ArtistGNDphotography

Investment Thesis

YETI Holdings, Inc. (NYSE:YETI), the iconic brand name of drinkware and coolers, is down 58% from its high in early November 2021. YETI sold off during the broader market decline that has been especially harsh to consumer discretionary stocks. However, YETI’s operational performance has been quite strong anchored by a strong consumer. YETI posted 19% revenue growth in its most recent quarter, completed a $100 million share repurchase, and reiterated guidance for 2022. Operating a fairly diversified strategy with a high-end product that attracts a high-end consumer, I believe YETI will weather any macroeconomic headwinds that may come its way. With shares down considerably, YETI appears attractively priced and may offer an opportunity for patient investors.

Current headwinds are temporary

YETI is not immune to the supply chain and inflationary environment most companies find themselves in today. Indeed, gross margins took a 5.9% hit in its most recent quarter, mainly due to increased freight costs. Add in a non-recurring 2.2% hit to true up prior year inbound freight costs resulting from a late-arriving invoice and that’s an 8.1% decline year of year. However, these headwinds are short-term and will improve throughout the remainder of the year. During the Q1 2022 earnings call, CEO Matthew Reintjes had this to say on the topic:

Even with this headwind, we continue to expect improving margins and profitability as we progress through fiscal 2022.

As we look forward, we have reiterated both our full year gross margin target of approximately 55% and our full year adjusted operating margin target of approximately 20%.

With the stock down as much as it is, the market is doubting YETI’s guidance and ability to deliver, but investors with a multi-year time horizon may view this weakness as an opportunity to pounce.

Customer base more immune to macro woes

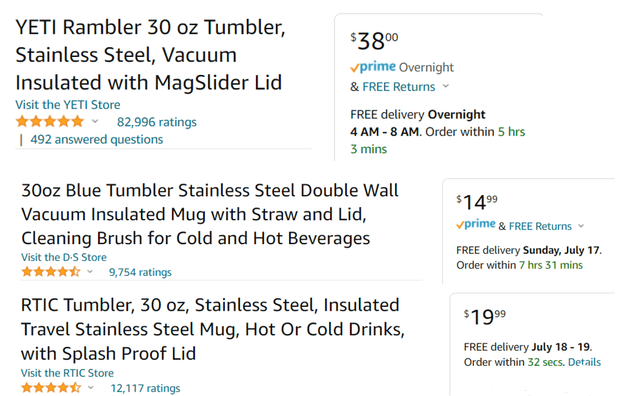

Those familiar with YETI’s products know they offer excellent quality but are very expensive. A 30-ounce Rambler is $38. A lunch box is $80. Coolers will run you $250+. Their stuff is by no means cheap. With gas at $4.50+ per gallon, inflation at 9%, and every headline talking about a recession, you have to believe YETI’s revenue is going to take a hit. I too am in this camp.

As I was researching YETI, my wife and I got to talking about the company. We both knew their product was expensive, so I asked her…”Why would anyone spend $80 on a lunch box? Or buy a $40 tumbler from YETI when they can buy a $20 tumbler from RTIC?”

Her reply to me was quite enlightening. She said…”people buy YETI for the same reason they buy an Acura over a Chevy.” In other words, they can afford it. They have more disposable income and are willing to pay up for quality. This is the same reason consumers buy lululemon (LULU) over Target brand (TGT) or even Nike (NKE).

30 oz tumbler comparison (Amazon.com)

I am not suggesting YETI will be able to skate through a recession unscathed or without an impactful drop in revenue and profitability. I am suggesting YETI’s customer base is made up of higher end consumers with greater disposable income than those shopping at Dicks Sporting Goods (DKS) or Walmart (WMT). These higher income consumers are likely to weather a recession better than most which should help buoy YETI during economic hard times. The price point of YETI’s products, past revenue growth, and ability to increase pricing to offset inflation are my supporting evidence.

More diversified than you think

You may think of YETI as a one-trick pony, serving primarily as a wholesaler to retailers such as Dicks Sporting Goods and REI. But YETI is more diversified than you think.

