Fritz Jorgensen

You’ve probably heard of don’t fight the Fed. That’s going on right now.

The Fed is trying to slow the economy and you don’t want to be on the wrong side of that.

Well, there’s another giant you don’t want to go up against and that’s the American government. Right now, two of the largest governing bodies are all in on one specific industry – electric vehicles. The United States government included an expansion and extension of electric vehicle tax credits while California went as far to say no new gas-powered cars will be sold in the state by 2035.

With the amount of money set to pour into this industry, it’s too big to ignore. And I don’t want to be caught fighting the government.

So, I’m digging into electric vehicle stocks and electric vehicle-related companies as we speak to add some to my buy list, or as I like to call it, my Bank It list.

These are going to be stocks that operate in the electric vehicle space, though it can be any aspect – electric vehicles, chips, mining, batteries, etc. You name it, and it’s on my list to take a look at. I see this as a rising tide will lift all boats. But I still want to be on the fastest boat.

Today I’m breaking down XL Fleet (NYSE:XL), a fleet electrification company in the United States.

What they do…

XL Fleet began back in 2009, just after the financial crisis and is based out of Boston Massachusetts. All the way up until December 2020, they were simply operating one segment: Drivetrain. The drivetrain segment offers systems for vehicle electrification.

In December 2020, they launched the XL Grid segment. This segment installs charging stations to enable customers to effectively plug in their electrified vehicles.

And in May 2021, they completed the acquisition of World Energy Efficiency Services, LLC (World Energy). This allowed the company to offer comprehensive solutions to commercial fleets to sustainably transform their operations.

In the first quarter of this year, that all changed. The company has been struggling with sales, issues with internal controls in financial reporting and the resignation of the company’s president and board of directors, Thomas Hynes III, on March 21, 2022. And they made some major changes: restructuring the bulk of its drivetrain business, eliminated its Plug-In Hybrid Electric Vehicles products, reduced the size of workforce by 51 employees, closing production center and warehouse in Quincy, IL, the closure of the company’s engineering activities in its Boston office and the termination of the company’s partnership with eNow. [Source: Q2, 10-Q filing; pg. 29]

This is a big red flag to me.

I’m looking for energy efficient companies that are going to be blessed by the good graces of the government. Just like Tesla (TSLA) has largely been subsidized to this point, more and more companies are now ready to ride that same trend. XL Fleet looks like it won’t get to see that opportunity.

The problems adding up…

Revenues in the second quarter fell 19%, but their expenses didn’t drop as fast, resulting in shrinking margins and a gross profit that declined 41%. The decline in revenues was largely attributed to a $0.5 million drop in the Drivetrain segment due to timing as well as interruptions in OEM vehicle supply. For XL Grid, the main operating segment, revenue declined $0.2 million due to lower numbers of projects in the second quarter of 2022 versus second quarter of 2021.

The company posted a sharper loss of $12.7 million in the second quarter of 2022 compared to $10.5 million in the second quarter of 2021. Despite the weakness in revenues over the past quarter, a strong start to the year has the company on track to post somewhat improved revenues for the full year.

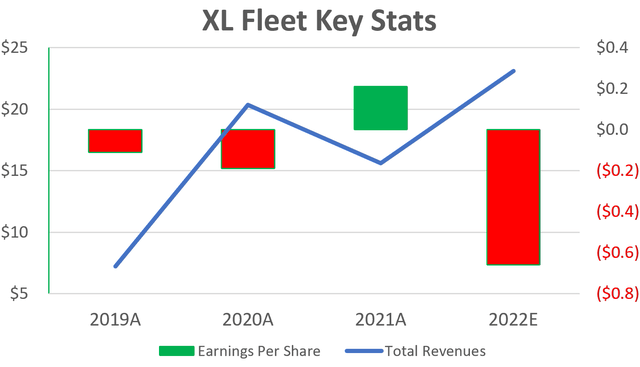

Though the expectations at $24 million are a bit lofty for me. Take a look:

I don’t see the company getting back on track to hit these expectations, but it could catch up to the $15 million in revenues from last year.

What’s more alarming is the losses that are piling up, despite increasing revenues. The company is burning through some serious cash, with operating cash flow at negative $30 million through the first six months of the year. This is after the company said they scaled back Drivetrain, XL Grid and corporate operations which is expected to reduce near team operating cash burn.

Remember, sales were only $15 million last year. They have already burned twice as much cash than sales, just to generate about $8 million in sales numbers through the first six months of the year. XL Fleet has a solid amount of cash on the balance sheet, at $322 million.

Even with all of this, the company has managed to beat analyst expectations on earnings in each of the last four quarters. The company posted a loss on earnings of $0.05 compared to expectations for a loss of $0.10 in Q3 2021. In Q4 2021, the company posted the same, $0.05 loss on earnings, but expectations were even lower, at an $0.11 loss. In Q1 2022 and Q2 2022, the company posted the exact same bottom-line results. Even as analysts lowered their expectations to a $0.17 loss, the company posted a better-than-expected $0.08 loss. The company still posted a loss every quarter, just not as bad as analyst were looking for.

