Jumbo2010/iStock via Getty Images

Investment Thesis

Yellow Cake (OTCPK:YLLXF) is an investment company with its primary listing in London, UK. The company is a passive investment vehicle that invests in uranium and is very similar to the Sprott Physical Uranium Trust (OTCPK:SRUUF).

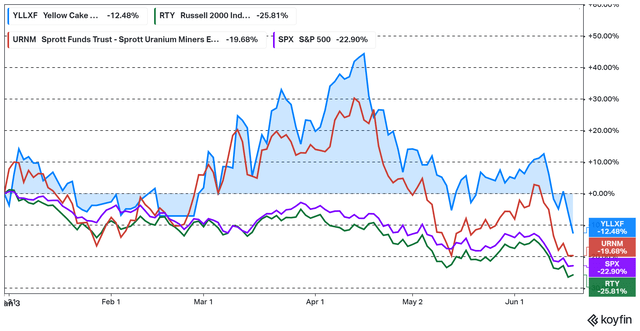

The stock has so far this year done marginally better than the overall uranium industry even though Yellow Cake has been punished substantially over the last few months as well.

As the below chart illustrates, the price of uranium has actually increased in 2022. So, the recent negative performance in Yellow Cake is primarily due to an increased discount to the net asset value of the company, making it more of a compelling investment for value investors.

Figure 1 – Source: TradingView

Recent Uranium Developments

We have seen the price of uranium decline from the 11-year high around $65/lb that was achieved in April of this year. More recently, the price has held up reasonably well when we consider how turbulent the general stock market has been.

Figure 2 – Source: TradingView

Prior to Fukushima, Japan has historically had 54 operating nuclear reactors. The reactors were taken offline at the time of the accident, 10 reactors have so far been restarted, and 24 reactors are schedule for decommissioning. Japan recently pledged more concrete steps to restart the remaining reactors to deal with the ongoing energy crisis, which is of course a very positive development in the industry. This is just one more country that recognizes the reality that nuclear is presently the best low-carbon solution for low & stable energy prices.

Another country where the wind has been turning is Finland, which recently had its fifth nuclear reactor started. The green party has changed its stance, where it has now endorsed nuclear extensions, and the potential for new small modular reactors in the future. It remains to be seen if this trend can spread to less rational Western European countries like Germany and Sweden.

The UK, France, and recently South Korea are countries which have in a relatively short period gone from planning to close nuclear reactors, to pushing out closures, and are now actively planning to expand the use of nuclear power to meet climate targets and energy needs.

I do expect we will see more positive nuclear announcement throughout Europe given the ongoing energy crisis, and maybe in Eastern Europe especially. Ukraine did a few weeks ago announce a partnership with Westinghouse to fuel existing nuclear reactors and the plan to build 9 new nuclear reactors.

Another interesting news story that broke early June was that the current administration in the U.S. is seeking $4.3B in funding to support the domestic uranium & enrichment industry and wean off Russian imports. It is still too early to confidently tell when or if this will come to pass and how the money will be spent. In is nevertheless a positive development for U.S. producers, the entire uranium industry, and the price of uranium in general.

Yellow Cake Stock Valuation

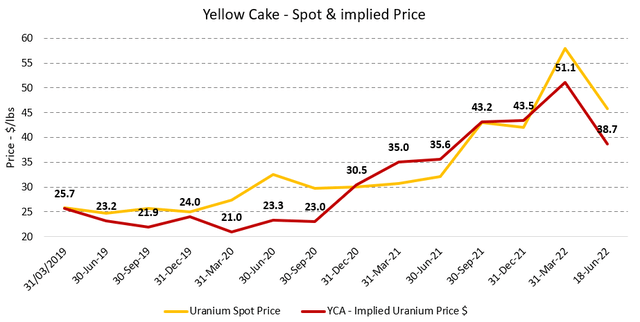

The below charts highlight the current discount to net asset value and the implied uranium price for Yellow Cake. We can see that the discount to NAV of 15.2% using a uranium price of $45.75/lb is among the largest discounts we have seen in quite a while, at least on quarterly data.

We can also see that the implied uranium price for Yellow Cake is now at $38.7/lb, which the lowest level we have seen since this time last year even though the actual price of uranium is now well above the levels seen in mid-2021, as illustrated further in figure 2 above.

Figure 3 – Source: Data from Quarterly Updates & TradingView

Figure 4 – Source: Data from Quarterly Updates & TradingView

Conclusion

Yellow Cake has similar to many uranium equities sold off lately. So, it is far from the only attractive stock in the industry, but it is a low-risk alternative for uranium investors with a very healthy discount to NAV. 2020 was the last time we saw a discount to NAV for Yellow Cake of this magnitude, which turned out to be an excellent time to invest.

It is very hard to argue against the positive developments in the nuclear industry, where the sentiment is turning in favor of nuclear in many countries globally. However, in the very near term, Yellow Cake and uranium industry have been rather correlated with the general market. So, there is always the potential for more downside even if I think the industry has the potential to diverge from the general stock market if there is sufficiently positive nuclear developments or a decrease in volatility in the general stock market.

Figure 5 – Source: Koyfin

Be the first to comment