constantgardener/iStock via Getty Images

Introduction

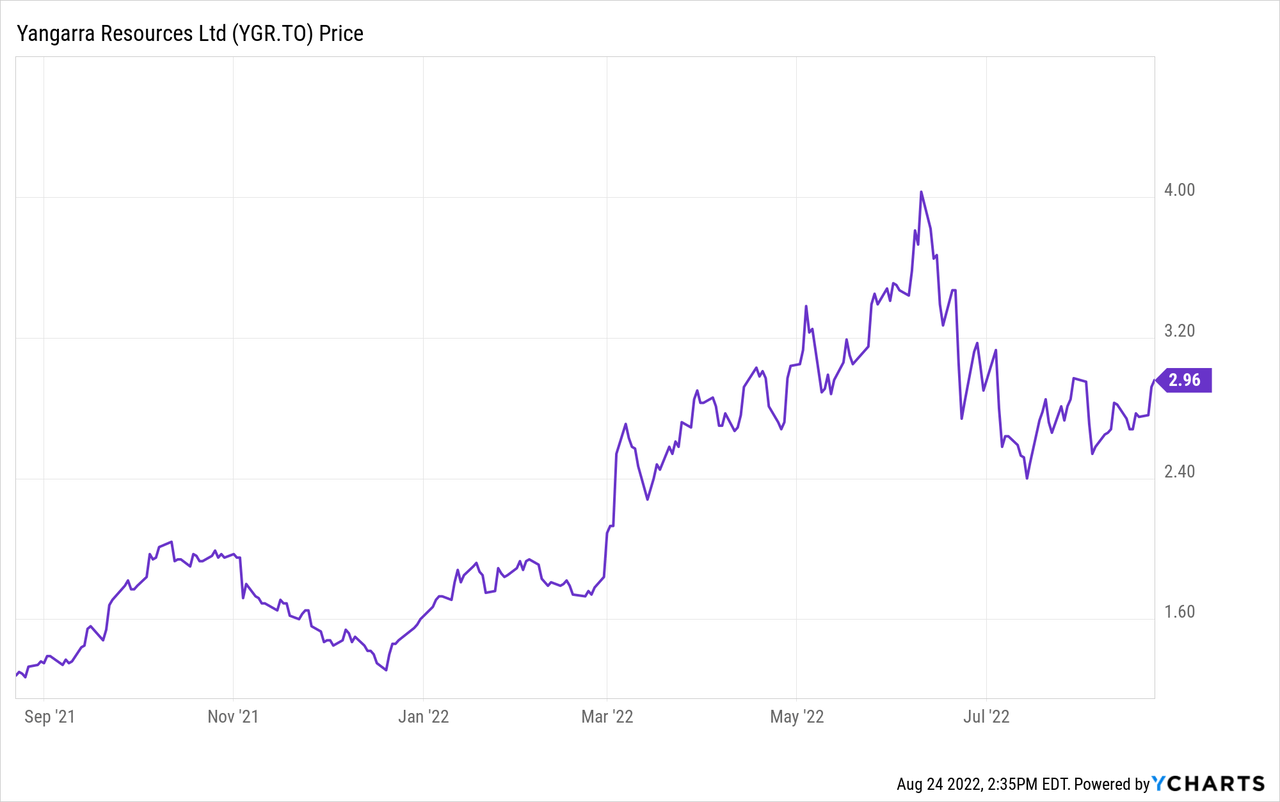

I recently initiated a long position in Yangarra Resources (OTCPK:YGRAF) (TSX:YGR:CA), a natural gas and producer which is rapidly ramping up its production on its Canadian assets. Although the company still has quite a bit of debt on its balance sheet I’m not too worried and I believe Yangarra has definitively turned a corner.

As the trading volumes on the US exchange are pretty low, I would strongly recommend you to trade in Yangarra’s shares using the facilities of the Toronto Stock Exchange where Yangarra is trading with YGR as its ticker symbol. As the average daily volume in Canada is approximately half a million shares per day, Yangarra’s TSX listing clearly offers superior liquidity.

