Robert Way

XPeng Inc (NYSE:XPEV) – also known as Guangzhou Xiaopeng Motors Technology Co Ltd (广州小鹏汽车科技有限公司) in its motherland of China – had attracted an eclectic group of investors ranging from Xiaomi and Alibaba to Qatar Investment Authority and Abu Dhabi’s sovereign wealth fund Mubadala before raising $1.5 billion via an IPO at the New York Stock Exchange near the end of August 2020. Today, XPeng could be considered to be at a crossroads of sorts, at least from a holistic investment perspective.

Manufacturing and Fiscals

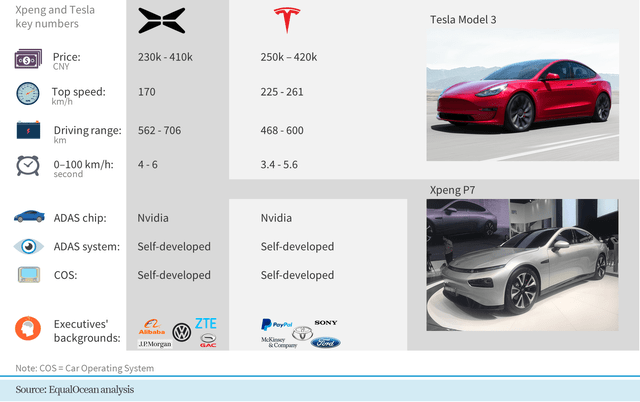

The company’s first model, the G3 SUV, was launched at the end of 2018 and initially manufactured under an Original Equipment Manufacturing (OEM) agreement with Haima Automobile, a subsidiary of the State-owned FAW Group. In June 2020, the company’s own factory in Zhaoqing (in Guangdong Province) went online to produce its new P7 sedan – a model that draws frequent comparison with the Tesla Model 3 in China:

The company’s agreement with Haima, on the other hand, ended as of the 31st of December 2021. In the meantime, the Zhaoqing facility rolled out its 100,000th P7 in March this year. Construction of a second factory in Guangzhou (the company’s home turf) was announced in September 2020, with production expected to start by the end of this year. Meanwhile, its third factory in the now-familiar city of Wuhan is expected to go online sometime around 2023 – to amount to around 400,000 vehicles in total annual production capacity.

Now, the details of this expansion are rather interesting: the vast bulk of the financing for setting up facilities come directly from the State. In the case of its Guangzhou plant, the company has to repay the State after seven years and take ownership. A similar agreement can be assumed in its other facilities, given the nature of its backers for its Zhaoqing facility as well as its upcoming Wuhan facility.

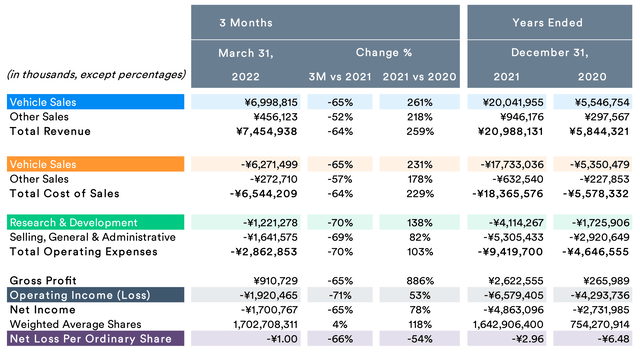

This is rather pertinent when it comes to existing trends in the company’s fiscals over the past two full years’ audited results vis-à-vis its most recent quarter’s unaudited results:

Source: XPeng Financial Statements

Note: The 2021 FY report didn’t report its yearly numbers in US$. Hence, all figures are laid out in RMB to maintain consistency.

The trends that are apparent indicate:

- At first blush, the recent quarter’s fiscals seem to be more in line with the past year’s rather than 2020.

- In the current year, revenue is trending to close out the year much higher than in the previous year. However, so are cost of sales as well as operating losses.

- Net Loss Per Ordinary Share (which the company’s American Depositary Shares is equivalent to two of) is trending to be nearly 25% higher than in the previous year.

So, simply on the face of fiscal trends, the company’s bottom line doesn’t make its ticker very attractive. Added to this is the fact that the company’s impending expenses during asset transfer from the State would be rather substantial – thus making future net earnings potentially even more frayed.

However, the company’s trends in market share add further depth to the matter.

