simonkr/E+ via Getty Images

Shares of pediatric cancer specialist Y-mAbs Therapeutics (NASDAQ:YMAB) have fallen by 58% since my March 2019 article, in which I highlighted high probability of success for lead indications while cautioning readers about the small size of initial opportunities targeted. Shares have lost 45% so far in 2022.

With share price down drastically following receipt of FDA briefing documents for omburtamab in neuroblastoma and 16-0 AdCom vote against approval (Complete Response Letter or CRL likely to follow), I decided to revisit this one for readers in case there is an opportunity to take advantage of renewed pessimism.

The story has progressed significantly (Danyelza approved with up to $50M in 2022 sales expected and lead SADA construct set to enter phase 1 study), so I believe there could be more to like here beyond the dubious regulatory fate for omburtamab.

FinViz

Figure 1: YMAB weekly chart (Source: Finviz)

When looking at charts, clarity often comes from taking a look at distinct time frames in order to determine important technical levels and get a feel for what’s going on. In the weekly chart above, we can see share price decline from highs above $50 to mid-single digits at the beginning of 2022. Rebound ensued up to the $20 level as Danyelza launch got off to a good start out of the gate, but a near 20% decline was sparked by damning briefing documents from the FDA that put the regulatory fate of omburtamab into doubt. Additionally, after hours shares are down another 30% to $6.20 (we will see how much of that move actually holds up in main session on Monday). With this setback and excessive pessimism taking center stage, I can see the rationale for value investors to buy an initial pilot position. At the same time, given increased uncertainty on near term upside and state of the balance sheet, I’d argue that more caution and due diligence is warranted.

Overview

Founded in 2015 with headquarters in New York (148 employees), Y-mAbs Therapeutics currently sports enterprise value of ~$260M and Q2 cash position of $133M providing them operational runway into mid-2024.

In my 2019 article, I highlighted receipt of the coveted Breakthrough Therapy Designation from the FDA, as well as Rare Pediatric Disease and Orphan Drug designations for lead oncology programs. For naxitamab (now approved as Danyelza), I noted that it is an anti-GD2 antibody with multiple advantages over other GD2 targeting therapies, including modest toxicity (allows for 2.5x greater dose) and shorter infusion time (30 minutes in outpatient setting versus 10-20 hours with hospitalization for several days dinutuximab). On the other hand, B7-H3 targeting antibody omburtamab showed interesting data in CNS/LM from neuroblastoma patients (median overall survival of 47 months as compared to historical median overall survival of approximately six months). Initial indications the company was going after were quite small, but when considered in aggregate a decent-sized opportunity was being targeted.

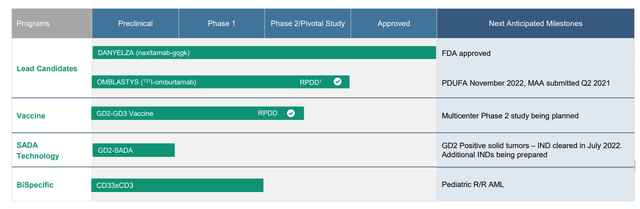

Corporate Slides

Figure 2: Pipeline (Source: corporate presentation)

Flash forward to the present, where harsh briefing documents from the FDA clearly state that the BLA filing for omburtamab in neuroblastoma does not provide substantial evidence of efficacy (seems like a Complete Response Letter will be forthcoming). Issues raised include the single center, single arm nature of the trial and especially damning the inappropriate choice of external control population (too different from study population to be able to draw any meaningful conclusions). Treatment arm for the trial was more intensive than in control population, initially promising differences in survival are not necessarily attributable to omburtamab and reliable response data was not included. Unless something changes, for my purposes I consider the drug candidate to be unapprovable and thus a zero in terms of contributing to upside potential.

Still, when looking at the Q2 conference call, I see multiple reasons to believe there’s an opportunity to take advantage of here in the medium term. Danyelza product revenue came in at $9.8M (7% decrease from previous quarter which included slight decrease in new patients early in Q2, which was partially offset by June’s rebound which continued through July). While this number came in below analyst consensus of $11.1M, the hope is that new Chief Commercial Officer Sue Smith will utilize her global launch experience to penetrate and differentiate in both US and other markets.

