imaginima/E+ via Getty Images

Market media attention has primarily focused on the technology and energy sectors throughout the year. On the one hand, skyrocketing energy prices have pulled energy stocks dramatically up from their depression. On the other, rising inflation, mainly due to energy prices, triggered a sharp decline in growth stock valuations, leading to a dramatic decrease in many once-booming technology stocks. Overall, this pattern marks a significant reversal from the 2012-2020 trends wherein technology was generally the top-performing sector while energy was the worst.

Since around 2012, coming out of the 2008 recession, the critical battle in markets has been between energy and technology. Before then, there was far more market media attention on the financials sector, which had extreme gains before 2008 that eventually led to equally significant losses. Today, while most investors are not watching the financials sector, it appears there are brewing factors and trends that may soon dominate the headlines. Financials have been generally quiet over recent years, paying dividends and usually avoiding the volatility (both positive and negative) seen in other sectors. However, the monetary environment has shifted dramatically over recent months toward an environment hardly seen since 2007.

Since 2009, financial stocks have benefited immensely from the Federal Reserve’s stimulus programs. In general, since the last significant recession, the Federal Reserve has maintained a dovish attitude toward monetary policy with accommodative interest rates that have consistently allowed financial institutions to borrow at low rates. Additionally, whenever asset prices stumbled, financial companies could rely on the Federal Reserve to pursue another wave of quantitative easing to lift asset prices and restore liquidity. In reality, if not for this consistent support, I believe most large banks in the U.S would be insolvent – most effectively being Zombie Banks.

I have been bearish on the financial sector since last year, as detailed in “XLF: Not All Is As It Seems For The Banking System” regarding the popular financials ETF (NYSEARCA:XLF). While the fund has declined ~9% since, I believe its latest declines may be around the corner. Looking forward, the Federal Reserve is no longer in an accommodative attitude. While Powell is still slow to act on inflation due to concern about shocking financial markets, political and economic pressure seemingly favors stopping inflation at the expense of asset prices. For now, it is impossible to control both inflation and asset prices, given debt levels are high and economic production remains stifled. Even more, with the yield curve inverted, banks will have difficulty keeping net interest margins up. Combined with the rise in recessionary bankruptcy risks, most financial stocks in XLF may be on the verge of a very sharp move lower.

The Tide Goes As Many Swim Naked

Warren Buffett is famous for saying, “Only when the tide goes out do you discover who’s been swimming naked.” The apt quote may prove true today as, if we look closely at the banking sector, it is apparent that many unseen risks lurk beneath the surface. Even more, recent signals of a liquidity shock from the rising U.S dollar and real interest rates as well as declines in credit assets imply these risks may come to the foreground soon.

Superficially, banks and other financial institutions may appear secure due to their low reported non-performing loans. However, we must consider how many loans would not be performing if it were not for excessive monetary and fiscal stimulus. For example, during the 2020 recession, banks saw technical declines in mortgage delinquencies while the “forbearance” rate skyrocketed to 9%. Additionally, as retail vehicle prices surged last year due to shortages, new vehicle loans carried an average loan-to-value of 118%, giving many banks significant unsecured assets. Home prices have also begun slipping under the pressure of high mortgage rates in many cities, potentially causing a sharp rise in mortgage debt LTVs.

