Pgiam/iStock via Getty Images

(This is the first part of a series we have started on our service, Yield Hunting.)

The current market environment can be characterized as one with significant future risks. This is one of those times where the consensus looks like they will be right where a recession is highly likely and expected by the majority. In this report, we discuss how we are investing today to mitigate risk and lock in yields that we don’t expect to last.

We highlight a bunch of individual bonds but for those that do not like buying individual bonds (most investors have never done so but it has become much easier than in years past), we highlight ETF alternatives like BulletShares defined maturity ETFs.

Locking In Yields

Yields today are at levels not seen in more than a decade-and-a-half. For 15 years, we have had a ZIRP environment (zero interest rate policy). That meant yields on safe investments paid next to nothing.

There was no income in fixed income.

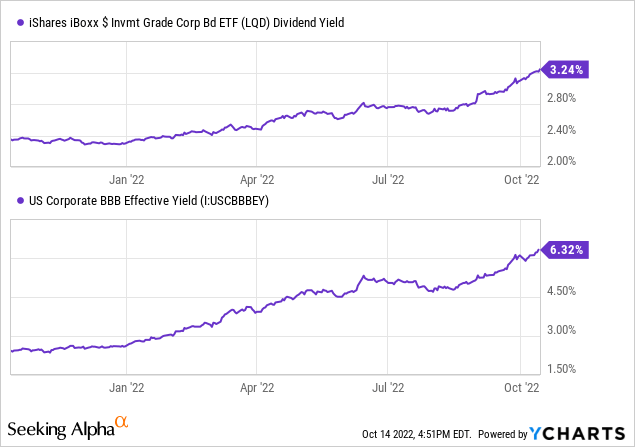

Today, investment grade bonds actually yield something. Below we have the iShares iBoxx Investment Grade Bond ETF (LQD) and below that, the US Corporate BBB Effective Yield. Remember, BBB is the lowest rung on the investment grade credit rating ladder.

ycharts

So the entirety of the investment grade bond space yields about 3.24% but if you focus on BBB-rated investment grade corporate bonds, the yield is much higher. Almost half of the entire investment grade corporate bond space is BBB-rated.

We think now is the time to start ‘locking in yields’ for the next couple of years. That includes a barbell approach where we look at some near-term maturities/call bonds as well as some long-term bonds that will not mature for at least 7 years.

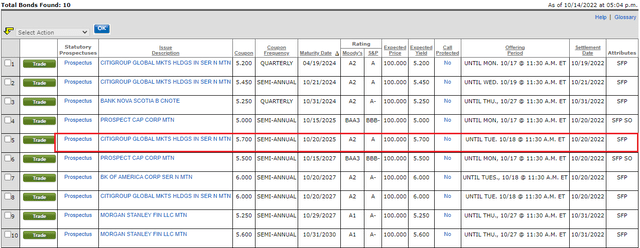

To demonstrate the change in income available today compared to just a year ago, we will use the CITIGROUP GLOBAL MKTS HLDGS IN SER N5.70000% 10/20/2025 MTN bond. This is a new issue that just came to market.

Below is the screenshot from Fidelity’s bond research center of new corporate issues. Fidelity has the best individual bond platform for retail investors that I have found.

fidelity

What I want to stress is the difference in income that can be produced today. We are at a point now where you can generate $50,000- $65,000 annually per million invested in high grade corporate notes. A year ago, you produced maybe $6,000.

In other words, for the same bond purchased a year ago, you are generating 900% more income.

Not bad.

This is why we are in favor of purchasing these investments today. While we may not be at the highs in rates, we think we are much closer to the end than the beginning.

The Fed will likely continue to tighten into next year but we think the market is pricing a lot of that in right now with that 5.0% terminal rate.

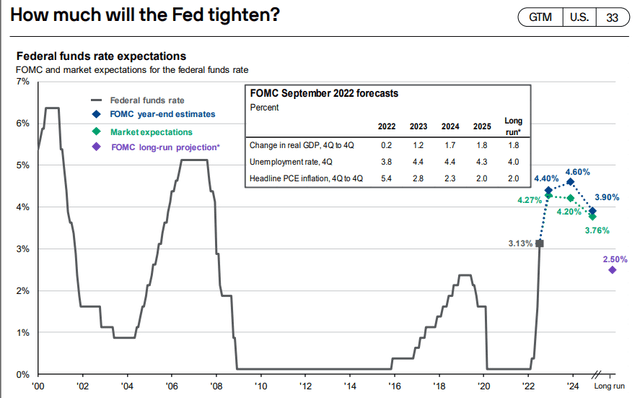

How much will the Fed tighten?

jpmorgan

The terminal rate – or the expected highest rate that the Fed moves rates to – is now approaching 5.0%. The market has been terrible this year at forecasting this rate. As inflation has moved higher, or not subsided nearly as fast as expected, the terminal rate has adjusted up.

In other words, the market believes that it will take more and more restrictive monetary policy to get inflation under control.

