IakovKalinin

Life is too short. That’s what they all say. Though “they” have hundreds, maybe even thousands or more different reasons for saying it.

How about you? Go ahead and fill in the blank…

Life is too short because/when/to ______.

I really want to know. So please leave lots of comments down below after you’ve finished reading through!

For now though, let me share my rather long-winded answer to that simple yet oh-so-important question.

As I mentioned in a recent article, around three months ago, my perspective changed. That was thanks to my first grandchild – a boy – being born. As I explained:

“I remember those days when I had to change diapers during the darkest hours of the night. In fact, I think I have an all-time record for changing diapers. My five kids are well-laddered, so as one kid was potty-trained, another one was born.”

At times, every hour felt like an eternity as a parent. But being a grandfather has changed my mindset, as I am constantly reminded that my time on this planet is finite.

Therefore, I must take advantage of every waking minute of the day.

My Pre-REIT Life Was Filled With Risk

When I was in my twenties – well before I was a real estate investment trust (‘REIT’) guru – I’ll admit I took some risks such as flying single engine airplanes. Pulling so many all-nighters probably wasn’t so smart either.

When I was in my thirties, I took even bigger risks, just in different ways. By that, I mean buying vacant land and investing in non-income properties.

And that only got worse in my forties. During that particular decade, I became even more fixated on building an empire.

And I did it by taking on excessive leverage without examining the potential for things to go wrong.

If I’m being completely honest, I didn’t examine risk at all for the first 20 years or so of my real estate career. Although I was taking on enormous amounts of it at the time, I wasn’t aware that I could lose money.

As long as the banks kept lending, I kept borrowing.

I remember one project I worked on. It was a franchise location that I needed a $200,000 loan for to upfit the space and purchase equipment.

I chose a likely bank – one that I’d never been to before, mind you – walked in, and sat down with a loan officer. Less than an hour later, I walked back out with a check for $200,000 payable to Brad Thomas.

There was no collateral required other than my signature.

It seemed so easy, and it was. But easy doesn’t always make it right. Or intelligent.

As I’ve since informed all five of my kids, leverage can be good. And it’s important to always strive to build a solid credit profile.

But leverage can also be bad, especially when you don’t take risk into account.

I guess I had to find that out the hard way.

The Positive Side to My Previous Pitfalls

By the time I was forty, I’d amassed a collection of net-lease properties, shopping centers, warehouses, and vacant land. I also owned over 12 duplexes and was an investor in two national franchises.

That would have been even more impressive – and definitely more sustainable – if I’d ever considered what Howard Marks wrote in The Most Important Thing:

“Risk is the most interesting, challenging, and essential aspect of investing.”

Marks, who cofounded Oaktree Capital Management, is now worth $2.5 billion. But he began his impressive career at Citibank with much less than that.

There, he started a portfolio of high-yield bonds after meeting with junk bond king Michael Milken. And in order to be successful in that endeavor, he had to learn a thing or two.

Like how “loss is what happens when risk meets adversity.”

I just never thought about it like that though. I didn’t give enough thought to the potential for my gravy train to come to an end.

I was taking on excessive risk, instead of taking wise words like this into consideration (from Marks once again):

“Great investing requires both generating returns and controlling risk. And recognizing risk is an absolute prerequisite for controlling it.”

Most of you didn’t know me prior to my 12-year tenure at Seeking Alpha. But I can assure you I’ve learned my lesson since then.

These days, I have a greater understanding of investing: how monetary success is gained by playing good offense (earning money) and defense (spending as little as possible).

As Marks wrote, “Risk is inescapable.” Recognizing that is why I’ve become an intelligent REIT investor. As Ben Graham explained:

“Adversity is bitter, but its uses may be sweet. Our loss was great, but in the end, we could count great compensations.”

That’s the story of my life.

2 REITs We Will Not Buy

It doesn’t have to be the story of your life though. You can learn from my mistakes instead of your own.

