solarseven

The long-term uptrend challenged

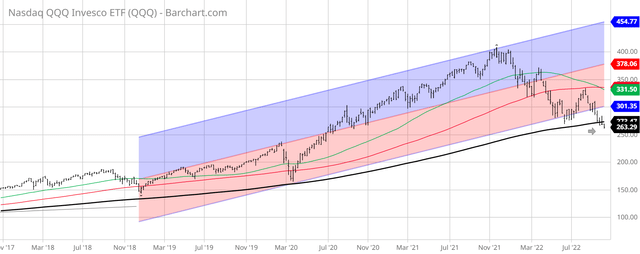

The ETF that closely tracks NASDAQ 100 (NASDAQ:QQQ) is down by nearly 35% YTD. Yet, it appears that the major long-term breakdown is just underway – the breakdown that could cause potentially a long-term bear market, probably measured in years.

Specifically, during the previous downturns, QQQ was able to find the support at the 200-week moving average line – which kept the long-term uptrend intact. This included the first leg of the 2022 crash, the March 2020 crash, and the 2018 sharp correction. Now, QQQ is trading under this key long-term support. Thus, the long-term uptrend is being challenged and the major breakdown seems to be in progress. Here is the chart:

The initial bearish thesis

I was publicly bearish on QQQ and recommended a sell with the simple bearish thesis: the Fed is seeking to engineer for a “growth recession” to lower the CPI inflation, which will lead to a prolonged period of low growth and high nominal and real interest rates. As a result, 1) the corporate earnings will have to be downgraded, and 2) the valuations must contract to reflect a prolonged period of low growth.

The QQQ ttm PE ratio is still very high at 24 and the forward ratio is also high at nearly 21. Thus, the valuations still don’t reflect the low growth environment, and further downside is likely as the valuations adjust.

Notice, Apple (AAPL) weights for nearly 14% of QQQ, and as I previously explained, Apple was not priced for a recession, and it’s still expensive even after the 10% selloff since my initial recommendation to sell.

The tactical bullish thesis

However, I recently upgraded QQQ to neutral as the price approached the key 200wma support, specifically questioning whether there is a trigger that could cause the major long-term breakdown and the selloff of the magnitude of the 2000 crash and the 2008 crash.

As I explained, in 2000 the QQQ PE ratio was over 100, and the 70-75% crash was a classic valuation bubble burst. We are currently not in such a bubble with the PE ratio at 34 at the peak in 2021. Similarly, the 2008 crash was primarily due to extraordinary credit crunch caused by the Lehman Brothers bankruptcy. Currently, the credit spreads are not indicating a major credit risk in the system.

In my view, the QQQ selloff YTD was caused by the Fed-induced liquidity shock. I warned in April that “the Fed will talk the talk and walk the walk”. However, currently, the Federal Funds futures are pricing the end of the Fed’s hiking cycle in April of 2023. Thus, given that we are near the end of the hiking cycle, while the economy is still not in a recession, at least by looking at the still resilient labor market, it makes sense to expect a bounce in QQQ from the key support at 275 to the 100wma resistance at 330 – for a 15-17% rally. This, I indicated that I would evaluate this tactical buy opportunity – if the support holds.

Unfortunately, QQQ is now trading below the key support, and we need to evaluate the opportunity to short the major breakdown. However, I am still puzzled with the same issue – what are the triggers that would warrant further 20-30% drawdown in QQQ?

What could trigger a major breakdown?

- The Fed-induced 1987-like liquidity shock crash.

The CPI inflation remains stubbornly elevated and persistent. In fact, we are still not sure that we have even reached the peak inflation point. Cleveland Fed’s Inflation Nowcast predicts that tomorrow’s core CPI for September (10/13/22) will be 6.64%, above the consensus estimate of 6.5%, and well above the previous high of 6.3%. More importantly, the October core CPI estimate is still at 6.58, with the new high for core PCE inflation at 5.12%. If these predictions prove to be correct, the Fed will definitely be in the panic mode, with the sudden realization that the peak inflation is nowhere near yet.

This type of a systematic shock will definitely cause the major cross-asset contagion. First, the US Dollar (UUP) could enter a parabolic blow-off stage, which could trigger the financial crisis and loss of liquidity in the emerging markets (EEM) and in the vulnerable EU and UK. The contagion would spread to the US stocks and cause a massive selloff in QQQ. The combination of a technical support level breakdown (and execution of stop loss orders), with the major fundamental trigger is a prescription for a 1987-type selloff.

- Negative corporate earnings guidance

This week we start with the critical earnings season. This is the quarter where corporations will have to acknowledge the deteriorating macro environment for 2023: weak global growth, led by China, with the Europe already in a recession, the effect of a strong US Dollar, higher interest rates, and shrinking margins. Thus, the earnings guidance is likely to provide major warnings, which could be the trigger for the significant selloff. As previously mentions, Apple is around 14% of QQQ. Microsoft (MSFT) is around 11% and Amazon (AMZN) is around 7% of QQQ. Technology (XLK) is almost half of QQQ by weight. Thus, broadly, the big tech earnings guidance is particularly important for the QQQ performance.

- Geopolitical considerations

The probability of a surprise use of the tactical nuclear weapons by Russia is probably much higher than many acknowledge. Thus, many longer-term buyers are likely to be more cautious in this environment. Nevertheless, it is important to acknowledge the possibility of a significant geopolitical escalation, which could be imminent, near term, or sometime this winter.

Tactical implications

Short QQQ at around 263 (current level), with the stop loss above the 200wma above 273 seems like a good risk-reward trade. Stop-loss could be executed for around 4% loss, but the gain could be significant if the major breakdown is in progress. For NASDAQ 100, these levels are around 10850 (short), and 11220 (stop loss).

Obviously, the Fed is the key risk variable. Any slightly dovish (or even less hawkish comment) could cause a major short covering. Thus, with this trade it is important to have the stop loss in place and re-evaluate the tactical long if necessary. At this point my recommendation is a sell.

Be the first to comment