narvikk

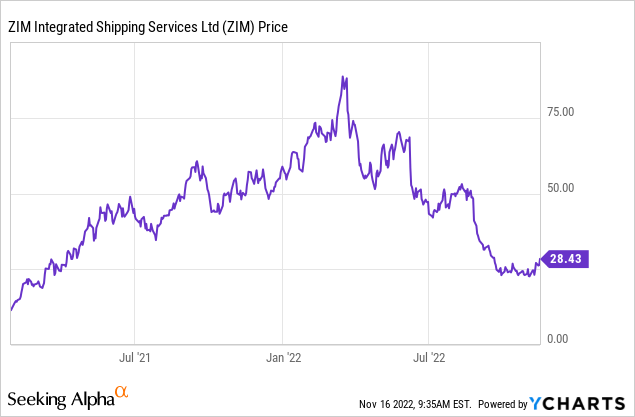

ZIM Integrated Shipping (NYSE:ZIM) is an international shipping company, which was founded way back in 1945, but unlike many companies founded so long ago, ZIM has continued to innovate and stay on top of its game. In 2021, the company had its IPO on the New York Stock Exchange, which was the opportune time as shipping rates exploded thanks to the pent-up demand, driven by the reopening of the global economy. This caused ZIM’s share price to skyrocket by ~600% to its all-time highs in March 2022, taking investors on a tremendous voyage. However, since that point the company’s stock price has gone “titanic” and plunged by 66%, as shipping rates have normalized across the world, and the world economy has slowed down considerably. The good news is ZIM Integrated Shipping has still continued to generate solid financial results and recently beat both revenue and earning expectations for the third quarter. However, management has slashed its guidance downwards due to the falling shipping rates. In this post I’m going to breakdown the recent financials and see if ZIM Integrated shipping is still worth staying on board for, let’s set sail.

Solid Third Quarter Earnings

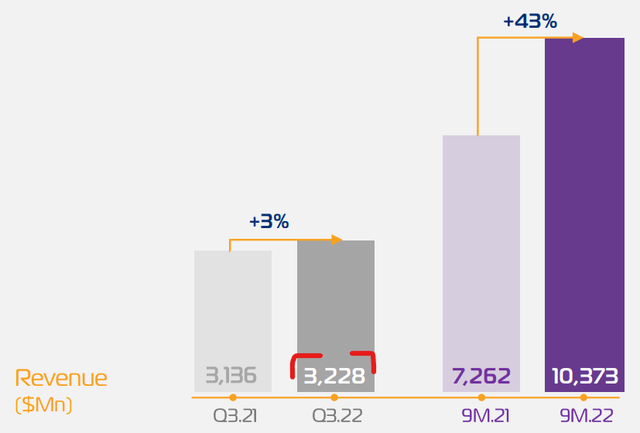

Zim Integrated Shipping generated solid financial results for the third quarter of 2022. Revenue was $3.2 billion which beat analyst expectations by a sliver at 2.21% over the expected $3.16 billion (Google finance data). However, this only increased by 3% year over year which isn’t exactly great. A silver lining is trailing 9-month revenue did increase by 43% year over year to $10.4 billion. However, we know that has mainly been driven by the high shipping costs which are now falling rapidly, as the world economy slows (more on that later).

Revenue (Q3,22 Report)

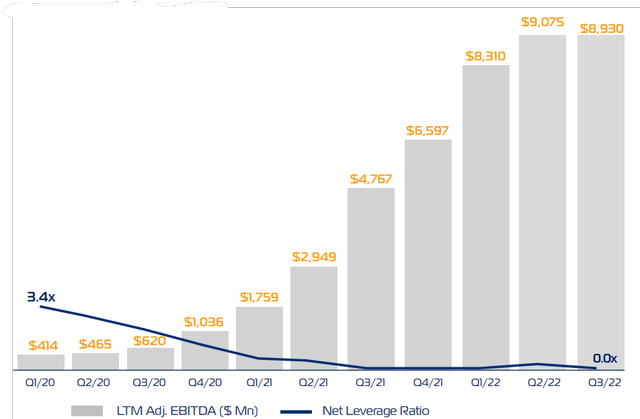

The good news is the company is in a much stronger position, as it prudently used the excess cash flow generated previously to reduce its net leverage ratio from 3.4x in 2020 to close to zero by Q3,22.

