shaunl

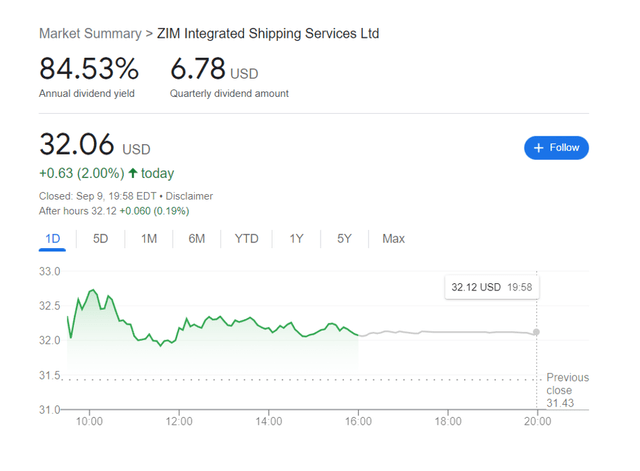

Many people in the shipping industry are wondering whether the dividend yield of 85% from ZIM Integrated Shipping Services Ltd. (NYSE:NYSE:ZIM) is too good to be true, or if the shipping company can sustain its massive pay-out to shareholders.

I believe it can, and I purchased ZIM Integrated Shipping stock last week for three reasons: strong free cash flow that covered the company’s pay-out, dividend potential, and the stock’s ultra-low valuation.

ZIM Integrated Shipping Has A Huge Pay-Out

At a current stock price of $32.06 per share, ZIM Integrated Shipping offers investors an eye-popping 85% annual dividend yield. However, the yield is estimated and will ultimately be determined by the shipping company’s actual earnings performance.

ZIM Share Price (ZIM Integrated Shipping Services)

A Globally Oriented Shipping Company

ZIM Integrated Shipping is an Israel-based shipping company that operates 149 vessels that transport its customers’ goods to various ports around the world. The shipping company is worth $3.8 billion and has very little debt on its balance sheet.

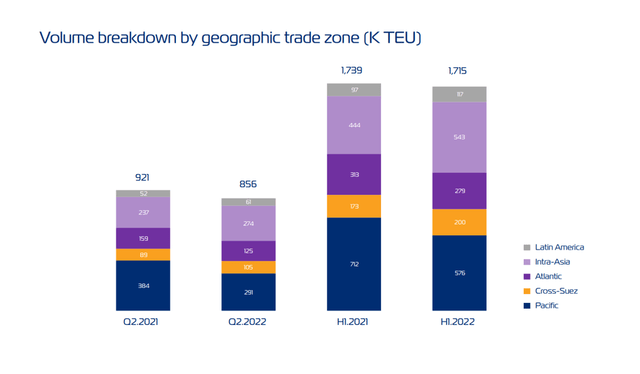

ZIM Integrated Shipping adheres to a global niche strategy and serves customers on critical trade routes all over the world. Importantly, the majority of ZIM’s traffic occurs in the Asia and Pacific regions, which account for approximately 65% of the company’s shipped container volume.

Volume Breakdown By Geographic Trade Zone (ZIM Integrated Shipping Services)

Very Low Net Debt

ZIM Integrated Shipping has a strong balance sheet. As of June 30, 2022, the company’s net debt was $630 million, representing a net leverage ratio of just 0.1x.

Is ZIM Integrated Shipping’s 85% Dividend Yield Crazy?

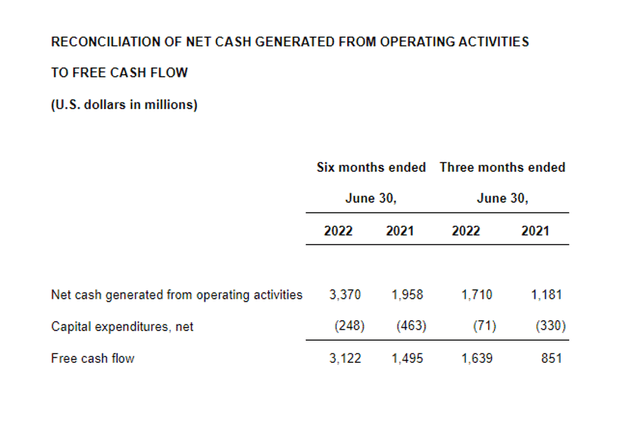

The fact that ZIM Integrated Shipping covers its dividend with free cash flow is probably the most important takeaway from the company’s second-quarter earnings release.