The free cash flow is now accelerating fast

For a better understanding of where the company is coming from I’d like to refer you to Long Player’s articles on Yangarra. The 21 articles he has published over the course of the past six years contain all the valuable information to fully understand the big picture.

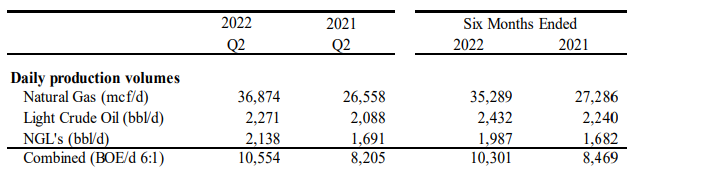

During the second quarter of the year, Yangarra produced just over 10,500 barrels of oil-equivalent per day with oil and NGLs accounting for just over 40% of the oil-equivalent production rate. The vast majority, almost 60%, came from the production of natural gas. And while the Q2 production rate is just a 4% increase compared to the Q1 output, investors should be aware Yangarra’s production rate will accelerate in the current semester.

Yangarra Investor Relations

As Yangarra hedged some of its oil and gas, the realized prices including the hedges were just slightly lower than the average received price: Yangarra received approximately C$7.50 for its natural gas while the oil was sold at just over C$130 per barrel. As of June 30, there’s only a very limited amount of hedges in place.

