RichLegg/E+ via Getty Images

Young companies have immensely attractive growth potential, yet are full of uncertainties making them very difficult to evaluate. Guided by Aswath Damodaran’s three-step process to analyze uncertainty, I hope to provide a valuable standpoint on Xponential Fitness, Inc.’s (NYSE:XPOF) performance by looking at the story behind the financial numbers, highlighting key valuations, and, of course, addressing the company’s failure risk.

Since its IPO in July 2021, the company, with a small market cap of 705.372 million, has yet to breakeven. Nonetheless, it has invested heavily in a strong and increasingly globally growing franchise strategy that is set up to continue reaching a broader range of consumers through a larger number of fitness brands and studios in an industry said to be worth $20 billion. Although heavily dependent on the success of its franchisees for its revenue, it has a low-cost business model that incentivizes its partners through strong brand provisions and economies of scale benefits. Furthermore, this young company has invested in a very experienced management team to continue its upward growth trend. This makes me confident that we will see its profitability increasing over the next year, and for this reason, investors may be interested in taking a bullish position on the company.

Company Introduction

XPOF is classified as a boutique fitness franchisor and was founded in 2017. In brief, the company offers fitness and wellness services through its franchisees and more recently through its subscription-based online platforms. The company initially launched with four main fitness brands, namely Barre, Yoga, Pilates and Spin. Although the fitness industry is extremely competitive and diverse, varying from well-established traditional companies to small high-tech companies fighting for the attention of wellness consumers, the company has taken up market space by growing its portfolio from four to ten different fitness brands and an ever-increasing number of studios.

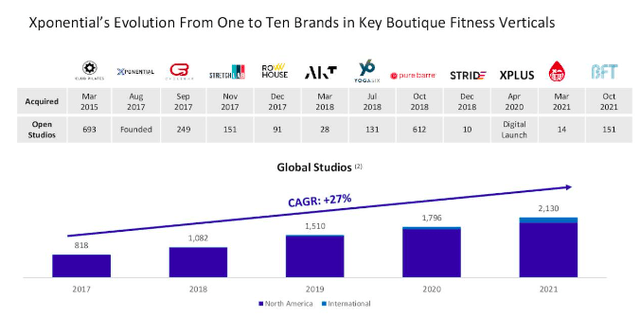

In the table and the graph taken from the company’s 2022 Investor Presentation below, we can see an ongoing, almost yearly, acquisition of multiple new brands and an upward annual trend of studios opening. One essential thing to note is that XPOF financially benefits in the running of these studios, if studios are shut or do not have customers attending them, this negatively impacts the company. This was a big problem during COVID-19, which forced the closures of all indoor fitness spaces as seen by the low company revenue reports in 2020. Impressively as a fitness company, it maneuvered through the COVID-19 obstacle course. XPOF has even won awards for its performance. For instance, it received the 2022 Franchise Times Dealmakers of the Year award, which pays tribute to franchisers making big M&A moves.

Lastly, although it is difficult to get a lot of financial information on new companies, one credible aspect we can look at is the history of the management team. The CEO and founder, Anthony Geisler, is an entrepreneur at heart having started up various companies from the ground up. Furthermore, John Meloun, the CFO since July 2018, won the Public Company CFO of the Year award for outstanding performance. Special mention was given for his leadership in steering the company through the COVID-19 pandemic and various transactions, acquisitions, and the IPO all within the last year.

Xponential Brand Acquisition Timeline (Xponential Fitness Investor Presentation)

Performance Under the Public Eye

Pushed on by the beating of COVID-19, 2021 saw a number of fitness companies making the decision to go public. XPOF decided to IPO on the NYSE in July 2021 raising a rather unimpressive and less than planned $120 million at a share price of $12, just a week after competing companies, F45 Training Holdings (FXLV), which priced at $16 and raised $300 million, and Beachbody Company (BODY), which priced at $13.15 and raised $225 million, went public. XPOF was well below its planned $14 to $16 price range and the company decreased the initial number of shares for sale from 13.3 million to 10 million. In spite of the rocky start, and unenthusiastic response by investors, the stock price reached its peak value in March 2022, at $26. While I am being cautious regarding the significant decrease in price over the last few weeks, consistent with the general uncertainty in the stock market since going public in July 2021 it has grown over the last year by 17.7%.

