Robert Way

Chinese electric vehicle manufacturer XPeng (NYSE:XPEV) continued to out-perform its rivals NIO (NIO) and Li Auto (LI) in July regarding absolute delivery volume and year-over-year growth. XPeng is executing extremely well and is growing its deliveries at about twice the rate that Li Auto is. Given the enormous delivery and revenue ramp that the Chinese EV start-up is going through, XPeng remains one of the most promising EV stocks for investors!

XPeng continues to outshine the competition

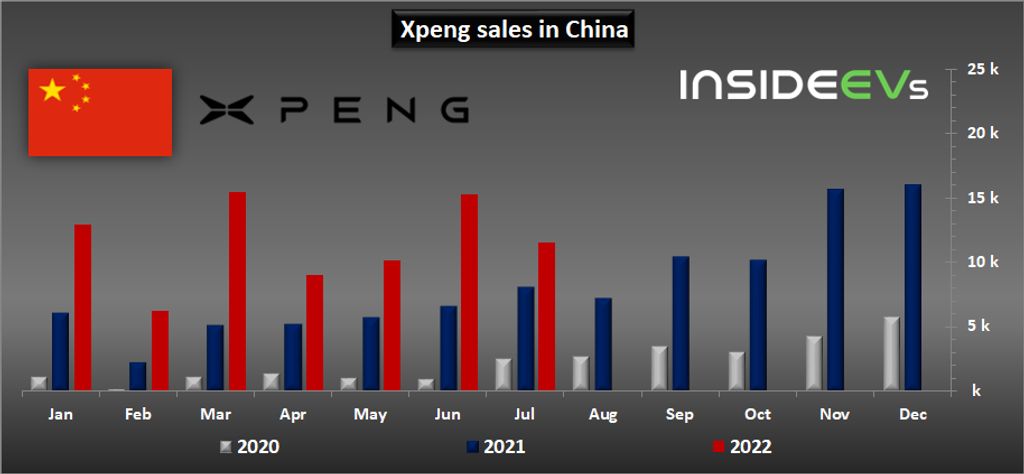

XPeng reported excellent delivery numbers for July and, once again, the EV start-up performed significantly better than its nearest rivals in the electric vehicle industry. XPeng delivered 11,524 electric vehicles in July, showing 43% year-over-year growth. Total deliveries of 11,524 consisted of 6,397 P7 sedans, 3,608 P5 sedans and 1,519 G3i sport utility vehicles. XPeng’s growth is chiefly driven by the relatively new P5 sedan which started selling in China in September 2021, although the EV company has run into some troubles with its P5 roll-out in Europe, chiefly due to export timeline issues.

XPeng: Sales FY 2022

While XPeng rolled a solid number of EVs off of its factory belts in July, growth has been slowing down even for XPeng due to COVID-19 outbreaks and related factory shutdowns in FY 2022. Still, XPeng produces the fastest delivery ramp of the top three EV manufacturers and delivery volumes/sales have, despite challenges, continued to grow compared to FY 2021.

NIO, which has seen increasing limitations on its ET7 sedan production due to problems with the sourcing of casting parts, delivered 10,052 electric vehicles in July, showing growth of 27%. NIO is increasingly diversified, moving away from sport utility vehicles and into the sedan market, where it sees stronger prospects for growth. Li Auto delivered 10,422 Li ONE sport utility vehicles in July, showing 21% year-over-year growth. Li Auto just sells one major EV product, the Li ONE SUV, and therefore has the easiest production line to manage.

XPeng’s grew deliveries 2 X faster than Li Auto in July and 1.6 X faster than NIO. Regarding delivery volumes, July was the second consecutive month in which XPeng had the highest number of sales relative to its rivals.

|

Deliveries |

May |

May Y/Y Growth |

June |

June Y/Y Growth |

July |

July Y/Y Growth |

|

XPEV |

10,125 |

78.0% |

15,295 |

133.0% |

11,524 |

43.0% |

|

NIO |

7,024 |

4.7% |

12,961 |

60.3% |

10,052 |

26.7% |

|

LI |

11,496 |

165.9% |

13,024 |

68.9% |

10,422 |

21.3% |

(Source: Author)

XPeng is not generating any profits yet

The market’s attitude toward electric vehicle companies has changed in FY 2022. Investors are no longer willing to reward EV companies with high valuation factors, even when they are growing deliveries at annual rates exceeding 100%. Investors increasingly want to see profits and XPeng is not expected to generate positive EPS until FY 2024 The fading hype in the EV industry as well as higher demands being placed on EV start-ups regarding profitability is what has driven a downward valuation of EV stocks lately.

Based off of consensus EPS predictions, XPeng is expected to start making profits in two years.

|

XPeng |

FY 2022 |

FY 2023 |

FY 2024 |

|

EPS |

$(0.97) |

$(0.59) |

$0.04 |

|

YoY Growth |

-13.68% |

39.50% |

– |

|

P-E Ratio |

– |

– |

660.6 X |

(Source: Author)

Attractive valuation

XPeng is expected to generate revenues of $6.0B in FY 2022 and $10.5B in FY 2023 which represents top line growth rates of 81% and 77%. XPeng’s rivals are expected to grow their top lines just a tiny bit faster than XPeng, but XPeng has the lowest price-to-revenue ratio based off of FY 2023 expected revenues.

|

Revenue Estimates |

FY 2022 |

FY 2023 |

Implied Y/Y Growth Rate |

P-S Ratio (FY 2023) |

|

XPEV |

$5.95B |

$10.53B |

76.8 % |

2.0 X |

|

NIO |

$9.00B |

$15.92B |

77.0 % |

2.2 X |

|

LI |

$7.96B |

$14.64B |

83.9 % |

2.2 X |

(Source: Author)

Risks with XPeng

A slowdown in the Chinese economy as well as the potential phasing out of electric vehicle subsidies are risks for electric vehicle manufacturers in general and XPeng specifically. The EV start-up is primarily valued based off of its prospects for production and revenue growth and a slowdown in deliveries would most likely translate to a lower valuation factor and a potential delay in achieving profitability. XPeng is not expected to be profitable this year or next year, but the market consensus is that the EV company could achieve a marginal profit in FY 2024. A delay in achieving profitability may weigh on XPeng’s valuation. What would change my mind about XPeng is if the firm started to see a dramatic drop-off in delivery volumes and fell behind its rivals regarding delivery growth.

Final thoughts

Shares of XPeng went through a, mostly undeserved, 52% drop in pricing this year because COVID-19 factory shutdowns have compounded existing supply chain problems. However, a full reopening of the Chinese economy could be a strong catalyst for an upside revaluation of XPeng’s shares. I believe XPeng’s potential is greatly undervalued at a price-to-revenue ratio of 2.0 X considering how quickly XPeng is growing deliveries. Since XPeng continues to grow its deliveries the fastest, the EV start-up has a risk profile that remains heavily skewed to the upside!

Be the first to comment