SeventyFour

It’s been a rough year for the precious metals sector, with severe margin compression for many companies due to the unfavorable combination of rising costs and a weaker gold price. However, while many companies have been soaking up shares opportunistically at attractive levels and reducing their share counts, some companies have seen considerable share dilution, resulting in a less drastic improvement in their valuation as their share prices have dropped. Argonaut Gold (OTCPK:ARNGF) was one of the worst offenders, with severe cost overruns at its Magino Project, resulting in more than 260% dilution year-over-year (~846 million fully diluted shares vs. ~320 million shares in Q3 2021).

The bulk of this dilution arrived with ~434 million shares sold at US$0.36, with a follow-on raise at US$0.31 and a flow-through raise at US$0.38. Argonaut also sold a 2.0% NSR on its project to Franco-Nevada (FNV) for US$52.5 million to provide an additional buffer in case of any further cost overruns. Given this continued share dilution combined with a stock that was in freefall, it was hard to justify going long. However, with the stock finally reaching an oversold signal in mid-November, the reward/risk was compelling enough to start a position at C$0.355. Since then, multiple developments have turned this trade into a potential investment, with the major one being the appointment of a new CEO, Richard Young. Let’s take a closer look below:

All figures are in United States Dollars unless otherwise noted at an exchange rate of 0.80 CAD/USD.

Recent Developments (Financing)

As discussed in my most recent article on Argonaut Gold (“Argonaut”), this was a case of a high-risk, high-reward stock, given that further share dilution couldn’t be ruled out (which we saw that same week). In addition, when selecting small-cap stocks, I prefer to own those companies that are consistently under-promising and over-delivering because negative surprises can have a much more dramatic effect in sub $500 million market cap names due to their volatility. Fortunately, the thesis has improved considerably after a busy month, in addition to the fact that Magino is one month closer to completion, with the major catalyst for a re-rating now closer on the horizon (construction 72% complete as of Q3 Conference Call, first gold pour expected by May).

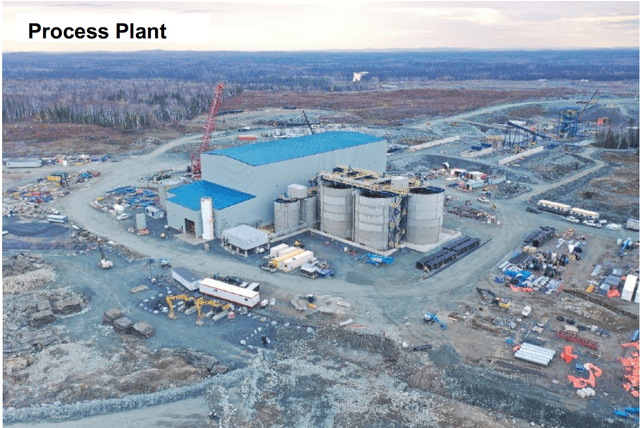

Magino Process Plant (Company Presentation)

The first positive development was the royalty sale with Franco Nevada and simultaneous financing, which provided a $50+ million buffer in case of further cost overruns. While giving up a 2.0% NSR on the project was not ideal, this deal, combined with the closing of the financing package, took the biggest risk off the table, which would be a temporary stoppage due to an inability to raise further capital which would lead to even higher costs to completion. In addition, it also provided investors comfort that arguably the most effective and successful allocators of capital in the royalty/streaming business were confident in Magino’s long-term potential, a further vote of confidence for Argonaut’s crown jewel.

The second major development was that Argonaut had entered into a binding term agreement to sell its Ana Paula Project, a non-core asset in Guerrero State that had been passed from Newstrike Capital to Alio Gold and then to Argonaut during its takeover of Alio Gold. While the $10 million upfront payment ($20 million contingent payments) might seem low for a ~1.50 million-ounce gold project, this is an asset Argonaut was not getting any value for it in its current valuation, making this a smart deal. In addition, Argonaut also entered into an option agreement for its San Antonio Project, where Heliostar can earn a 100% interest for $80 million to $150 million and a 2.0% NSR depending on the average gold price for six months preceding the exercise of the option.

Argonaut Gold – Non-Core Asset Sales (Company News Release)

Overall, these agreements on non-core assets are smart, given that they could yield up to $180 million in value (upfront + contingent payments) plus a 2.0% NSR for assets being ignored in Argonaut’s portfolio due to the negative sentiment for the stock. Some investors might disagree with these asset sales, with two solid Mexican projects that could be the next leg of growth seemingly given away. However, given Argonaut’s financial position and the time it would take to bring these assets into production, I think this was the right move, especially given the very reasonable prices negotiated for these agreements. After closing these deals (Ana Paula, Franco-Nevada), Argonaut’s net cash position will improve by ~$72 million, separate from the ~$12 million flow-through financing earmarked for Canadian development expenses.