Yangarra Investor Relations

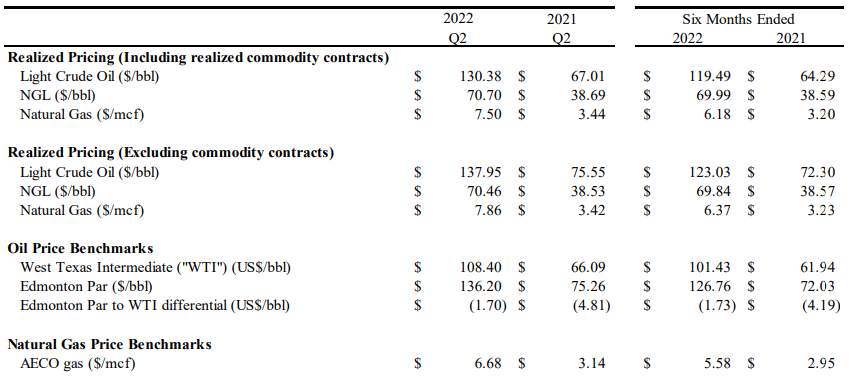

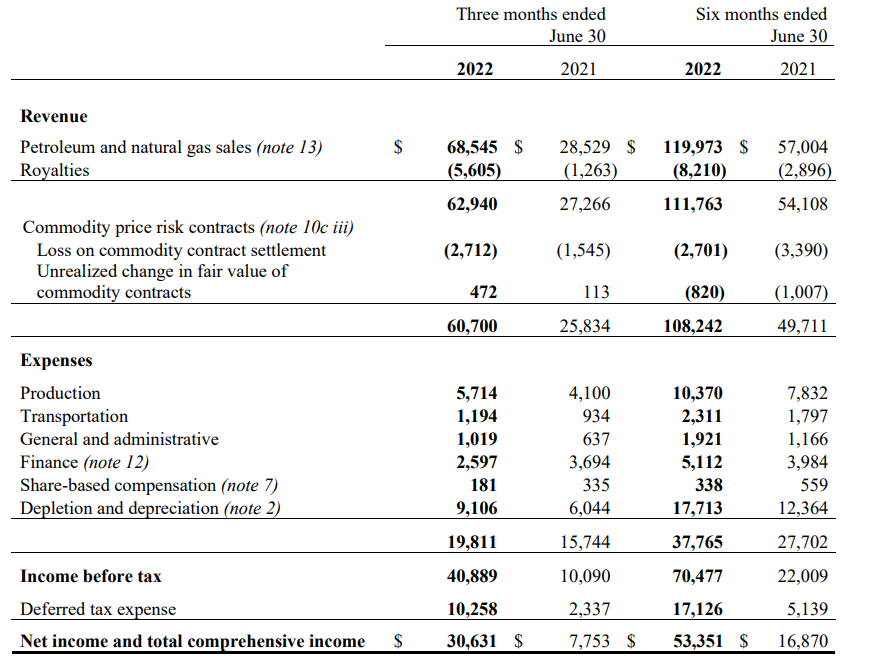

This resulted in a total revenue of just over C$68.5M and after deducting the royalties and hedging losses, the net realized revenue in the second quarter was C$60.7M. And as you can see below, the total production and transportation expenses are exceptionally low: Less than 12% of the net realized revenue (including hedging losses) were needed to cover these expenses.

Yangarra Investor Relations

This helped Yangarra to post a pre-tax income of almost C$41M and a net income of C$30.6M for an EPS of C$0.35. Not bad for a stock trading at less than C$3/share.

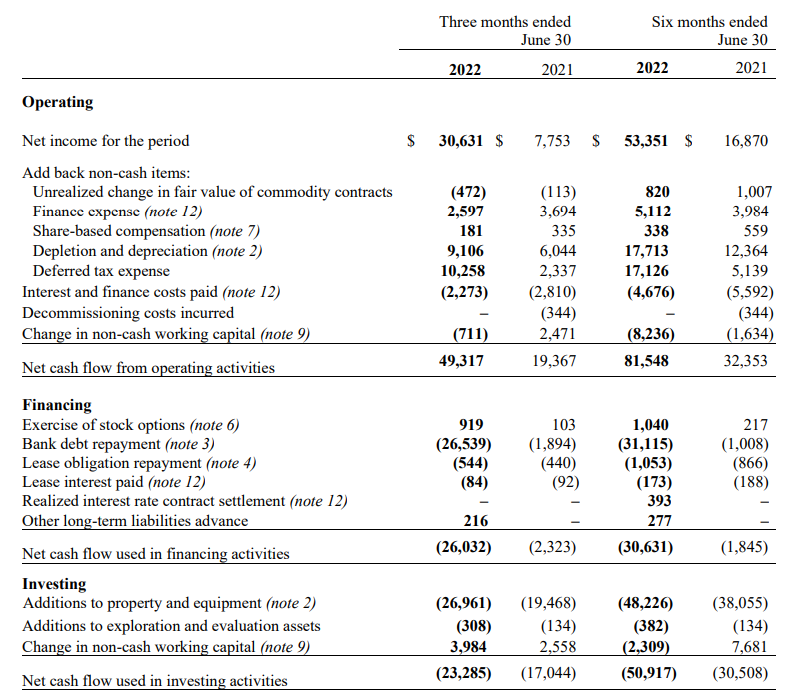

The operating cash flow during the second quarter came in at C$49.3M but this includes the deferral of the C$10.3M tax bill and excludes the C$0.6M lease payments. While Yangarra does not anticipate to pay taxes in 2022 and 2023 due to its use of existing tax pools, investors should realize that the company will eventually have to pay taxes again.

Yangarra Investor Relations

The total capex was C$27M (in line with the full-year guidance of C$105M) resulting in a free cash flow of approximately C$22M. Keep in mind this includes growth investments as the quarterly depreciation and depletion expenses are less than C$10M per quarter. I estimate the sustaining capex for the 12,000 boe/day producer to be approximately C$15-17M per quarter.

The capital allocation plans remain unchanged

We can anticipate the production rate to increase in the current quarter. The capex spent during the second quarter was used to complete eight wells of which only three were brought online early June with four additional wells being added to the production base at the end of June. This means that the vast majority of these wells were only online for a very short period and Q3 will be the first full quarter these wells will be contributing.

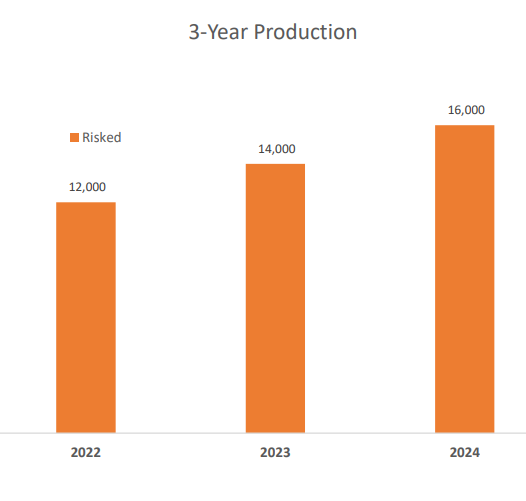

Yangarra is still aiming to produce 12,000 barrels of oil-equivalent per day in 2022 which means the H2 production rate will have to come in close to 14,000 boe/day to make this happen. And Yangarra plans to continue to increase its annual production rates to 16,000 boe/day in 2024.

Yangarra Investor Relations

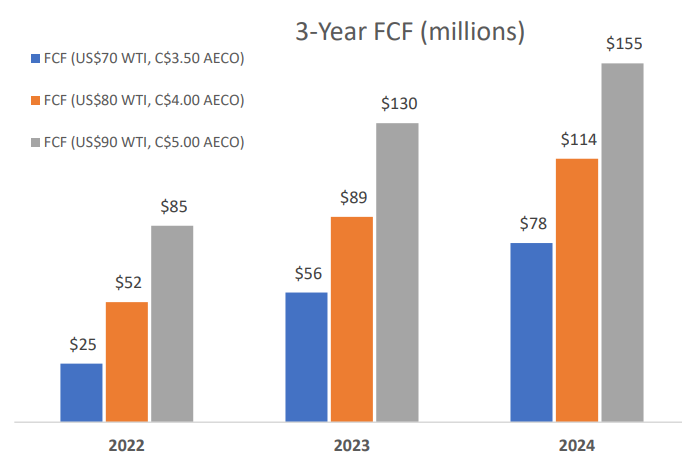

Meanwhile, the total capex spending should not materially increase from the current C$105M per year (although inflation will very likely increase the cost of drilling new wells). This means the company also remains on track to actually generate the free cash flow result it has been eyeing. As you can see below, the relatively moderate capex program should still generate C$78M per year in free cash flow using $70 WTI and C$3.50 AECO (although I don’t think the 2024 results already include the potential corporate taxes Yangarra may have to start paying). With just under 88M shares outstanding, the free cash flow per share would come in at almost C$0.89. In the mid-case scenario using $80 WTI and C$4 AECO, the free cash flow per share would be almost C$1.3/share.

Yangarra Investor Relations

The free cash flow is currently used to rapidly reduce the net debt. As of the end of June, Yangarra had a total net debt of approximately C$165M, down from in excess of C$195M at the end of last year. The company originally had a plan in place to reduce the net debt to C$150M before starting rewarding its shareholders but has recently revised that to C$100M. As soon as that C$100M net debt target is achieved (which will likely be in Q1 next year), Yangarra has promised it will return the “excess cash flow” to its shareholders. And given the low multiples Yangarra is trading at, those payouts could be substantial. If it would apply a 50% payout ratio on the estimated 2023 free cash flow in the conservative scenario, a dividend would come in at close to C$0.30/share. But if the share price remains this low, I think Yangarra should opt for a share buyback program.

Investment thesis

Excluding growth investments, Yangarra appears to be on track to generate close to C$1/share in free cash flow this year and this will rapidly reduce the net debt toward the C$100M level. I expect that net debt level to be reached in (early) Q1 2023 but depending on working capital fluctuations that may happen sooner (and likely not later).

Yangarra is becoming a cash cow, even if one would apply lower commodity prices (as shown in the sensitivity analysis for 2023 and 2024). Meanwhile the pre-tax NPV value of the proved resources discounted by 10% and applying a 15% discount rate to the probable reserves results in a net value of in excess of C$1B after taking the current net debt into consideration, but before taxes. And that’s based on WTI oil in the mid-$60s range and an AECO natural gas price in the lower C$3 range.

I’m a buyer at these levels, mainly because the current valuation seems to be backed by a solid sensitivity analysis and reserves.

Be the first to comment