naphtalina/iStock via Getty Images

Israeli shipping company, ZIM Integrated Shipping Services Ltd. (NYSE:ZIM) has been a market leader since its listing in the United States. Its historic profitability is a consequence of broad industry trends that are supportable over the next few years. With a free cash flow yield of more than 130%, there is a huge amount of margin of safety for an investor.

Stock Price Performance

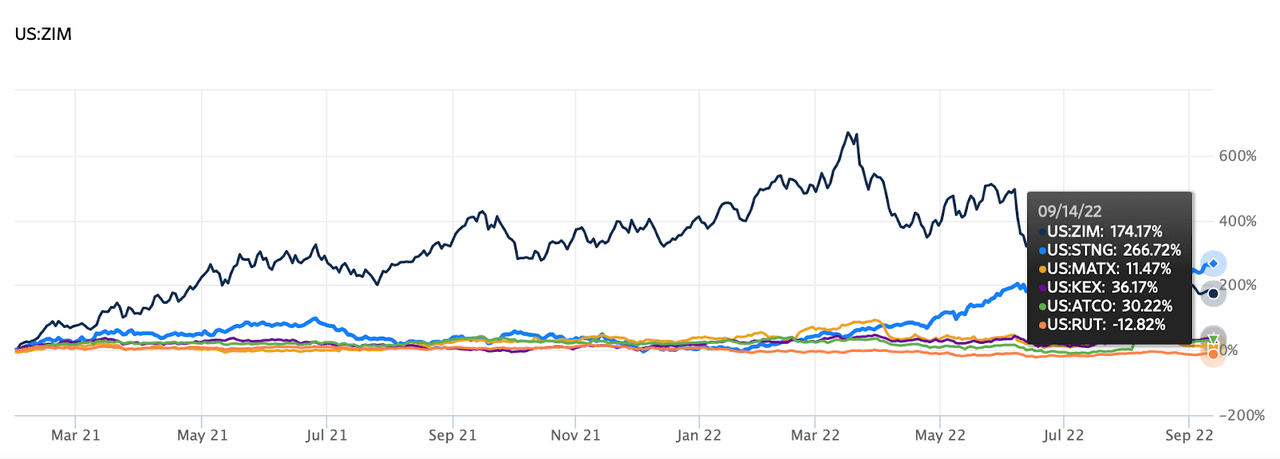

Since listing on the New York Stock Exchange (NYSE) at the beginning of 2021, shares in ZIM have appreciated by 174.17% at time of writing, compared to a -12.82% performance for the Russell 2000 Index (RUT). During that time, the company’s peers have also outperformed the market, with Scorpio Tankers Inc (STNG) gaining 266.72%, Matson Inc (MATX) gaining 11.47%, Kirby Corporation (KEX) gaining 36.17%, and Atlas Corp. (ATCO) gaining 30.22%.

Source: Wall Street Journal

However, year-to-date, the company’s shares have fallen 44.45%. Existing shareholders who bought the company at the start of the year, need an 80% gain in the price just to get break even. For those shareholders, it may be time to sell, but for investors who do not own stock in the company, the situation is different. Risk for one party is an opportunity for another.

ZIM’s Historic Profitability

ZIM’s run on the market has come about as a result of the firm’s historic profitability in the wake of the global pandemic. The company is at the height of its profitability, improving its financial performance according to every single metric. That profitability was not a once-off.

ZIM compounded revenue at over 29% between 2017 and 2021, growing revenue from nearly $2.98 billion in 2015, to nearly $10.73 billion in 2021. According to Credit Suisse‘s Base Rate Book, just 1.9% of teams achieve a 5-year revenue compounded annual growth rate (CAGR) of that magnitude. In the trailing twelve month (TTM) period, the company has earned nearly $13.75 billion. The 5-year gross profit CAGR for that period was nearly 85%, with gross profit growing from over $280 million to more than $6 billion. Gross profitability rose from nearly 0.16 in 2017, to nearly 0.62 in 2021, well above the 0.33 threshold of attractive stocks as determined by Robert Novy-Marx. In the TTM period, gross profitability has risen further, to nearly 0.72, reflecting improvements in the ability of the company to earn money. Operating profit has compounded at over 112% per year, from over $135 million in 2017, to more than $5.8 billion in 2021. In the TTM period, operating profit was nearly $7.98 billion. Operating profit margin has grown from $4.5% in 2017 to 54.2% in 2021, rising to 58% in the TTM period. Operating profit margin for the shipping industry was 56% in 2021, compared to 3.7% in 2019. Net income has risen from $6.24 million in 2017, to $4.64 billion in 2021, a 5-year net income CAGR of more than 275%. In the TTM period, net income is $6.2 billion. Free cash flow (FCF) has grown from over $206 million in 2017 to $4.98 billion in 2021, for a 5-year FCF CAGR of over 89%. In the TTM period, FCF was over $6.6 billion. FCF margin has risen from 6.9% in 2017, to 46.4% in 2021, rising to 48% in the TTM period. Return on invested capital (ROIC) has grown from -1.4% in 2018 to over 67.5% in 2021, rising further to 193.8% in the TTM period.

