Andrii Dodonov/iStock via Getty Images

The collateralized loan and senior secured loans are a great place for earning good risk-adjusted returns. Historically, defaults here are lower than in the high yield space and recoveries are higher as well. The key reason is that these loans sit on top of the credit chain and control the flow of debt placement. Owners of senior secured loans are also in a position to force the company into bankruptcy, so all other debt and, of course equity, have to bow to their will. XAI Octagon Floating Rate & Alternative Income Term Trust (NYSE:XFLT) is a closed end fund which focuses on this space.

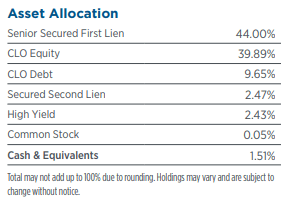

The Trust’s assets are managed opportunistically primarily within private below investment-grade credit markets including:

Senior secured floating-rate loans.

Structured credit (CLO debt and CLO equity).

Opportunistic credit (long/short credit investments and stressed credits).

Source: XA Investments

With the recent credit turmoil, we thought it would be a good time to examine whether the fund was worth investing for income investors.

The Basics

Investing in CLOs and senior secured loans is a specialized area and one where the cookie-cutter approach does not work. Octagon Credit Investors, LLC, is one of the best in this area and it has over $30 billion in assets under management. Octagon is the investment sub-adviser to XFLT. The XFLT investment team has a strong line-up and a deep bench with 39 professionals boasting close to 800 years of combined investment experience. As far as management teams go, there is nothing better out there.

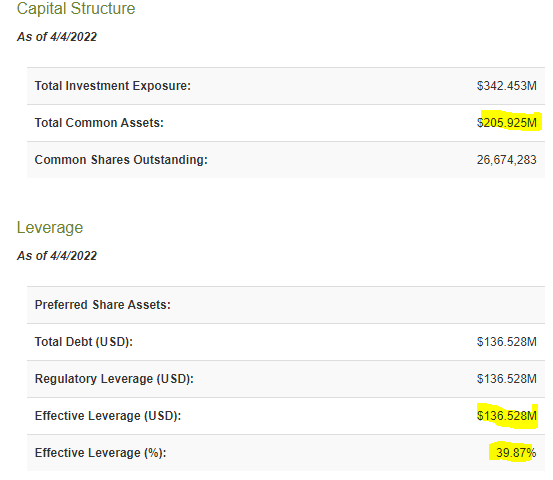

The fund has a few issues that stick out on close examination. The first being the rather abnormally high levels of leverage. As we have repeated a few times and will so again, CEF Connect presents leverage in a manner that is rather distasteful to the conservative investor. The 40% leverage is obtained by dividing debt by total assets.

XFLT Capital Structure (CEF Connect)

We prefer debt divided by equity and that gets us close to 66%. We can see the eye-rolls here. Leverage does not matter says the crowd that has forgotten how many funds were annihilated in 2020. But outside a 100-year event like COVID, the risks should be low, right? Perhaps. We don’t think any of the past interest-raising cycles remotely apply to this one. So less leverage is better for us. That said, XFLT has not exactly used this leverage to its advantage.

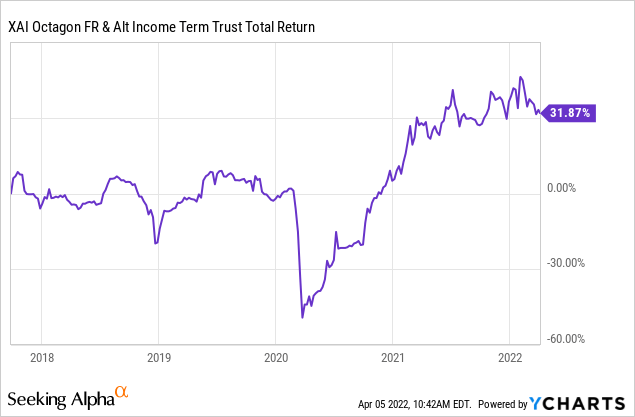

Below, we show the total returns for this fund starting in late 2017. We are now approaching 4.5 years and total returns have been 6.1% compounded on NAV. Even those returns have been boosted by multiple secondary offerings above NAV (which are accretive).

While we may take the opportunity to blame the COVID-19 crisis, the chart above actually shows the opposite. Note that from inception till February 2020, a period of about 30 months, XFLT delivered precisely zero total returns. All the gains came after the COVID-19 crisis presumably as they picked up great investments at bargain basement prices. This, of course, is a better alternative than permanently losing capital during the crisis, of that we are 98% sure.

