Igor Alecsander/iStock Unreleased via Getty Images

Summary Investment Thesis

YPF Sociedad Anónima (NYSE:YPF) or Yacimientos Petrolíferos Fiscales as it’s called in Argentina, has been severely limited to reach its potential and develop the Vaca Muerta resources in the last 12 years. This entailed de facto price controls, currency exchange restrictions, forced debt restructure, high leverage, falling production and closed capital markets.

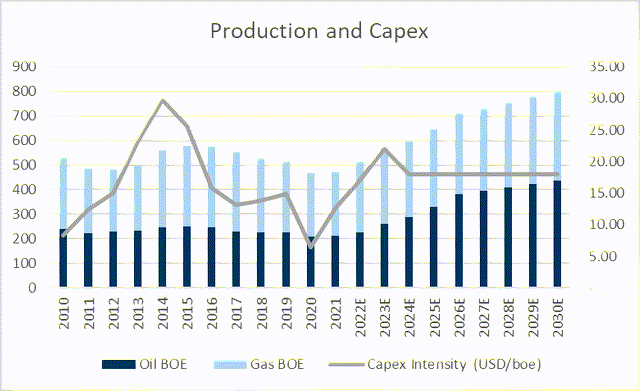

2022 appears to be the turning point: YPF is recuperating pricing power and margins, spending US$4bn in capex and targeting to double oil and gas production production by 2026 while exports could be on the horizon.

The equity market seems enthused with shares tripling since July 2022 as production grew and 2Q22 results came in with surprising strength on domestic pricing. However, capital controls and political risk remain. Debt and equity rating improvements may suffer headwinds from Argentine country risk.

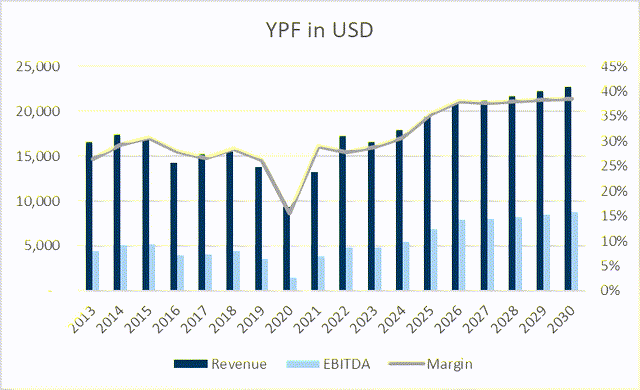

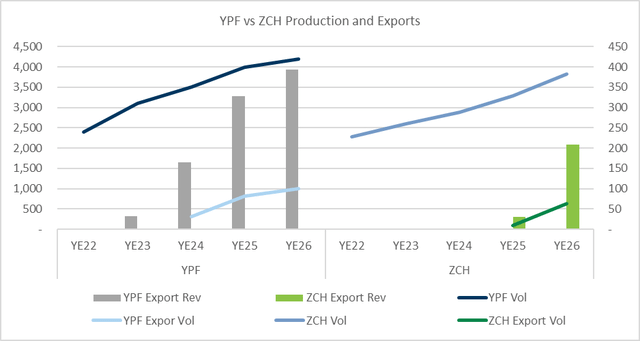

On my estimates, which are 50% of YPF guidance, the company may see oil and gas volumes double by 2030 and begin exports in 2025. This would drive free cash flow, deleveraging and substantial value creation for its bonds and equity. Key is the capacity to fund medium term capex to unlock Vaca Muerta production.

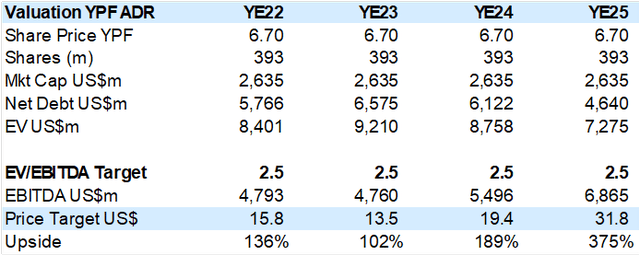

At 2.5x EV/EBITDA on YE23 estimates the stock has 100% upside, in my view.