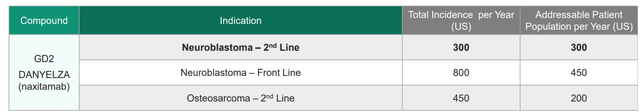

Corporate Slides

Figure 3: Initial commercial opportunities for Danyelza (Source: corporate presentation)

Such efforts take time, but Danyelza now has experience with 36 treatment centers administering across the US in Q2 (up 6% over prior quarter) and 2 new centers added to formulary in Q2. Importantly, higher potential accounts are being added and geographic expansion is being observed. Management continues to guide for $45M to $50M in 2022 revenues (not insignificant for a company with $300M EV and being 1.5 years into launch).

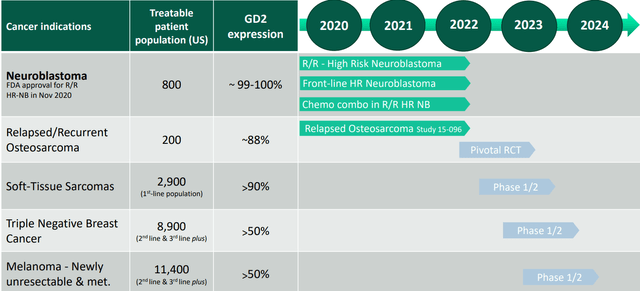

Corporate Slides

Figure 4: Potential label expansion plan for naxitamab (Source: corporate presentation)

Phase 2 data evaluating combination of Danyelza with Irinotecan, Temozolomide, and GM-CSF in 90 patients with chemo-resistant high-risk neuroblastoma was promising with 64% ORR and 26% CR rate (no toxicities greater than Grade 2 as well). Management notes that this is the first time any anti-GD2 antibody has been studied in such a heavily pre-treated patient population. As noted in Figure 4 above, management will also give larger adult patient populations a shot in early-stage studies and they estimate that there were more than 200,000 new adult patients diagnosed with GD2-positive cancers in the United States in 2021.

Moving on to the area of high optionality, the SADA technology, this is an innovative platform meant to accomplish targeted delivery of radiopharmaceuticals to tumor sites with minimal off target effects (greatly increasing therapeutic index). Y-mAbs gained access to this tech via license agreement with MSK and Massachusetts Institute of Technology [MIT] in April 2020. They believe the SADA technology could potentially improve the efficacy of radiolabeled therapeutics in tumors that have not historically demonstrated meaningful responses to radiolabeled agents. This video overview was quite helpful in understanding this approach, as was prior R&D Day presentation.

First patient for GD2-SADA is expected to be treated during Q4 and initial efforts are focused on validating the approach in small cell lung cancer while simultaneously pursuing other pediatric GD2 indications.

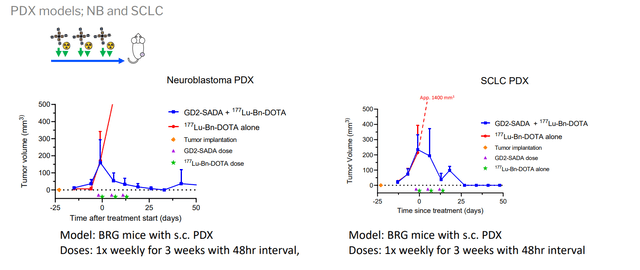

Corporate Slides

Figure 5: GD2-SADA in established mouse tumor models (Source: corporate presentation)

Management is being careful to not bite off more than they can chew, as larger indications will be out-licensed over time and internally they will focus on pediatric indications. Initial clinical data could be shared in 2023. SADA could also be useful for previously-failed clinical targets that have already proven safe in humans (use SADA construct to enhance therapeutic index). Also, the company is pursuing a CD33 bispecific in pediatric AML, but this indication is quite crowded to my eyes and I won’t give it any credit until I see clinical evidence.