In the second quarter, the shipping company generated $1.6 billion in free cash flow from vessel operations, and $3.1 billion year to date. ZIM’s free cash flow has been primarily boosted by a rebound in freight rates, which increased 54% YoY to $3,596/TEU.

Free Cash Flow (ZIM Integrated Shipping Services)

The company paid $2.4 billion in dividends and $627 million in debt service out of $3.1 billion in free cash flow in 2022, for a free cash flow pay-out ratio of 76%.

ZIM Integrated Shipping’s 85% dividend yield is not as outrageous as it appears because the shipping company had very little debt on its balance sheet as of June 30, 2022 and the free cash flow pay-out ratio was significantly less than 100%.

Don’t Worry About The Dividend

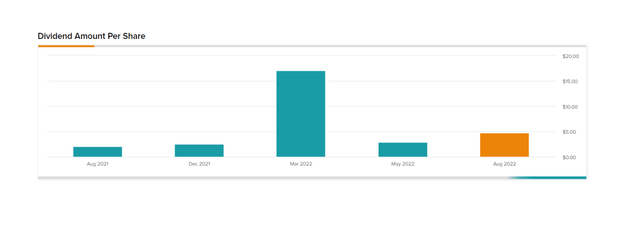

In the previous year, ZIM Integrated Shipping paid a wildly fluctuating dividend. The most recent dividend paid to shareholders was $4.75 per share on September 8, 2022.

ZIM Integrated Shipping has paid dividends totaling $27.10 per share over the last twelve months. The shipping company intends to distribute up to 50% of its annual net income and up to 30% of its quarterly net income. This means that the shipping company’s dividend payments will be highly volatile in the future, based primarily on the company’s operating performance.

If the performance is excellent, the dividend will be excellent, otherwise, ZIM Integrated Shipping shareholders will have to accept a lower total dividend pay-out than in the previous twelve months.

Dividend Per Share (ZIM Integrated Shipping Services)

ZIM Integrated Shipping Is Cheap

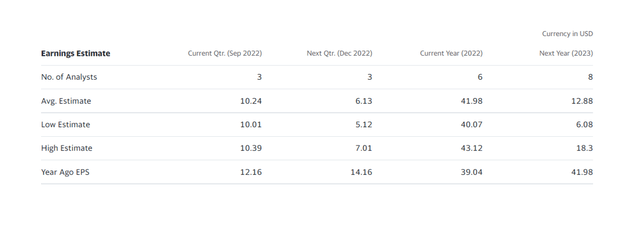

The market anticipates earnings of $12.88 per share on average for the coming year, translating to a P/E ratio of 2.5x. Even if earnings fell 50% next year due to weaker shipping conditions, ZIM Integrated Shipping’s stock would still trade at a P/E ratio of 5x.

I believe the margin of safety is extremely wide here, implying that ZIM Integrated Shipping’s stock is fundamentally undervalued.

Earnings Estimate (ZIM Integrated Shipping Services)

Why ZIM Integrated Shipping Could See A Lower Valuation

The shipping industry’s conditions will determine whether or not ZIM Integrated Shipping’s valuation falls. The company recently increased its pay-out ratio from 20% to 30% of quarterly net income, demonstrating its confidence in its long-term earnings potential.

A global recession, on the other hand, may result in an even larger drop in earnings and a corresponding drop in net income next year (dividends).

My Conclusion

ZIM Integrated Shipping’s 85% dividend yield appears absurd at first glance, but the shipping company actually covered its dividend pay-out with free cash flow in the first six months of the year.

After the pandemic, ZIM Integrated Shipping’s earnings recovered significantly, fueling the company’s free cash flow growth.

ZIM Integrated Shipping’s stock is very appealing for income investors to own because it covers its dividend with free cash flow, has no debt on its balance sheet to service, and its earnings have gained momentum in the last two years.

Be the first to comment