I’m Avoiding Global Net Lease (GNL)

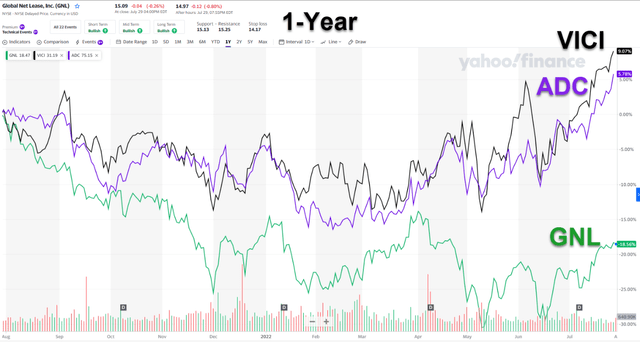

As you may already know, I own and recommend a number of net lease REITs including Realty Income (O), STORE Capital (STOR), Agree Realty (ADC), VICI Properties (VICI) and others. However, one of the names that I have avoided is GNL.

Just for starters, GNL is externally managed by AR Global, a sponsor with its hands in other REIT pies (other than GNL) such as The Necessity Retail REIT (RTL), Healthcare Trust, and New York City REIT. Collectively AR Global manages 69 million square feet with around $12 billion of AUM.

GNL has a market cap of ~$1.6 billion so it would seem as though the company is large enough to manage itself, if it weren’t for this manager-centric long-term contract that does not expire until June 2035.

So, what this means is that AR Global can milk the fees for another decade or so, while investors get the very last bit at the apple. Kevin Egan did a nice job explaining the “put the manager first” model:

“GNL has bucked this trend, as its G&A fee load has actually increased to 1.24% in 2021 from 1.08% in 2017, showing that the firm has actually experienced diseconomies of scale.”

Kevin is 100% correct, in that there’s zero alignment of interest when you’re a shareholder in GNL, since the external fund manager is more focused on what’s in his pocket, versus Average Joe or Jane.

More importantly, do not let the juicy 10.6% dividend yield lure you into the buy zone. This is an old trick amongst the Wall Street crowd in which they show off their shiny looking toy, later to dupe the participant into a big fat dividend cut.

And keep in mind, that’s already occurred with GNL, and it appears to be a chronic case of dividend-cuts-aplenty.

If that hasn’t scared you off yet, just read what Kevin Egan had to say,

“I estimate that AFFO/share will be diluted by -3.2% from external growth alone. While a dilutive cost of capital typically results in REITs taking their foot off the gas pedal until their cost of capital recovers, GNL has not shown this discipline as management acquired $492mn of real estate in 2021 at an average cap rate of 8.9% despite a depressed share price (GNL’s dividend yield averaged 9.2% in 2021).”

With an equity multiple (AFFO yield) of 11.7% it will be hard for GNL to issue equity, as Egan explains,

“…while most management teams are likely to put the brake on acquisitions when their share price is not trading at accretive levels, dilutive capital costs do not seem to be a deterrent for AR Global.”

Call it what you want – value trap, sucker yield, or lemon – I would not touch this toxic net lease REIT for any reason whatsoever. A dividend cut is likely given the continued dilutive impact (consistent decline in FFO per share) and reckless management structure.

By the way, this is not the first time that I have recommended staying away from GNL, and I hope readers listened as our top picks have blown past this little stinker.

I’m Also Avoiding Necessity Retail REIT

I just mentioned RTL above, a diversified retail REIT that is also externally managed by AR Global. The company owns 1,029 properties – consisting of 48% net lease and 52% shopping centers – in 48 states.

Just like GNL, RTL has no employees, since the management team provides services under contracts with its Advisor, AR Global. In addition, RTL also invests in net lease properties (48% of the portfolio) so it essentially competes with GNL, as explained in RTL’s Annual Report,

“Many investment opportunities that are suitable for us may also be suitable for other entities advised by affiliates of AR Global. For example, Global Net Lease or “GNL,” an entity advised by affiliates of our Advisor seeks, like us, to invest in sale-leaseback transactions involving single-tenant net-leased commercial properties, in the U.S.

