welcomeinside

Thesis

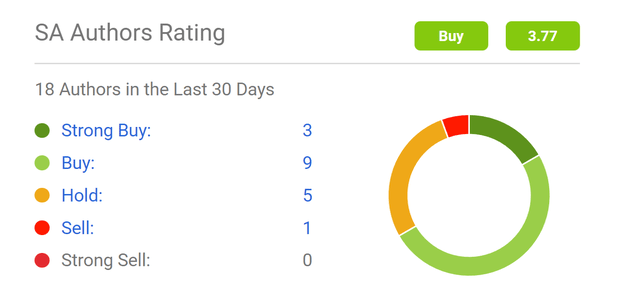

The prevailing sentiment on ZIM Integrated Shipping Services (NYSE:ZIM) is quite bullish, both within the Seeking Alpha community and also beyond. Take SA authors’ ratings as an example. As shown below, a total of 18 authors rated the stock in the past 30 days. And three of them rated the stock a “strong buy”, nine rated it a “buy”, five rated it a “hold”, only one rated it a sell, and no one rated it a “strong sell”. Beyond SA, leading institutions such as CFRA also rated the stock a “strong buy”.

The prevailing bullish thesis rests upon a few pillars: cheap valuation (0.62x PE), high current dividend (107%), and reasonable profitability ahead. And the goal of this article is to provide a contrarian view. You will see that, upon closer examination, each one of these pillars is questionable.

Freight rates have normalized dramatically already. The spot rates have nearly halved in the past three months, mainly driven by softened demand and decongestion of the global supply chain. I foresee such fundamental forces to continue and dramatically change the valuation and profitability scenario for ZIM in the near future. Considering the possibility of a sharp decline in profitability, my estimate of its PE is in the ~15x range in the year or so, not cheap at all given the risks.

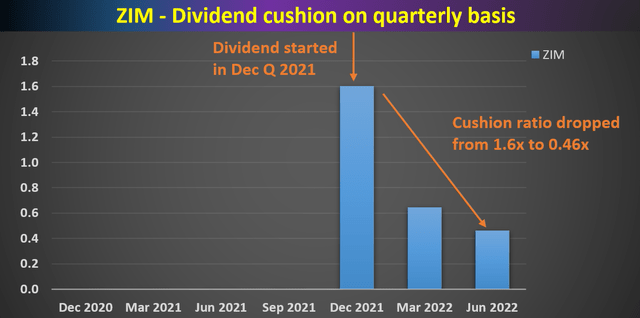

As for the dividend, no rational investor would expect it to sustain. It is just the cut may come sooner than many bulls expected. It could come as soon as in 3 to 6 months. Its current dividend cushion ratio is 0.46x on a quarterly basis, signaling that it will have to cut dividends even if profitability suffers a hiccup in one single quarter, as to be elaborated next.

Profit and ocean spot rates

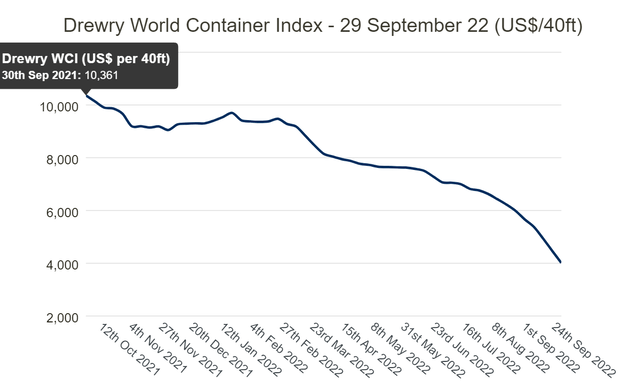

First, let’s take a look at the rise of the ZIM bull thesis. ZIM profitability soared together with the global shipping rates in the past one or two years. As seen from the following chart based on Drewry’s data, the spot price for shipping containers peaked above $10k in September 2021. To put things into perspective, the 5-year average shipping index is about $3,700.

The shipping cost has gone down dramatically since its peak about a year ago. It has dropped to about $7,600 in the June quarter of 2022, a decline of more than 25%. The decline continued in the past quarter, and the current ocean spot rates (about $4,000) have more than halved compared to their peak value. Such renormalization is only inevitable in my view, and it has been mainly driven by softened demand and continued cleanup of the supply chain congestion. Just in the past week, the composite index decreased by another 10%, which marked the 31st consecutive weekly decrease, and has dropped by 61% when compared with the same week last year.