Select Recent Developments

In April the company announced that CEO Dr. Claus Moller stepped down and was being replaced by Thomas Gad (Founder, Chairmen and President). Dr. Jim Healy was appointed as Director of the Board to replace Moller, who previously occupied that position. Playing devil’s advocate, one could argue the optics are not good here and a prior Seeking Alpha piece by Mariner Research details how several of Gad’s prior companies were dissolved or went bankrupt. On Fintel, we can see that Gad has a history of aggressively selling his stock holdings as well.

On July 12th, the company announced initiation of first clinical trial using a SADA construct. Phase 1 multicenter basket trial is targeting malignant melanoma, sarcoma and small cell lung cancer. First part [A] of the study is for dose finding and testing intervals between the protein and the 177Lu-DOTA payload. Part B will determine the optimal dose of 177Lu-DOTA, and Part C will evaluate safety and initial efficacy signals using repeated dosing. Total of 59 patients will be recruited across 6 to 10 sites in the US. An interesting note from the Q2 call is that they will submit an additional IND in Q1 of 2023 while they focus on validating GD2 in the clinic prior.

Lastly, on October 28th, the company announced the outcome of the FDA ODAC (Oncologic Drugs Advisory Committee) for the treatment of CNS/leptomeningeal metastasis from neuroblastoma using omburtamab. It’s been a long time since I’ve seen such a resoundingly negative outcome (16 to 0 against the drug candidate, concluding there is not enough evidence for improvement of overall survival). Again, corporate presentation suggests 80+ addressable patients for lead indication and another 400 between Diffuse Intrinsic Pontine Glioma (DIPG) and Desmoplastic Small Round Cell Tumors (DSRCT). However, for our purposes, I will consider the drug candidate to be a zero until otherwise proven.

Other Information

For the second quarter of 2022, the company reported cash and equivalents of $133.7M as compared to full year 2022 cash burn of $78M to $83M. This is concerning at present lows, as operational runway to mid-2024 likely means the company needs another round of dilution via secondary offering by 1H 23.

Q2 Research and development expenses rose to $26.4M (from $19.8M), while SG&A rose by ~70% to $23.1M. Net loss nearly doubled to $41.1M, but keep in mind that there was a $10.7M charge for severance-related benefits for the departing CEO within that number (also attributable to increased R&D costs.)

Revenue of $10.8M for the quarter came in below consensus, representing a 1% decrease over comparable period in 2021. Danyelza product revenue increased by 9% to $9.8M, but the encouraging nugget is that rebound in sales was observed in June (continued into July per conference call) and new patients at MSK continued to grow.

I’ve seen peak sales forecasts for the drug of up to $400M, driven in part by convenience of treatment in outpatient setting and shorter infusion time (4 10-20-hour infusions per week for competitor dinutuximab versus 3 30-minute infusions per week for Danyelza). For our purposes of staying conservative, let’s cut that estimate in half to $200M and that still measures up well to the current $260M enterprise value, leaving room for upside via sales growth alone (SADA tech providing investors a call option).

As for institutional investors of note, HBM Healthcare Investments owns a 7.1% stake and Sofinnova owns 5.2% stake (both have been adding). As for insiders, continued selling and lack of purchases over the past 3 years does not inspire confidence.

As for relevant leadership experience, it’s interesting that President and CEO Thomas Gad founded the company as a result of (or due in part to) his daughter’s journey through high-risk neuroblastoma treatment. CFO Bo Kruse served prior as CFO at Genmab, SVP Head of Technical Operations Torben Lund-Hansen also served prior at Genmab as did Chief Operating Officer Joris Wilms and Chief Scientific Officer Steen Lisby. Chief Commercial Officer Sue Smith (came on board December of last year) served prior as VP US Oncology Business Unit Head at Kyowa Kirin.

