alfexe/iStock via Getty Images

Yum China Holdings, Inc. (NYSE:YUMC) operates successful American restaurant chains in China. Management expects to open more new stores in 2022, and the guidance appears quite optimistic. Like other analysts, I am also quite optimistic about the future of the company. Yum China reports a significant amount of cash to pay marketing campaigns, so sales growth may be expected. Under several case scenarios with conservative assumptions, my financial models resulted in a valuation that is significantly higher than the current stock price. In my view, the stock is a must-follow.

Yum China, Its Business Growth, And Yum! Brands

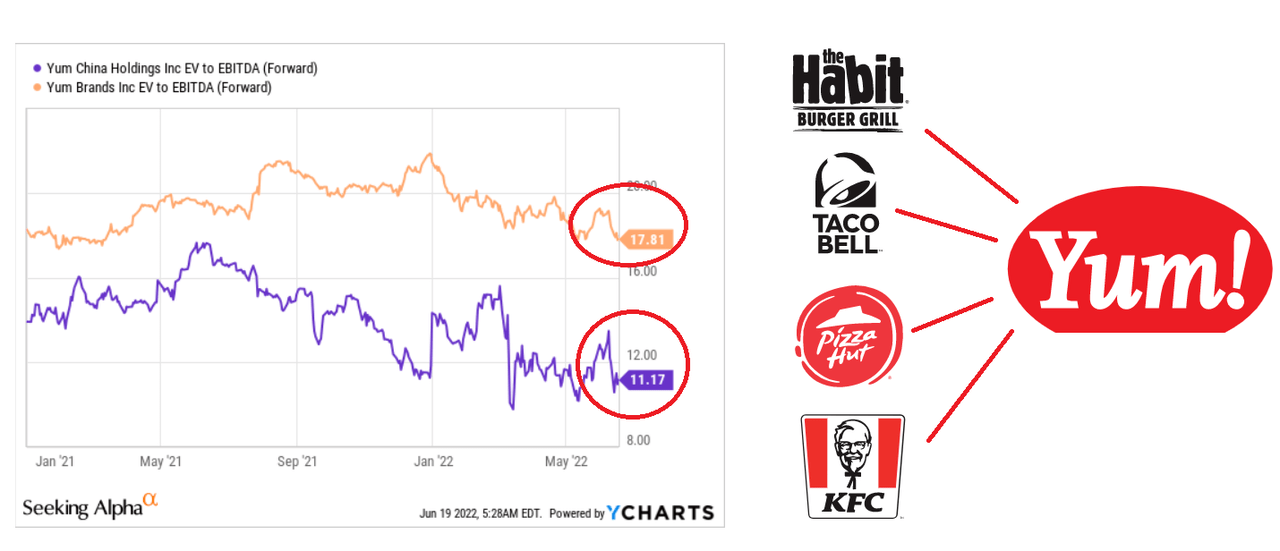

Yum China Holdings owns entities that own and operate restaurants under well-known brands in North America like KFC, Pizza Hut, Little Sheep, Huang Ji Huang, and Lavazza. With know-how acquired in the United States, in my view, Yum China will be able to offer innovative products in the massive Chinese market.

ir.yumchina.com

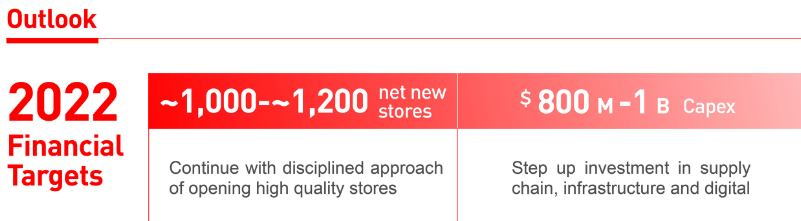

I decided to write about Yum China because of its 2022 financial targets. Management expects to report 1k-1.2k net new stores by 2022, which could, in my view, multiply future free cash flow, and enhance revenue growth.