Market Share Trends

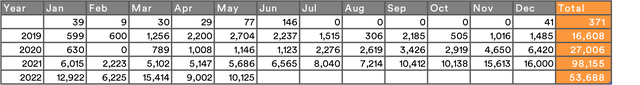

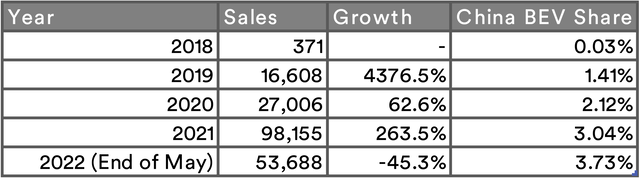

In terms of total vehicles, 2021 was a stalwart year for the company: it registered a 263% increase in sales over the past year

Sources: CarSalesBase, InsideEVs

In sales over the first five months of the year alone, the company’s sales are nearly half of 2021’s total sales. Furthermore, in June, the company sold 51% more vehicles than in the previous month. If this trend continues, the current year will be the company’s brand-new stalwart year.

Long-time watchers of China’s Electric Vehicle (“EV”) market will recognize the fact that the share of EVs in total car sales has seen a consistent uptrend for quite some time. Consolidated EV sales in China for the month of June that can be confirmed against multiple sources aren’t available yet. However, total “Plugin Car” sales in the first five months of the year are already 45% of that sold over the entirety of 2021.

The company’s share of sales in this segment continues to trend seemingly-ever upward:

Sources: CarSalesBase, InsideEVs

Ratios and Recent Price Trajectory

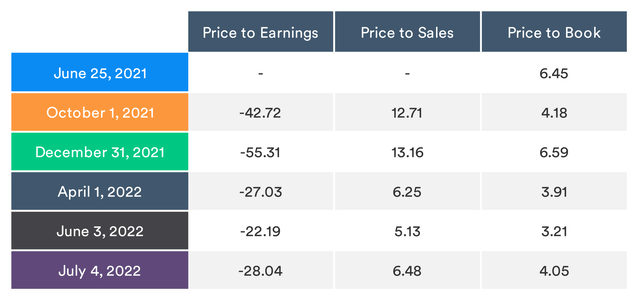

An analysis of the 3 ratios similar to that executed in recent articles indicates that, as would be deducible for a company that is still in its growth phase, the ratios aren’t particularly pretty:

Seemingly spurred by its June sales data, the company’s ratios do seem to have arrested their fall as of July 4th.

Note: The company is dual-listed in both the NYSE as well as the Hong Kong Stock Exchange (HKEX).

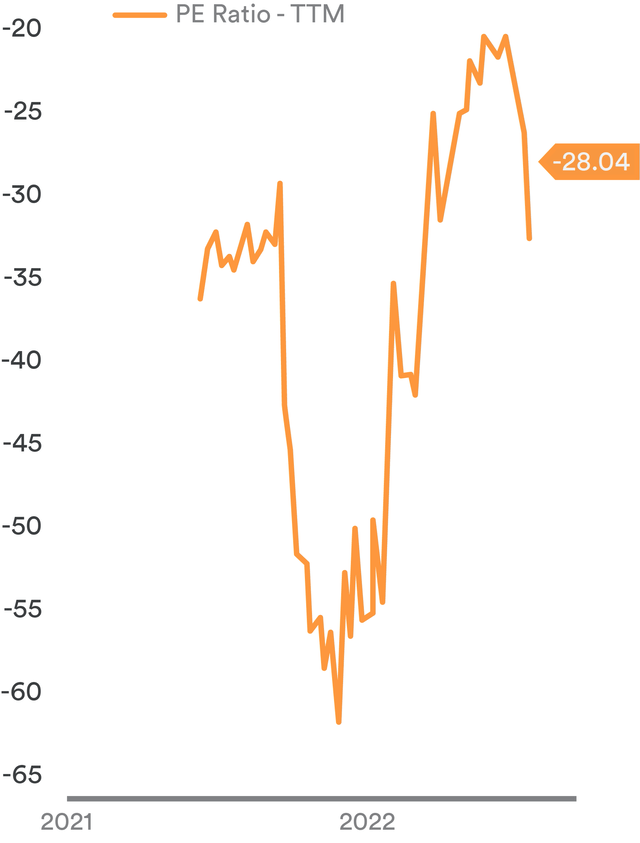

Now, the ticker’s P/E Ratio trajectory since its listing is rather interesting:

Historically, the ticker has been highly prized, leading at times for the P/E Ratio to go south of negative 60. As “ratio cool-offs” began to manifest themselves in the U.S. market (home to the most overvalued equities in the world), the ticker had a precipitous fall until the June delivery data came in to push this ratio southward again.