Other Recent Developments

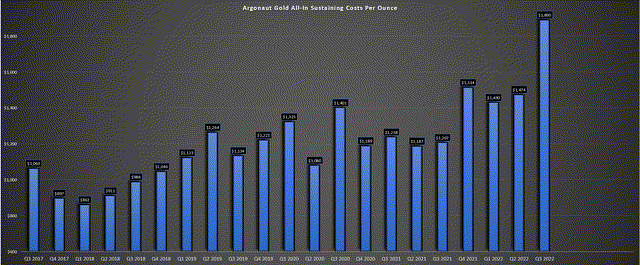

Looking outside Magino, one of my criticisms for owning Argonaut was that the rest of its portfolio (Florida Canyon, El Castillo Complex, La Colorada) left a lot to be desired, with these being high-volume and low-grade assets that lack economies of scale. This meant that their margins were under considerable pressure in an inflationary environment, evidenced by all-in-sustaining costs rocketing up to $1,890/oz in Q3, a new all-time high for the company (+57% year-over-year). However, we have seen some positive changes since Q3, with natural gas and oil prices dropping sharply while the price of gold has found a bottom and reclaimed the psychological $1,800/oz level.

Argonaut – Quarterly All-in Sustaining Costs (Company Filings, Author’s Chart)

In addition to this positive backdrop from a commodity standpoint, the company expects to save $350,000 a month at its San Agustin Mine (a reduction of 300,000 liters of diesel consumption per month) with the commissioning of the CFE powerline in October. This is a significant figure for a small operation like San Agustin, leading to an incremental improvement in costs in the future for this portion of its Mexican business. So, with the combination of a stronger gold price, diesel savings, and lower natural gas and diesel costs due to the pullback in energy prices, Argonaut is in much better shape for Q4 2022 and Q1 2023 with sequential margin compression and a high likelihood that Q3 2022 will mark peak costs for the company.

Crude Oil Price (StockCharts.com)

It’s also worth noting that with Magino set to head into commercial production by year-end 2023, Argonaut has the unique setup of very easy comps year-over-year (H2 2023 vs. H2 2022). This is because not only should it benefit from lower energy prices and reduced diesel consumption, but it will be bringing a lower-cost operation online, with Magino set to enjoy all-in-sustaining costs below $1,000/oz. So, while I am still not that impressed with Argonaut’s current portfolio, given that it’s relatively marginal, at least it’s not breaking even on an AISC basis vs. where it was in Q3 2022 with an average realized gold price of $1,895/oz and AISC of $1,890/oz.

In summary, while the situation at Magino has improved substantially (closer to first gold pour, cash buffer in place) and Argonaut’s balance sheet has strengthened, the outlook for its current asset base has also improved with margin expansion on deck (Q4 2022 vs. Q3 2022). However, the most recent development cannot be understated, and this was the appointment of Richard Young as President & CEO. Let’s take a closer look at why this is a big deal below:

New Management

The appointment of Larry Radford earlier this year was a massive upgrade after years of over-promising and missing estimates under previous Argonaut management. This is because Larry Radford had 30 years of technical and operations experience, including serving as SVP and COO at Hecla (HL), VP and General Manager at Fort Knox in Alaska, plus 14 years spent at the company’s flagship Goldstrike Mine in Nevada. However, the appointment of Richard Young last week due to Larry Radford stepping down is another impressive appointment that will place Argonaut in safe and responsible hands as it graduates to ~400,000-ounce producer status.

For those unfamiliar, Richard Young was Teranga Gold’s former President and CEO. He benefits from 30 years of experience in the industry, including joining Barrick (GOLD) in 1991 and serving in a series of positions. However, his most notable accomplishment was growing Teranga into a ~400,000-ounce producer with two mines in West Africa (Wahgnion and Sabodala-Massawa) before its eventual takeover near all-time highs for ~$2.0 billion. Under his tenure, Teranga increased production from ~131,000 ounces in FY2011 to an annualized run rate of more than 460,000 ounces in its final quarter as a public company (Q4 2020).

This was accomplished by adding the high-grade Massawa Mine to its Sabodala Operations (now Sabodala-Massawa), Endeavour’s most impressive asset, and was the main prize when acquiring Teranga. However, the company also brought a new mine into production (Wahgnion) ahead of schedule in August 2019, further diversifying itself in West Africa. Perhaps most impressively, though, the company accomplished this growth at lower operating costs than when Young started at Teranga (FY2011: $900/oz, FY2020: sub $750/oz cash costs) and would have graduated to 500,000-ounce plus producer status if Teranga wasn’t acquired. Not surprisingly, Teranga was among the best performers in the Gold Miners Index (GDX) for this solid execution.