It is time to start nibbling on these issues and reducing risk while increasing overall portfolio yield. A year ago, our taxable CEFs barely yielded these levels with 35% leverage and a 5% discount.

With our macro outlook, we think being underweight equities and CEFs in your portfolios makes sense. Instead, we need to overweight defensive and ‘bendable’ assets.

What is a Bendable Asset?

The fixed income market aligns itself into three broad buckets: the traditional risk-off assets (such as treasuries and agency MBS), ‘bendable’ assets (such as investment grade corporates and senior non-agency MBS), and ‘breakable’ assets (such as high yield and EMD).

Today, we want to avoid breakables. High yield spreads are just far too tight for us to invest in, in the face of a recession.

Risk-off assets are okay here, especially on the short end. But we think venturing into corporate debt of investment grade caliber, results in higher yields with little to no additional risk.

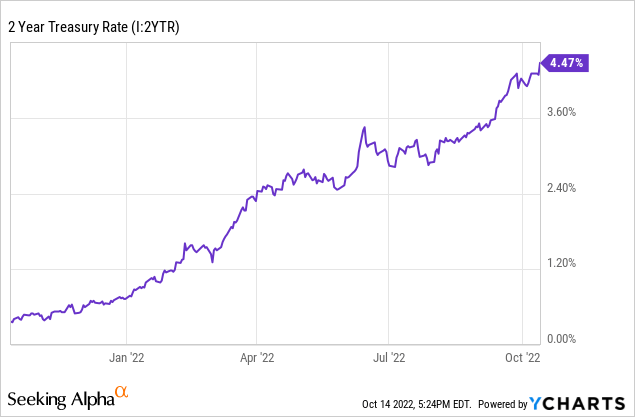

The two-year treasury note now yields 4.5%. This is an investment that has no credit risk (risk of default) in theory, and no real interest rate risk since it matures so soon. A year ago, the note barely yielded 0.3%.

ycharts

The distinction between risk-off and risk-on assets is widely understood. What distinguishes “bendable” assets from “breakable” ones? Bendable assets will experience a “linear” widening in their risk premia while many breakable assets will “gap” to the downside in terms of price.

In other words, breakable assets will act more like stocks with large downside moves. Bendable assets will decline but far less than stocks and breakable assets.

A “breakable” asset is one whose valuation suddenly transitions from “going concern value” to “workout value”. Needless to say, when the market changes its valuation paradigm, the ride down is stomach churning.

Bendable Assets To Consider: Investment Grade Corporate Notes

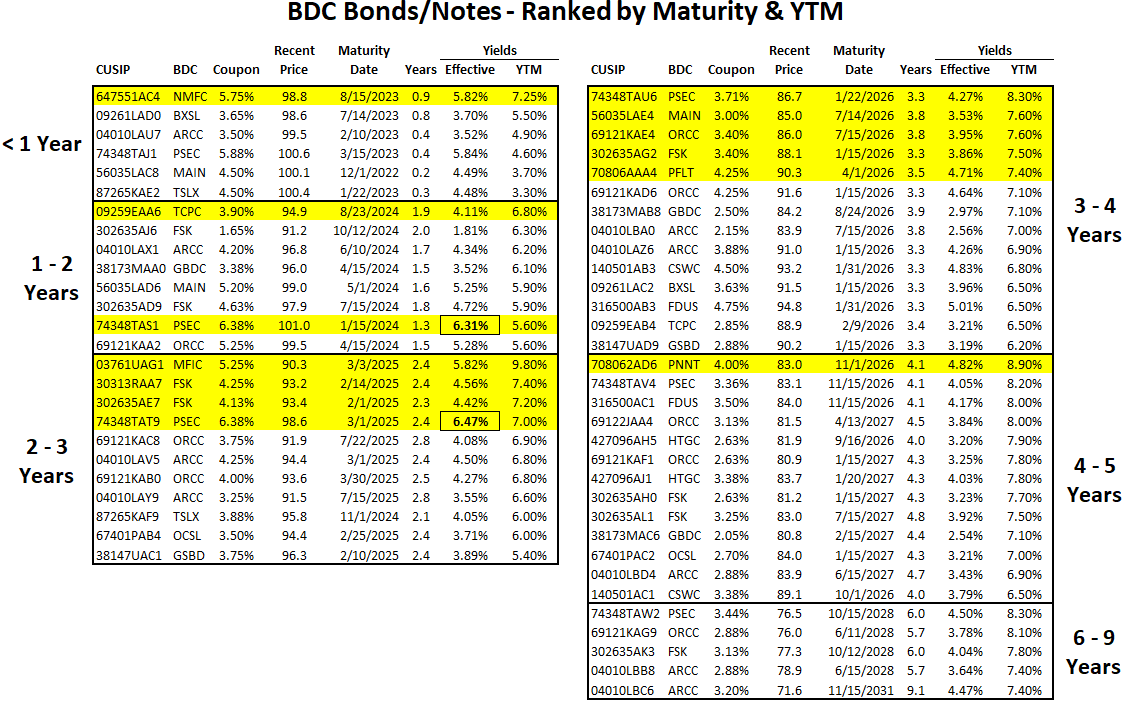

1) BDC Notes. Follow BDC Buzz for the best research on these notes on the planet. These are the leverage vehicles for the underlying common shares of the BDC. For example, Ares Capital (ARCC) has 9 individual issues with maturities ranging from Jan 2023 to Aug 2031. Yield-to-maturities are 4.5% to 7.4%.