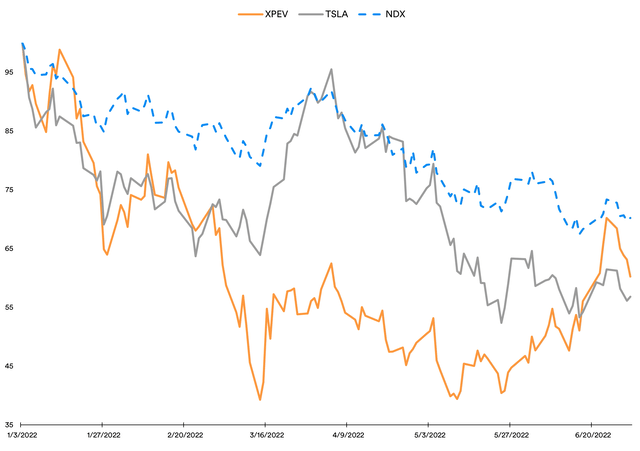

Since the company’s products do find frequent comparison with Tesla (TSLA), let’s consider the Year Till Date (“YTD”) performance of the company’s ticker as well as Tesla’s versus the benchmark “tech-heavy” Nasdaq-100 (NDX).

Source: Created by Sandeep G. Rao using data from Yahoo!

What’s apparent in trends for both EV stocks are:

- Both stocks are particularly sensitive to broader “tech” market trends in both the upside as well as the downside. The company’s ticker has been a little more sensitive to the downside until recently.

- While neither stock nor the benchmark have drawn par to levels at the dawn of the new year, the company’s ticker has been gaining steadily higher bullish sentiment since mid-June that has recently edged it past Tesla’s performance.

Final Thoughts and Recommendation

Given its growth potential, this is a very interesting company to watch. In terms of product range (and even financials), XPeng shares a lot of characteristics with NIO Inc. (NIO) (which was recently covered for the second time in a year). Both companies – as well as their third Chinese rival Li Auto Inc. (LI) – offer attractive products aimed at the mid- to high-end spectrum of the Chinese BEV market, which is increasingly being spoilt for choice.

Now, the company’s Q2 results are expected sometime in the latter half of August. Two items of particular interest to watch for would be:

- Whether the company announces a mass-market marquee model, just like NIO, in a bid to take its high-quality engineering expertise to the “budget” end of the BEV market in China. While the P5 is billed as being precisely that, the company’s increased production capacity certainly has room to attempt a deeper foray by introducing more models.

- Whether there is an improvement in earnings attributable per ordinary share to bring the trend for the year below that of the past two years’ recorded metrics.

The company’s President Mr. Brian Gu had already stated that he hopes the company will break even by the end of 2023. While plans were announced by the company that it would go deeper into Europe (i.e., beyond its modest market share in Norway) by entering the German, Swedish and Dutch markets later this year, no timetable has been announced till date. This could be another facet of information to consider, if further light is shed on it in the upcoming earnings call.

Long-term holders of the stock, both current and prospective, should keep in mind that the break-even period being so far away imparts a weakness to the stock price trajectory. In the customer segments the company currently services, the battle for dominance among major Chinese carmakers has been heating up for quite some time now. It’s truly a “buyer’s market,” and marketing and after-sales service will likely become as important for the carve-out of market share as “technical” features are. The overall advisory for this type of investor profile is to wait and see. Hence, “Hold” is the rating being given to the stock.

Investors not holding the stock but looking to buy in and seek inflation-busting gains over the next 5-6 months could take heart into recent cues that stocks in emerging markets are outperforming Western stocks. However, it bears remembering that the inflationary/recessionary cycle hasn’t really halted despite the recent fall in oil prices. Global declines in consumption could have all sorts of pass-through effects on the export-oriented ecosystem within the Chinese economic engine which, in turn, has a palpable effect on the spending power of many buyers in the company’s customer segments. Thus, an outright buy to meet this investor profile’s objectives cannot currently be made in good conscience.

All in all, it bears reiterating: this is a very interesting company to watch.

Be the first to comment