The shipping industry conforms to Nicholas Kaldor’s cobweb model, in which the time lag between production decisions and price changes is very large, leading to boom and bust cycles because of under- and over-estimations of future demand. With no firm possessing true pricing power, capital expenditure follows the course of demand, rising during booms, until capacity exceeds demand, whereupon rates collapse until excess capacity is removed. Along the way, capital exits, with bankruptcies and consolidations, making industry profitability more sustainable. Therefore, to understand if ZIM can support its future profitability, we have to ask what the industry’s prospects are for the future.

Sustainable Industry-Wide Profitability

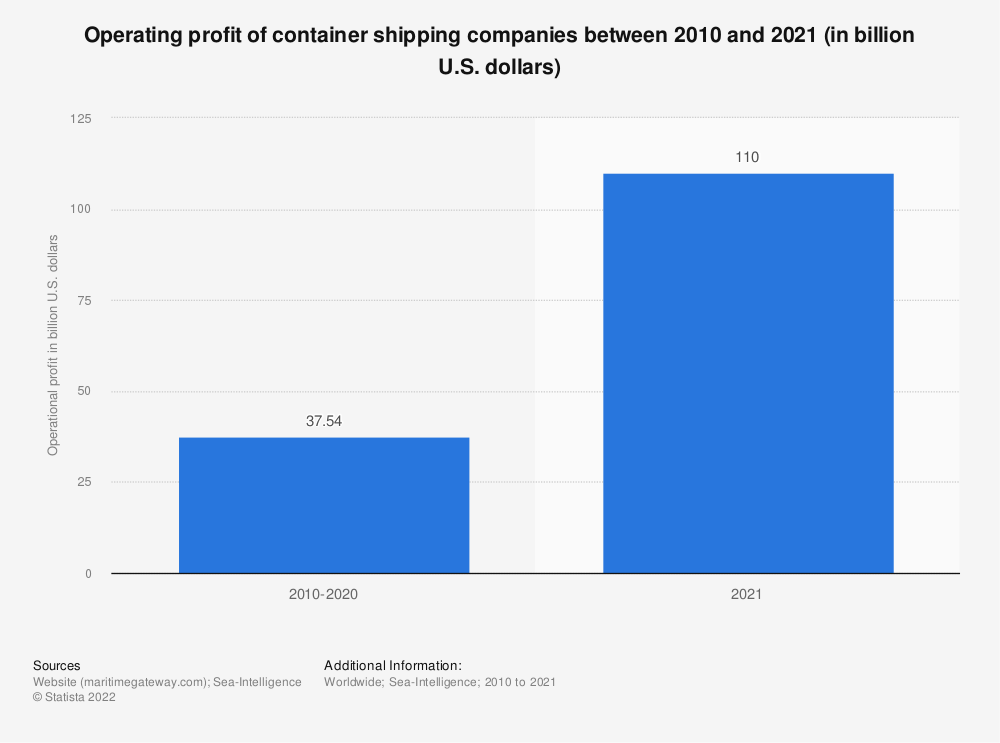

The shipping industry has never been so profitable, thanks to the surge in demand for shipping in the aftermath of the pandemic, and port congestion and a broader global supply chain disruption, forcing customers to sign-off on high priced contracts. In 2021, the global container shipping industry earned a record operating profit of around $110 billion, compared to $37.5 billion for the entire decade prior.

