hapabapa

Zillow (NASDAQ:ZG) (NASDAQ:Z) management seeks to leverage its platform to expand and diversify revenue streams in a capital-light fashion. The strategy is a no-brainer. Valuation is much cheaper, operating cash flow and balance sheet healthy, and risks well priced in. Macros (read, rates) and sentiment are the last increments holding down shares. When these turn, the shares should rerate powerfully. The market will anticipate, so the rerating may materialize way sooner than most anticipate.

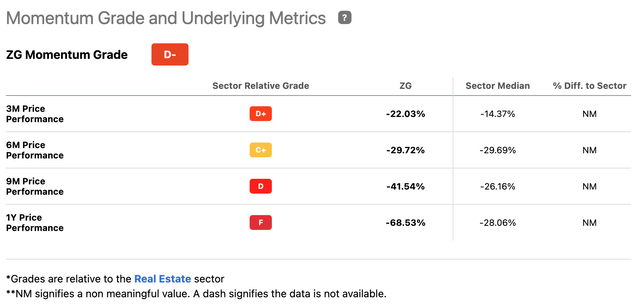

Momentum Is to the Downside, But Possibly Not Much Longer

A deterioration of the macro-economic environment, home affordability, and residential real estate transaction volumes added to the failure of the Home segment (iBuying) to contribute to a collapse of Zillow shares since reaching an all-time high of $212.40 on February 16, 2021. Good for a nearly 90% haircut.

Check out the graph below.

The momentum grade rates rather poorly, relative to the real estate sector. In any time capsule, the shares underperform. The 1-year price performance scores worst.

But the rate of deceleration of shares seems to be falling, suggesting the stock has started bottoming. Can they regain altitude, and how soon can the price begin to reclaim lost ground?

Macros Aren’t Helping But Zillow Makes Strides against the Tide.

Macro housing market parameters including interest rate and home price increases and pressure on transaction volumes constitute adverse trends, making the transition from a business designed to optimize iBuying to one serving all prospects across the Zillow ecosystem (apps and sites) all the more challenging.

Zillow’s Shareholder Letter, Q2 2022, puts it best:

Rapidly rising mortgage rates have compounded the existing affordability challenges created by unprecedented home price appreciation. This has driven buyer sentiment to a 20-year low, and reduced buyer demand (…). Across the industry, we are seeing price growth meaningfully soften on pending sales and new mortgage applications, with for-sale inventory levels rising as homes spend more time on the market. Ultimately, with all these factors combined, the housing industry saw flat year-over-year total transaction dollar volume in Q2 while various leading indicators deteriorated (…).

Lower home purchase demand (…) is impacting our overall Premier Agent connection lead volume. The recent double-digit percentage annual decline in the Mortgage Bankers Association (MBA)’s purchase mortgage applications index also indicates further headwinds for the housing sector.

Still, Zillow managed to deliver Q2 Internet, Media & Technology (IMT) segment results in line with outlook for both revenue ($475 million, flat year over year) and Adjusted EBITDA ($164 million, an 11% contraction year over year). Premier Agent revenue decreased 5%. Rentals revenue decreased 3% (but was up 16% sequentially from Q1). But Other IMT segment (than Premier Agent Revenue and Rentals) revenue increased 30%. It includes revenue generated by new construction and display advertising, as well as revenue from the sale of various other advertising and business technology solutions for real estate professionals, including dotloop. In the fourth quarter of 2021, the firm began to include the financial results of ShowingTime.com, Inc. in the IMT segment. Mortgages revenue (outside IMT) was down sharply (nearly 50%) year over year. Rapid increases in interest rates took a toll on refinancing loan originations and demand for mortgage.

On a GAAP basis, consolidated net income was $8 million in Q2. Segment income (loss) before income taxes in Q2 was $69 million, $(14) million and $(38) million and Adjusted EBITDA was $186 million, $(1) million and $(21) million for the IMT, Homes and Mortgages segments, respectively. Capital-light IMT has the most attractive profitability profile (driven by higher-than-anticipated margins). Losses in Homes matter less long-term since Zillow is exiting the business. Mortgages segment Adjusted EBITDA scores worst (and below the low end of outlook), as the business is only emerging and Zillow continues to invest in building a consumer-facing origination platform.

