ThomasVogel/E+ via Getty Images

By Rob Isbitts.

Summary

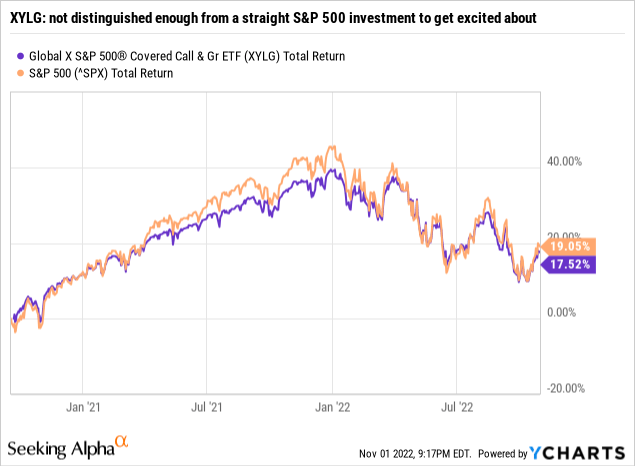

S&P 500 Covered Call & Growth ETF (NYSEARCA:XYLG) is an unattractive offering from an otherwise innovative and successful exchanged-traded fund (“ETF”) provider, Global X. It aims to take the S&P 500 Index and enhance its return by a strategy known as “covered call writing.” The fund has been around for just over two years, and has had a variety of market environments to perform in. It hasn’t really stood out in any of them. Thus, I rate XYLG a Sell.

Strategy

Writing covered calls means that you own an investment – in this case, the stocks in the S&P 500 Index – and you use that as a base to sell options against. Why sell options against it? Because you get paid to do so. The flip side of that transaction is that you limit your upside potential.

Proprietary ETF Grades

-

Offense/Defense: Offense

-

Segment: Broad Equity

-

Sub-Segment: Large Cap

-

Correlation (vs. S&P 500): Very High

-

Expected Volatility (vs. S&P 500): Similar

Holding Analysis

XYLG applies covered call writing to about half of its portfolio. So you get a hybrid here: half regular S&P 500 Index (SP500), and half a covered call version of the S&P 500 Index. XYLG’s own website page explains that it buys the stocks in the S&P 500 Index, and “writes” or “sells” call options on about half the value of that portfolio of stocks. While this is not misleading per se, it would be easy for an investor to miss what the fund actually does. A closer look at the holdings reveals that XYLG owns the full 500 or so stocks in the S&P 500 Index. But the covered call writing is not on any of the stocks. It is on the S&P 500 Index itself.

Strengths

XYLG does provide access to the S&P 500 Index, and Global X is an innovative and accomplished ETF provider. However, this is just not one of their best athletes, so to speak. The covered call aspect of the fund is where the value should be. But after two years, with conditions that could have been a differentiator for a fund in this broad category, it essentially came up empty. There are too many other ways to get an S&P 500 base portfolio and add value around it.

Weaknesses

This ETF’s first 2 years have exposed the many drawbacks of covered call writing funds. Granted, I’m a skeptic of covered call writing because in my (former) days as an investment advisor, I heard plenty of conversations about the virtues of this approach. If handled with extreme care and customization, it can have merits. But in an index-tracking, automated form like XYLG, I just don’t see the appeal. Apparently, I’m not the only one, as the fund has gathered limited assets and attention in its first two years. And, asking investors to pay 0.60% expense ratio for a fund that really does not separate meaningfully from the S&P 500 in its performance most of the time is a tough sell.

Opportunities

The only opportunity I see to really get something special out of this ETF is if it were to operate more like an S&P 500 proxy, owning far fewer stocks, and writing covered calls against many or all of those stocks. But that’s not going to happen, so I’ll move on to the more robust Threats category.

Threats

This ETF is not likely to “implode” by underperforming the S&P 500 by, say, 10-20% in a year. Instead, XYLG will likely continue to track and underperform the market as consistently as it has in the past. The bigger threat is a subtle distinction between what many investors know as “covered call writing” and what this fund does for that part of its strategy. I described this in the Holdings Analysis section above.

There’s nothing wrong with that operationally. But I suspect that investors thinking they are getting an efficiently-packaged set of individual call options on a big basket of stocks might be disappointed to find out that the fund sells covered calls on just two near-term S&P 500 options contracts.

Proprietary Technical Ratings

-

Short-Term Rating (next 3 months): Sell.

-

Long-Term Rating (next 12 months): Sell.

Conclusions

ETF Quality Opinion

XYLG’s portfolio construction is clear, if you delve into the underlying holdings like I did. But the bigger question is one I ask about any ETF to determine if it makes the cut in our research process, and will be considered for our model portfolio at some point. I just don’t see a compelling reason to consider this one, for the reasons noted above and below.

ETF Investment Opinion

Like an Olympic athlete, certain ETF styles can wait a long time for their moment to shine. 2022’s combination of high volatility and falling stock prices should have been the shining moment for XYLG and its brethren. It hasn’t been, and I don’t see that changing. XYLG gets a Sell rating.

Be the first to comment