Spencer Platt

Investment Thesis: I take a long-term bullish view on Yelp (NYSE:YELP) as a result of strong growth in net revenue and earnings, along with an attractive EV/EBITDA ratio and a healthy cash position.

As a leading business review site – Yelp saw a decline in the past year before seeing a significant rebound in price on the back of strong Q2 2022 results:

The purpose of this article is to investigate whether the stock has the potential to trail higher from here.

Performance

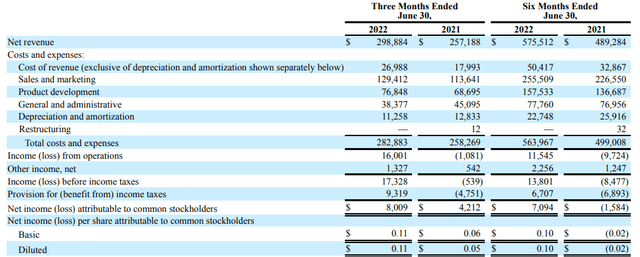

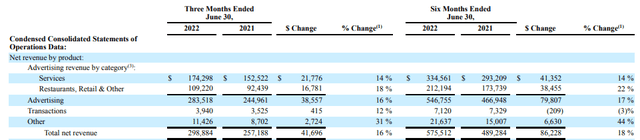

On a six-month ended basis, Yelp saw a strong rebound in earnings (both basic and diluted) from -$0.02 per share in June 2021 to $0.10 per share in June 2022. This was driven by a 17% increase in revenue over this period:

From a balance sheet standpoint, Yelp has seen a decrease in its quick ratio over the past six months (measured as cash and cash equivalents plus accounts receivable all over total current liabilities):

| December 2021 | June 2022 | |

| Cash and cash equivalents | 479783 | 421162 |

| Accounts receivable | 107358 | 124690 |

| Total current liabilities | 164013 | 180006 |

| Quick ratio | 3.58 | 3.03 |

Source: Figures sourced from Yelp Form 10-Q: Q2 2022. Quick ratio calculated by author.

With that being said, the company still has more than sufficient cash reserves to cover its current liabilities, and I take the view that investors would prefer the company to utilize excess cash reserves if it means significant growth in earnings.

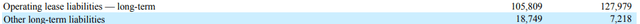

Additionally, the company’s long-term liabilities have seen an overall drop – driven by lower long-term operating lease liabilities (figures for June 2022 on left and December 2021 on right):

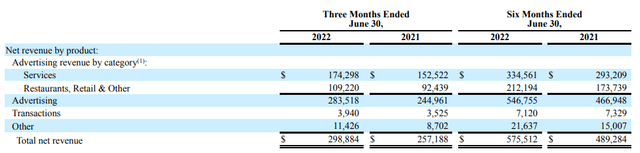

Moreover, when looking at the breakdown in net revenue on a six month basis – we can see that on a percentage basis – Restaurants, Retail & Other saw the most growth (at 22%) as demand for eating out rebounded strongly post-pandemic – facilitated by the strong rebound in travel demand.

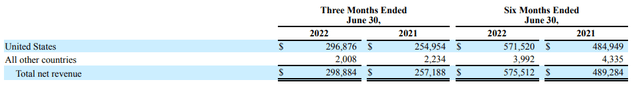

The United States accounted for the majority of the company’s net revenue in the most recent quarter:

While Yelp did broadly see a rise in costs as a result of increased marketing efforts – the company’s impressive earnings have lifted the stock significantly.

Looking Forward

When looking to the immediate future – inflation could be a concern for Yelp as with other businesses.

While a strong rebound in restaurant demand resulted in a strong boost in advertising revenue across this segment – the combination of inflation and potentially less demand heading into the winter months could mean that the growth we have seen across this segment might plateau in the short to medium term.

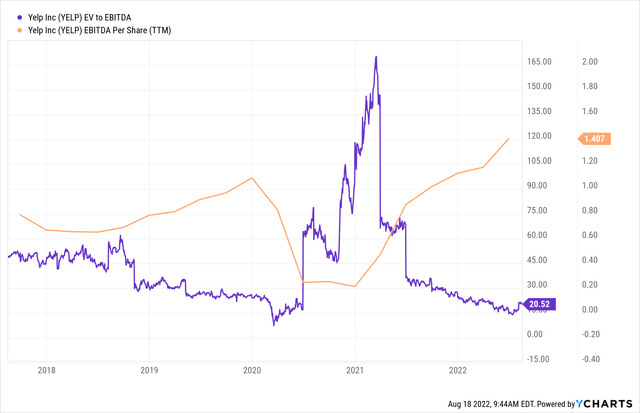

From an earnings standpoint, we can see that the company’s EV to EBITDA ratio has decreased to near a five-year low and EBITDA per share is currently trading at a five-year high.

On this basis – the stock could still represent significant value on an earnings basis – in spite of the recent price rise.

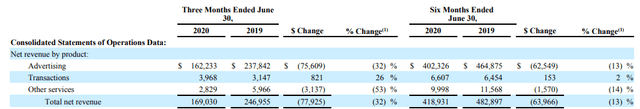

Overall, I take the view that Yelp could still see upside in an inflationary environment. Demand continues to remain strong post-pandemic, and we can see that on a six-month basis – net revenue by category for Q2 2022 has exceeded that of Q2 2019 across Advertising, Transactions and Other Services:

Net Revenue By Product – Q2 2019 and Q2 2020

Net Revenue By Product – Q2 2021 and Q2 2022

Therefore, while it is possible that inflation might place some pressure on growth in advertising revenue, Yelp is undoubtedly seeing strong long-term growth in net revenue across its business segments.

Conclusion

To conclude, Yelp has seen strong growth in revenue and earnings, and has continued to maintain a healthy cash position. For these reasons, I take a bullish view on the stock at this point in time.

Additional disclosure: This article is written on an “as is” basis and without warranty. The content represents my opinion only and in no way constitutes professional investment advice. It is the responsibility of the reader to conduct their due diligence and seek investment advice from a licensed professional before making any investment decisions. The author disclaims all liability for any actions taken based on the information contained in this article.

Be the first to comment