Source: 2021

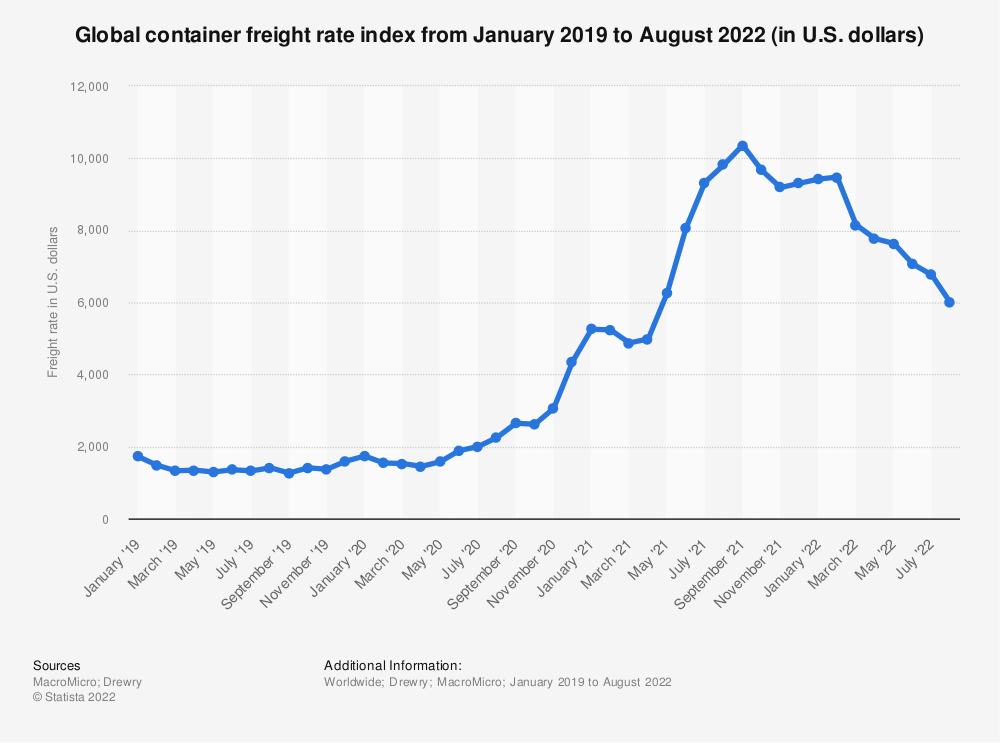

Freight rates have declined in recent months, as the U.S. and global economy starts to teeter on the brink of a recession. With global spot rates down, there is a large dose of pessimism about the sustainability of this profitability. Nevertheless, it must be said that freight rates remain at historically high levels.

Source: Statista

Rates will not return to those pandemic highs, but there are strong reasons to believe that future rates will be higher than pre-pandemic ones. Although pandemic restrictions have eased considerably, China maintains a zero-COVID policy, and although port congestions are expected to continue to ease throughout the rest of the year, the Russo-Ukrainian War and its impact on energy prices, is likely to drive up long-term prices for bunker fuel, keeping freight rates elevated.