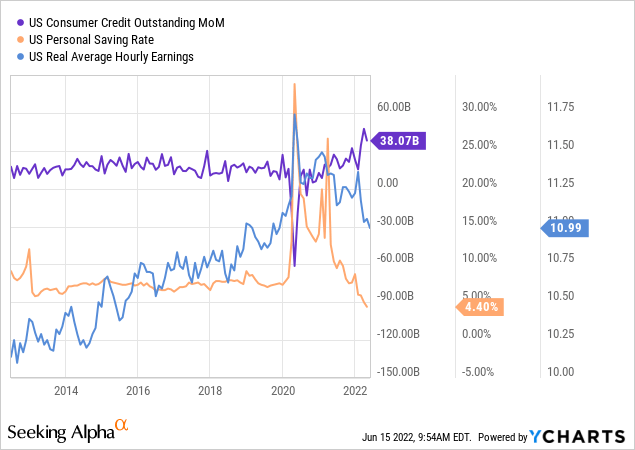

The U.S economy is a consumption powerhouse, with over two-thirds of GDP going to consumer spending. If spending falters, it is virtually guaranteed that the rest of the economy will follow suit. Consumption levels were generally high during the 2020-2021 pandemic period, primarily due to excess economic stimulus. Today, inflation is rising due to consumption being chronically higher than production, leading to significant declines in real hourly wages. As many people struggle to keep up with prices, savings rates have plummeted while consumer borrowing has skyrocketed. See below:

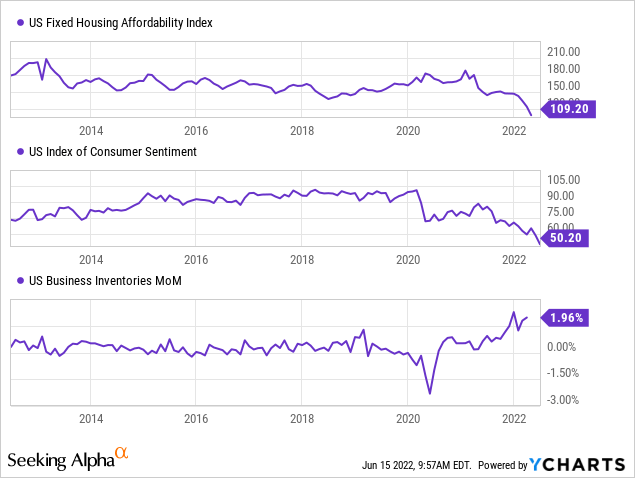

This pattern has driven consumer sentiment to desperate lows. Additionally, with both mortgage and home prices being very high, home affordability has fallen to an all-time low. These crucial factors are finally resulting in a decline in consumer exuberance, as seen by the sharp increases in U.S business inventories (a sign that sales are chronically worse than businesses anticipate). See below:

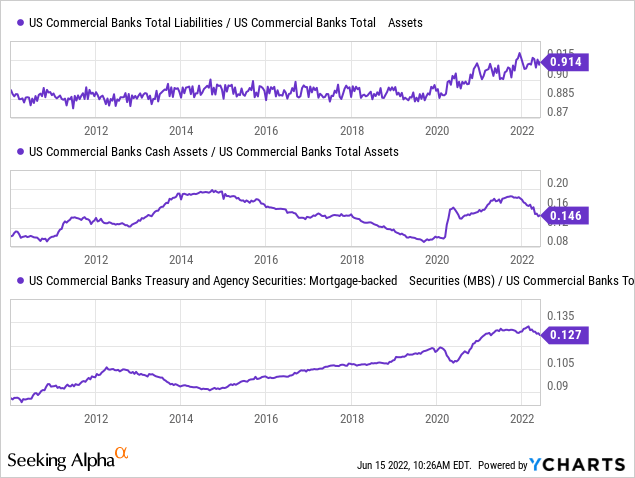

In my view, these data make it abundantly clear that the U.S economy is likely in a recession. The GDP declined in Q1, and the leading economic data has become far worse during Q2, so to me, it is virtually certain that the GDP has declined again since the end of March, meaning the economy is in a recession. At this point, it is unclear how large or long that recession will be, but with inflation as high as it is, it is doubtful the Federal Reserve can step in to prop markets up yet again. At the same time, U.S. commercial bank leverage has risen back to significant highs. See below:

