Justin Paget

Investment Thesis

Yellow Corporation (NASDAQ:YELL) reports a phenomenal quarter. It wasn’t so much about its top line. It’s all about its bottom line profitability that not only meaningfully improved from Q1 but appears to be that of a different company compared with the same period a year ago.

There’s a lot to like about this company and paying my estimated 3x EPS, including the 35% premarket jump in its share price, seems very much justified to me.

Needless to say that its overleveraged balance sheet is still an issue. But it will be substantially less of an issue to get it refinanced today than it was just 90 days ago.

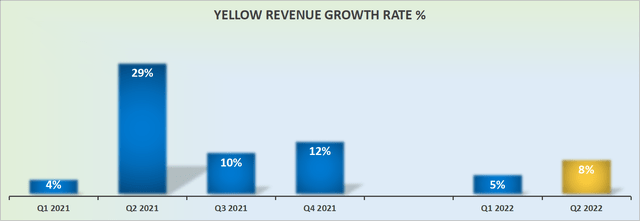

Revenue Growth Rates Still Strong

The big takeaway from Yellow’s Q2 2022 results was not about its topline revenue growth rates which were up 8% y/y. That was nothing to write home about.

That being said, when we take a step back and consider that Q2 of last year was so noticeably strong, suddenly the topic of discussion becomes more exciting.

Indeed, it’s not even that Yellow’s topline beat was all that impressive, as it beat on the topline was just 3%. Where Yellow really impressed was on its bottom line profitability, something we’ll get to next.

Yellow’s Impressive Results, What Happened?

Yellow is a supply chain solution offering less-than-truckload (”LTL”) logistics. In a time when the supply chain pricing environment is particularly strong, one would expect to see some level of pricing power. But on this front, Yellow seriously impressed.

Meanwhile, purchased transportation expense was down 150 basis y/y to 14.5%. So when you have strong pricing power, together with steady controls over expenses, good things can happen.

The company’s efforts to integrate its four different networks into a single less-than-truckload network are paying off. In essence, this is a simplification, efficiency, and cost-saving initiative all coming together under one quarter.

The big question that I have is the sustainability of this progress. To answer that question, this is what Yellow’s management team said on the call.

Ongoing demand for LTL capacity has kept the pricing environment favorable. In Q2, year-over-year, LTL revenue per hundredweight, including fuel increased 29.7% and favorable pricing trends have carried into Q3. For the month of July Yellow average between 6% and 7% on contract negotiation.

As you can see from the quote above, Yellow’s pricing environment has remained strong. Next, Yellow’s management team then went on to say,

Our strategy includes mitigating incremental purchase transportation expense, and as a percentage of revenue, it decreased by 150 basis points in the second quarter, compared to a year ago. (emphasis added)

Again, this reinforces what I already described. You have slightly stronger pricing power, combined with lower expenses, which lends itself to a lot of operating leverage in the business flowing to the bottom line.

Yellow, Now Oozing Cash Flow?

For Q1 2022, Yellow’s cash flow from operations was negative $34 million. That was very much in line with the negative $39 million in the prior year period.

Hence, when Yellow’s cash flow from operations jumped to $70 million in Q2, compared with $26 million in the same period, investors understandably took notice.

What’s more, keep in mind that Yellow’s leverage ratio today stands high at just below 4x. That being said, this is Yellow’s lowest leverage since 2019.

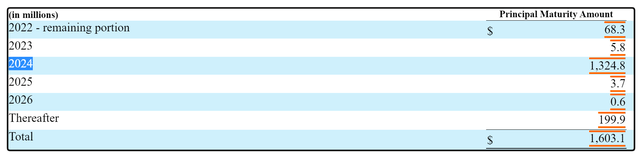

Nevertheless, with its next debt looming on the horizon in 2024, Yellow will have to do something to get in front of that debt stack.

That being, refinancing an unprofitable trucking business and a cash-generating trucking business is a difference of night and day.

YELL Stock Valuation – 3x EPS

As touched on already, for Q1 2022 Yellow was unprofitable with a negative $0.54 of EPS.

While that was an improvement from a negative $1.26 EPS, few investors would be keen to pay attention to this company, a trucking company, that is slightly less unprofitable than it was.

However, this time around, Q2 2022 saw its adjusted EPS jump to $1.15 from a negative $0.18 in the same period a year ago. Clearly, now things get really interesting.

The big question for investors is given that Yellow’s EPS figures thoroughly smashed through the EPS consensus figures of $0.45, by more than doubling estimates, the big question is what sort of sustainable traction will Yellow have going into the remainder of 2022?

Let’s assume that analysts slightly upwards revise Yellow’s EPS estimate for H2 2022 so that in H2 2022 Yellow see its EPS figures report $1.05. When we consider that Q2 2022 alone reported $1.15, this seems to me to be conservative to the point of foolishly low.

But we must start our analysis somewhere, so I believe that using $1.05 of EPS for H2 is a good starting point.

This implies that in 2022 as a whole, Yellow will make approximately $2.20 of EPS. This puts the stock right now, after the 35% premarket jump, at 3x EPS.

The Bottom Line

Yellow is a business that has suddenly turn a corner. It’s gone from being an overleveraged stock that was down more than 50% from its recent highs, to a business that is now making strong cash flows, and has a tangible path to refinance its debt profile.

It will not be easy for Yellow to refinance its debt stack on anything less than onerous terms, but at least now this looks like a highly probable scenario rather than simply a possible scenario.

Be the first to comment