Imagine getting 7.4% for an investment grade bond today. That wasn’t even achievable in half of the high yield market previously.

bdcbuzz

What we like today- combining some shorter-dated maturities while also locking in some longer-dated ones. That’s why I like the table above (from BDC Buzz).

(1) Ares Capital – (ARCC) 2.15% 2026 (04010LBA0) YTM: 7.0%

(2) PennantPark – (PNNT) 4.00% 2026 (708062AD6) YTM: 9.0%**

(3) Golub – (GBDC) 2.50% 2026 (38173MAC6) YTM: 7.2%

(4) Owl Rock – (ORCC) 2.625% 2026 (69121KAF1) YTM: 7.9%

(5) Hercules Cap – (HTGC) 3.375% 2026 (427096AH5) YTM: 7.8%

(6) Ares Capital – (ARCC) 3.875% 2025 (04010LAZ6) YTM: 6.9%

(7) Ares Capital – (ARCC) 2.875% 2028 (04010LAZ6) YTM: 7.4%

(8) Owl Rock – (ORCC) 2.875% 2028 (69121KAG9) YTM: 8.1%

(9) Main Capital – (MAIN) 3.0% 2026 (56035LAE4) YTM: 7.6%

Individual Corporate Issues

(1) Goldman Sachs – (GS) 5.0% 2025 BBB+ CUSIP: 38150APA7

(2) Dow Chemical – (DOW) 5.4% 2027 BBB CUSIP: 26054MAR2

(3) TD Bank Step-Up – (TD) 6.0% 2028 A CUSIP: 89114X4B6

– From 10/17/2022 – 10/17/2025 Coupon will be 6.00%

– From 10/18/2025 – 10/17/2028 Coupon will be 6.25% if not called

(4) Citigroup Global – (C) 5.25% 2024 A+ CUSIP: 17330RHB4

(5) TD Bank Step-Up – (TD) 5.5% 2025 A CUSIP: 89114X4A8

– From 10/17/2022 – 10/17/2024 Coupon will be 5.50%

-From 10/18/2024 – 04/17/2025 Coupon will be 5.75% if not called

-From 04/17/2025 – 10/17/2025 Coupon will be 6.25% if not called

(6) TD Fixed Coupon – (TD) 6.0% 2026 A CUSIP: 89114X4N0

iBonds and BulletShares as Individual Bond Alternatives

iShares, from Blackrock, and BulletShares from Invesco, offer up defined maturity bond ETFs. These are ETFs that liquidate at a certain date in the future and hold bonds that mature around that date. This gives the investor the look and feel of an individual bond, but with the ease of purchasing and selling an exchange-traded security.

These securities have unique attributes: Both companies have investment grade, high yield, and muni options.

You can easily build a bond ladder with these tools. Of course, they are not frictionless as there are some fees and other costs that would reduce overall total returns. But that needs to be weighed with the ease of use.

Remember, we need to balance the maturities. At this point investors should be locking in some yield here for longer time periods. One of the advantages that the ETF has over many of the individual corporate issues is the lack of a ‘call’. Sure, some of the underlying holdings have calls but the fund is managed so that they model out calls for the next several years.

Right now, you don’t get paid much extra to go out on the maturity spectrum. For instance, the BulletShares 2032 Corporate ETF (BSCW) yields 5.85% but the BulletShares 2026 Corporate ETF (BSCQ) yields 5.33%.

But make sure you think about this correctly. Yes, you only get an extra 50 bps to go out 6 additional years – and accept all the interest rate risk that comes with it.

However, if a year from now, rates come down hard, then that longer-dated option will bounce much harder because of the longer duration. When rates are up like they are now, we want to lock in some of that for as long a time as we can.

When rates come back down (again, not likely for at least a year), you will wish you owned long-dated high-quality corporate and municipal bonds.

Concluding Thoughts

We think investors should consider locking in some of their portfolios into longer-term corporate bonds. Individual bonds today are at an advantage to taxable bond CEFs despite the wide discounts in the latter. Given the headwinds to CEFs in this environment, we are still maintaining an underweight to CEFs and putting that capital into high-quality, investment grade, individual bonds.

For those that do not like or want to invest in individual bonds, the use of BulletShares (from Invesco) and iBonds (from Blackrock) is an easy alternative.

How much should you put in this area?

Right now, between individual corporate bonds and BDC notes, my portfolio is now weighted nearly 35% to this bucket. That does not include individual munis. What you should have is really up to you but the risk-return dynamics of this area of the market cannot be understated!

Be the first to comment