ir.yumchina.com

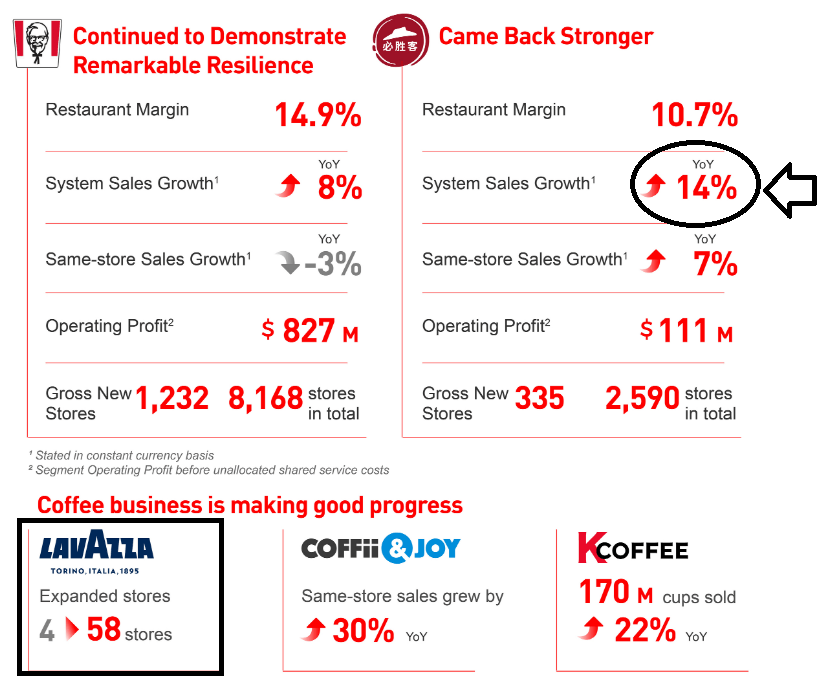

The financial figures of some of Yum’s brands in China are quite impressive, so I expect beneficial figures as the store count increases. Most brands report double digit restaurant margin, growing operating profits, and business growth.

Quarterly Presentation

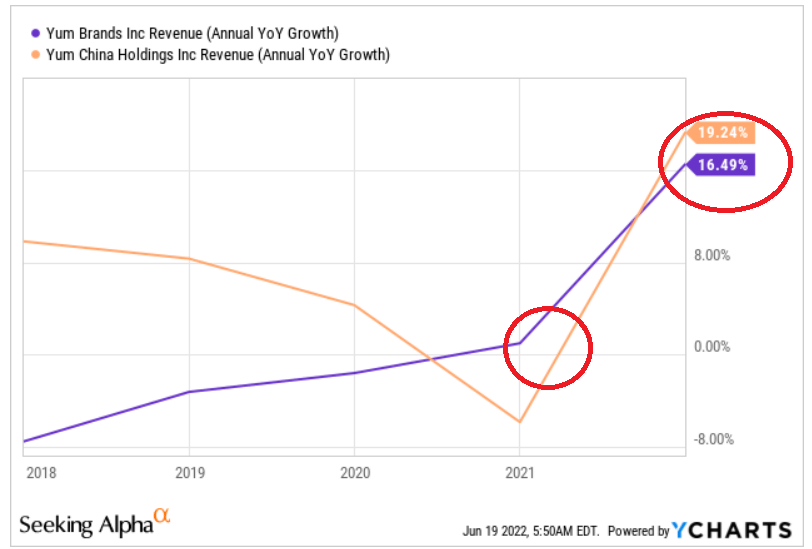

With these figures in mind, I don’t really see why Yum China trades undervalued as compared to Yum! Brands, Inc. (YUM). They both sell the same brands, and report approximately the same sales growth.

