Spencer Platt

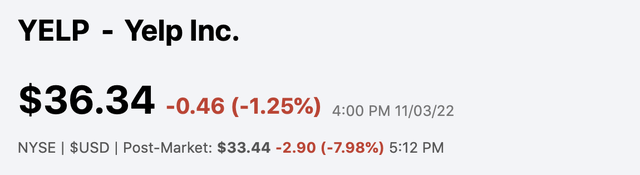

Like clockwork, Yelp (NYSE:YELP) reports strong quarterly results and the market mostly yawns. The consumer review site even repurchases shares at very discounted prices, but the stock is still stuck below $40. My investment thesis remains ultra-Bullish on Yelp due to the deep value, but the catalyst to make investors actually load up on the stock won’t be clear until after it actually occurs.

Another Great Quarter

Yelp reported Q3’22 revenues grew 14.8% to reach $309 million. The consumer review site cut Q4 expectations due to the tough macro environment in the local advertising market, but the company historically easily beats estimates, including $1.5 million in the last quarter.

The company even remains incredibly profitable, with adjusted EBITDA hitting a record of $74 million in the quarter. Yelp cut the EBITDA range for the year at $265 to $275 million from a previous high-end range of $285 million.

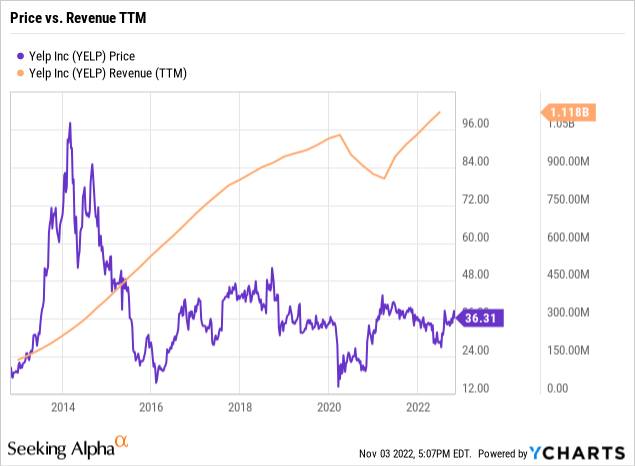

The company expects to report record revenue for the year at $1.19 billion, yet the stock has been flat for years, trading in the $30 to $40 range. As the below chart highlights, Yelp has grown revenue tremendously over the years (outside of the Covid hit), yet the stock hasn’t gone anywhere as revenues roar higher.

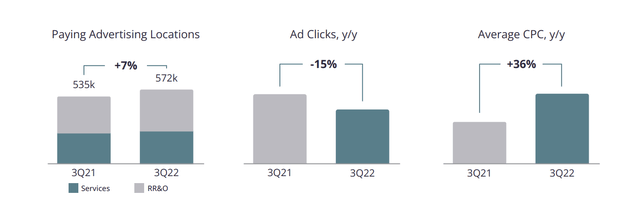

The company entered the year-end with paying advertising locations hitting a record 572K, up 7% from 535K last Q3. Outside of the macro environment causing some restaurants to likely pull in ad spending over the holidays, Yelp was hitting strong growth.

The updated Q4 revenue midpoint of $305 million amounts to 11.6% growth. Once considering the typical few million beat, Yelp could easily top 12% revenue growth in the current quarter.

Perplexing Stock

The odd part about the stock is that the market constantly sells it off due to volatile financials, yet the company always moves the business forward. Investors should expect another record year in 2023 with revenues reaching $1.3 billion. The company should hit record EBITDA for the year, with or without a domestic recession.

Possibly, the market is too fixated on the profit picture, not understanding the massive cash flows of the business. Yelp reports minimal GAAP profits, mainly due to stock-based compensation.

Yelp ended September with $442 million in cash to feed another $250 million stock repurchase program. While the company reported net income of only $9 million in Q3’22, adjusted EBITDA jumped to $74 million. SBC only accounted for half the EBITDA boost, with another $10 million for asset impairments along with other non-cash charges added back.

The large share buyback program is most likely incorrectly associated with repurchasing shares to cover the SBC issuance. In reality, the company reduced share counts in Q3 by nearly 5 million YoY to 72.6 million shares.

The stock only has an enterprise value of $2.0 billion due to the large net cash balance and the market cap dipping to $2.4 billion with the after-hours sell off to $33. If one just assumes 2023 EBITDA of $300 million for minimal 11% growth, the stock trades below 7x EV/EBITDA targets. A more normal economic climate could lead to higher adjusted EBITDA next year.

Takeaway

The key investor takeaway is that Yelp is just unloved at this point. The company continues to execute on initiatives to drive financials much higher over time, yet the stock is stubbornly stuck at levels associated with targets from years prior to Covid.

At 10% revenue growth, Yelp should probably trade at an EV/EBITDA target of 15x, suggesting a stock price at least double the current price. The market has no interest in paying this valuation for the consumer review site, yet additional growth will eventually reward shareholders, and those sitting on the sidelines are likely to miss the ultimate catalyst.

Be the first to comment