shaunl

ZIM Integrated Shipping Services Ltd. (NYSE:ZIM) stock price plunged by 64% in the last six months. In 2021, due to the port congestions and increased demand, freight rates jumped. However, in 2022, due to increased interest rates, inflation, and global recession, the demand for container vessels dropped, making freight rates decrease to their levels two years ago. As long as there is no sign of economic recovery, freight rates will not experience a significant increase. However, even with current rates, ZIM can stay profitable. The stock is a hold.

Quarterly highlights

In its 2Q 2022 financial result, ZIM reported a net income of $1.34 billion, compared to 0.88 billion in the second quarter of 2021, up 50%. The company’s net income per diluted share increased from $7.38 in 2Q 2021 to $11.07 in 2Q 2022. ZIM reported revenues of $3.42 billion, compared with 2Q 2021 revenues of $2.38 billion, up 44%. In the second quarter of 2022, ZIM’s adjusted EBITDA and adjusted EBITDA margin increased to $2.10 billion (up 57% YoY) and 61% (up 500 bps YoY), respectively. ZIM’s net leverage ratio of 0.0x on 31 December 2021, increased to 0.1x on 30 June 2022.

“We reported today strong Q2 results, including net profit of $1.34 billion, as well as our best ever first half-year results with standout margins, among the highest of our liner peers,” the CEO commented. “During this period, we maintained our strong execution, agility, and commitment to profitable growth as we continue to advance ZIM’s position as an innovative digital leader of seaborne transportation,” he continued. Due to its strong performance and high contract rates, ZIM reaffirmed its 2022 full-year guidance: adjusted EBITDA of $7.8 to $8.2 billion and adjusted EBIT of $6.3 to $6.7 billion.

The market outlook

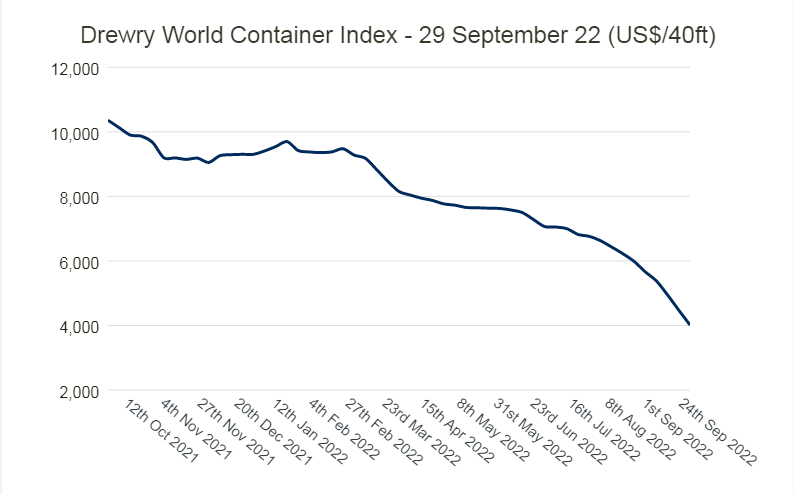

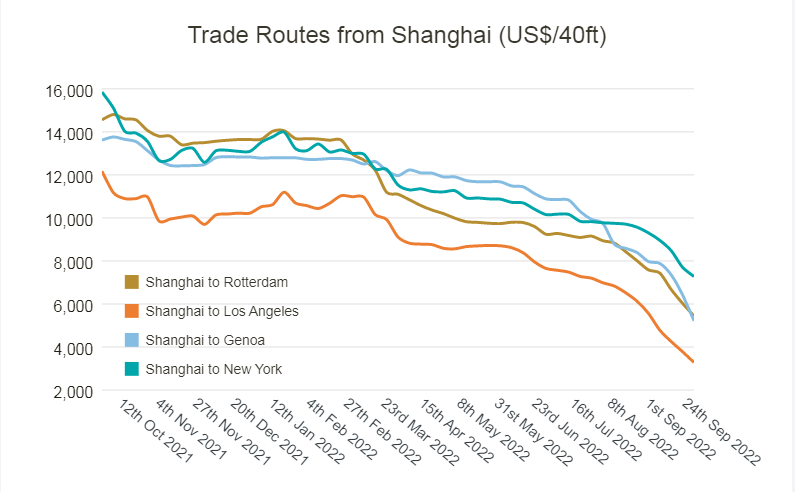

In 2021, due to port congestion and increased demand, container freight rates jumped. The opposite has happened in 2022. Figure 1 shows that from 30 September 2021 to 29 September 2022, Drewry World Container Index dropped from $10361/40ft to $4014/40ft. Drewry’s composite World Container Index decreased by 10% to $4,014/40ft container in the week ending 29 September 2022. Figure 2 shows that freight rates across trade routes from Shanghai plunged during the past few weeks as a slump in consumer demand caused the export level to decline. Now, freight rates across trade routes from Shanghai are below their levels two years ago. Due to the high inflations in the United States and European countries, increased interest rates in the U.S. and Eurozone, trade disruptions caused by the war in Ukraine, and the appreciation of the U.S. dollar against the Yuan, the level of Chinese export is not expected to increase in the near-term. Thus, I do not expect freight rates to increase across trade routes from Shanghai.

Figure 1 – Drewry World Container Index

www.drewry.co.uk

Figure 2 – Freight rates across trade routes from Shanghai

www.drewry.co.uk

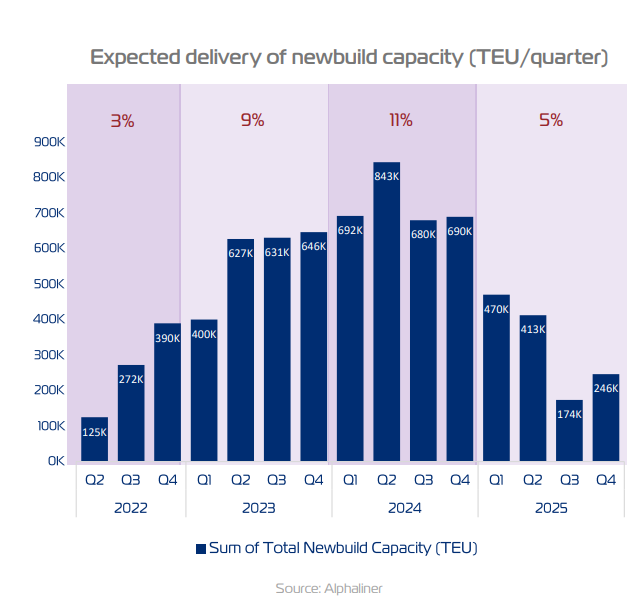

However, with lower interest rates, lower inflation rates, and a slight economic recovery, container freight rates will increase again. The global capacity of the container market is expected to increase by 3% and 9% in 2022 and 2023, respectively (see figure 3). On the other hand, due to lacking landside infrastructure, and IMO 2023 environmental regulations, higher capacity cannot make freight rates decrease. Moreover, with new environmental regulations, ZIM’s competitiveness among global liners will improve.

Recently, ZIM announced the signing of a ten-year marine LNG sales and purchase agreement, valued at more than one billion US Dollars, with Shell. The company entered into this agreement to supply ten 15,000 TEU LNG-fueled vessels, which are expected to enter into service during 2023-2024 and will be transporting goods from China and South Korea to US East Coast and the Caribbean. “With the addition of significant LNG-powered capacity to our fleet, beginning in 2023, we have positioned ZIM as a leader in carbon intensity reduction among global liners,” the CEO stated.

Figure 3 – Quarterly expected delivery of newbuild capacity

2Q 2022 presentation

ZIM Integrated performance outlook

In this detailed analysis, I have done some investigations into ZIM Integrated’s profitability ratios to evaluate the company’s ability to bring profit and utilize its assets to generate profit for its shareholders. To cater beneficial insights into the financial well-being of the ZIM company, I have analyzed the profitability ratios across the board of margin ratios and return ratios. To be more useful, I have calculated the ratios compared to previous periods.

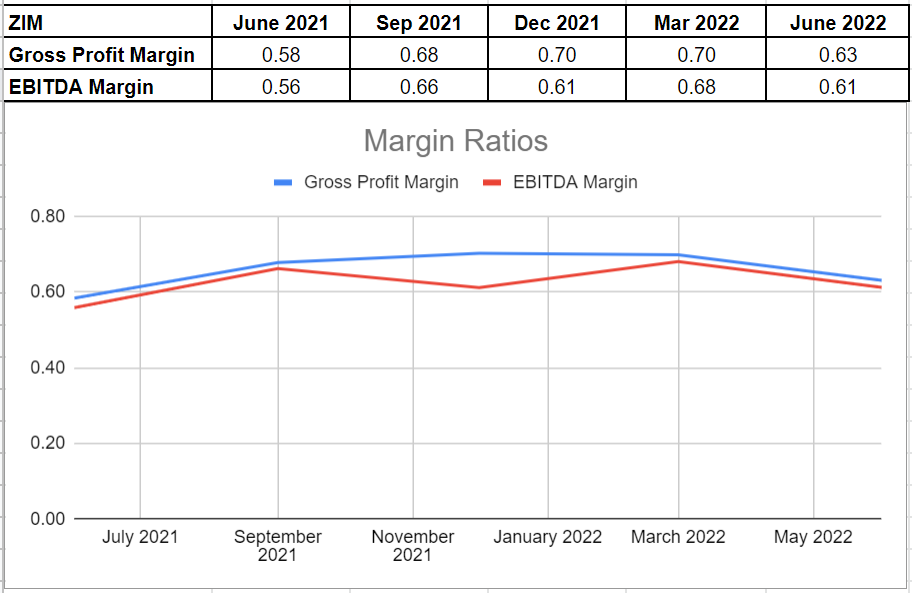

Overall, margin ratios capture the capability of the company to convert sales into profits in a variety of measurements. Albeit ZIM’s gross profit margin decreased slightly to 0.63 in 2Q2022 versus its level of 0.7 in the first quarter of 2022, its ratio improved slightly year-over-year compared with its level of 0.58 at the same time in 2021. Furthermore, there is a witness that ZIM’s EBITDA margin passed an increasing path from 2Q2022 to the end of the first quarter of 2022, which was from 0.56 to 0.68 in the 1Q2022. However, in the previous quarter, the ratio declined and sat at 0.61, 10% down. The benefit of investigating the EBITDA margin is that it excludes volatile expenses and thus represents a clear picture of the company’s performance. In short, notwithstanding the decrease in the second quarter compared with the first quarter of 2022, ZIM Integrated’s margin ratios have improved year-over-year compared with the same time in 2021 (see Figure 4).

Figure 4 – ZIM’s margin ratios

Author (based on SA data)

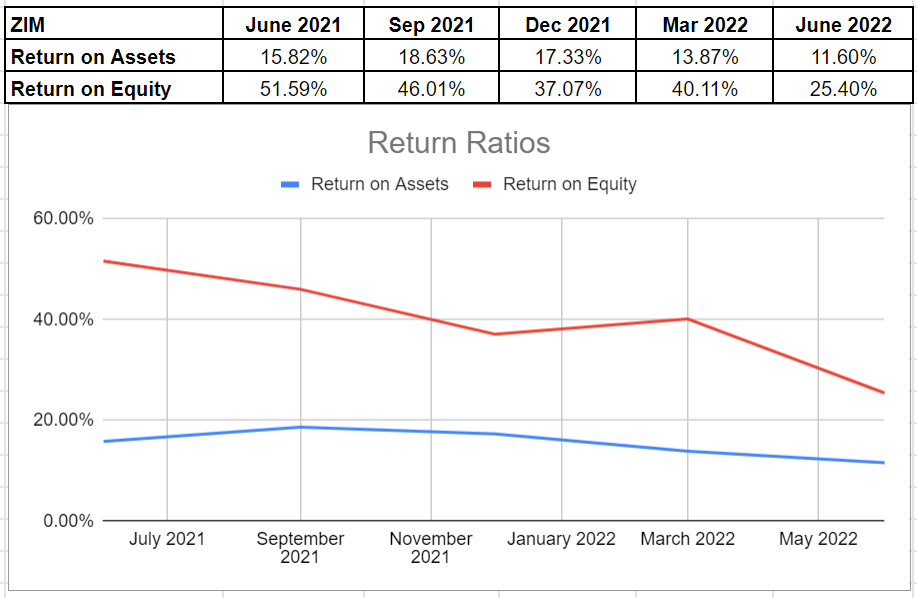

To represent ZIM’s ability to cater returns to its shareholders, I have investigated its return on assets and return on equity. Referring to the CFI explanation, the ROA ratio reflects how much profit a company is able to generate for every dollar of its assets. ZIM Integrated’s ROA ratio has decreased since 2022 and sat at around 12% in the second quarter of 2022. Also, its return on equity declined by 1471 bps to 25.4% at the end of 2Q22 compared with its previous level of 40% in 1Q2022. This ratio indicates the net income of the company, which is relative to the shareholders’ equity. The return on equity ratio is useful as it measures the rate of return on the money that has been invested into the company. Thus, decreasing return ratios of ZIM Integrated company may reflect the company’s dependency on debt financing (see Figure 5). Ultimately, when all is said and done, according to the preceding remarks, considering the company’s profitability performance, and softening global supply and demand, I believe that ZIM stock is a Hold.

Figure 5 – ZIM’s return ratios

Author (based on SA data)

Summary

According to Seeking Alpha ratings (Wall Street price target), ZIM stock has a low price target of $22, an average price target of $46, and a high price target of $80. I do not expect container freight rates to increase significantly in the near term. Thus, ZIM stock is a hold. However, it is worth noting that even with the current freight rates, which are close to their levels two years ago, ZIM can stay profitable. As interest rates start to decrease and export levels from China recover, the stock will turn into an opportunistic investment.

Be the first to comment