The outlook remains challenging. Zillow expects Q3 consolidated revenue to be $446 million (midpoint of outlook, down 7% from Q2). IMT segment revenue is expected to decline 12% year over year (at the midpoint of the outlook range) to between $409 million and $434 million. Q3 Premier Agent revenue is expected to be between $275 million and $295 million, down 21% year over year at the midpoint of the outlook range. Q3 IMT segment Adjusted EBITDA may reach between $111 million and $121 million (sharply down from Q2’s $186 million).

Still, per the Q2 shareholder letter:

We believe our Q3 investment level is appropriate despite the headwinds in the market, given the significant growth opportunities ahead, the positive signals we see in testing, and the seller solutions opportunity with the announcement of our partnership with Opendoor. (…) In Rentals, we are expecting to return to positive year-over-year growth as we continue to see signs that low rental vacancies may be subsiding.

Zillow expects to complete the wind-down of its iBuying operations during Q3 and to report Zillow Offers as a discontinued operation beginning in Q3.

In Q3, Mortgages segment revenue is expected to be between $22 million and $27 million, which is down sequentially from the $29 million reached in Q2; the higher mortgage rate environment impacts both refinance mortgage volumes and overall loan demand.

Per the Q2 shareholder letter:

Our Q3 outlook also reflects sequential growth in purchase mortgages and flat-to-lower gain-on-sale spreads due to the competitive industry environment. We expect Mortgages segment Adjusted EBITDA to be between a loss of $31 million and a loss of $26 million based on expected market conditions and additional investments to build tools and technology for both customers and agents, and as we integrate Mortgages with our other products and services.

Zillow Constitutes the Leading Brand in Real Estate and Remains Dominant

The company’s growth record remains impressive. Check out its Compound Annual Growth Rates (TTM):

|

Name |

YoY |

3Y |

5Y |

10Y |

|---|---|---|---|---|

|

Revenue |

173.94% |

83.49% |

62.36% |

61.61% |

Still, revenue is expected to decline over the next year or so (primarily due to the firm’s strategic repositioning after aborting iBuying).

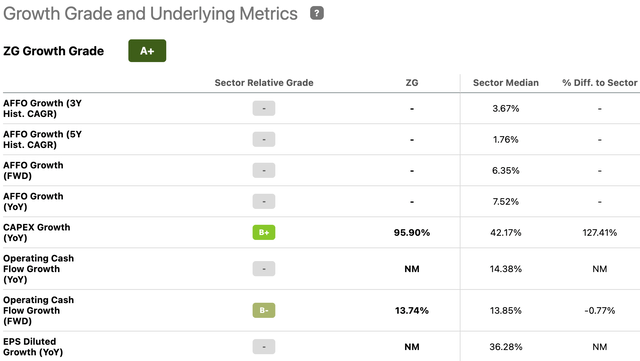

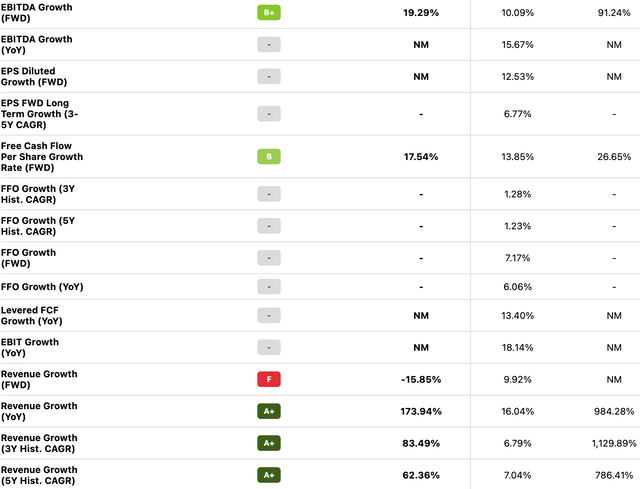

Most parameters align to delineate a rather positive growth record for Zillow, as illustrated below:

Seeking Alpha – Growth Seeking Alpha – Growth

Per Zillow’s 10k:

As the most visited real estate website in the United States, Zillow and its affiliates help high-intent movers find and win their home through digital solutions, first class partners and easier buying, selling, financing and renting experiences. Millions of people visit our mobile applications and websites every month to begin their journey. Traffic to our services reached an annual monthly high of 234 million unique users in July 2021, with more than 10.2 billion visits to our mobile applications and websites in 2021, primarily to Zillow, Trulia and StreetEasy.