Furthermore, again addressing the uncertainty of a young company, while not having sufficient historical data to make predictive foundations, I want to take a look at the growing confidence institutional investors have been putting into XPOF by purchasing large numbers of shares. XPOF is backed by major investors including BlackRock, which recently acquired an additional 87,975 shares in Q1 2022, Vanguard Group, which added 13,759 shares in Q1 2022 and Citadel Advisors grew their position in XPOF. Currently, 60.65% of the stocks are owned by institutional investors.

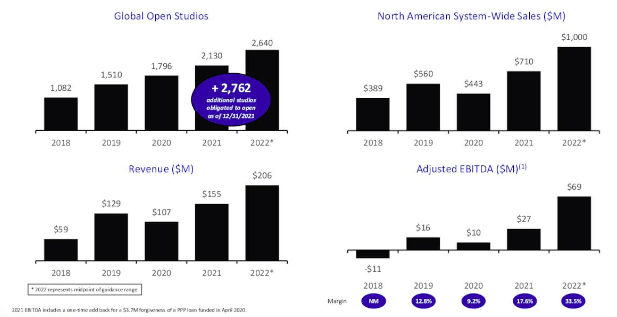

As a freshly public company, XPOF only has one annual financial report and three quarterly reports to review. For young companies, Damodaran recommends looking at essential variables on the business model such as revenue growth and price/sales, in addition to identifying metrics related to risk such as the company’s free cashflow. From the XPOF 2022 Investor Presentation screenshot below, we can see the company is confident in the growth numbers for this year.

Xponential Fitness, Inc. Performance in Numbers (investor.xponential.com)

The company’s revenue growth has seen impressive growth year over year. Continuing on from a successful fourth quarter last year, XPOF has exceeded expectations of analysts this first quarter of 2022. Q1 2022 revenue increased by 73% and North America system-wide sales increased by 70% from Q1 2021 results. In Q1 2022, the company sold 260 new franchise licenses and opened 99 more new studios, totaling the number of franchise licenses to 4684 and studios to 2229. Its quarterly revenue for 2022 surpassed expectations by 11.4% coming in at $50.4 million. Despite the revenue numbers being impressive, in its Q1 2022 earnings report, the company reported a loss of earnings per share of $1.51, which fell disappointingly under the expectations of analysts. While the company had an overall higher profitability of $14.0 million, it was offset by high expenses; these expenses will be broken down.

As the company grows, we can see the transition from a startup to an established company. We can also see big investments being made into not only the business model, in the form of large acquisitions and new product development, but also in the people being selected to run the business. One example is the onboarding of Chelsea A. Grayson, an experienced CEO and corporate board member. She will serve as an independent director and be part of the audit committee. The executive team is built up of brimming curriculums and valuable experience, which is beneficial but also costly to the business.

One of the issues for rapidly expanding companies is obtaining sufficient cash and investment for growth. Looking at the free cash flow we can see a positive free cash flow, thus there is no need to raise additional capital to support its long-term growth strategies. At the end of March 2022 the net cash from the companies operating activities was $2.9 million. Although positive, the low cash flow is a concern that was brought forward by investors and addressed by the company during the Q1 2022 conference call. The company made some earlier investments for future openings and future revenue streams in addition to legal issue payments. The acquisition of Rumble and a $15.0 million increase in non-cash, equity-based compensation expenses was primarily responsible for an increased loss to $ 15.2 million. However, they expect to have a high free cash flow conversion going forward from Q1 2022 on the back of these early year investments; and more importantly, its business model is asset-light.

