Beo88/iStock via Getty Images

Cosmetics can be a great business. Just ask Estee Lauder (EL) shareholders who have seen their shares rise more than ten-fold form 2009 lows. However, I feel Yatsen Holding Limited (NYSE:YSG) may be in the wrong place at the wrong time. It is attempting to scale a retail-focused cosmetics business amidst rolling lockdowns that have no end in sight. It is also facing possible delisting risk due to the SEC’s HFCAA rules. I would recommend investors avoid Yatsen’s stock.

Company Overview

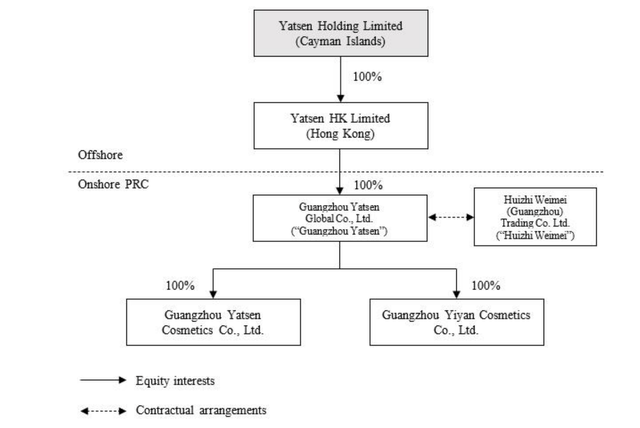

Yatsen Holding Limited is a Cayman Islands holding company that manufactures and sells cosmetics and beauty products in China through contractual agreements with a Variable Interest Entity (“VIE”). The corporate structure is shown in Figure 1.

Figure 1 – YSG Corporate Structure (YSG 2021 20F Report)

Yatsen was founded to develop and market beauty products directly to Chinese consumers through online platforms and a growing retail network. The company is headed by founder, Chairman and CEO, Jinfeng Huang, who had previously worked at Hunan Yujiahui Cosmetics Co. and Guangzhou P&G Co.

Yatsen has launched and acquired numerous cosmetic brands including Perfect Diary, Little Ondine, Abby’s Choice, Galénic, DR.WU, Eve Lom, Pink Bear and EANTiM (Figure 2).

Figure 2 – YSG Brands (YSG Investor Presentation)

Cosmetics Is A Great Business

Appealing to people’s vanity is a great business, according to Forbes. Personal care products enjoy strong brand loyalty, as customers are buying more than just the secret formula or special ingredients; they are buying the brand and any emotional connections / cachet evoked by it. Even during the depths of the 2008 recession, sales of skincare products grew, according to the Forbes article.

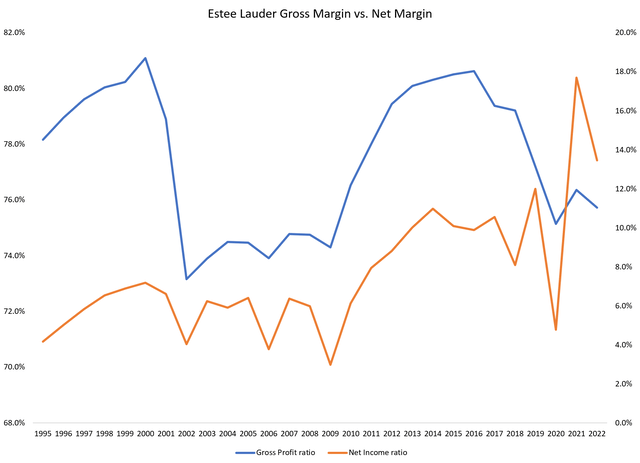

In fact, if we look at industry leader Estee Lauder, we can see that the company enjoys incredible gross margins between 75-80% (Figure 3). The company has been profitable every year, even in 2009 ($218 million in net income on $7.3 billion in revenues, Figure 3).

Figure 3 – EL Gross Margins & Net Margins (Author created with data from roic.ai)

Successful IPO in 2020

Yatsen IPO’d in late 2020, with a goal of creating domestic Chinese cosmetic brands to satisfy a large and rapidly growing market. According to market research cited in Yatsen’s F-1 registration statement, China had the largest beauty market in 2019 with $39 billion in sales, and the Chinese market is expected to grow to almost $70 billion by 2025 driven by increased per capita spending, purchasing frequency, and adoption from lower tier cities.

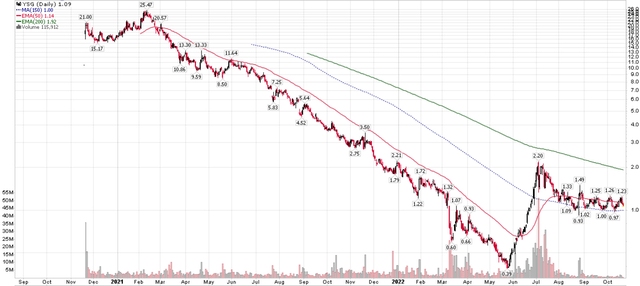

Yatsen’s IPO was well received and the company was able to raise more than $600 million via the sale of 59 million ADRs for $10.50 apiece. The shares quickly doubled in the days after the listing, and reached as high as $25 in early 2021 on favorable investor sentiment (Figure 4).

Figure 4 – YSG stock price (stockcharts.com)

However, a string of earnings misses coupled with souring investor sentiment towards Chinese equities (not least because they faced the risk of delisting), caused Yatsen’s shares to trade to a low of $0.39 in May 2022.

HFCAA Designation Marked The Recent Low

Yatsen was formally placed on the SEC’s Holding Foreign Companies Accountable Act (“HFCAA“) list on May 26, 2022, which appear to have marked the recent bottom in the share price.

For those not familiar, here is an excerpt from my article on Sinopec (OTCPK:SNPTY) that explains the HFCAA list and its ramifications:

The HFCAA was enacted in December 2020 and states that the SEC has the authority to prohibit shares or ADRs from trading if the company has been audited by an accounting firm that has not been subject to an inspection by the Public Company Accounting Oversight Board (“PCAOB”) for three consecutive years beginning in 2021. Furthermore, in June 2021, the U.S. Senate passed an act to accelerate the HFCAA to 2 years instead of 3.

Sinopec, along with several other SOEs, actually voluntarily delisted from the NYSE at the end of August 2022. Yatsen has not delisted from American markets, but is subject to the timeline mentioned above.

Lockdowns Hurting Demand

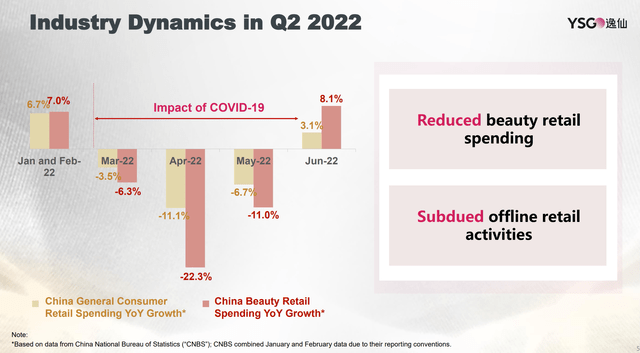

Financially, Yatsen has been hurt by China’s continued fight against COVID-19 that has hurt consumer spending and retail demand for beauty products. Beauty spending showed large YoY declines from March to May 2022, as Shanghai and many large cities were placed in months-long lockdowns. Even now, China continues to periodically lockdown Shanghai and other cities to stop COVID-19 transmission.

Figure 5 – Chinese Beauty Product Trends (YSG Investor Presentation)

Troubled Financials

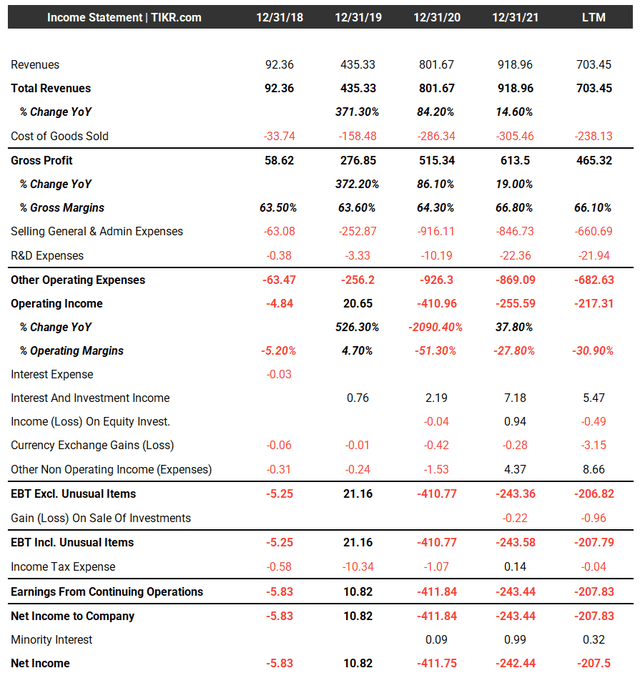

When the company went public in 2020, it had eked out a small profit in 2019 of $11 million and the idea was to expand its physical store presence to drive further revenue growth (Figure 6). SG&A was ramped up dramatically in 2020 and the number of physical ‘experience stores’ reached almost 300.

Figure 6 – YSG Summary Financials (tikr.com)

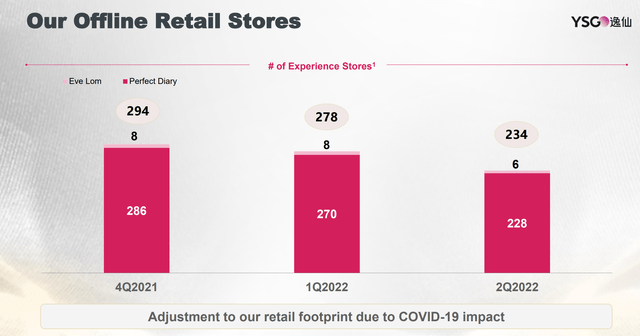

However, due to the impact of COVID-19 and the Chinese government’s draconian response, physical stores no longer make as much strategic sense and the company has been pruning them, with the store count down to 234 recently (Figure 7).

Figure 7 – YSG Pruning Stores (YSG Investor Presentation)

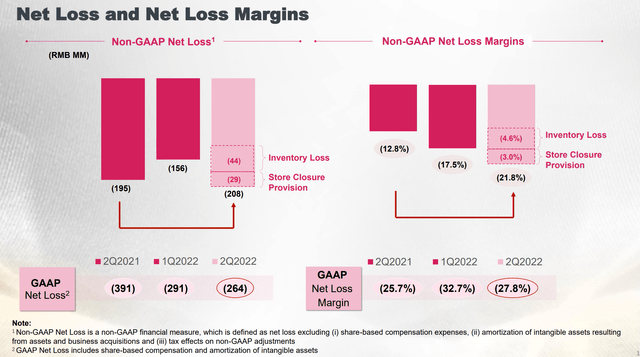

However, despite the reduction in SG&A, operating losses continued unabated. In the recent Q2/2022 report, Yatsen reported a net loss of RMB208 million ($39.5 million), and a net loss margin of -27.8% (Figure 8).

Figure 8 – YSG Losses Continue (YSG Investor Presentation)

Hard To Value

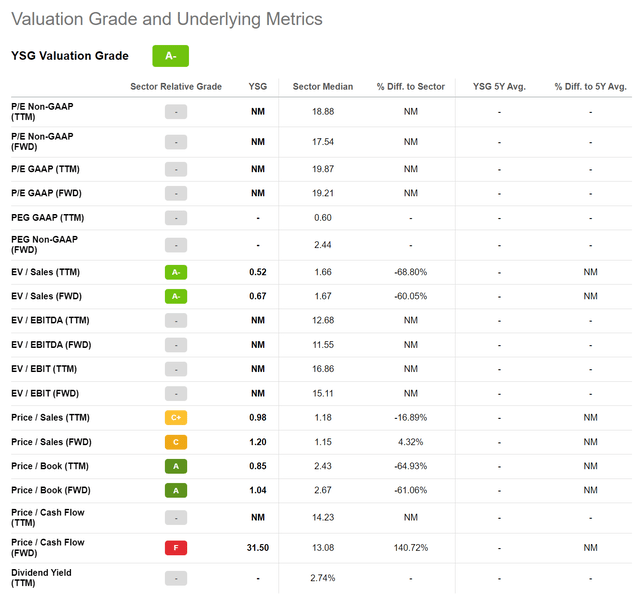

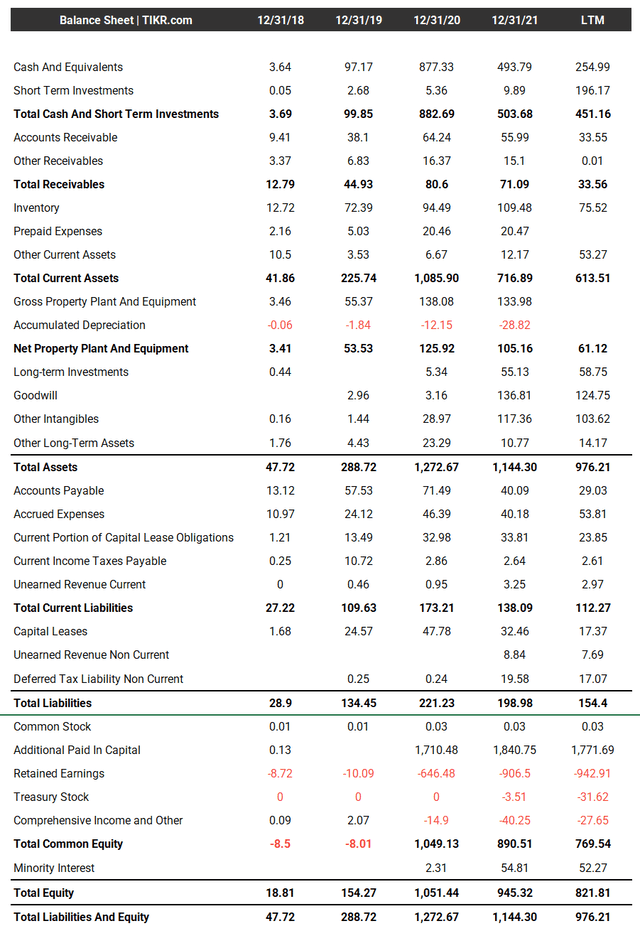

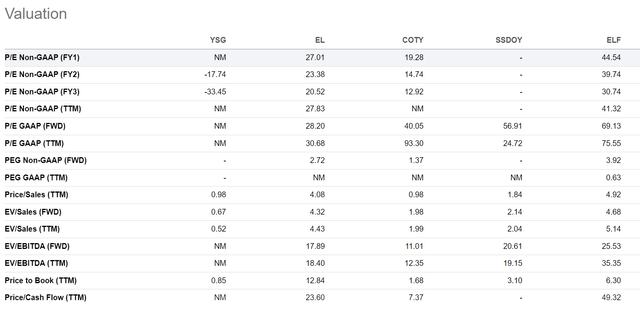

With no earnings or EBITDA to speak of, it is very difficult to ‘value’ Yatsen shares in the traditional sense using P/E or EV/EBITDA multiples (Figure 9).

Figure 9 – YSG Valuation (Seeking Alpha)

Instead, we can look at Yatsen’s balance sheet to get a sense of the ‘asset’ value. Yatsen has cash and investments of $451 million and 2.5 billion shares outstanding as of June 30, 2022. Each ADR is equivalent to 4 ordinary shares, so per ADR, Yatsen has $0.72 in cash and investments (Figure 10).

Book value per ADR is $1.32, so at a recent ADR price of $1.08, shares of Yatsen are trading at ~0.85x P/B.

Figure 10 – YSG Balance Sheet (tikr.com)

Upside Vs Downside

On the upside, a successful cosmetics business is obviously worth a lot of money. Leaders like Estee Lauder and e.l.f. Beauty, Inc. (ELF) are worth 12.8x and 6.3x P/B respectively, with ROE of 36% and 9%. An Asian comparable is Japanese cosmetics giant, Shisheido Company Limited (OTCPK:SSDOY) that trades at 3.1x P/B with 14% ROE.

Figure 11 – YSG Comparables (Seeking Alpha)

If Yatsen can outlast the current COVID lockdowns and return to profitable growth, it is conceivable the company can achieve a 2.0x P/B or $2.60 in value.

However, on the downside, we can see that Yatsen’s current business structure is not profitable, with LTM gross profits of $465 million and SG&A of $660 million (Figure 6). At a minimum, revenues will have to grow 43% to $1 billion while maintaining the same gross margin (66%) and SG&A ($660 million), for the company to break even.

For the upcoming Q3, the company is guiding to RMB 738 to 873 million in sales or a 40% decline YoY at the midpoint. So it appears breakeven is still far away.

Risks

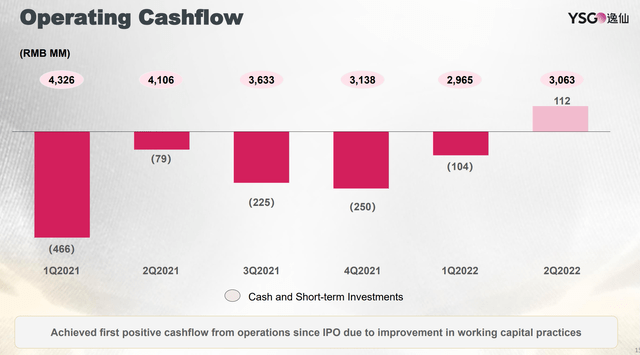

For a company that cannot even generate positive EBITDA, the biggest risk is that it runs out of cash / capital before the business scales to breakeven. For Yatsen, it has $451 million in cash and investments. At the latest quarterly loss rate of $39.5 million, Yatsen can still operate for 2-3 years.

More importantly, Yatsen was able to generate positive operating cash flow in the latest quarter, so bankruptcy is not an imminent risk (Figure 12).

Figure 12 – YSG Generated Positive OCF (YSG Investor Presentation)

Another risk investors face is a possible delisting due to HFCAA rules mentioned above. Unlike many larger technology companies like Alibaba Group Holding Limited (BABA) or SOEs like Sinopec, Yatsen is a relative minnow and does not have a secondary listing. Hence if the company is delisted from the NYSE, investors may not have a liquid venue to sell their shares.

Conclusion

While cosmetics can be a great business, judging by the roaring success of Estee Lauder, I feel Yatsen may be in the wrong place at the wrong time. It is attempting to scale a retail-focused cosmetics business amidst rolling lockdowns that have no end in sight. Until the Chinese government reverses policy decisions regarding lockdowns, Yatsen will continue to face headwinds. Furthermore, Yatsen remains listed on the NYSE with possible delisting risk in 2023 and no secondary listing venue. I would recommend investors avoid Yatsen’s stock.

Be the first to comment