At the core of Zillow is our living database of more than 135 million U.S. homes and our differentiated content, most notably the Zestimate, our patented proprietary automated valuation model through which we provide home value estimates. With the launch of the Zestimate in 2006, we introduced important transparency to residential real estate in order to empower consumers to make better decisions. Our improved Zestimate currently has a median absolute percent error of 2.65% for homes listed for sale and 7.26% for off-market homes. Our data and content has helped the Zillow brand become synonymous with residential real estate. Today, more people search for “Zillow” than “real estate,” according to a 2021 Google Trends report, and Zillow is the most visited brand in the online real estate industry according to a 2021 Comscore Media Metrix® report.

Our position as the leading online residential real estate company in the United States today has afforded us the opportunity to significantly expand our strategy over the past several years. We have evolved from an advertising lead generation model to a transactional model that is more directly involved with our customers’ moving journeys. With that, our strategic expansion has dramatically increased our Total Addressable Market (“TAM”) from $19 billion in residential real estate related advertising (according to a 2019 Borrell Associates report) to approximately $300 billion of the $2 trillion residential real estate market, derived from transaction fees from our real estate partners, advertising from rental professionals, and revenue earned from mortgage originations and title and escrow service fees (…).

Both Operating Cash Flow and Balance Sheet Remain Healthy

Zillow ended Q2 with cash and investments of $3.5 billion, down slightly from $3.6 billion at the end of Q1, after $249 million in share repurchases. The firm has about $850 million remaining under its total share repurchase authorizations of $1.8 billion.

Q2 debt shrank to $1.7 billion from $2.5 billion at the end of Q1, after paying down all remaining iBuying debt.

Per the Q2’22 Shareholder Letter:

Our cash position, core operating cash flow and now less capital-intensive operations give us the flexibility to continue to invest against our growth strategy as we look to efficiently navigate through the current macro environment.

Both cash flow generation and debt levels thus remain healthy, allowing Zillow to reboot strategically in the face of adverse market conditions.

Building a Revenue Diversification Engine Seems Like the Right Strategy

Zillow is assembling a suite of complementary seller offerings across agent transactions and adjacent services like mortgage and title & escrow while growing its business in a capital-light fashion (thus escaping the voracious capital requirements of iBuying).

Zillow has struck an exclusive multi-year partnership with Opendoor to provide customers the ability to get a cash offer on their home. Potential sellers on Zillow apps and sites ecosystem may request and land an offer directly from Opendoor, and a licensed Zillow advisor will help them compare it to an open-market sale. Zillow receives a referral fee when a customer sells to Opendoor, while customers who opt to sell traditionally will be connected with a Zillow Premier Agent partner. The firm also offers a bundle that allows sellers to buy their next home with a Premier Agent partner, finance with Zillow Home Loans, and close with Zillow Closing Services.

Zillow’s product roadmap is evolving; increasing transactions and revenue per transaction is the key goal. Financing, for example, is becoming an integral part of the strategy.

Per the Q2 shareholder letter:

Many millions of customers have inquired about financing on Zillow in the past 12 months, and we’ve begun to make changes to our apps and sites designed to convert a portion of that huge customer signal into originating purchase mortgages through Zillow Home Loans. As a result, pre-approvals for purchase mortgages doubled from January to June 2022, and our purchase origination volume grew 58% sequentially in Q2. We are early in our journey and still have work to do, but we believe we have an opportunity to be a substantial purchase mortgage originator and help more customers with their financing needs. Additionally, a vast majority of customers who initially come to us for a mortgage do not yet have a real estate agent. This gives us confidence that we can introduce Zillow Home Loan customers to trusted Premier Agent partners, who are happy to meet buyers who already have financing lined up and are ready to find and win their next home. We are investing to build technology that supports customers across our platform, and build efficient digital tools for loan officers and agents. While the early indicators are promising, we want to ensure the key foundational components are in place so we can scale profitably. We’re investing in financing not only as a significant growth pillar but as a critical enabler of Zillow’s integrated transaction experience.

While mortgage revenue has been caught in a downtrend due to adverse real estate market conditions, it’s quite likely that the financing segment will constitute one of several growth engines once Zillow reaches scale and integrates all technologies required to service customers end-to-end.

Per the 10k, there are additional prospective service ventures, as follows:

With nearly half of all people looking to buy also considering renting (according to the Zillow Group 2021 Consumer Housing Trends Report), our TAM also includes our complementary rentals marketplace which we estimate participates in nearly $11 billion of estimated annual rentals advertising spend. We also participate in the nearly $5.0 billion annual property management software industry (according to a May 2021 report published by Fortune Business Insights). Our rentals marketplace assists our partners with listings, advertising and leasing services in a market of nearly 47 million rental units in the U.S. (…).

We also may explore additional opportunities in the future, including but not limited to home insurance ($119 billion TAM according to an IBISWorld report published in August 2021), home renovation services ($595 billion TAM according to a 2021 report published by Angi Inc.), moving services (nearly $18 billion TAM according to an IBISWorld report published in September 2021) and home appraisal services (over $9 billion TAM according to IBIS World in May 2021). The amounts listed represent the estimated total industry size associated with these opportunities.

Management thus has a well-delineated plan to leverage its platform to expand and diversify its revenue streams in a capital-light fashion via seller solutions, transaction fees, rentals, adjacent services like mortgage (Home Loans) and title & escrow, and more, on top of advertising.

Stock-Based Compensation (SBC) Is Well under Control

In an effort to retain talent in a competitive job market, the company is resorting to dilutive stock-based compensation to boost total compensation for a significant number of employees deemed mission-critical. Per the same shareholder’s letter:

The Board and our executive team agreed this is a practical decision for Zillow, that we expect to minimize the challenges and costs associated with attrition down the line, all while recognizing the importance of retaining key talent and realigning their compensation with the interests of shareholders. We expect this action will result in approximately 2% dilution, spread largely over the next two years.

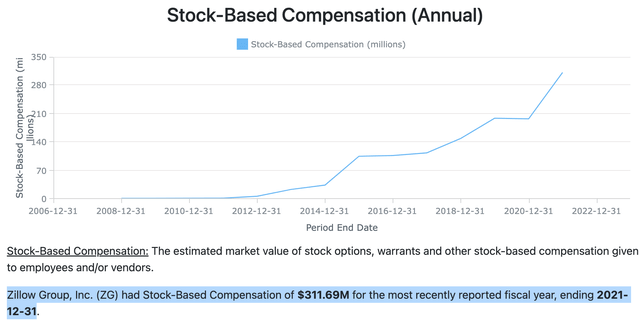

Zillow’s repricing of its restricted stock unit program with employees to enhance retention should be gauged relative to competitors. Check out the SBC data for Zillow below:

Zillow’s SBC of $311.69 million for the year ending 2021-12-31, amounts to less than 5% of revenue (of around $8,150 million).

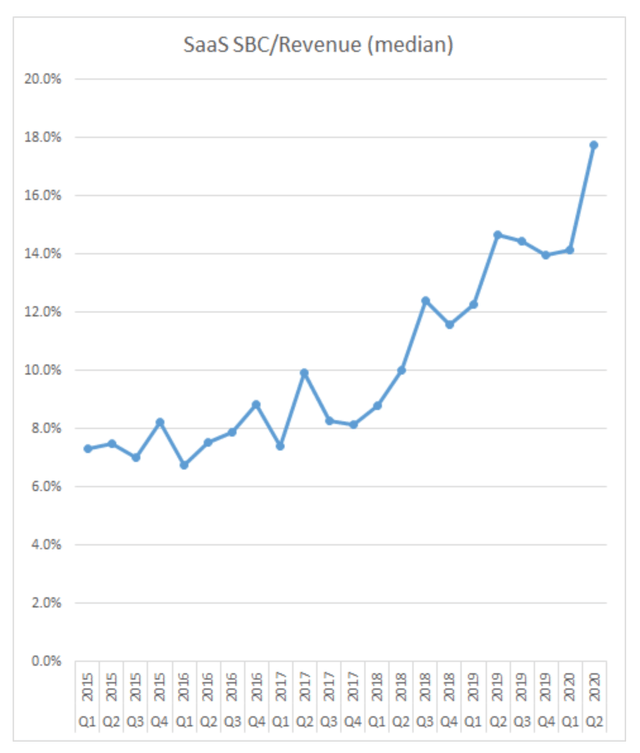

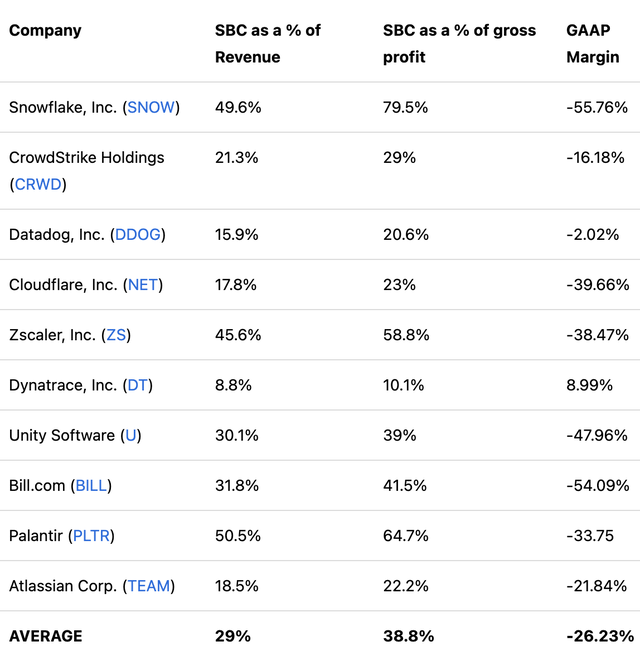

A comparison of the market’s high-flyers for SBC makes it obvious that Zillow is far from being amongst the most aggressive with SBC, as its SBC/Revenue ratio is well below the median (around 18%).

The list below makes it obvious that other tech firms are much worse offenders.

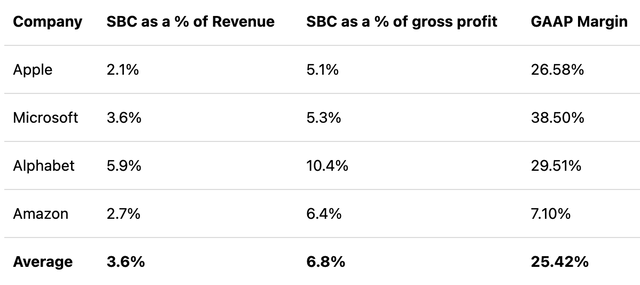

While Zillow does not exactly behave like a more established tech vendor like Apple (AAPL) or Amazon (AMZN), its SBC seems to be falling within the range of reasonable practice (and in the vicinity of Alphabet’s own SBC profile).

Further, Zillow is repurchasing shares under its existing share buyback program in the near term to cover the potential future dilution. As indicated above, the firm ended Q2 with $249 million in share repurchases. It has about $850 million remaining under its total share repurchase authorizations of $1.8 billion (as of the end of Q2, ’22).

Profitability is Work-in-Progress, Valuation is Getting Increasingly Attractive

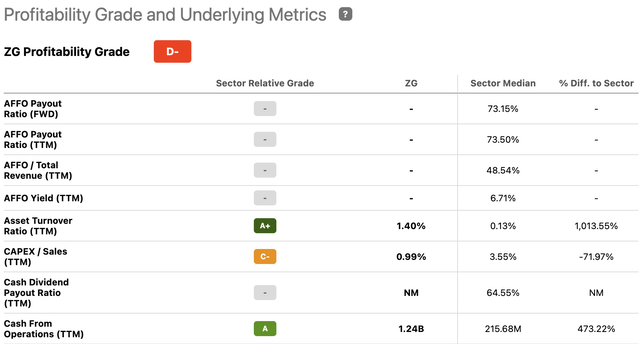

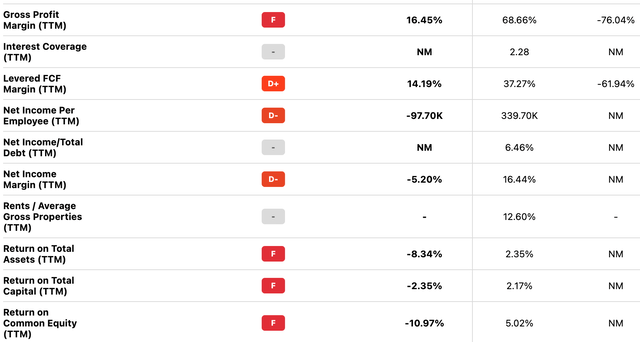

First, a quick look at profitability gauges.