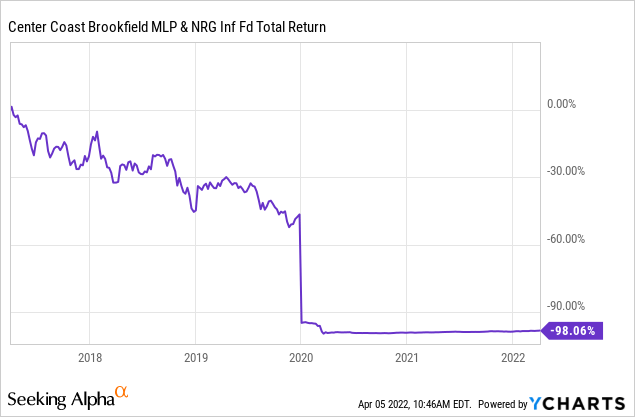

Overall, the longer-term results are not good for XFLT considering the amount of leverage being used. Keep in mind the CLO debt index has returned about 5.2% compounded over the last 5 years.

CLO Debt Returns (Palmer Square CLO Debt Index)

Considering that XFLT used such astounding levels of leverage and takes risk further down the scale (40% CLO equity), the results are not particularly impressive.

XFLT Holdings (XA Investments)

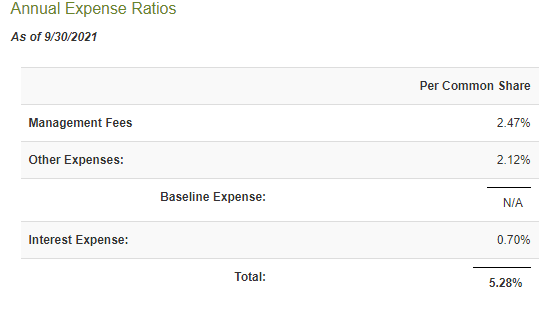

The key reason here is the expense ratio which is off the charts and funnily matches the total compounded returns of the CLO index.

XFLT Expense Ratio (CEF Connect)

Outlook & Verdict

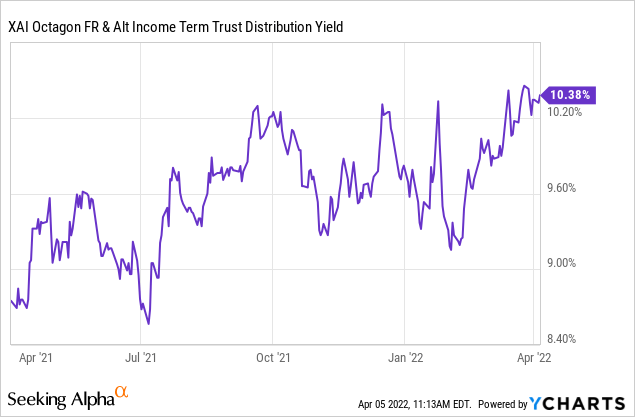

We like the CLO space even in the face of rising rates. That said, it won’t come close to delivering the distribution yield of XFLT which is about twice of what we would expect.

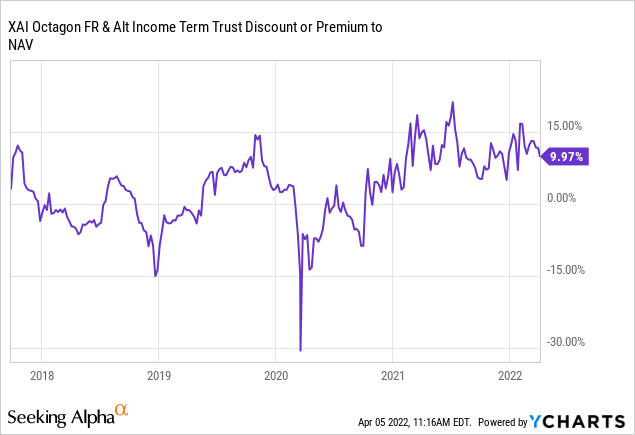

That yield too is on the market price. The fund trades at a premium of 10% over NAV.

The yield on NAV is over 11%. Of course, here we are not investing in an index but in the fund. The leverage should, in theory, add a few extra points of returns, but with that fee structure, we are doubtful you can get much mileage over the index returns, maybe 1-2% annually. Hence, we would rate the common shares a hold or at neutral currently.

XAI Octagon Floating Rate & Alternative Income Term Trust – 6.50% PRF (NYSE:XFLT.PA)

For those admiring the asset class, you might be able to get your 6% plus returns here with far lower risk using the preferred shares. These are term preferred shares with a maturity date of March 31, 2026. They also have a call date of March 31, 2023. The current stripped (next ex-dividend is in the middle of April) yield is 6.37%, and the shares remain well-insulated from interest rate risk thanks to the short-term maturity. We think these are better for risk-adjusted returns and should outperform S&P 500 (SPY) and SPDR Bloomberg Barclays High Yield Bond ETF (JNK) type ETFs.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment