bfk92/E+ via Getty Images

ZIM Integrated Shipping Services Ltd. (NYSE:ZIM) has faced choppy trading in recent weeks, and this week in particular, amidst a worsening macroeconomic situation and broader market swings. It is beginning to look like the container shipping boom is winding down. However, the music has not yet stopped playing for ZIM, and the market is acting as if it has. The company is selling for roughly its cash value at the end of the year, and we can still expect a 20-30% yield.

Fundamentals Stay Strong

ZIM’s first quarter earnings were strong. Well, strong may be a bit of an understatement. They completely knocked it out of the park. The company reported $14.19 in earnings per share on a diluted basis, more than $1.7 billion in profit on revenues of $3.7 billion – not bad margins if you ask me. The company also still has a leverage ratio of – wait no, they don’t have a leverage ratio because they have functionally no leverage. However, the company does have $2.7 billion in cash and a total of $6.4 billion in current assets.

Fleet Growth Ahead?

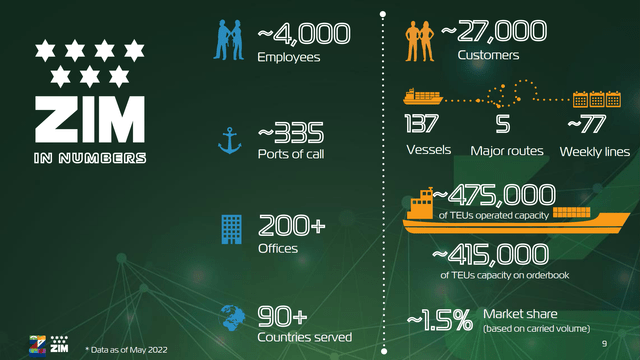

It is worth looking at ZIM’s most recent May 31 presentation, to see how the company is looking ahead. One of the most notable points is that ZIM is aiming to nearly double its TEU capacity with an orderbook of 415k on top of 475k in current operating capacity. As with ZIM’s current fleet, the majority of this orderbook comes through chartered deals, primarily with Seaspan (ATCO), rather than direct ownership, as has been the company’s long-time MO.

ZIM Integrated

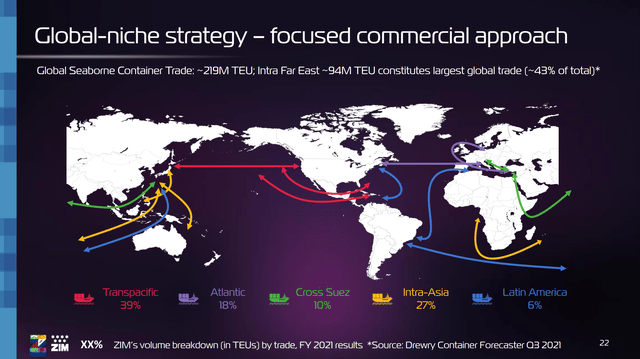

ZIM is also continuing with its strong “Global-niche strategy,” focusing on developing routes where it can have a competitive edge. This diversified global-niche strategy makes sense with the company’s newbuilding charters that have focused significantly on vessels sized 7,000 TEU or less (respectably sized ships, but not neck-and-neck competing for those new 23,000 TEU behemoths ferrying transpacific cargoes).

ZIM Integrated

Expanding into some of the less-covered shipping markets where economic growth is supposed to be the most robust over the next few decades is a solid move from ZIM and speaks to management’s unique strategy.

But How About Rates for those New Vessels?

The main question for ZIM’s future growth comes from freight rates: will they fall from these record highs, and if so, when?

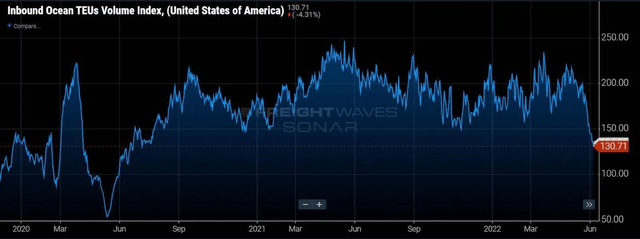

Well, if the recent import numbers are any indication, soon. Or even now. Imports to the United States have collapsed in recent weeks, though we may see somewhat of a rebound in the coming months.

Ocean Imports to the United States in TEU (Freightwaves)

The level of inventory that companies have built up (largely because of supply chain fears) means that there will be less demand for new imports and thus demand for TEUs will stay lower. Although depending on the success of companies, like Target, in holding inventory sales in the hope of being able to reorder to meet shifting consumer tastes, we may see a sharp rebound in shipping demand to the United States sooner than you think.

Looking at the Freightos Global Container Index, we can see that though rates have fallen from their height of heights, they remain way higher than years past – and very profitable.

Freightwaves Global Container Index (Freightwaves)

Even if shares were to drop another 50% from $7,261, ZIM would still be rolling in cash. Judging by the company’s 2021 first quarter – some of the rates for which were set in late 2020 at lower than $3,000 – the company could easily still be earning $5+ per share per quarter for earnings of $20 per year. This would provide a yield of 13-20% conservatively.

I think that rates may indeed have further to fall. But ZIM is ready and will still be profitable – plus with all its debt repaid, the company can be expected to post even better free cash flow in the near term (though newbuildings aren’t free, the company has pure cash).

The Uber-Strong Dividend Continues

Even at just 20% of ZIM’s quarterly net income, this dividend payment of $2.85 would make a respectable dividend-paying stock of ZIM alone – with a yield of 5.47% when we pretend it’s the one annual payment we get. And not only does ZIM pay quarterly but the company’s policy of a top-up payment in the fourth quarter to bring the overall payout ratio to 30-50% of the company’s net income guarantees a hefty yield.

This year may well be the peak for ZIM’s dividend payments, but what a peak it will be. The company can be expected to easily pay out an average of $2.50 per quarter, with a top-up dividend at the end of the year likely to raise that amount. Conservatively, with $10 of dividends, ZIM is still paying out a whopping 19% yield. And this yield is a near-certainty given the company’s cash reserves. More than likely the company will pay out a near 30% yield.

Valuation

Over the past week, ZIM’s share price has cratered – starting with a stiff 15% drop on Wednesday as concerns rose about the economy and slowing imports.

ZIM Share Price Wednesday June 8 (Seeking Alpha)

The following days were similarly hard for ZIM, leading the company to shed around $2 billion in one week. Down 22.14% in one week is not a great place to be, for any company.

ZIM Share Price Week of June 6 (Seeking Alpha)

However, it could be a great place to be for investors looking to load up on ZIM shares. The book value per share of ZIM shares is currently $35.56 for a price-to-book value of 1.46. As I mentioned in my last article on ZIM, by the end of the year, ZIM will have more than its current share price in cash. That makes ZIM a hard-to-lose bet.

Conclusion

ZIM is selling for its cash balance plus a conservative estimate of its earnings for the year. The macro-environment, and sentiment along with it, have certainly worsened. However, the truth of the matter is that ZIM can afford to weather worse rates. Yes, the good times were good – great even – but the fall in rates is not about to be a return to the bad times, just a slightly-less-profitable-than-boom-times level. ZIM is offering a 20%+ yield, zero leverage, and a strong management team. That makes the stock a hard-to-lose proposition.

Be the first to comment