An investment opportunity allocation agreement to which we and GNL are parties states that we will have the first opportunity to acquire one or more domestic retail or distribution properties with a lease duration of ten years or more and that GNL will be given first opportunity to acquire office or industrial properties.

However, there can be no assurance the executive officers and real estate professionals at our Advisor or its affiliates will not direct attractive investment opportunities for which we do not have contractual priority to GNL, or other entities advised by affiliates of AR Global.”

Does that sound like you would be happy owning GNL knowing you’re playing second fiddle, or vice versa?

Once more, RTL’s management agreement with AR Global reads,

“Our advisory agreement with our Advisor does not expire until April 29, 2035, is automatically extended for successive 20-year terms upon expiration and may only be terminated under limited circumstances.”

Hmm…almost the same expiration date as GNL…

Who’s getting rich here folks?

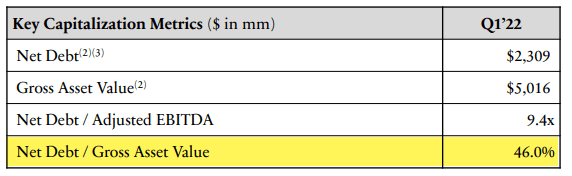

Now if this has not scared you off yet, take a look at RNL’s capital structure:

RTL Investor Presentation

As you can see, RTL has a highly-levered balance sheet and of course this means that the company’s cost of capital is much higher than other net lease REIT or shopping center REITs peers. Just take a look that Equity Yield (AFFO multiple) for RTL and several peers:

AFFO Yield

- RTL: 13.8%

- Kimco (KIM): 5.2%

- Regency Centers (REG): 5.1%

- Realty Income (O): 5.1%

- Agree Realty (ADC): 4.7%

- VICI Properties (VICI): 5.5%

Shocking right?

RTL’s dividend yield is currently 10.9% and that’s even after a dividend cut in 2020 in which the distribution was cut from $1.10 per share to $.70 per share.

I could go and on, but hopefully you get the point… life is too short to invest hard-earned capital into REITs like RTL.

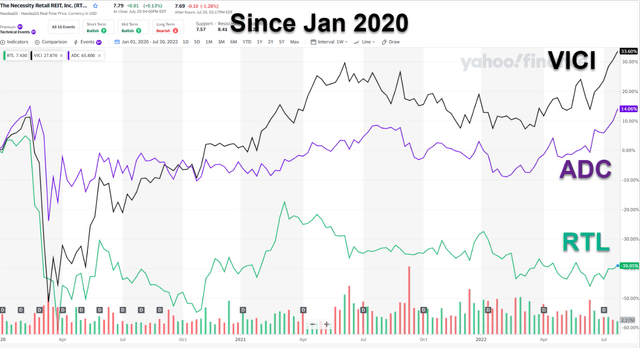

By the way, I cautioned readers prior to Covid-19 to avoid this name and here’s a visual validating my harbinger call:

Now It’s Your Turn

Our time on this planet is limited and the older I get I’m reminded that I must make the most use of my time to do what I enjoy (one of these things is writing on Seeking Alpha).

My grandson, Asher, is now three months old, and as many of you know, I really enjoy spending time with him.

I also enjoy teaching, which is one of the reasons that I decided to teach again at NYU this fall. It’s not necessarily a wealth creation gig, but this is one of the things that I really enjoy doing.

In order to do some of these things that I enjoy, I have also decided to cut back on things that aren’t productive.

Also, as I explained earlier, I always analyze the risks for each company that I decide to invest capital, and I always ask myself this all-important question before I decide to pull the trigger…

“Life is too short to _____”.

“The best preparation for the future is to live as if there were none.” – Albert Einstein

Happy REIT Investing!

Author’s Note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: written and distributed only to assist in research while providing a forum for second-level thinking.

Be the first to comment