It has an average rating as a hold, but at this point, I have pretty much made up my mind about the stock. It’s on my Tank It list. Now let’s see if there’s anything on the price chart that could change my mind…

Even bigger issues at play…

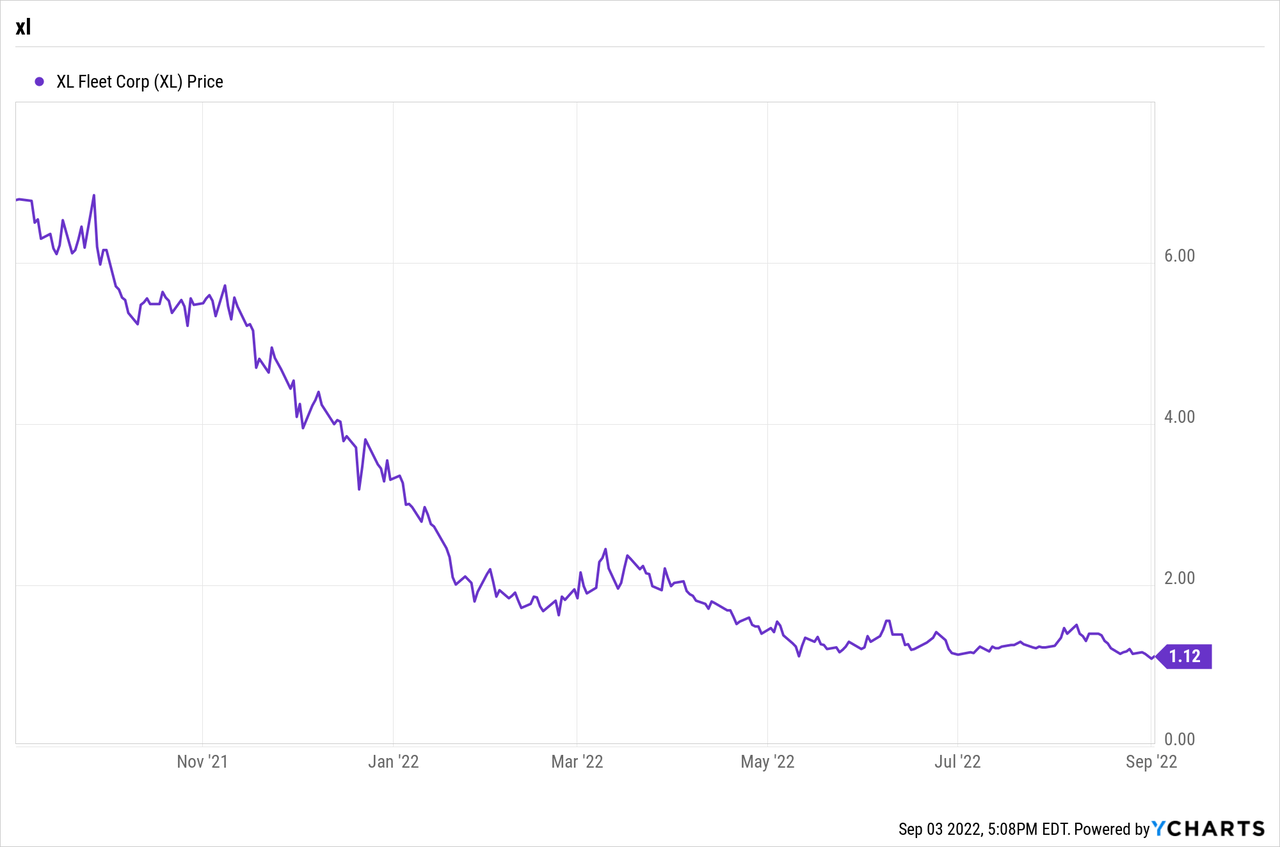

Here’s a look at the price chart showing late 2020 to today.

This price chart isn’t pretty either, so there’s nothing to override the lower financial results for the second quarter, in my opinion.

Material Weakness in Internal Control

The company is also working through a material weakness in internal control over financial reporting for last year, with a remediation plan in place. [Q2, 10-Q filing; pg. 37]

A material weakness is a deficiency or combination of deficiencies in internal control over financial reporting such that there is a reasonable possibility that a material misstatement of its financial statements would not be prevented or detected on a timely basis.

In the course of preparing the financial statements for the year ended December 31, 2021, the company identified separate material weakness in internal control over financial reporting, which relates to the ineffective design and implementation of Information Technology General Controls combined with the lack of properly designed management review controls to compensate for these deficiencies. Management for the company are actively in the process of developing a remediation plan.

Other Risks

XL Fleet also has several legal proceedings including a Securities and Exchange Commission investigation and two class action complaints that they are having to defend [Q2, 10-Q filing; pg. 25].

At this time, the company is unable to estimate potential losses, if any, related to these proceedings. Regardless of the outcome, that could swallow up some cash.

Upside Risk

I’ve laid out a pretty bearish case so far, but remember my opening statements, the federal government is heavily supporting the electric vehicle industry.

XL Fleet has attempted to innovate a unique segment of the electric vehicle industry, focusing on fleet management instead of retail consumers. This is an area that could easily gain the attention of governments looking to support the green initiatives in their state and award large sums of money for more projects to the company.

Increased demand for EVs, supported by governments or out of general consumer interest, is still a tailwind for XL Fleet.

Conclusion

There seem to be too many internal issues at the company, slowing sales growth and increased cash burn to make me want to buy the stock today.

I think XL Fleet may be on the verge of an even bigger collapse. I know some people will want to jump in due to the cash position and buy the stock at the lows, but this looks like a falling knife to me.

Buying XL at current prices may result in heavy losses.

Be the first to comment