What is YPF

YPF is a 100yr old Argentinian integrated exploration and production oil company. It produces oil & gas that it refines and distributes thought Argentina. The Argentine state owns 51% which has been at times a curse and at other times a blessing.

Upstream: Conventional and Shale resources i.e., Vaca Muerta. Oil volume production of 227k bpd (barrels per day) and natural gas of 290k bpd equivalent.

Downstream: Refining capacity of 320k bpd and 1500 gas stations and associated pipelines and distribution.

YPF is also the 3rd largest electric energy producer with 2400 MW of thermal (natural gas) capacity.

YPF Historic and Estimated Oil and Gas Production (Created by author with data from YPF) YPF Historic and estimated Revenue and EBITDA (Created by author with data from YPF)

Vaca Muerta

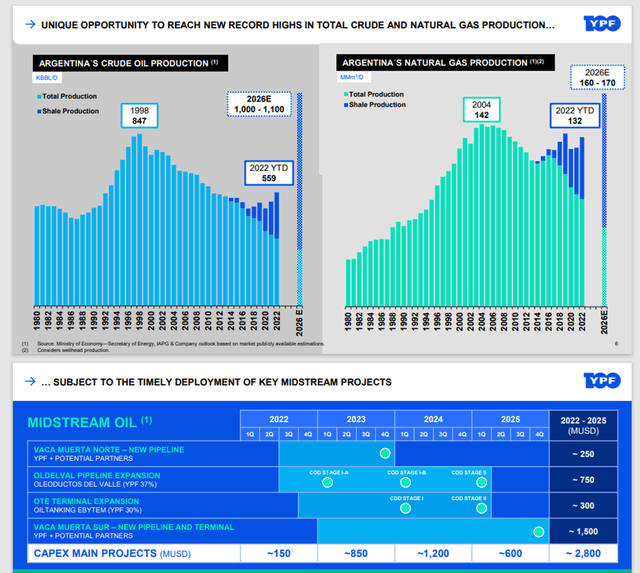

Discovered more than 12 years ago, the Vaca Muerta formation holds 308bn m3 of gas and 16bn bbl of oil, twice the size of Eagle Ford. But it has seen near zero development due to Argentina’s erratic energy regulations/price controls and a difficult macroeconomic situation that entails capital controls, the free flow of USD. It has been a very risky place for foreign and domestic companies.

YPF has about 50% of the acreage to Vaca Muerta where it has finally begun to deploy significant capex of US$4bn to US$5bn to double its oil and gas production by 2026. The Vaca Muerta shale formation (as in most shale resources) provides rapid capex conversion with 6 months from drilling to production.

However, drilling and production is not the main challenge nor the obstacle, it is bringing this volume to market i.e. midstream or pipeline and storage infrastructure. YPF has detailed 4 pipelines than are being built or need to be, to monetize this oil and gas. The reactivation of Gas Andes is already occurring, which will allow for oil and gas exports to Chile.

Shale Oil should be the primary product, it has less infrastructure friction as Atlantic coast ports can handle exports. Natural Gas has more hurdles as first it needs to satisfy domestic needs to replace Bolivian and LNG imports. Then LNG plants need to be built for eventual export.

As long as political/macro forces do not greatly interfere, Argentina may finally develop Vaca Muerta. I am far more conservative than YPF and estimated production to double by 2030 vs 2026.