Ycharts and Yum Ycharts

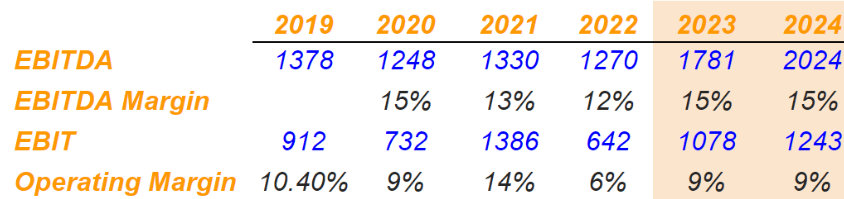

Yum China Reports A Significant Amount Of Liquidity To Invest In Marketing And New Stores

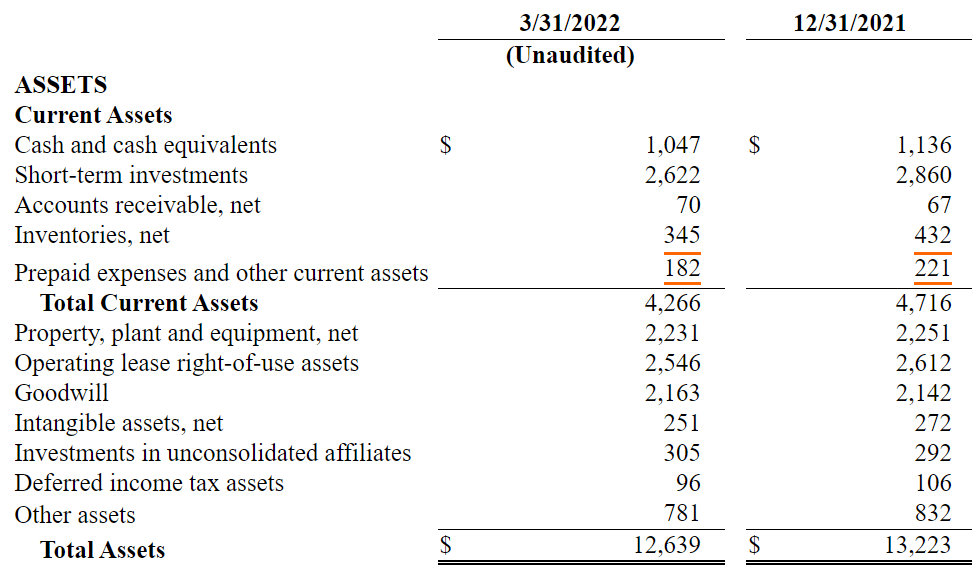

I do believe that we can expect business growth because Yum China has a significant amount of cash to make investments. As of March 31, 2022, the company reported $1 billion in cash and $2.6 billion in short-term investments. The asset/liability ratio is also beneficial at 2x-3x.

10-Q

The total amount of financial debt is close to zero, which most financial advisors may find interesting. In my view, if management needs some leverage to accelerate its business growth, banks will likely offer good credit conditions.