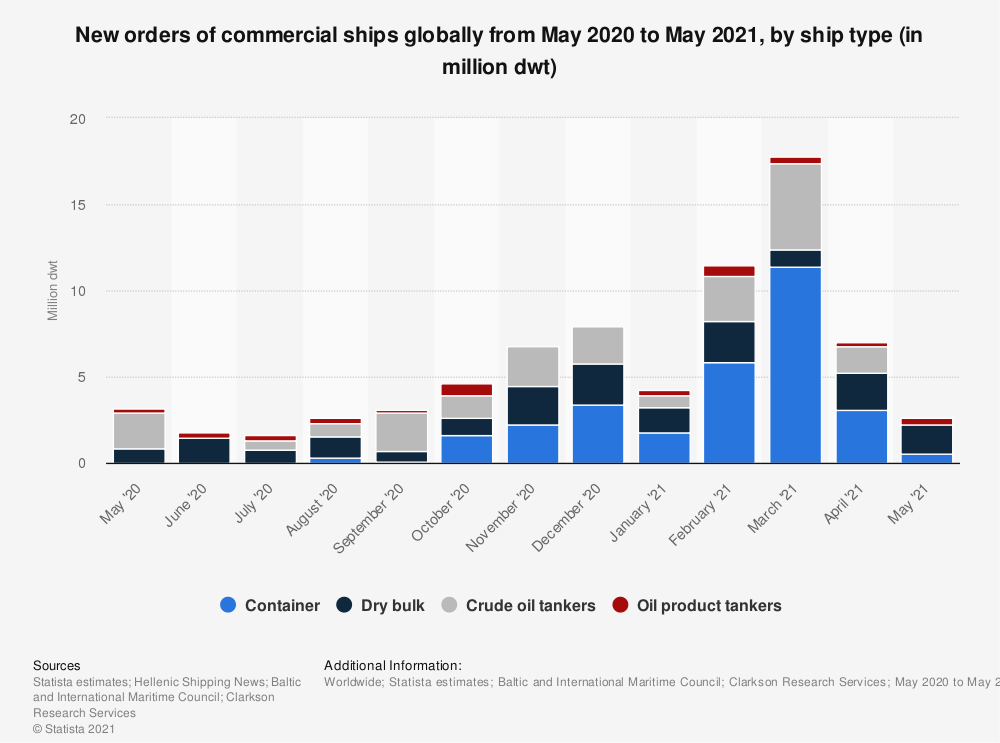

Although shipping companies have used their historic profitability to order new container ships, this is unlikely to expand the existing fleet in the near-term, given that it takes 18 months to build a ship, and may take longer to actually deliver them.

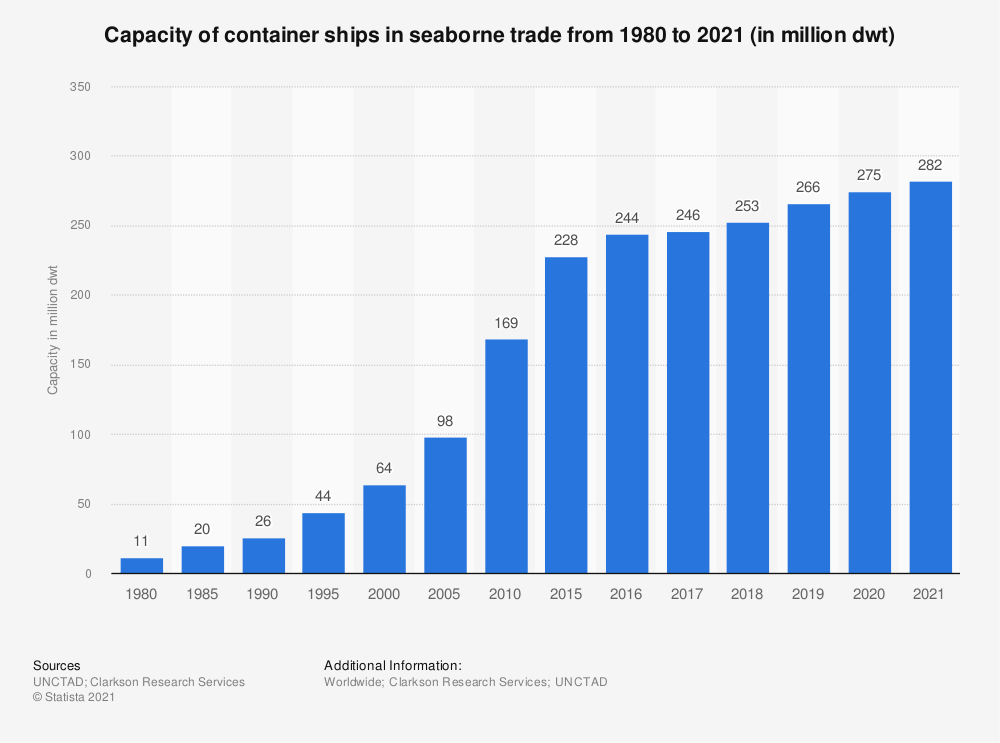

Source: Statista

It is impossible to know if the enlargement of the global fleet size will match the world’s needs, exceed them, or be too low for what the world needs. Consequently, generally, there is an inverse relationship between asset growth and future returns. Neither ZIM nor its peers should, at this moment, be seen as long term investments, but, the delay in actually delivering ships, and the continuance of the zero-COVID policy in China, and the Russo-Ukrainian War, and the possibility of a Sino-American War over Taiwan within the next half-decade, could keep rates elevated.