Argentina Oil and Gas Production (YPF)

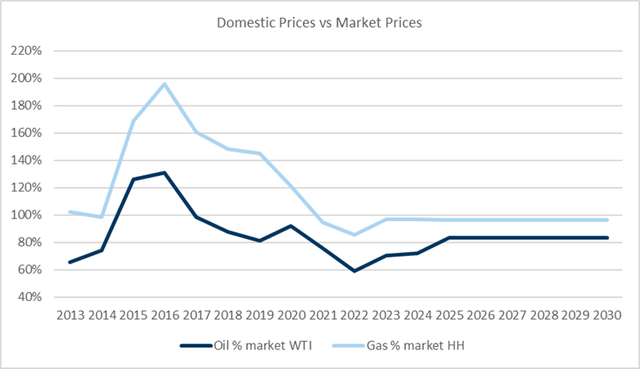

Price Controls

While gasoline/diesel price controls don’t exist, YPF has been “asked” to hold back prices as seen in the realized oil price vs WTI chart. As an integrated oil company YPF sell most of its crude to its refining company who then sells gasoline and diesel to its distribution i.e., gas stations. If prices at the pump do not rise with crude oil, then the distribution or refining report lower margins and thus YPF reduces its effective margins vs free market pricing. This has led to lower FCF, lower capex, higher debt, and declining production. I assume national production will continue to have a discount vs WTI of about 20%, which is a big improvement vs 40% seen at end of 2021.

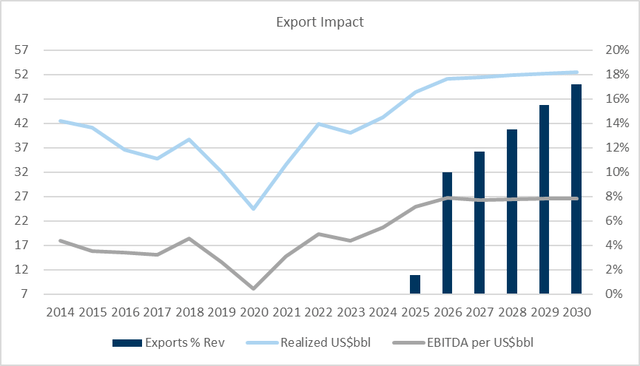

The best way to circumvent de facto price controls is to export crude at market prices and this is where production growth at Vaca Muerta comes in. Under my estimate’s margins begin to expand more aggressively in 2025 and YPF starts to generate free cash flow to fund oil and gas production expansion.

YPF Price Gap vs WTI (Created by author with data from YPF)

Oil Exports

The company indicated a scenario of oil exports by 2023 as shale oil output increases beyond refining capacity. At US$90 for WTI this would be US$300m revenue in 2023 and climb to US$4bn in potential revenue by 2026 and lead to significant EBITDA growth, far above my estimates.

My estimates are far more conservative but have a very positive impact on operating results. I assume exports start in 2025 at 9k bpd and climb to 119k bpd by 2030 or 17% of sales. This is predicated on YPF doubling oil volumes by 2030 vs 2026 as they target, as well as US$90 WTI.

Oil Export Volume Scenarios (Created by author with data from YPF) YPF Oil Export Estimates (Created by author with data from YPF)

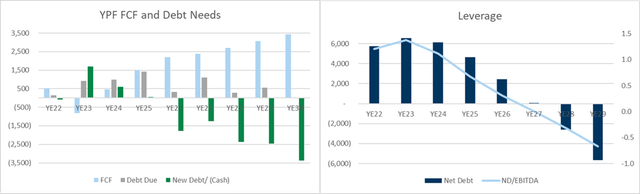

Deleveraging

While YPFs debt rating is unlikely to improve before Argentina’s, credit risk may decline as the company improves FCF. Key is the ability to fund capex in 2023 with domestic funding. Argentina’s highly distorted macro/financial situation makes this possible. Domestic investors and banks need/want dollar assets, YPF (and other corporations with dollar revenue/pricing power) place dollar linked debt at zero rates. The company seemed confident this was a viable and deep source of funding.

Once 2023/24 capex gets converted into production and eventually exports, YPF can turn FCF positive and deleverage. The risks to this scenario are plentiful and include the depth of the Argentine USD linked debt market as well as production execution, regulation and oil markets.