Going forward, I see the shipping rates renormalization continuing. In the case of a global recession, such renormalization would come more quickly and would hurt shipping companies like ZIM more deeply. And as a result, I see very gloomy prospects for ZIM’s profitability, valuation, and dividend safety, as detailed next.

Valuation renormalization

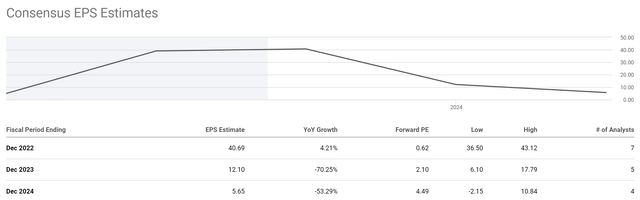

Of course, the market is already expecting profit decline and valuation renormalization as you can see from the chart below. Based on the consensus EPS estimates for 2022, its PE is only 0.62x. And the FW PE rises quickly to 2.1x based on 2023 consensus estimates and further to 4.5x based on 2025 consensus.

My view is that the EPS decline can happen more quickly than the above consensus estimates and happen more deeply. My opinion is that ZIM is more vulnerable than other carriers and would respond more sensitively to shipping rates decline for at least two reasons: A) its fleet is predominantly chartered, and B) it has a lower percentage of contractual volumes.

As aforementioned, the current shipping rates (about $4000) are still higher than the pre-pandemic levels and also the 5-year average. As such, I anticipate the shipping rates will continue to fall. As such, I see a large possibility of a significant drop in Q3 and/or Q4 earnings, a drop larger than the consensus guidance. To wit, I anticipate ZIM’s realized average rate to drop by more than 50% in the next year, leading to an EPS around $1.60 in 2023, far worse than the $6.10 to $17.79 range quoted in the above consensus estimates. Such an EPS would mean an FY1 PE around 15x, not cheap at all for a business like ZIM.

Next, we will see that its financial picture is even more concerning when examined holistically.

Overall financial picture and dividend

No rational investor would expect the 107% dividend yield to last. The question is not whether it will be cut or not, but when. And many investors are probably just hoping to receive a few (or even just one) such outsized dividends, and then exit the position before the cuts. But in my view, the cut may come sooner than many bulls expected as indicated in its dividend cushion ratio of 0.46x as shown in the chart below.

ZIM started paying a quarterly dividend in December 2021 as seen. And it has paid out a total of $7.60 per share during the first half of 2022 earnings. On the surface, such a generous dividend is well-covered considering its 2021 EPS of $39. However, when its finances are holistically considered by the dividend cushion ratio. The concept is detailed in my earlier article, and it considered ZIM’s current cash position, leverage, CAPEX requirements, and dividend obligation holistically. The results are shown below, and the picture is very concerning to me.

A cushion ratio of 1.0x is considered a threshold for a safe dividend. As you can see, ZIM’s cushion ratio has been in sharp decline since it started paying a dividend in December 2021. Its cushion ratio was 1.6x (when its December quarterly payment is annualized). And it declined to the current level of 0.46x after two quarters of payments only, less than half of the 1.0x threshold. Since the results here are on a quarterly basis, approximately, a cushion of 0.46x means ZIM would have to cut dividends if any financial hiccups occur in the next quarter or so, which is all too likely based on the shipping rates and shipping demand as analyzed above.

Author based on Seeking Alpha data

Other risks and final thoughts

Besides the above risks, there are a few other risks worth mentioning, both downside and upside risks. Other downside risks include government interference in freight rates, for example, due to escalation of geopolitical conflicts or trade wars. Compliance and execution of its existing contracts could be in jeopardy too if such geopolitical risks escalate or a recession occurs. The most likely upside risk to the contrarian thesis here is that port congestion persists longer than expected.

To conclude, the prevailing bullish thesis on ZIM is largely anchored on its current cheap valuation (0.62x PE), high current dividend (107%), and an assumption of reasonable profitability ahead. In my view, all these pillars are shaking given the recent normalizing of the shipping rates and the weakened demand. My estimate of its PE is in the ~15x range in a year or so, not cheap at all for a business like ZIM. A dividend cut may come sooner and deeper than many bulls expected as signaled in its current dividend cushion ratio of only 0.46x. As a matter of fact, my estimates for its dividend payout would be only about $1 per share in order to maintain a cushion of 1x under its current conditions. Such a payout would translate to a dividend yield of ~4% on its current price.

Editor’s Note: This article was submitted as part of Seeking Alpha’s best contrarian investment competition which runs through October 10. With cash prizes and a chance to chat with the CEO, this competition – open to all contributors – is not one you want to miss. Click here to find out more and submit your article today!

Be the first to comment