10-Q

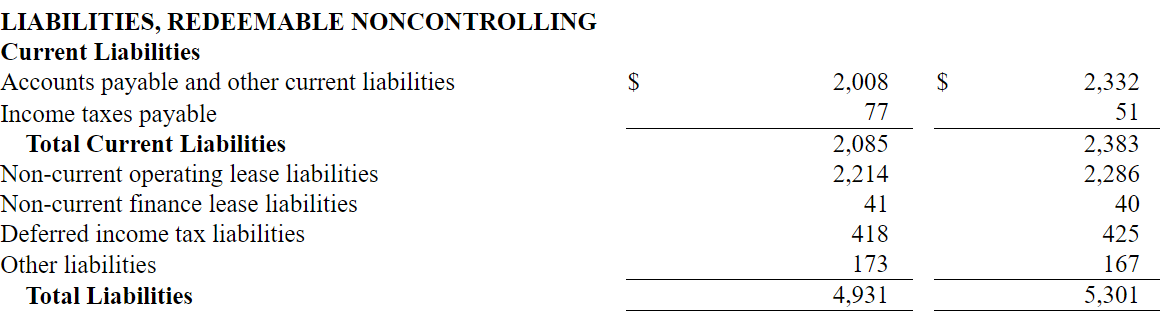

Analysts Expect Sales Growth

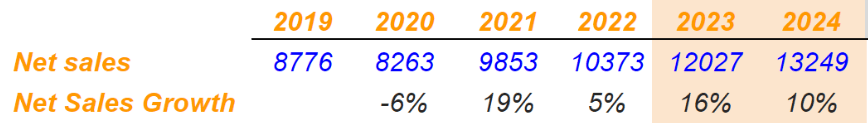

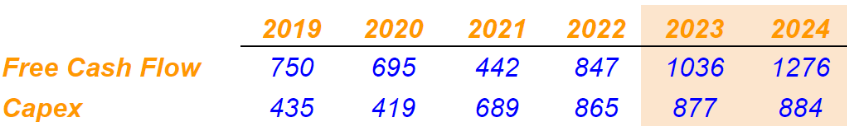

Before mentioning my own financial figures, I took a look at the numbers reported by other investment researchers. Most advisors are optimistic about the company. They expect double digit sales growth in 2023 and 2024.

Arie Investment Management

With regards to the margins, in 2023 and 2024, Yum China is expected to deliver an operating margin of around 9% and an EBITDA margin of 15%.

Arie Investment Management

Finally, it is also quite beneficial that estimates include free cash flow growth of $1.036 billion in 2023 and $1.276 billion in 2024. Capital expenditures are also not expected to increase significantly, which may help explain free cash flow growth.

Arie Investment Management

Bullish Case Scenario

Under normal conditions, I believe that Yum will likely benefit from rapid geographic expansion in China. Take into account that restaurant chains have a low penetration in China, and management intends to increase its efforts to increase its geographic footprint. Management discussed this strategy in the annual report.

Restaurant chains have a low penetration rate in China, especially in lower-tier cities. Given the rapidly expanding middle class and dining out population as a result of continued economic growth and urbanization, we believe there are significant opportunities to expand within China, and we intend to focus our efforts on increasing our geographic footprint in both existing and new cities. Source: 10-k

Yum China will likely benefit from franchise opportunities as the company’s brands are well-known. Right now, the company reports that only 15% of the company’s restaurants were run by franchisees, and management expects more demand. More franchisees will likely mean more financing and further sales growth. As a result, the company’s valuation would likely increase.

While we continue to focus on the operation of our Company-owned restaurant units, we will also continue to seek franchise opportunities for both our core and emerging brands. As of December 31, 2021, approximately 15% of our restaurants were operated by franchisees. We anticipate high franchisee demand for our brands, supported by strong unit economics, operational consistency and multiple store formats to drive restaurant growth. While the franchise market in China is still in an early stage compared to developed markets, we plan to continue to develop our franchisee-owned store portfolio over time, especially in select channels such as gas stations. Source: 10-k