ZIM Earnings (Q3,22)

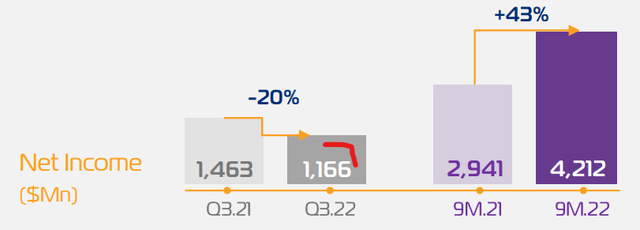

The company reported earnings per share of $9.66 which beat analyst expectations by $9.39 or 2.83% which is a positive. The bad news is Net income has continued to fall and was down 20% year over year with $1.166 reported as shipping rates corrected. Similar to the revenue trend mentioned prior, on a trailing 9-month basis, earnings are still up 43% year over year with $4.2 billion reported.

Net Income (Q3,22)

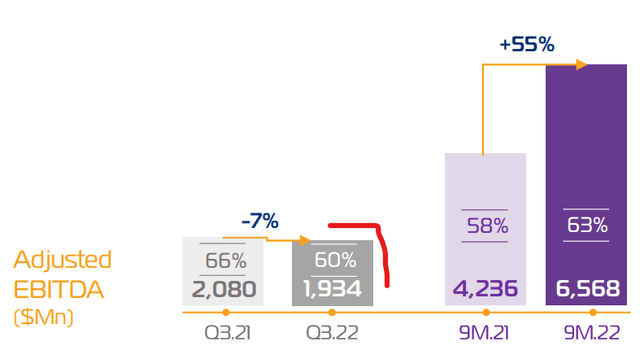

Adjusted EBITDA reported a similar pattern to the prior metrics, which a negative 7% decline year over year to $1.934 billion. However, on a trailing 9 month basis Adjusted EBITDA has increased by 55% year over year to $6.6 billion.

Adjusted EBITDA (Q3,22)

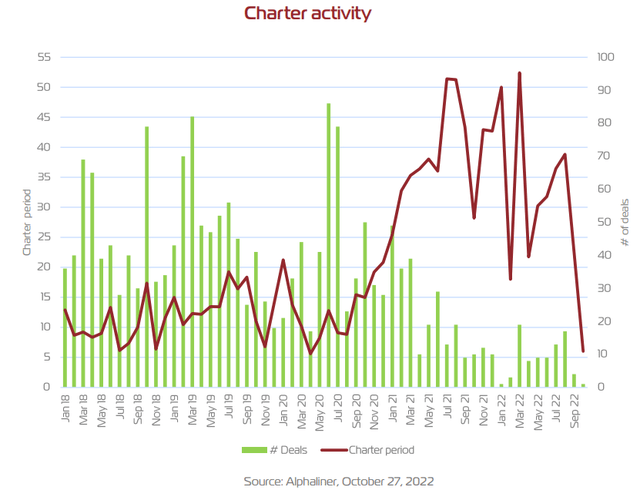

ZIM operates using a “charted capacity” model, which gives them greater flexibility than most shipping companies as it can take advantage of high spot rates, as it did during 2021. However, from the chart below we can see Charter activity has fallen sharply as the number of details has plummeted.

Chart Activity Rates (Alphaliner)

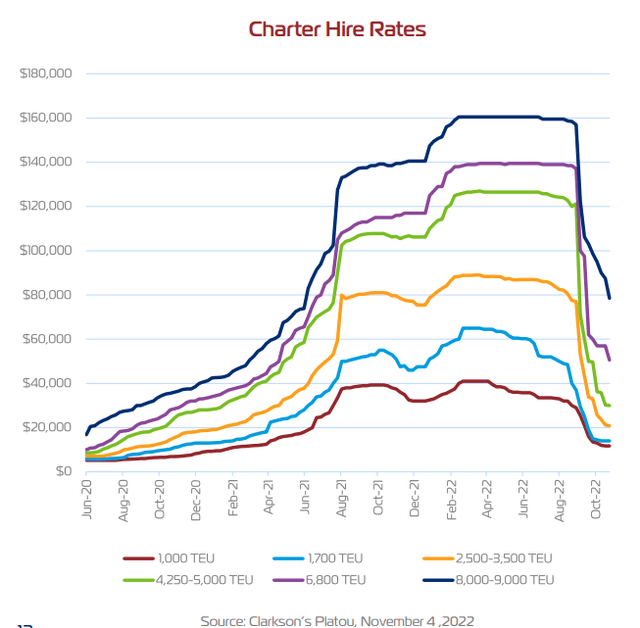

The economic slowdown has caused a slowdown in the number of goods moving by the ocean and a steep decline in Charter rates. For example, the cost to ship 1,000 TEU (containers) was ~$40,000 in early 2021 and 2022, this has now fallen by more than half to ~$16,000, as shown by the red line on the chart below.

Charter Rates Falling (Clarkson Platou)

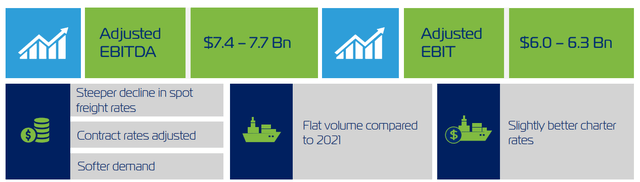

I forecasted this decline in rates in past posts, however the extent of the declines has taken management by surprise and caused them to revise down guidance for the full year of 2022. ZIM Integrated Shipping now expects Adjusted EBITDA in a range between $7.4 billion and $7.7 billion. This is significantly lower than the prior range guided for between $7.8 billion and $8.2 billion. Adjusted EBIT is has had a similar guidance adjustment with a range between $6 billion and $6.3 billion expected. This is down from $6.3 billion and the $6.7 billion forecasted.

ZIM Integrated Shipping Revised Guidance (Q3,22 report)

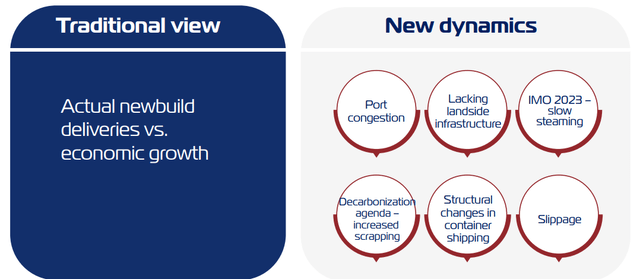

On the below image, you can see the “Traditional View” of the industry was simply “actual” new build deliveries relative to economic growth. However, now the dynamics is alot more complex as its not just about the number of ships but “effective shipping”.

Industry Dynamics (Q3,22 report)

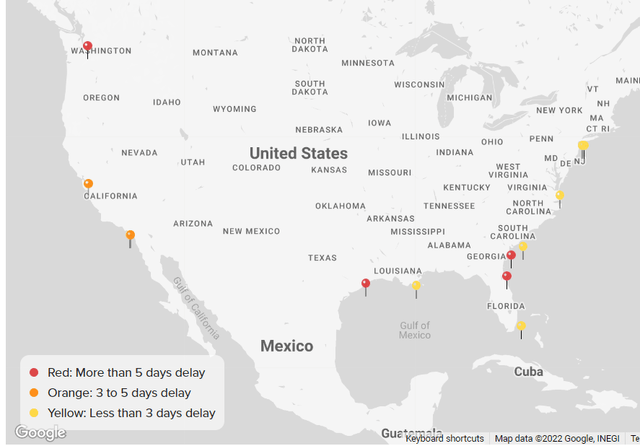

During the peak shipping rates of 2021, there were plenty of ships, but not enough “effective shipping” as the ports were clogged, according to a study by McKinsey. In previous posts on ZIM, a couple of months back I highlighted that the U.S still had high congestion at its ports with wait times of over 5 days. However, from the real-time port congestion map below you can see that the majority of U.S ports now have less than 3 days of delay. This is a positive for the global supply chains but maybe not so much for shipping companies that want to charge higher rates.

Real Time Port Congestion (gocomet author screenshot)

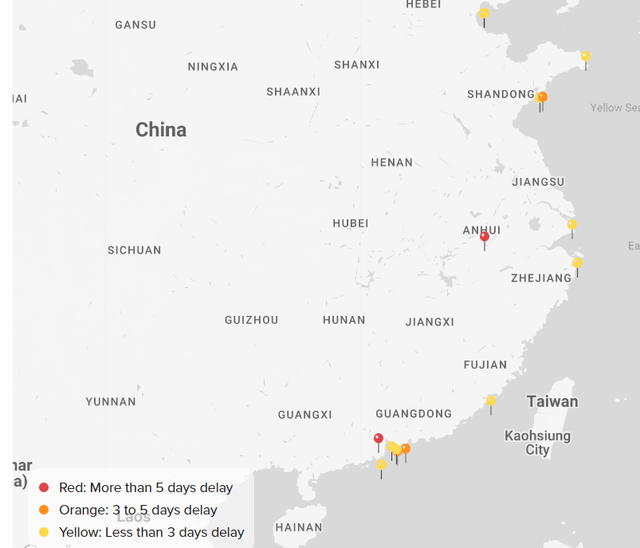

The situation in China has also begun to improve, as the majority of ports have a delay of less than 3 days. This is a stark improvement over a few months back when many ports had delays of over 5 days.

China Port Congestion (Gocomet)

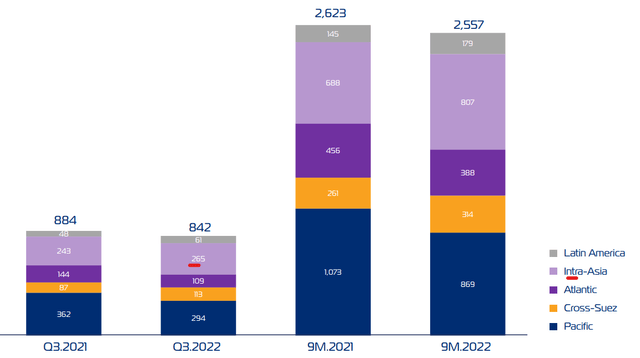

The graph below shows how ZIM Integrated shipping has reported an increase in its Intra Asia trade (pink box) as a portion of total volume in Q3,22. In the third quarter of 2021, Intra-Asia trade made up ~27% of total volume or 243 KTEU. However, by the third quarter of 2022, this percentage has risen to 31%, as total volume shipped has fallen.

ZIM Shipping Volume (Q3 report)

A tailwind for ZIM Integrated shipping could be its move toward becoming the “greenest” shipping company in the world. The company has 46 newbuild vessels coming online in 2023 and 2024, the majority (28) being powered by Liquified Natural Gas [LNG]. This will improve the fuel efficiency of the business and improve its environmental credentials, as LNG creates 20% less greenhouse gas emissions than traditional marine fuels. Therefore this move to LNG could cause ESG funds to increase inflows into the stock.

The company has even secured its LNG supply over the next 10 years, in a landmark deal with Shell. This may not seem like a big deal but given the Russia-Ukraine crisis and energy security fears in Europe the need to secure supplies of LNG is becoming vital and could be a competitive advantage.

ZIM Integrated Shipping has also scored a huge operational partnership with the two largest shipping companies in the world, Maersk Line and MSC via the 2M partners Alliance. This means if shipping volume starts to pick up again, as the economy improves then ZIM Integrated Shipping will be poised to increase its capacity more easily than most.

Moving forward the company will continue to focus on being a “global niche” carrier and diversify its presence across emerging markets. In addition, management will focus on two new “growth engines” such as increasing car carrier capacity for Asia exports and digital freight forwarding.

ZIM Integrated Shipping has a robust balance sheet with $4.44 billion in cash, cash equivalents and short-term investments. In addition, the company has net debt of just $250 million, as I mentioned its leverage ratio has declined.

Epic 30% Dividend

ZIM pays an epic dividend that aims to pay out between 30% and 50% of its net income to investors. In the third quarter, the company paid out $2.95 per share or $354 million which equates to ~30% of net income.

Valuation?

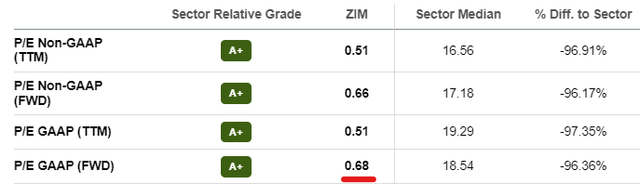

Valuing ZIM is fairly challenging as future shipping rates are challenging to forecast as is demand. However, we do know ZIM is trading at a very cheap forward P/E ratio of just 0.68, which is cheaper than historical levels, which range between a PE = 1.7 and 2.1.

ZIM Integrated Shipping Valuation (Seeking Alpha data)

ZIM stock also trades at a cheaper P/E ratio than industry peers such as Navios Maritime Partners L.P. (NMM) which trades at a P/E (forward) Ratio = 1.4 and Golden Ocean Group (GOGL) which trades at a P/E (forward) Ratio = 3.8, at the time of writing.

Risks

Recession/Shipping Volume Slowdown

The high inflation and rising interest rate environment is squeezing both businesses and consumers. Traditional economics states that higher costs generally reduce demand for products, which could be why we are seeing lower shipping volumes globally. Citigroup even downgraded ZIM Integrated Shipping to a neutral or high-risk investment due to these macroeconomic reasons. However, a silver lining is that the Citigroup analyst has a price target of $51.50 per share which is significantly higher, than the $27 per share price at the time of writing,

Dividend Withholding Tax

As ZIM is an Israel-based company it has a “withholding tax” on dividends paid to shareholders. The rate is between 25% and 30%, but investors may be eligible for a “reduced Israeli withholding tax rate” subject to a variety of conditions based on tax treaties etc. If you want to learn more about this you can check out the company’s press release and I suggest seeking independent tax advice for details.

Final Thoughts

ZIM Integrated Shipping has taken investors on an epic voyage with great returns of over 118% since its IPO in 2021 (even with the correction). The company continued to produce strong results in the third quarter of 2022 and its LNG fleet should improve efficiencies and margins longer term. The stock is still undervalued but given management’s guidance cut and the uncertainty of shipping rates, the stock is speculative at this time. I will therefore label it as a “Hold” for investors, the company is exceptional but I would expect volatility until the global economy begins to recover.

Be the first to comment