For a young and growing company, it helps to take into consideration the price/sales ratio to see if it is undervalued by the public. This seems to be the case with XPOF which has a small and positive P/S ratio of 2.15, falling under the travel & leisure industry average of 2.66. Its direct competitor, FXLV, has a negative P/S ratio of 2.68, indicating that the losses are greater than what the company is valued at. There may still be a lack of confidence in fitness companies that are predominantly associated with indoor activities in large groups; a business concept that failed miserably during the heat of the pandemic and its safety and security regulations.

As an undervalued small-cap stock with a market capitalization of $806.91 million, the company has set up its business model for continued growth. Analysts have set a price target of $27.89. Currently, its price/earnings ratio is lower than its competitors, indicating that it is more affordable than other companies in the industry. Respectable analysts have highlighted the stock as a stock with great potential; Evercore ISI Group ranks it as Outperform, Raymond James maintains a Strong Buy position, and Wall Street has a Strong Buy rating of 4.66. Moreover, 6 analysts in the last 90 days are indicating a Strong Buy on this stock.

The Future is Fitness

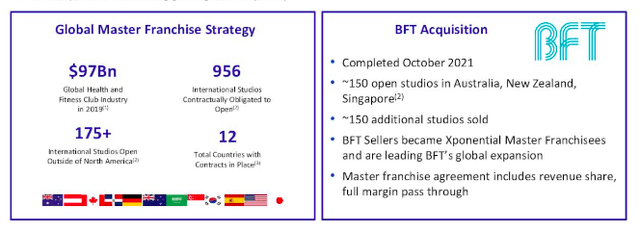

This company is making big moves and growing its franchising business model through strategic acquisitions and new technological product developments. In March 2021 it acquired Rumble, which is a large fitness concept focused on boxing. Rumble has existing franchise agreements in Australia, New Zealand and the United States. In October 2021, it acquired BFT, a company that is headquartered in Australia and is a functional and strength-based training fitness franchisor.

Growth and BFT Acquisition Highlights (Xponential Fitness Investor Presentation 2022)

