sweetandsour/E+ via Getty Images

We have all at least once wondered about what we would do if we won the lottery.

Well, today is the day. Let’s imagine that actually won.

After-tax, you are set to receive exactly $1 million.

What do you do with it?

This is a surprisingly difficult question to answer in 2022.

Treasuries (IEF) and corporate bonds (VCLT) yield a negative return once you deduct taxes and inflation.

Stocks (SPY) are also priced at a 2x higher valuation multiple than usual.

Homes (HOMZ) have experienced significant appreciation over the past 2 years and the most desirable properties now sell at substantial premiums to asking price.

Cryptocurrencies like Bitcoin (BTC-USD) experienced enormous upside in the last year and reached levels never seen before.

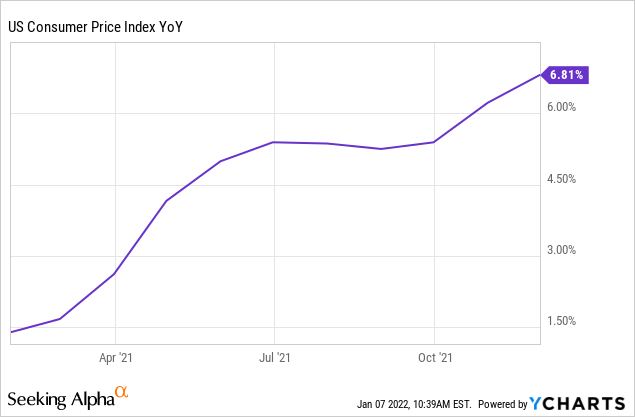

Finally, if you thought that holding cash was the answer, you need to remember that inflation is running at nearly 7% right now.

During most times, $1,000,000 would be a lot of money, but since everything has gotten so expensive, the million doesn’t go that far in 2022.

But don’t lose hope.

Treasuries, bonds, stocks, homes, and cryptocurrencies may have gotten crowded and expensive, but the universe of investment options is actually far larger than that, and opportunities remain abundant in some overlooked sectors of the market.

Below I describe what I would do with the $1 million. Please remember this relates to my personal situation, and therefore, what I do may not be right for you.

I am still fairly young, have a long-time horizon, a high-risk tolerance, and importantly, I have a strong affinity for real estate investing because that’s what I know best as a former private equity real estate investor.

Let’s get started:

Undervalued Real Estate via Publicly-Listed REITs: $400,000

Real estate is pricey and rightfully so.

We live in a world of ultra-low interest rates and high inflation, and this combination is particularly beneficial to real estate investors. On one hand, your property gains substantial value, and on the other, your cheap mortgage is slowly inflated away.

To give you a real-life example, in late 2020, I bought a property for ~$500,000, I put ~$100,000 down, and since then, the value of the property has risen by nearly $100,000, doubling my equity in the process, and because inflation is running at nearly 7%, the value of my mortgage, which is fixed, has lost in real value. Later this year, I expect to refinance the mortgage to pull some of that equity out of the deal and reinvest elsewhere.

Unfortunately, these insane returns are now well-known to investors and the competition for buying private properties has gotten so intense that transactions commonly close at large premiums to asking prices.

But there is still one hidden opportunity in the real estate market:

Enter REITs (VNQ).

REITs are publicly listed companies that only invest in income-producing real estate. Given today’s environment, you would expect such companies to be very popular and trade at high valuations, but contrary to all logic, many of them are priced at steep discounts due to temporary fears of the pandemic.

As a result, it is not uncommon to find REITs that trade at large discounts to the underlying value of their properties.

Just to give you a quick example: Clipper Realty (CLPR) owns a vast portfolio of apartment communities mainly located in Brooklyn and Manhattan. It is well-managed, has a good balance sheet, its rents are rising, and despite all of that, the shares are today priced at an estimated 30% discount to the value of the properties.

There are many similar opportunities. Macerich (MAC) owns the highest quality malls in the US and it is priced an estimated 50% discount.

Why are REITs so cheap?

They collapsed early into the pandemic due to the false perception that most of them invest in offices, hotels, and low-end malls. In reality, 90% of REITs invest in more defensive property types like apartment communities, cell towers, farmland, warehouses, and so on.

Since REITs are hybrids between stocks and real estate, they often end up mispriced because most stock investors understand little about real estate, and most real estate investors understand little about the stock market.

At times, they become overpriced (pre-2008) and at other times, they become undervalued (post-2020). I think that buying REITs at a discount to net asset value is very attractive because you are essentially getting real estate at pennies on the dollar that’s professionally managed, diversified, and liquid. You don’t need to deal with any of the tenants, you don’t have to sign on any of the loans, and your liability is limited. It results in exceptionally strong risk-to-reward and for this reason, I would allocate a large portion of my lottery winnings into discounted REITs.

Of course, as a real estate investor myself, I feel comfortable investing in what I know best. You may want to be more diversified.

