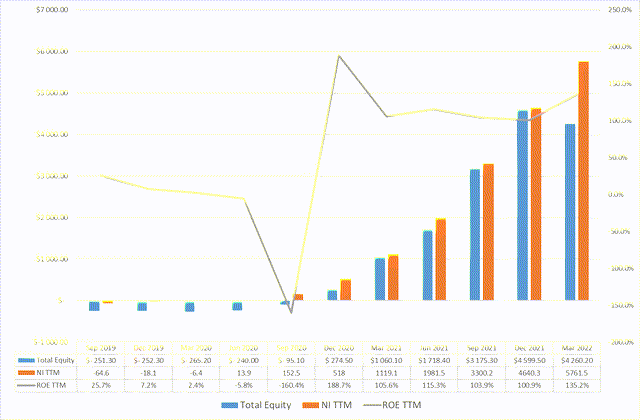

However, as we can see, other factors did not suffer much – even the decline of ROE growth, which also affected the downgrading of the Growth factor, remained at a fairly high level according to the results of the last quarter (TTM net profit divided by total equity capital in each quarter):

Seeking Alpha data, ZIM’s financials, author’s calculations

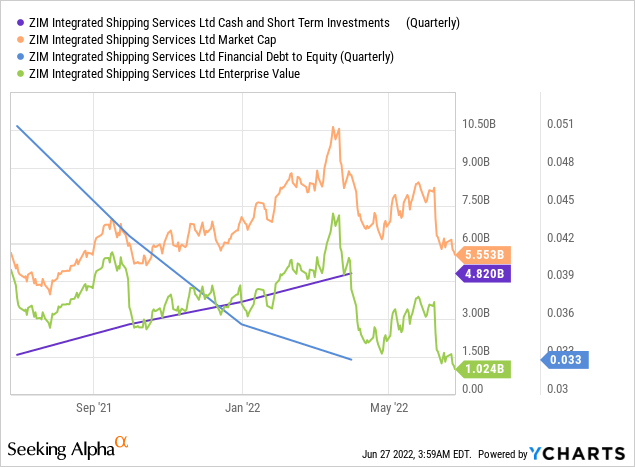

The company ended the last quarter with a cash balance of $4.820 billion, or about 87% of its current market capitalization, with financial debt representing only 3.3% of total common equity. This means that ZIM has so much cash that its enterprise value is only 18.44% of its market capitalization due to negative net debt.

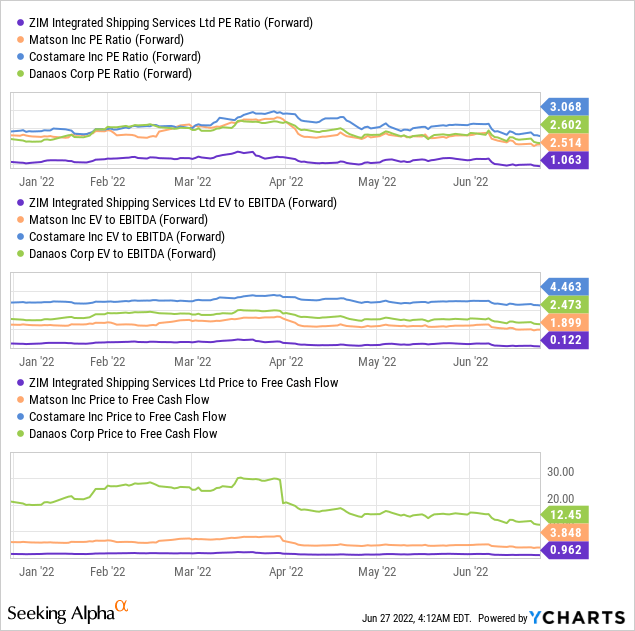

ZIM’s current financial performance against the backdrop of the recent share correction makes the company, in my view, highly undervalued, even compared to other shipping companies.

That is, as you can see from the chart above, ZIM needs 12.2% of forward EBITDA to buy out itself completely (we focus on enterprise value using cash as well as EBITDA). That’s about 44.5 days of operational work (including weekends and ignoring seasonality)!

And at the same time, the stock is trying to find support at the moment in order not to fall even lower – a truly curious sight. It is moments like these that give investors the most opportunity to make profits.

We should take into account that fears of deglobalization are indeed justified – it is hard to argue with that. Developed economies have realized that too many important things for their economies depend on developing, unreliable markets, which carry many risks that can occur at any moment. Take the war in Ukraine or the escalating risks in Taiwan as key examples. However, transforming the existing system of relations and logistical supply is an arduous process that can take years. Therefore, the demand for the services of companies like ZIM will definitely never lose relevance – no matter how much imports to the United States are reduced in the short term, it will always exist because labor-intensive production cannot be fully localized inside the U.S.

For its part, ZIM is trying to establish itself in the top echelon of its industry by investing in various projects and expanding operations – this is evident from the company’s sequence of recent corporate news. This is not surprising – when a company has 4.7x more cash than its enterprise value, this seems to be the only optimal move (besides high dividends).

Apart from the low valuation that should eventually drive the stock towards its fair value, I believe in a reversal of the current price trend based on the historical performance of this stock. I recommend you take a look at the ZIM price action (with my notes):

Investing.com, ZIM chart, author’s notes

It is no secret that there are a large number of stock screeners these days. One popular strategy is to look for high dividend stocks and buy them during or before the cumulative dividend period and hold on to the ex-dividend date. Advanced investors start buying in a month or two, expecting the influx of new retail investors to support quotes.

As we can see, something similar happened in the case of ZIM Integrated Shipping – investors started going long by the ex-date, creating strong demand for the stock and driving its prices up. The company’s next report is due on 19 August, less than two months from now, according to Seeking Alpha data. If we assume that the company’s business has not suffered much in recent months (which seems to be true), then the dividend yield should remain at a fairly attractive level – well above U.S. inflation on an annual basis. This, I believe, will be a catalyst for the rise in quotations by the end of this summer.

Moreover, the technical picture is consistent with my conclusion that ZIM is already at its bottom. In the past, after selling pressure as strong as today – when the RSI indicator was in the 30-35 range – investors caught a 1-3 month bounce with an average growth of ~43%.

Risks and Takeaway

I see the following risks in my findings:

- The use of last quarter’s financial data may lead to misleading conclusions about both the valuation of the company and its actual current financial ratios and future growth prospects;

- The company’s investment activity may prove inefficient, which could lead to financial problems at the end of the current bull cycle;

- If Danaos’ (DAC) management decides to actively sell its stake in the company, this will put further pressure on ZIM in the medium term;

- I may be wrong in my assessment of the technical picture – this is more art than an exact science. Beauty is in the eye of the beholder, as they say. The RSI indicator I am referring to may not bounce, but go southeast if the stock continues to correct from its current level. I have highlighted this option in the chart above – look out for it.

Despite these risks, however, I tend to believe that ZIM is heavily oversold and will see increased demand for its shares in the coming months. As the fundamental attractiveness of the industry has not changed and ZIM has become even cheaper, I reiterate my earlier buy recommendation.

Feel free to share your opinion in the comments.

Be the first to comment