ipopba

A Quick Take On Xiao-I Corporation

Xiao-I Corporation (XI) has filed to raise $71.3 million in an IPO of its American Depositary Shares representing underlying ordinary shares, according to an F-1 registration statement.

The firm develops natural learning software technologies for a variety of industry users.

When we learn more IPO details from management, I’ll provide a final opinion.

Xiao-I Overview

Shanghai, China-based Xiao-I Corporation was founded to develop machine learning for AI use case applications in China.

Management is headed by Chairman and CEO Hui Yuan, who has been with the firm since 2009 and is also the vice chairman of the Artificial Intelligence Development Alliance and the vice chairman of the Shanghai Robot Industry Association.

The company’s primary offerings include:

-

Conversation chatbot

-

Intelligent voice processing

-

Computer vision

-

Industry solutions

-

Robotic process automation

-

iBot OS for hardware solutions

As of June 30, 2022, Xiao-I has booked fair market value investment of $75.9 million from investors including AI Smart Holding, ZunTian Holding, PP Smart Holding, River Hill China Fund, Grand Glory (Hong Kong) Corporation, iTeam Holding, Shanghai Maocheng Enterprise Management Center and Shanghai Tongjun Enterprise Management Consulting Partnership.

Xiao-I – Customer Acquisition

The firm sells its software products, cloud platform access and maintenance & support services to customers through its direct in-house sales and marketing efforts.

The firm is focused on the Mainland China market but also seeks to sell to customers in Hong Kong, Macao and Taiwan.

Selling expenses as a percentage of total revenue have trended lower as revenues have increased, as the figures below indicate:

|

Selling |

Expenses vs. Revenue |

|

Period |

Percentage |

|

Six Mos. Ended June 30, 2022 |

16.3% |

|

2021 |

14.2% |

|

2020 |

33.0% |

(Source – SEC)

The Selling efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of Selling spend, dropped to 1.9x in the most recent reporting period, as shown in the table below:

|

Selling |

Efficiency Rate |

|

Period |

Multiple |

|

Six Mos. Ended June 30, 2022 |

1.9 |

|

2021 |

4.0 |

(Source – SEC)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

XI’s most recent calculation was 58% as of June 30, 2022, so the firm has performed well in this regard, per the table below:

|

Rule of 40 |

Calculation |

|

Recent Rev. Growth % |

45% |

|

EBITDA % |

13% |

|

Total |

58% |

(Source – SEC)