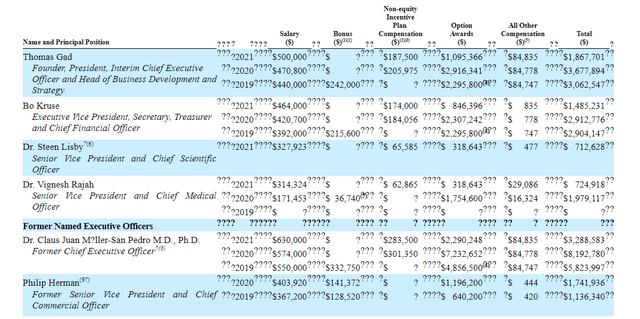

Moving on to executive compensation, cash portion of salaries in the $300k to $500k range appears appropriate for a company this size (though I’d argue prior CEO Claus Moller’s $630k was excessive). Levels of non-equity incentive and option awards also are in the normal range.

Proxy Filing

Figure 6: Executive Compensation Table (Source: corporate presentation)

The important thing is to avoid companies where the management team is potentially in it for self-enrichment instead of creating value for shareholders, and looking at compensation is one of several indicators in that regard.

As for IP, patent portfolio for Danyelza stems from exclusive licenses from MSK to two patent families. The first consists of composition of matter claims including 3 US patents and several across other countries (first family set to expire in 2031, patent term extension was filed in 2021 and could extend this to 2034). Second family consists of applications with composition of matter claims covering high affinity anti-GD2 antibodies with expiration expected in March 2034. For radiolabeled antibody technology, they have one patent family related to potency assay for radiolabeled antibodies and international patent application pending (expiration in December 2040).

As for other useful nuggets from the 10-K filing (you should always scan these in your due diligence as many companies like to sweep undesirable elements under the rug), it’s worth noting that the company does not own any manufacturing facilities and relies on outside vendors for commercial and clinical supply (purchase drug supplies on purchase order basis). SADA license agreement with MSK and MIT requires Y-mAbs to pay them mid to high single digit royalties based on annual net sales of licensed products. Additionally, total milestones potentially due under SADA license agreement are $4.73M and $18.125M across clinical and regulatory, respectively. Sales based milestone payments in total amount up to $60M and MSK is due to receive 25% of any income generated by sale of PRV (priority review voucher).

Playing devil’s advocate, if the company’s new Chief Commercial Officer is unable to reinvigorate Danyelza sales and there are delays or setbacks to GD2 SADA in the clinic, coupled with the expected Complete Response Letter for omburtamab, the company could be in a weak place financially with less in the way of near-term prospects for upside.

Final Thoughts

To conclude, the unanimous AdCom vote against omburtamab could be seen as weighing on management’s credibility especially following 2020’s refusal to file. As concerns raised against the drug are on the clinical data side (not manufacturing or other more easily addressable issues), a bet on the company at this point is on reinvigoration of Danyelza sales and SADA technology delivering on the promise of targeted radiopharmaceuticals to increase therapeutic index and achieve proof of concept in lead study for multiple indications.

If we see signs of Danyelza sales ramping up in Q3 or Q4, that would likely be a sign for investors to consider gaining more exposure here. As it stands, I would be concerned about a dilutive offering at lows which would be necessary to get the company to cash flow positive (not to mention aid with the investment necessary to move SADA into mid-stage studies should initial POC be achieved).

For readers who are interested in the story and have done their due diligence, I cannot recommend shares of YMAB at this time.

Current valuation would seem advantageous especially in light of potential for sales growth to accelerate, but I’ve learned the hard way to NOT anticipate such events and instead await actual proof that the story is in fact getting better.

From a Core Biotech perspective (emphasis on next 3 to 5 years), I could see the rationale for revisiting the story here once we see signs of accelerating sales growth for Danyelza or lead GD2 SADA is closer to generating initial clinical data.

Key risks include dilutive secondary offering near current lows in the next few quarters, negative FDA decision for omburtamab (leading to discontinuation in the clinic), and setbacks in the clinic for SADA starting with GD2 construct. Failure to reinvigorate Danyelza sales would also weigh on the stock and long-term prospects.

Author’s Note: I greatly appreciate you taking the time to read my work and hope you found it useful. While I post research on many companies that interest me, in ROTY (clinical stage) and Core Biotech (commercial stage) portfolios I own just 15 or fewer names in order to focus on stories that are highest conviction for me.

Be the first to comment