High-Conviction Concentrated Equity Positions: $400,000

As noted earlier, I have a long-time horizon and a high-risk tolerance.

That’s reflected in how I invest in regular stocks.

Instead of building a well-diversified portfolio, which is probably preferable for most people, I seek to make concentrated investments in my very best ideas.

A great equity investment in my mind is one that:

- I can truly understand

- Has a strong moat

- An ability to reinvest capital at high rates of return

- A shareholder-friendly management

- And a discounted valuation with repricing potential

In other words, it’s a company that has a predictable path to above-market rates of return in the long run. Finding those opportunities is extremely difficult because for one, I can only understand a limited number of companies, and for two, most of the market is today fairly pricey.

A good example of such a concentrated investment is my single largest holding, RCI Hospitality (RICK), a strip club owner and operator. I am very bullish on the company because, as we explain in a recent report, it has a clear path to 20%+ annual free cash flow per share growth, but today, it is priced at just around 12x free cash flow, offering exceptional value for a rapidly-growing, high-quality business.

Source: RCI Hospitality

As its valuation multiple expands, and it delivers on our growth expectation, we expect it to deliver 20-25% annual total returns over the coming 5-10 years.

These superior returns come with high volatility of course. But since I have a long-term horizon, I am fine with that, and because my investments are concentrated, I also know them very well and have the courage to buy more when prices dip.

If I won the lottery, a large portion of the proceeds would go into these concentrated equity investments. It is the highest risk, but also the most rewarding portion of my portfolio.

Downpayment for Property Investment: $200,000

Earlier, I mentioned that it is getting increasingly difficult to buy private properties in today’s market. Competition is intense and prices are up significantly.

But that does not mean that you should skip real estate altogether. All it means is that you need to become more creative and selective in how you invest.

The real estate market is vast and versatile. While one location or property type may be pricey, others are still emerging and discounted.

An example in which I am investing in Estonia. I think that the capital city of the country, Tallinn, offers exceptional real estate opportunities for people who have a multi-decade investment horizon. That’s because today, they are still a small and emerging country, but over the coming few decades, I expect them to become one of the richest and most expensive countries on earth.

Source: Tallinna Sadam (OTCPK:TSMTF)

Why is that?

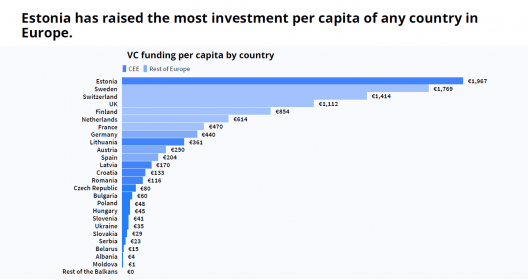

I have covered this topic at great length with members of High Yield Landlord, but put shortly, Estonia is on track to become the “Silicon Valley of Northern Europe” where young ambitious entrepreneurs move to enjoy the most business-friendly and digitally-advanced society of the EU and Euro-zone.

At the same time, it is also becoming the “Switzerland or Luxembourg of Northern Europe”, where older wealthy business owners and retirees move to reduce their taxes and improve their quality of life.

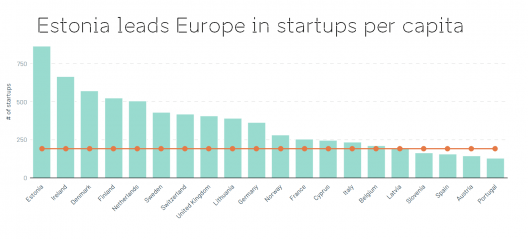

Today, Estonia already has the most Start-Ups per capita in the EU and the most Unicorns per capita (Tech start-up valued at over $1B) in the entire world. Massive companies like Wise (OTCPK:WPLCF), Bolt, Pipedrive, and Skype are emerging from this small country of 1.3 million people and these successes are leading to rapid economic growth and real estate appreciation.

Today, the highest quality properties of Tallinn are still nearly 3x cheaper than in Helsinki, just 30 miles north, but over time, we expect Tallinn to become more expensive, leading to substantial price appreciation.

Essentially, Estonia is yet another small country that’s positioning itself to replicate the past successes of Luxembourg, Switzerland, Monaco, and Lichtenstein. All these small European countries have one thing in common: they are great for business, pull talent and capital, and have notoriously expensive real estate.

Now is still a good time to buy quality assets in Estonia and that’s why I would put a portion of the proceeds into a downpayment to buy another property. With $200,000, I would probably target a property that’s worth ~$600,000-800,000, adding cheap leverage to my lottery winnings, and diversification to the whole portfolio.

Bottom Line

As you can tell, my real estate heavy investment plan is quite unique and probably wouldn’t be suitable for you.

That’s why this question is so interesting. Tell us in the comment section below what you would do if you won $1,000,000 in the lottery. Thanks for reading!

Be the first to comment