Xiao-I’s Market & Competition

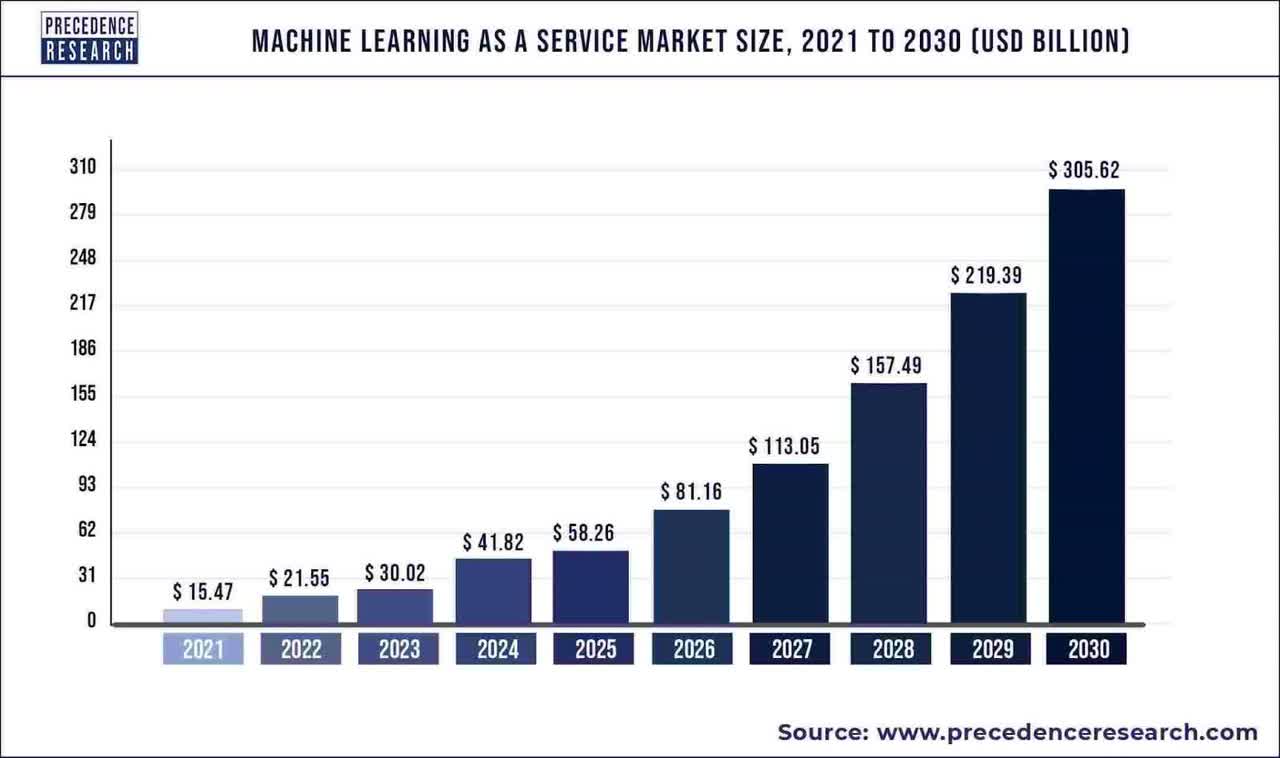

According to a 2022 market research report by Precedence Research, the global market for machine learning as a service was an estimated $15.5 billion in 2021 and is forecast to reach $305.6 billion by 2030.

This represents a forecast CAGR of 39.3% from 2022 to 2030.

The main drivers for this expected growth are a combination of enterprises continuing their transition to cloud-based IT systems and the potential gains from higher-order analysis of their business operations from machine learning-enabled software systems.

Also, below is a chart showing the historical and projected future growth trajectory of the machine learning as a service market:

Machine Learning As A Service Market (Precedence Research)

Major competitive or other industry participants include:

Xiao-I Corporation Financial Performance

The company’s recent financial results can be summarized as follows:

-

Variable topline revenue

-

Lowered gross profit but increased gross margin

-

Reduced operating profit in 1H 2022

-

Increasing cash used in operations

Below are relevant financial results derived from the firm’s registration statement:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

Six Mos. Ended June 30, 2022 |

$ 12,859,481 |

44.9% |

|

2021 |

$ 32,524,013 |

134.7% |

|

2020 |

$ 13,856,734 |

|

|

Gross Profit (Loss) |

||

|

Period |

Gross Profit (Loss) |

% Variance vs. Prior |

|

Six Mos. Ended June 30, 2022 |

$ 9,138,776 |

73.2% |

|

2021 |

$ 21,638,282 |

226.4% |

|

2020 |

$ 6,628,688 |

|

|

Gross Margin |

||

|

Period |

Gross Margin |

|

|

Six Mos. Ended June 30, 2022 |

71.07% |

|

|

2021 |

66.53% |

|

|

2020 |

47.84% |

|

|

Operating Profit (Loss) |

||

|

Period |

Operating Profit (Loss) |

Operating Margin |

|

Six Mos. Ended June 30, 2022 |

$ 1,649,528 |

12.8% |

|

2021 |

$ 4,997,009 |

15.4% |

|

2020 |

$ (7,869,580) |

-56.8% |

|

Comprehensive Income (Loss) |

||

|

Period |

Comprehensive Income (Loss) |

Net Margin |

|

Six Mos. Ended June 30, 2022 |

$ 735,628 |

5.7% |

|

2021 |

$ 3,247,711 |

25.3% |

|

2020 |

$ (7,413,737) |

-57.7% |

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

Six Mos. Ended June 30, 2022 |

$ (6,826,343) |

|

|

2021 |

$ (11,887,122) |

|

|

2020 |

$ (3,463,094) |

|

(Source – SEC)

As of June 30, 2022, Xiao-I had $1.5 million in cash and $60.3 million in total liabilities.