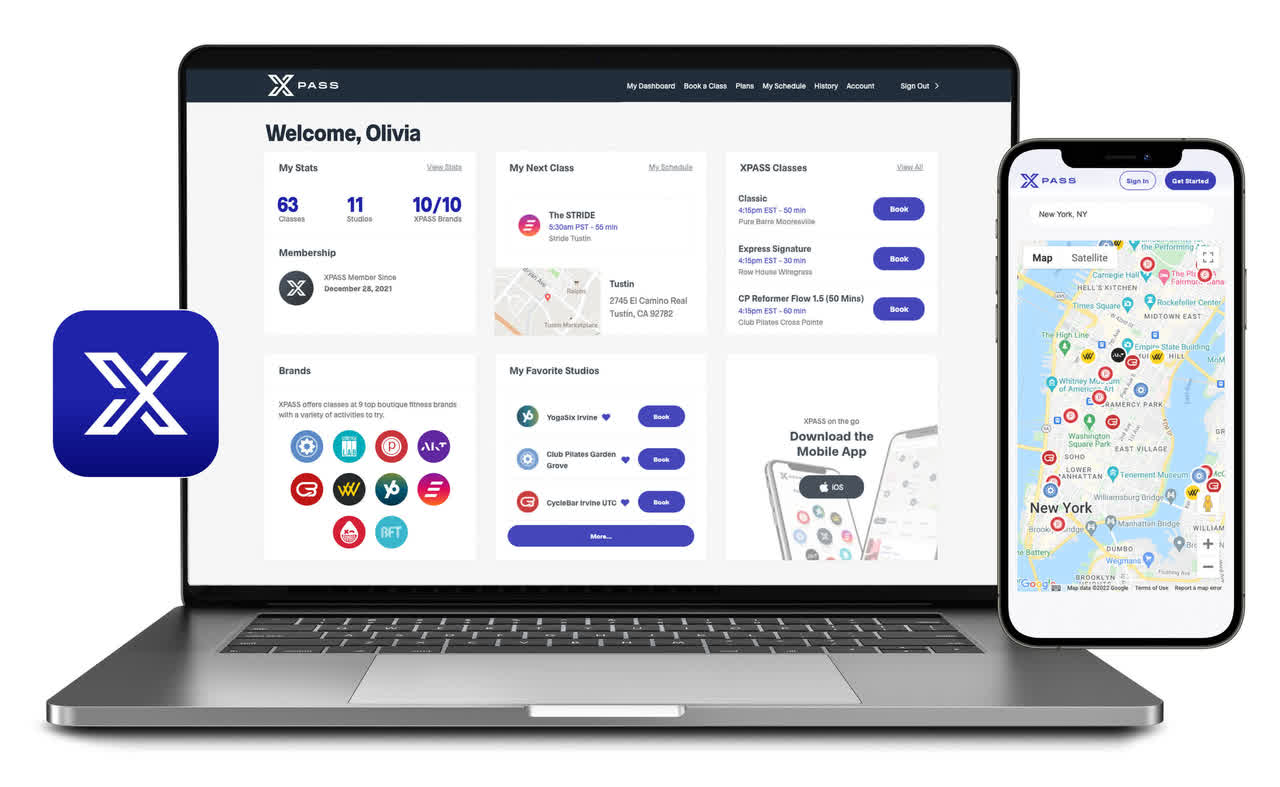

On the digital front, only at the start of this year, it released its new online platform XPLUS and pass, XPASS. These digital solutions, on the one hand, give users the ability to book classes online across all the brands from one subscription. On the other hand, XPLUS is a platform that allows users access to a wide range of workouts on-demand from the comfort of their homes. These are popular workouts that are also on offer in the many international studios XPOF has. Lastly, the company is continue on its hunt to benefit from strong brands in the form of collaborations. It is developing a fitness program with Lululemon (LULU) to be made available as one of LULU’s at home gym solutions.

XPass Online Platform (Sportzbusiness.com)

Remain Cautious of Potential Injuries

Although XPOF has recovered to near pre-COVID-19 numbers, one thing we cannot forget is the impact of the pandemic-driven regulations on the business and that the majority of its revenue is dependent on open and running franchisee studios. Companies were forced to adhere to government-mandated shutdowns on top of slow and restricted openings due to health and safety regulations. Although online videos and online fitness platforms with subscriptions provided alternative income streams, it was only a small portion and the company could fail if it were not able to have sufficient number of well running fitness studios. The majority of XPOF’s revenue comes from the classes held at its franchisee locations. It is uncertain whether the fitness industry as a whole could survive another equally severe pandemic.

Secondly, there is a risk that consumers may become more price-sensitive and cut out nonessential costs as the U.S. economy is experiencing inflation and other macroeconomic pressures that may reduce the number of consumers interested in fitness classes. On top of this, fitness consumers are not known to be sticky consumers. Platform-based subscriptions depend on the activity of its users. Fitness consumers tend to become infrequent and inconsistent users of the platforms and classes.

Lastly, although insider trading is not always a cause for concern, in April 2022, the company’s chairman of the board Mark Grabowski sold 5,175,000 of his shares. Nonetheless, he has recently bought new shares and the overall insider buying ratio of the latest inside trades is at a high of 38.032.

Final Thoughts

Despite the tricky circumstances of the last few years, XPOF has managed to build a growing and diverse portfolio of fitness brands and services under a franchiser business model through large and strategic acquisitions while opening studios globally. It has scaled and shared its service platforms across franchisees and online to provide more and easier subscription options for consumers, which contributes to its financial and operational performance. It has strong brands that put it on top of its market and awards that have recognized the company’s performance.

Although the company is not yet profitable, and there is a big risk involved by most of its revenue being produced through the success of its studios, it has a growing asset-light business model and is managed by strong-performing individuals who have made investments to layout the foundation for growth and proven themselves worthy under very difficult circumstances. The ability to turn an immensely difficult scenario into a success story of growth and strength is the reason I think investors may be interested in taking a bullish position in this company.

Be the first to comment