YPF Cash Flow Debt and Leverage Estimates (Created by author with data from YPF)

No Consensus

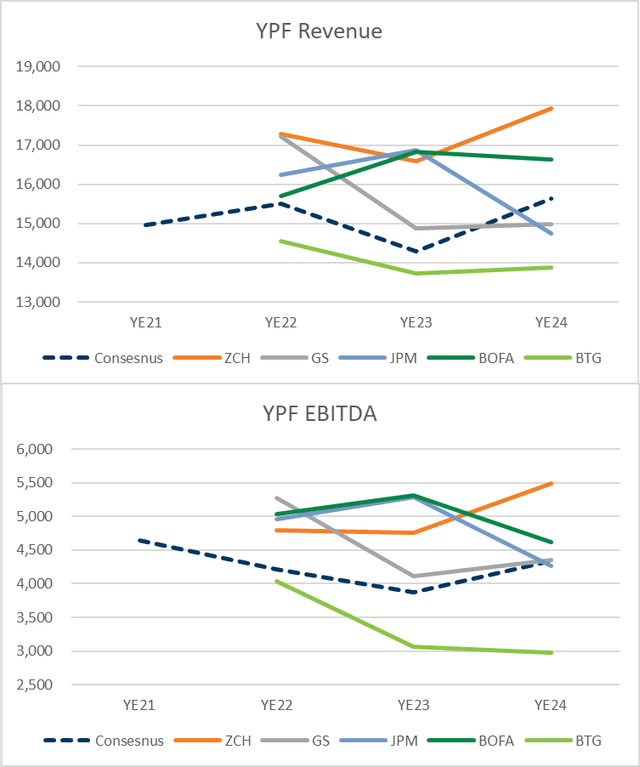

YPF has had a very good 1H22 and 2H22 is guiding for higher EBITDA on better pricing and higher production. However, as can be seen in the charts below, consensus (sell side analysts) doesn’t really believe YPF and assumes a return to price controls and flat or low growth in production.

YPF Consensus Revenue and EBITDA forecast (Created by author with data from Capital IQ)

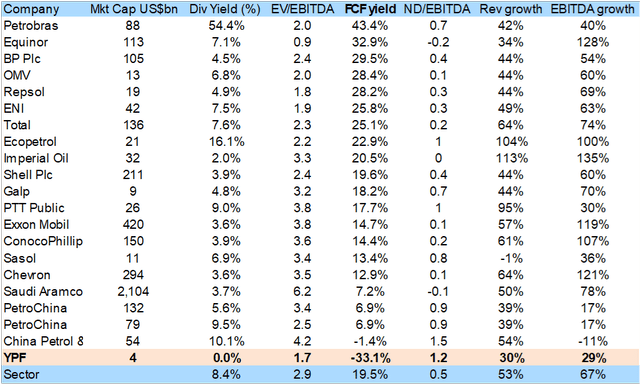

YPF is cheap but so are many oil stocks

YPF is cheap despite the recent mega rally. However, the global oil sector is also cheap and YPF does not really stand out on this metric, especially given extra risk ingredients.

Why are oil stocks generally cheap or trading 50% below historic levels is a whole other discussion, it may be due to the market’s oil price view i.e. that WTI/Brent will collapse in a recession, which I do not believe given OPECs stance. Or that oil has reached peak demand and is headed into a 30 year death spiral.

YPF shares vs global Integrated oil peers have one significant differential, its capex is far higher than cash flow i.e. negative FCF yield. The company is investing for growth while most other oil companies are increasing dividends and share buy backs or investing in renewable energy.

I value YPF at a 2.5x EV/EBITDA target multiple, lower than its 3.55x 20 year average. The market has generally discounted Argentina risk in YPF.

YPF Share Price Target and Valuation (Created by author with data from YPF)

Global Integrated Oil Company Comparables (Created by author with data from Capital IQ)

Conclusion

YPF is beginning a path of production growth, developing the Vaca Muerta assets, that should produce oil exports, margin and free cash flow growth that would then allow it to reduce debt and sustain further volume growth which creates considerable value for stakeholders, including the Argentine government and society. The upside is considerably more than the downside.

Be the first to comment