Free cash flow during the twelve months ended June 30, 2022, was negative ($11 million).

Xiao-I Corporation IPO Details

Xiao-I intends to raise $71.3 million in gross proceeds from an IPO of its American Depositary Shares representing underlying ordinary shares, although the final figure may differ.

No existing shareholders have indicated an interest in purchasing shares at the IPO price.

Management says it will use the net proceeds from the IPO as follows:

research and development;

investment in technology infrastructure, marketing and branding, and other capital expenditure; and

other general corporate purposes.

(Source – SEC)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, the company filed a Chinese patent infringement lawsuit in August, 2020 against Apple related to Apple’s Siri system.

The listed bookrunners of the IPO are Prime Number Capital and Guotai Junan International.

Commentary About Xiao-I’s IPO

XI is seeking U.S. public capital market investment for its general corporate expansion plans in China.

The company’s financials have generated fluctuating topline revenue, reduced gross profit but increased gross margin, lowered operating profit in 1H 2022 but higher cash used in operations.

Free cash flow for the twelve months ended June 30, 2022, was negative ($11 million).

Selling expenses as a percentage of total revenue have fallen as revenue has increased; its Selling efficiency multiple dropped to 1.9x in the most recent reporting period.

The firm currently plans to pay no dividends and to reinvest any future earnings back into the company’s growth initiatives and working capital requirements.

The company’s Rule of 40 results have been impressive, with a 58% result for the trailing twelve-month period.

The market opportunity for machine learning software and related services is large and expected to grow at an extremely high rate of growth in the coming years, so the company enjoys very strong industry growth dynamics in its favor.

Like other Chinese firms seeking to tap U.S. markets, the firm operates within a VIE structure or Variable Interest Entity. U.S. investors would only have an interest in an offshore firm with contractual rights to the firm’s operational results but would not own the underlying assets.

This is a legal gray area that brings the risk of management changing the terms of the contractual agreement or the Chinese government altering the legality of such arrangements. Prospective investors in the IPO would need to factor in this important structural uncertainty.

Additionally, the Chinese government’s crackdown on IPO company candidates combined with added reporting requirements from the U.S. side has put a serious damper on Chinese IPOs and their post-IPO performance.

A significant risk to the company’s outlook is the uncertain future status of Chinese company stocks in relation to the U.S. HFCA act, which requires delisting if the firm’s auditors do not make their working papers available for audit for three years by the PCAOB.

Additionally, post-IPO communications from the management of smaller Chinese companies that have become public in the U.S. has been spotty and perfunctory, indicating a lack of interest in shareholder communication, only providing the bare minimum required by the SEC and a very different approach to keeping shareholders up-to-date about management’s priorities.

Prime Number Capital is the lead underwriter and IPOs led by the firm over the last 12-month period have generated an average return of negative (57.5%) since their IPO. This is a bottom-tier performance for all major underwriters during the period.

Risks to the company’s outlook as a public company include its focus on Chinese markets and the potential for unpredictable and arbitrary regulatory actions by Chinese authorities in relation to the firm’s software and services.

Recently, Chinese IPO candidates have also received increased scrutiny from U.S. market exchanges for alleged IPO trading and allocation practices.

When we learn more about the IPO from management, I’ll provide a final opinion.

Expected IPO Pricing Date: To be announced.

Be the first to comment