Seeking Alpha – Profitability Seeking Alpha – Profitability

Zillow’s gross profit margin trails peers. Any net income-related metrics is deep negative. Returns on assets, capital, and common equity print well below competitors’.

A combination of a declining housing market, reduced mortgage activity following interest rates increases, limited housing inventory, higher rental occupancies, and lower transaction sales are likely to continue to pressure the IMT and Mortgage segments and constrain revenue and the volume of Zillow Home Loans, making it that much more challenging for Zillow to reach profitability.

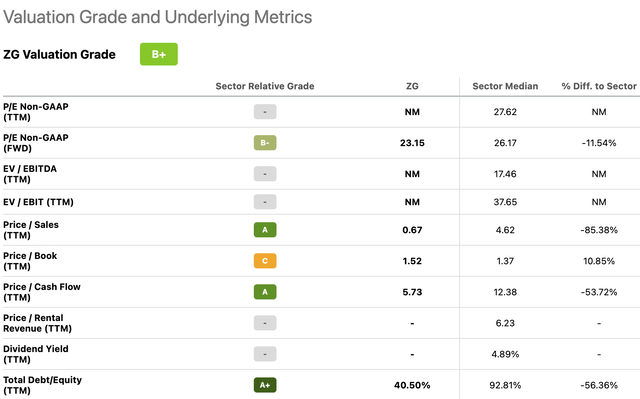

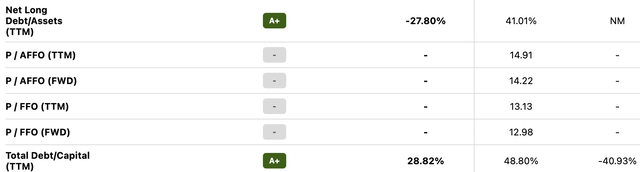

But valuation is favorable. Price per sales and price per cash flow are well below peers’, while price per book is just about fair. See the table below for some detail.

Seeking Alpha – Valuation Seeking Alpha – Valuation

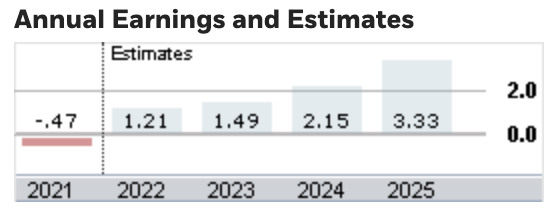

Still, annual earnings and consensus estimates remain in the black, as illustrated in the table below:

E*Trade

Fiscal 2022 qualifies as a transitional year as the firm exits its iBuying or Homes segment. Without Zillow Offers Group, there is a risk Zillow will see flat revenue in 2023 year-over-year (including for the IMT and the Mortgage segments). But Zillow will be in a unique position to capitalize upon any turnaround in the real estate market.

If we assume a forward P/E of 18x versus peer average at 18.0x, maintain 2023 EPS estimate at $1.50 (see table above), it’s easy to reach the conclusion that the current share price of $31.29 (quote: Oct 25, 2022, 4:00 PM ET) is just about adequate (or 10% overvalued vs. 18×1.5=$27). But ascribe any premium to the most powerful brand in online real estate, understand the magnitude of the rerating of shares the compounded effects of multiple revenue streams going live and gaining momentum off the most powerful tech platform for internet real estate, and input the turn in sentiment likely to occur concomitantly, and it’s easy to apply a 20+ (some will dare venture a 30, nothing like anticipating the good times) multiple to a rerated earnings number. Any positive surprise at the macro- or micro-level may see the shares take off and never look back.