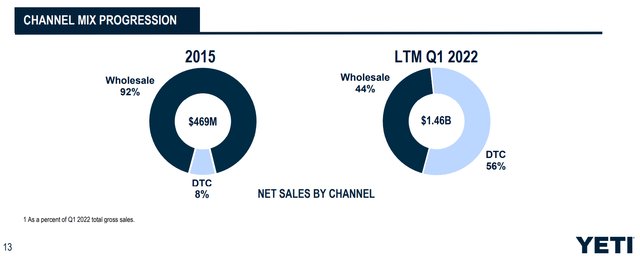

Growth in DTC

In 2015, YETI’s direct to consumer business only accounted for 8% of total revenue. Fast forward to 2022 LTM and that number is 56%. YETI’s investment in the online channel has clearly paid off, resulting in a significant expansion in DTC. DTC sales are also higher margin than wholesale, so the significant shift to DTC as a percentage of revenue is a welcome sight.

YETI Channel Mix (YETI IR Website)

Wholesale remains strong

YETI’s wholesale channel continues to be strong. They have numerous partnerships with national retailers including Bass Pro Shops, Dicks Sporting Goods, and REI. In Q1 2022, wholesale channel sales increased 14% year over year compared to DTC’s growth of 23%. It’s encouraging to see wholesale increasing alongside DTC.

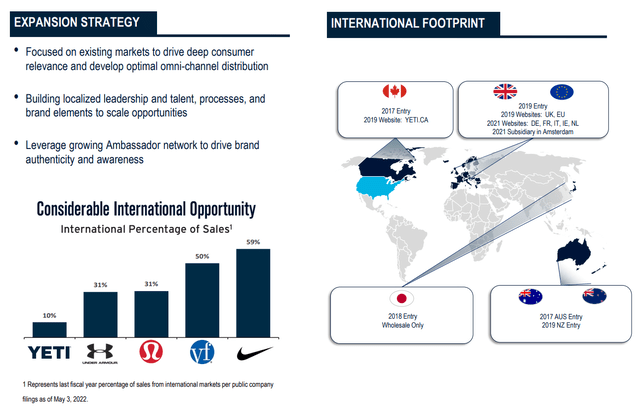

Long runway for international expansion

I find YETI’s international growth opportunity most appealing. Currently, international sales only account for 10% of revenue and I believe they’ve only scratched the surface. CFO Paul Carbone said as much during the Q1 2022 earnings call:

And what we’ve said is there is no reason international in this business, over the long term, shouldn’t be north of 20% of our business. And we really like the growth that we’re seeing in our international business.

International Opportunity (YETI IR Website)

Risks

No investment is without its risks. Here are a few that could prevent this investment thesis from playing out as expected.

Competition gains market share

Competition in the drinkware and cooler industry is already steep. YETI has been dealing with knockoffs and look-a-likes for years. Thus far, they’ve been able to stave off the competition, but should a competitor such as Coleman or Igloo dethrone the king, YETI shares are sure to suffer.

A prolonged recession impacts everyone

A recession lasting more than a year is likely to have a substantial impact on all consumers, even those with greater disposable income. YETI, like nearly all consumer discretionary companies, is likely to feel the economic pain should this scenario play out.

Product not well received internationally

Just because YETI is successful domestically doesn’t mean it’ll have the same success internationally. If international markets are not willing to pay up for the YETI brand, international performance is likely to suffer. This could limit YETI’s return potential in the long term.

Valuation

For growth companies like YETI, I use the historical S&P 500 PEG ratio to find an appropriate market multiple. The S&P 500 PEG ratio typically ranges between 1.2 and 1.6. It currently sits at 1.2. But with the market in such turmoil over recession fears, I will use 1.0 which equates to a S&P 500 PE of 10 using 10% per share earnings growth (10 divided by 10 equals 1.0 PEG).

The 18 analysts covering YETI have a 2023 consensus EPS estimate of $3.49, which equates to 20% growth over 2022 assuming YETI delivers near the expected $2.90 EPS.

Put it together and these figures equate to an estimated market multiple (PE) of 20 (20 x 1.0) and a fair value of $69.80 ($3.49 x 20). With a current value near $45 per share, YETI appears to be 36% below its fair value using the market multiple approach.

Conclusion

YETI is an iconic brand offering a high-quality product at high-quality prices. Their customer base is comprised of higher income consumers who should be able to weather economic hard times better than most, which could buoy YETI’s financial performance. YETI operates a strong omni-channel business and is fairly well diversified, which should help to dull the effects of an economic downturn. With shares significantly off their high, YETI appears to be attractively priced for patient investors willing to hold for the long haul.

Be the first to comment