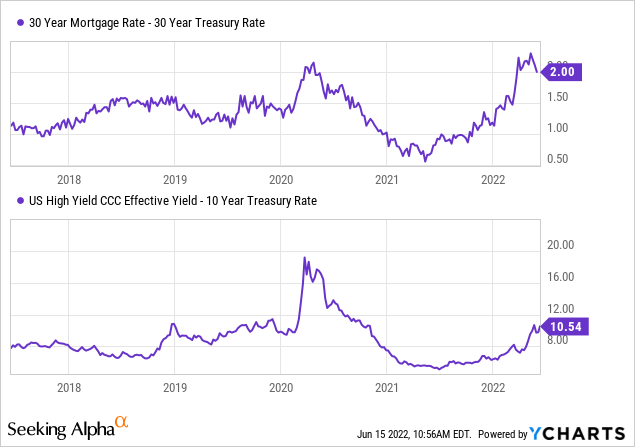

Since 2020, U.S banks have seen their leverage levels grow pretty dramatically. Today, most banks only have 8.6 cents in equity for every dollar of assets. Initially, much of these assets were cash found from asset rebalancing during the Q.E period. A substantial portion of the growth in bank assets went to Mortgage-Backed-Securities which, though “backed” by Fannie Mae and Freddie Mac, could carry credit risks in the case of a financial crisis as it is doubtful those institutions can bail out the market (or that the government can bail them out again). Additionally, as I’ve explained in-depth regarding mortgage REITs with high MBS assets, it is essentially impossible to hedge against rising mortgage-to-Treasury spreads – a major risk factor for leveraged MBS investors. See below:

These spreads rise with credit risk perception. There has been a sharp rise in mortgage market credit risk, likely triggered by the immense declines in home affordability. The higher-rated corporate credit market has only recently seen sharp increases in credit risk spreads, but for speculative CCC debt, risk spreads have been rising for roughly a year. Notably, both of these spreads are likely a bit higher today than shown in the data above, as both junk bonds and mortgage-backed securities saw extremely sharp declines earlier this week.

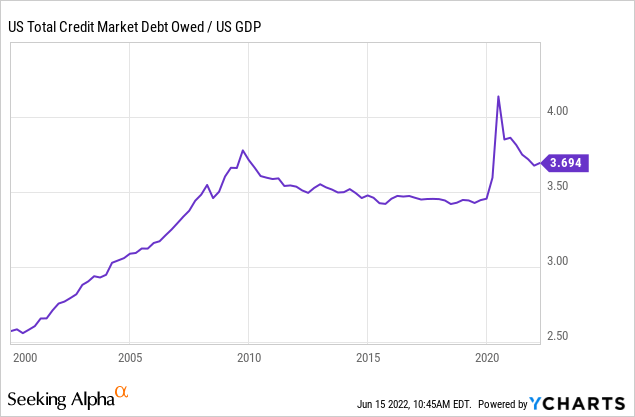

In reality, today’s overall leverage situation is not much worse than in 2008. While debt levels have risen dramatically since 2020, the overall debt (both public and private) stands at about $90T, giving the U.S. a total debt to GDP ratio of nearly 370%. In 2008, before the last debt crisis began, this figure was around 340%, which is slightly higher today. See below:

While total public and private leverage are only slightly worse than it was before the last large debt crisis, this also means that no core financial issues were fixed after 2008. Extreme leverage was the chief issue in 2008, and leverage is slightly higher today. The only major difference is that inflation is far higher, so the Federal Reserve cannot be used to bail out the system without creating true hyperinflation. Furthermore, a great plethora of data, including consumer, business, and market, clearly show a growth slowdown in activity. In my view, this is a perfect storm for a financial crisis, specifically for banks, which could be more significant than 2008 since there is essentially no capacity for bailouts.

Insurance Stocks Best Among XLF

The popular financials ETF declined by roughly 80% from its peak from mid-2007 to early 2009. The fund is currently down around 20% from its peak and is trading at nearly the same price as its 2007 peak. Of course, banking stocks typically pay higher dividend yields, so its total return index is still far above the 2007 peak. Still, financial stocks are beginning to tumble faster, and I suspect the recent yield curve inversion, sharp rises in credit spreads, and falling consumer data may increase its gravity.