We may arrive at a similar conclusion following different valuation methods. Sure, housing cyclical pain and stress at a time of deteriorating affordability and rising rates are taking a toll. But merely believe Management’s claim that the company will reach its goal to deliver on its $5 billion revenue and $2.5 billion EBITDA targets by 2025, and assume ZG’s valuation reaches a reasonable ~10x 2025 EBITDA estimate, and investors may reach a price objective of 10x 2025E EV/EBITDA of 10 x $2.5 billion, good for a $25 billion enterprise value, versus current market cap of $2 billion, good for a silly 12-bagger. Sure, Management may be off by some margin (which has yet to be established, doesn’t it?), but even if reality hits half-way, at some point over the next 2-3 years, the shares rerate powerfully. Further, to regain this kind of altitude, the stock would have to start moving up sooner than most believe. Again, sentiment is key. When macros start to turn, and so does sentiment, and at the first sign that they do, shares will probably gap up.

Further, in the current gloomy world of inflation and rates increases and Ukraine wars and stressed geopolitics, investors forget that Zillow used to trade at a P/E of 238.3x and EV/EBITDA of 28x back in 2020. EV/EBITDA was 35.9x in 2021. Welcome to the world of sentiments. Rest assured they will shift again. It may take time, but they always do.

Note the aforementioned calculations may factor in the incremental $180-190 million in share-based compensation (spread over two years, as alluded to earlier), but this kind of SBC hardly makes a dent in the greater scheme of things. What’s 2% dilution to the potential Amazon of real estate? Small price to pay. Sure, we may remain cautious and fear continued housing downside through the rest of the year and await more clarity on how Management is going to pull it off. At the risk of seeing the shares unexpectedly take off and leave us in the dust.

Risks Seem Well-Priced In

The Company’s 10k, which lists all risk factors, is always a good place to start for any prospective investor. We’ll focus on a couple that are, in our view, high-impact.

The success of Zillow is contingent on the health of the United States residential real estate market, which is impacted, in large part, by general economic conditions. Slow economic growth, recessionary trends; increased levels of unemployment or labor shortages; low levels of customer confidence; inflation; increased interest/mortgage rates; federal, state, or local regulatory changes that may negatively affect the residential real estate industry, such as the Tax Cuts and Jobs Act of 2017, which limited deductions of certain mortgage interest expenses; all constitute key risk factors. And it seems quasi-impossible to shake them at the current time. Add volatility and general declines in the stock market, and at least some of us aren’t having too much fun these days.

Conditions specific to the housing market, including increases in costs for homeowners such as property taxes or homeowners’ association fees or insurance; low home and/or rental inventory levels and the deterioration of home affordability; changes in international, national, or local economic, demographic, or real estate market conditions; declines in the value of residential real estate; illiquidity in residential real estate; are other factors to consider.

Zillow Home Loans and the Mortgages Segment depend on United States government-sponsored entities and agencies policies, operate in a highly regulated industry, and may be impacted by interest rate and other general market fluctuations. As interest rates rise, refinancing becomes a smaller portion of the mortgage loan market and demand may also decrease for purchase mortgages. Alternatively, if interest rates remain low, customer demand for refinancing residential mortgage loans may decrease after many homeowners have refinanced at low rates already, and Zillow may be unable to increase its share of purchase mortgages. In either case, Zillow’s mortgage origination business is at risk.

Zillow Home Loans uses derivatives to reduce exposure to adverse changes in interest rates. But Zillow Home Loans’ hedging activity may fail to provide adequate protection for interest rate exposure due to market volatility, hedging instruments not directly correlating with the interest rate risk being hedged or counter-party defaults on obligations. Certain hedges may be subject to margin calls, as well, which, if applied, may adversely impact Zillow’s liquidity.

How about lower mortgage rates and increased U.S. sales listings for U.S. residential homes for another risk to valuation to consider? This sounds ironic now, until one day it’s not.

Conclusion

Zillow may constitute a significant wealth creation opportunity for long-term investors. The firm qualifies as:

- A market and technology leader with the most powerful brand in online real estate.

- Engaged in a strategic thrust to diversify revenue in a light capital manner that seems compelling.

- Endowed with a healthy balance sheet and operating cash flow to help in the transition.

Negative momentum and market sentiment have punished the stock, presenting bargain hunters with an emerging opportunity. Solid appreciation potential exists within the next five years.

It is impossible to ascertain whether Zillow’s stock has bottomed, but we should be close enough. Bullish investors should start accumulating decisively. The more cautious ones – i.e., those waiting for an end to the bear currently punishing growth stocks and greater visibility into Zillow’s future cash flow and earnings – might prefer to dollar average.

Be the first to comment