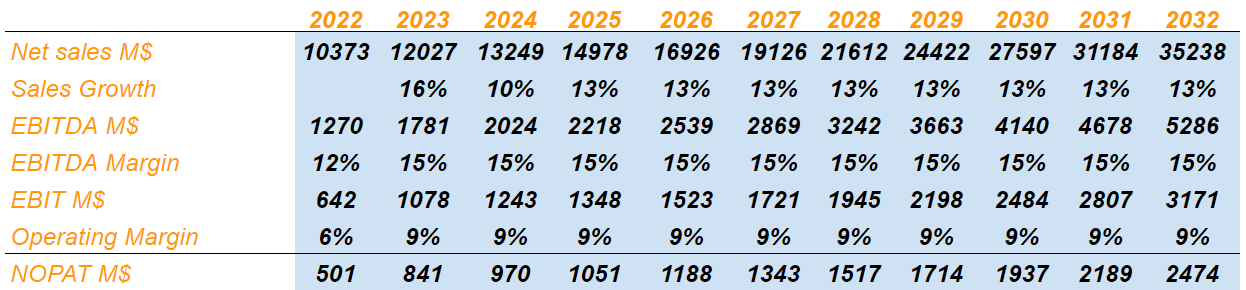

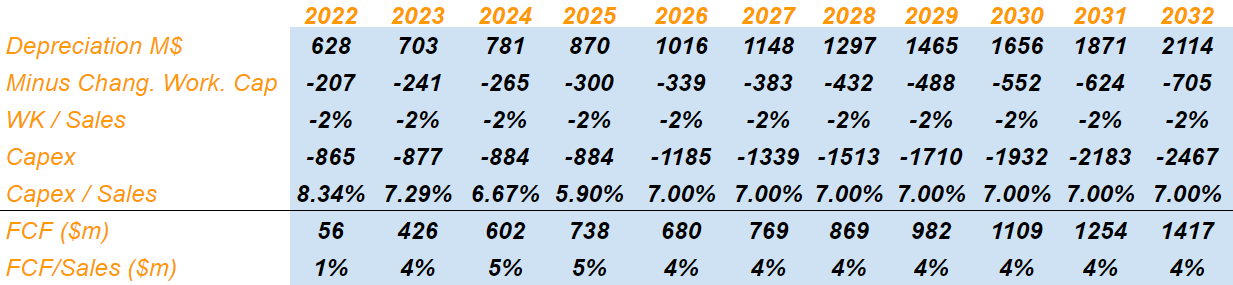

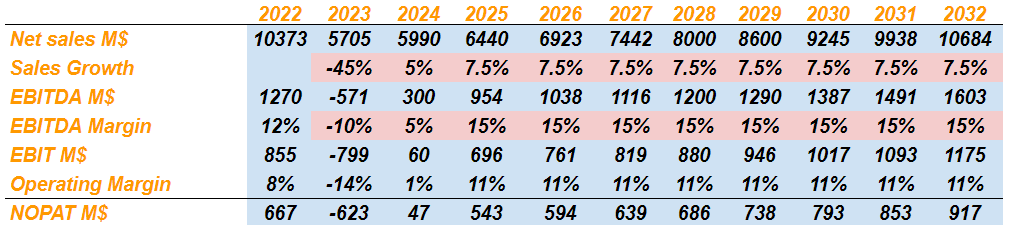

Under normal conditions, I used 13% sales growth from 2025 to 2032 and an EBITDA margin close to 15%. My figures are pretty much what I saw in the previous years. I believe that I am conservative in this scenario. I obtained a 2032 non operating profit after tax of $2.4 billion.

Arie Investment Management

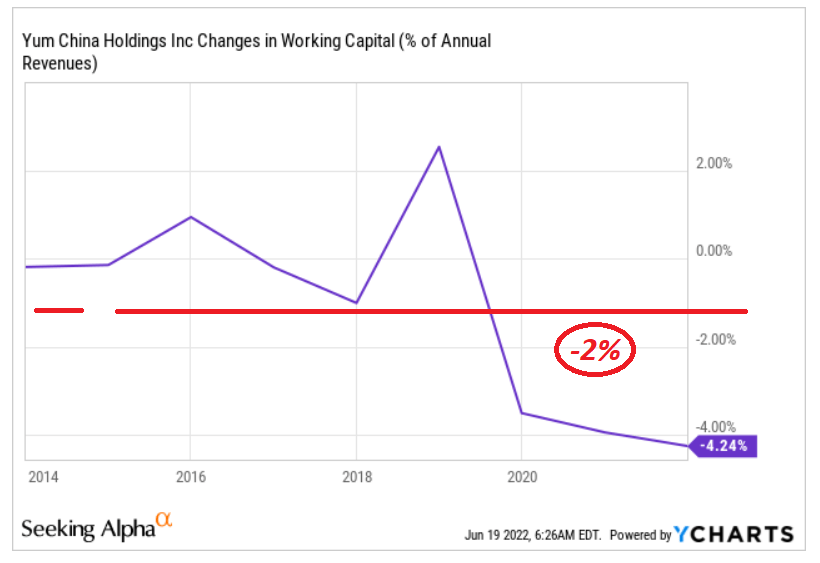

I also assumed a change in working capital/sales of -2%, which is close to the ratio reported in the past. With capex/sales close to 7%, I obtained 2032 free cash flow around $1.41 billion.

Ycharts Arie Investment Management

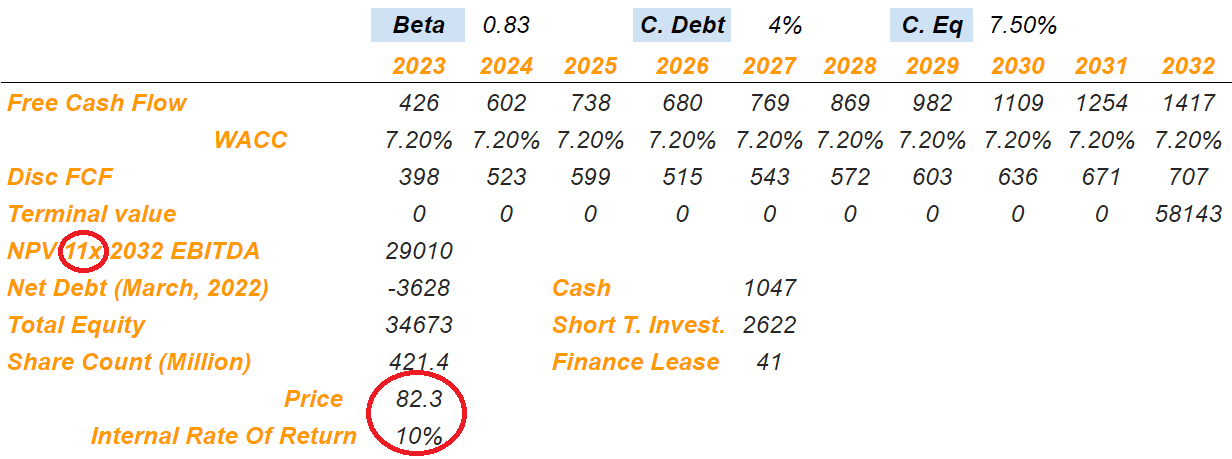

My CAPM model also included a beta of 0.83, cost of debt of 4%, and cost of equity of 7.5%, which implied a discount of 7.2%. Yum China is currently trading at close to 14x-11x EBITDA, so I used an exit multiple of 11x for the year 2032. The results include an implied price of $82.3.

Arie Investment Management

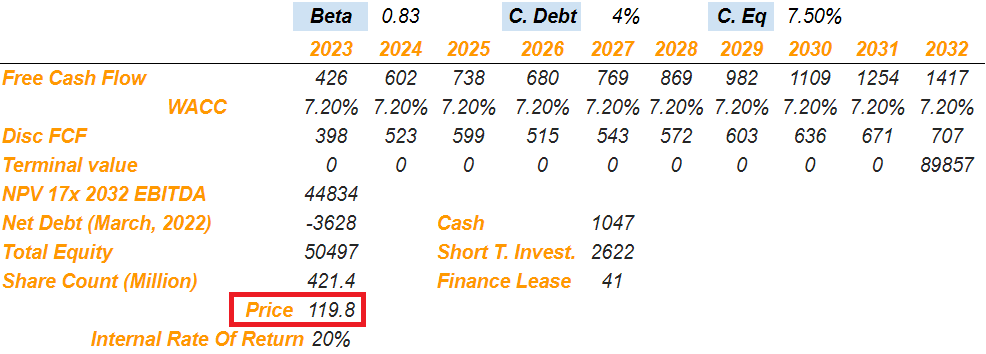

With the EV/EBITDA multiple of 17x EBITDA reported by Yum Brands, I obtained a valuation of $119 per share and an implied equity of $50.4 billion.

Arie Investment Management

Decline In The Quality Of The Food Offered Or A New Food Safety Law Could Send The Stock Price Down To Almost $20

Yum China could suffer significantly from a decline in the quality or safety of the food served. If any of the franchisees offers food in bad condition, or receives detrimental publicity, Yum’s reputation may suffer significantly. As a result, the company’s valuation may decline:

There can be no assurance that our and our franchisees’ quality assurance systems will prove to be effective. Any significant failure of or deviation from these quality assurance systems could have a material adverse effect on our business, reputation, results of operations and financial condition. Source: 10-K

Yum China could also suffer significantly from further changes in the Food Safety Law. Authorities may impose penalties on the company, or Yum may have to invest significantly to monitor safety even more closely. Under both cases, Yum may report a decline in its free cash flow, which may affect the company’s stock price.

In October 2019, China’s State Council amended the Regulation for the Implementation of the Food Safety Law, which became effective on December 1, 2019. If penalties are imposed on our senior management members, they may be prevented from performing their duties at the Company, which could in turn negatively affect our business operations. Such penalties could also have a material adverse impact on the Company’s reputation. Source: 10-K

Yum China collaborates with a number of suppliers inside and outside of China. The company could suffer shortages or interruptions in the supply of food products, which may damage the revenue line, and could also damage Yum’s reputation. In the worst case scenario, shareholders could dump their shares, which would lead to an increase in the cost of equity. Management discussed these risks in the annual report.

The products used in the operation of our restaurants are sourced from a wide variety of suppliers inside and outside of China. We are also dependent upon third parties to make frequent deliveries of food products and other supplies that meet our specifications at competitive prices. Shortages or interruptions in the supply of food products and other supplies to our restaurants could adversely affect the availability, quality and cost of items we use and the operations of our restaurants. Source: 10-K

Finally, an increase in the price of raw materials could also affect Yum’s operations. If the company cannot increase the price of its products because clients don’t buy anymore, revenue growth may decline:

Our restaurant business depends on reliable sources of large quantities of raw materials such as protein (including poultry, pork, beef and seafood), cheese, oil, flour and vegetables (including potatoes and lettuce). Our raw materials are subject to price volatility caused by any fluctuation in aggregate supply and demand. Source: 10-K

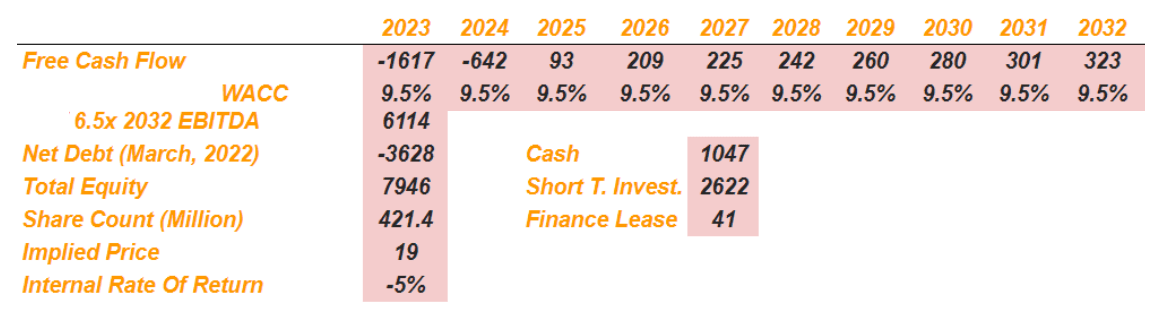

Under very pessimistic conditions, I included -45% sales growth in 2023 and 7.5% sales growth from 2025 to 2032. With 2023 EBITDA margin of -10% and operating margin close to 11%, 2032 NOPAT would stand at $917 million.

Arie Investment Management

I assumed a discount of 9.5% because the demand for the stock may decrease. Finally, with an exit multiple of 6.5x EBITDA, the implied price would stand at close to $20.

Arie Investment Management

Conclusion

Yum China operates business models that were tested successfully in the United States, and they are now in China. Yum reports a significant amount of cash in hand, which could be used for opening new stores and financing marketing campaigns. Besides, the guidance given by management appears quite optimistic. Under conservative scenarios that include franchisee growth and geographic footprint expansion, the implied fair price is significantly higher than the current stock price. Even considering potential risks from new regulations, safety issues, or a decrease in quality, I believe that the downside risk does not seem worrying.

Be the first to comment