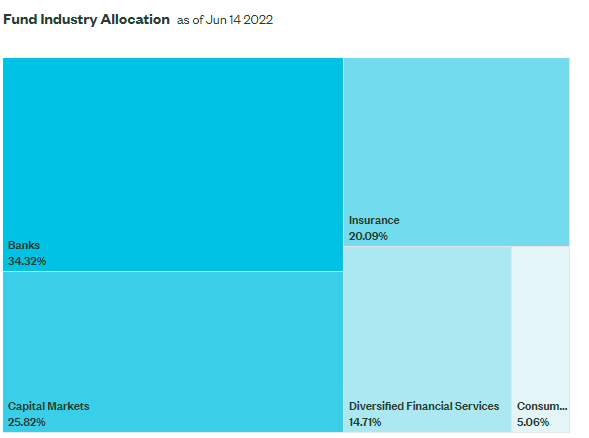

XLF is most heavily weighted toward banks and capital markets. See its total weighting below:

XLF Fund Industry Allocation (State Street Global Advisors)

In my view, banks have the most significant overall risks, but capital markets face greater short-term risks. Capital markets stocks, such as Schwab (SCHW) are coming off of a great series of years wherein market trading and investment activity have soared. The capital markets stocks in XLF are in a much better position than Robinhood (HOOD), but the fundamental risks facing that firm, declining users and user activity, are the same for all as the bear market has caused many retail market participants to slow trading activity. Lastly, significant expected changes in SEC regulatory rules may upset the sector as competition for lower fees rises, though it is unclear what this will mean for many market-making firms.

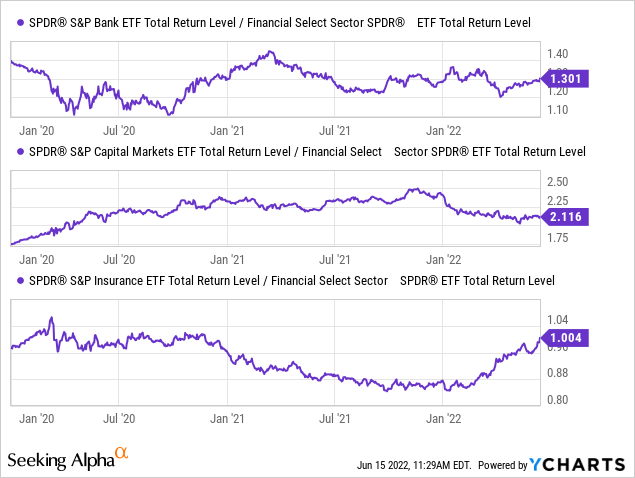

Of course, if the market’s volatility spike continues to soar, many capital markets firms may also be stuck “holding the bag” at a poor time, potentially triggering margin calls. The recent quake across the cryptocurrency brokerage market may be the “canary in the coal mine.” This risk factor is problematic for all financial firms since they use leverage to purchase assets, increasing their exposure to a decline in asset prices. Capital markets may fare worse, while insurance firms will likely be more stable. Indeed, looking at the comparative performance of each top three industries in XLF compared to XLF as a whole, it is clear insurance stocks have had good performance compared to capital markets. See below:

Since the beginning of the year, insurance stocks such as (KIE) have outperformed XLF by over 10%, while capital markets, measured through (KCE), have been pulling the fund down. Banks (KBE) have performed most similarly to XLF, mainly because most large banks operate in all financial subindustries.

The Bottom Line

Overall, given the multitude of financial risks surfacing today, I am bearish on all financial stocks and believe XLF will likely decline more than most sectors over the coming months. While I am not yet bullish on the technology sector, it seems financials are now the most overvalued, considering the massive potential declines that could occur as liquidity risks grow without injection from the Fed. XLF may seem cheap with its TTM “P/E” of 9.5X; financial companies can have extremely volatile earnings during volatile markets and lose far more in a bear market than they earn over many years. Even more, it will be difficult for banks to lend at a strong profit with the yield curve inverted.

Notably, The Dodd-Frank act made it legal for banks to take depositors’ savings (over $250K) and convert them into equity in the case of a large crisis. In my view, this crucial legal change complicates XLF’s future as, while it may lack Fed bailout protection, there is a “bail-in” possibility that could save banks at the expense of depositors. For now, this is a hypothetical possibility, and financial conditions must worsen before it arises. Even still, I believe many of the most highly levered financial institutions today may struggle to remain afloat over the coming year without some sort of liquidity injection.

Be the first to comment