In recent years, the shipping industry has become more conservative about its capital allocation policies. For example, between 1980 and 2015, the capacity of container ships rose from 11 million dry weight tons (DWT) to 228 million dwt, growing at a CAGR of 8.79%. Between 2016 and 2021, growth had declined to 2.44% CAGR.

Source: Statista

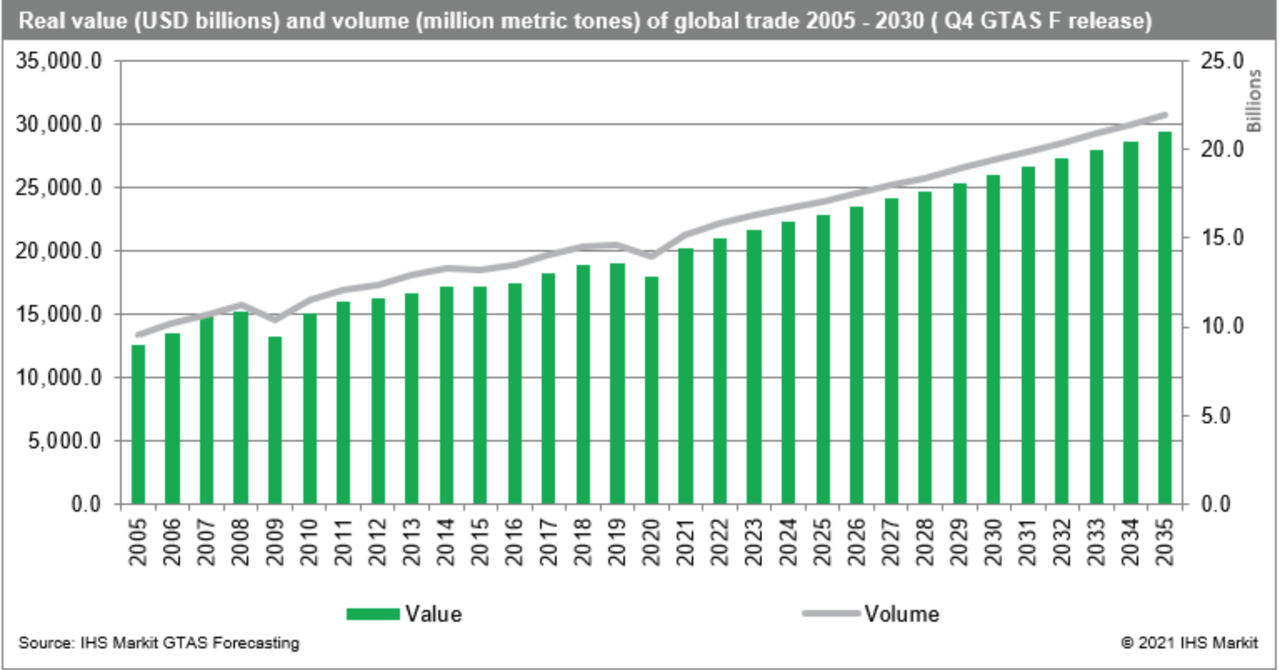

Increased capital discipline had allowed the shipping industry to become more profitable. Although there are questions about future growth and trade, for now, there is a consensus that it will continue to grow, with IHS Markit estimating that the real value of global trade will rise to $30 trillion by 2035, compared to $20 trillion in 2021, translating to an increase in volume from 12.8 billion metric tons in 2021, to 20 billion metric tons in 2035.

Source: IHM Markit

Valuation

With more than $6.6 billion in FCF for the TTM period and an enterprise value of $5.03 billion, ZIM has an FCF yield (FCF/enterprise value) of over 130%. Compare that with the FCF yield of the 2,000 largest firms listed in the United States, calculated at 1.5% by financial services firm, New Constructs, LLC. The company’s FCF yield points to exceptional future stock and company performance.

Conclusion

ZIM has beaten the market and the bulk of its peers, since listing on the NYSE last year. The company’s historic profitability is about more than the pandemic. Over the last 5 years, the company has improved its operating performance according to every metric, to become an immensely profitable business. Capital discipline in recent years has supported this profitability. In addition, although there are question marks about whether the industry will over, or under shoot demand with its capital expenditure, it will be several years before that new supply hits the market, and in that time, there are good reasons to believe that freight rates will remain elevated compared to pre-pandemic rates. With an FCF yield of more than 130%, there is more than ample margin of safety for an investor.

Be the first to comment