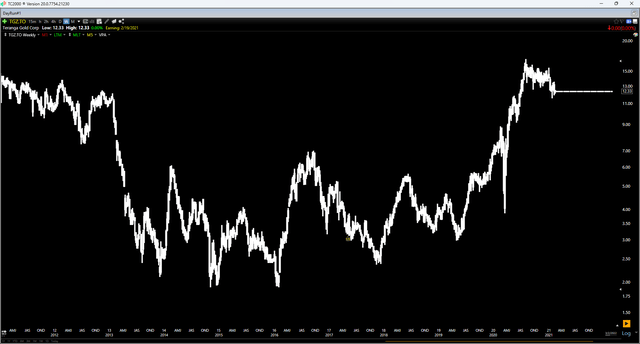

Teranga Gold Chart (TC2000.com)

As shown in the chart above, Teranga collapsed with the rest of the sector as a secular bear market for the GDX began in 2011, but it was one of the first stocks to find its lows in 2014, and it rallied all the way back to its previous all-time highs by 2021, something that only a few producers managed to accomplish. In fact, it rallied ~550% off its 2014 lows vs. a ~130% return for the GDX in the same period, helped by accretive acquisitions (a transformative one being Gryphon Minerals). So, with the confirmation of a stronger leadership team in the future vs. years of regular disappointments under previous management (2016-2021), I see this as an upgrade to Argonaut’s investment thesis. Let’s look at the valuation:

Valuation

Based on ~846 million fully-diluted shares and a share price of US$0.305, Argonaut trades at a market cap of $258 million. Even if we ignore its more marginal operating portfolio with all-in-sustaining costs above $1,500/oz, I see a conservative fair value for Magino of $400 million at a $1,725/oz gold price, which doesn’t include taking advantage of significant additional permitted capacity, which could turn this into a 250,000-ounce operation one day (open-pit + underground), and it would still operate at ~50% of total permitted capacity (17,500 tonnes per day vs. 35,000 tonnes per day). Even at a 0.80x P/NPV multiple to be conservative (140,000+ ounces per annum at sub $1,025/oz costs in a Tier-1 jurisdiction), Argonaut could command a valuation of $320 million or US$0.38 per share, representing 25% upside from current levels.

This might not seem that significant, but it’s important to note that this valuation doesn’t account for any exploration upside at Magino (underground opportunity), it doesn’t account for ounces outside of the mine plan, and it completely ignores a 225,000-ounce plus production profile at its other operating assets. So, on a sum-of-parts basis, and even assigning a conservative $350 million to its operating assets (+) the potential future underground opportunity at Magino, Argonaut could command a valuation of $670 million or US$0.80 per share. In summary, even if one detests their current high-cost business, which leaves much to be desired, Argonaut is undervalued on Magino alone.

Summary

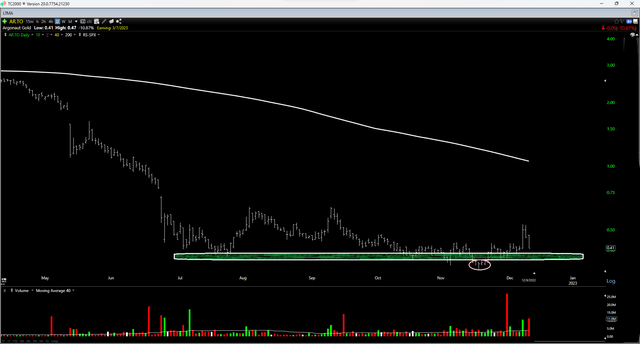

I usually prefer to avoid sector laggards which is why I have continued to prefer names like Karora (OTCQX:KRRGF) and i-80 Gold (IAUX) which had clearer paths to re-ratings and a better chance of outperforming. However, even sector laggards have a price and technical setup where they become attractive, and with Argonaut breaking its lows in mid-November on high volume, which may have triggered additional selling from this obvious level for stop-loss orders, this presented an ideal area to start a new position in the stock. Fortunately, the thesis has improved considerably since then, as discussed above, potentially turning this trade into a longer-term investment.

AR.TSX Daily Chart (TC2000.com)

To summarize, I see Argonaut Gold as a solid speculative bet with the recent upgrades to the investment thesis, and at US$0.305, this is a name that could have considerable upside given that priced as one of the most attractive turnaround stories sector-wide. It’s also worth noting that if Argonaut stays at these depressed levels and given its considerable sunk costs at Magino and other sites, it could become an attractive takeover target for a potential suitor looking to add a Canadian operation and divest the smaller assets. So, with takeover potential and a likely upside re-rating once Magino comes online, I would view any further weakness in the stock as a buying opportunity.

Be the first to comment